4 potential serious disadvantages of a cheap car insurance rate

We all like to get the most value for our money. That’s why we strive to find cheap auto insurance rates that still match the level of coverage we want. It is also a general secret that the insurer and the vehicle owner know that everyone is looking for a deal. In order to entice buyers to sign up, insurers promote cheap auto insurance rates.

However, if you are involved in an accident, cheap car insurance could lead to large out-of-pocket costs for car repairs or medical expenses. With better information, that cheap price suddenly isn’t the great deal you thought it was.

Considering that you must have car insurance to protect your finances whenever you drive, let’s examine a few of the disadvantages of cheap insurance rates.

Contents

- 1 What are the shortcomings of a cheap insurance premium?

- 2 You could pay more out of pocket later with a cheap auto insurance rate

- 3 You take in more risk

- 4 You get fewer packs when you have a cheap auto insurance rate

- 5 It’s Less Personalized

- 6 What five factors are most important in determining car insurance rates?

- 7 What are the 4 major elements of insurance premium?

- 8 What are the 4 basic coverages of the standard auto policy?

- 9 Are older cars cheaper to insure?

Although some more affordable insurance rates may be a good idea, it is necessary to know the possible consequences of lower rates. Extremely cheap auto insurance should serve as a reminder of this fundamental truth: “you get what you pay for. To see also : How much is average car insurance?.” Having said that, all motorist car insurance premiums vary and your budget and level of risk tolerance will determine how much cover you need.

For this reason alone, it is advisable to work with a local insurance provider to research what level of coverage is reasonable for your lifestyle and financial situation.

You could pay more out of pocket later with a cheap auto insurance rate

Choosing a lower premium automatically means that some critical risks have little or no coverage. This may interest you : What is bodily injury liability insurance? – Forbes Advisor. That means more out-of-pocket costs when you’re found to be at fault for anything the policy doesn’t cover.

Nothing is a simple incident when you have inadequate coverage with huge deductibles or have to pay real money, even for a minor incident. Medical bills, repair costs, and legal fees can also quickly run into the tens, even hundreds of thousands. Or worse – they all come at the same time.

The fines themselves can cause financial hardship. Better to pay the insurance and not have to find out.

You take in more risk

One of the most popular ways to reduce insurance premiums is to increase the deductible. This may interest you : NJM Auto Insurance Review 2022 – Forbes Advisor. Such cheap insurance rates push much of the responsibility onto the insured and mean that the driver must pay a significant amount of cash upfront before coverage begins.

This means you would be in serious trouble with the law or risk your investments and savings. Your property and assets may be seized or seized to compensate victims of the accident or any damage caused. In the long term there is also an effect on your creditworthiness.

You get fewer packs when you have a cheap auto insurance rate

Higher level insurance policies often come with other coverages. This could be roadside emergency recovery or car rental cover, but the bottom line is that they come as standard with a more expensive insurance premium. These little extras are great to have because you never know when you might need them.

In addition to these benefits, purchasing multiple policies can qualify you for automatic discounts from many brokers. This is a fantastic opportunity to further reduce the total cost of the policy.

It’s Less Personalized

Most cheap insurance prices come as a fixed package with little flexibility in the types of coverage. However, an insurance broker can help you choose the coverages you want with a reasonable insurance budget. This is probably one of the best ways to put together a shelf with recommendations and accessories that fit your lifestyle. For example, a water damage clause can help you recover from a disaster if you live in a flood-prone area. You’d be surprised how many insurers use your credit scores and driving record to determine your insurance rate. You must keep these records impeccable.

Related: Auto Insurance Myths You Should Stop Believing

Prix moyen de l’assurance selon le type de véhicule En moyenne, une assurance pour voiture sans permis au tiers tourne aux alentours de 46.45€ par an contre 114.22€ chaque année pour une couverture tous risques.

What five factors are most important in determining car insurance rates?

Answer:

- Age.

- Driving history.

- Credit rating.

- Years of driving experience.

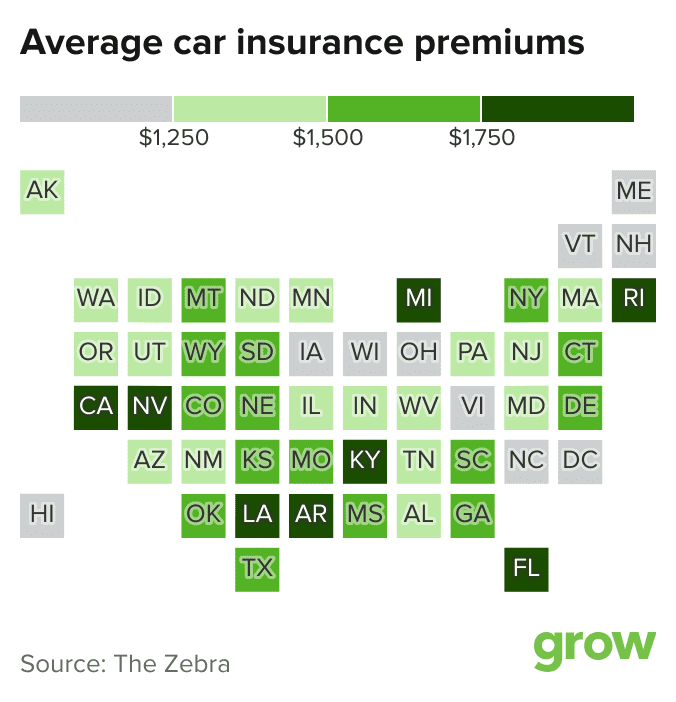

- Place.

These elements are determinable risk, fortuitous event, insurable interest, risk transfer and risk distribution.

What are the 4 mandatory elements of an insurance contract? There are four necessary elements to create a legally binding contract: (1) offer and acceptance, (2) consideration, (3) legal purpose, and (4) competent parties. The effective date of the policy is the date the insurer accepts the applicant’s offer “as written”.

What are the 4 basic coverages of the standard auto policy?

Although different states mandate different types of insurance and there are a few additional options (such as gap insurance), most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured/ underinsured driver.

What are the three basic types of coverage? The four main types of insurance are life, health, auto and home insurance.

What is standard coverage?

Standard auto insurance is the basic or lowest level of coverage available from an insurance provider. Regulations in most states require the driver to have liability insurance and will determine the exact dollar value of coverage required.

What are 4 different types of insurance coverage?

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.

Are older cars cheaper to insure?

Are older cars cheaper to insure? Yes, most older cars are cheaper to insure, especially in terms of comprehensive and collision insurance. Cars lose value as they age, so potential insurance payouts after an accident also drop. This is not the case with many classic or collector cars.