A new report shows that the cost of car insurance jumped by almost 2% in April. Here are some ways to save

Is $200 a month a lot for car insurance?

Contents

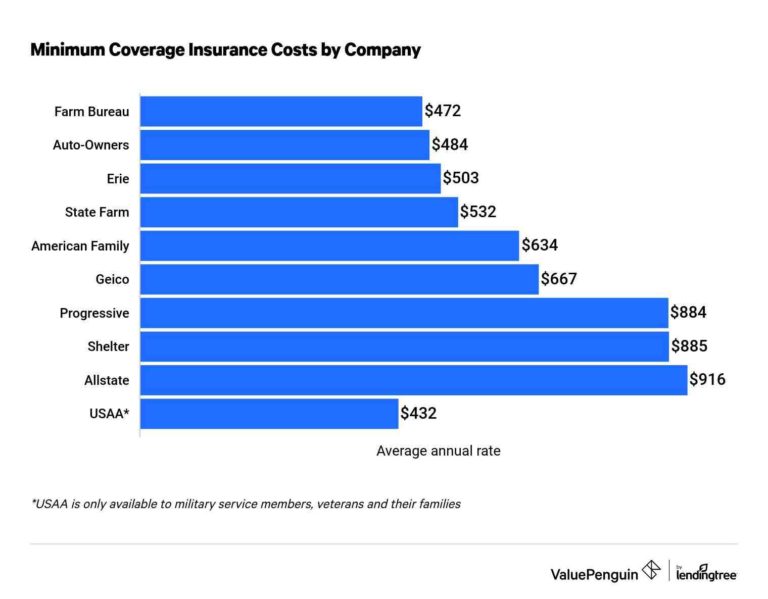

Is €200 a lot for car insurance? If you pay monthly, $200 is a lot to pay for car insurance. The national average cost for auto insurance is $52 per month for minimum liability coverage and $167 per month for full coverage auto insurance.

How much does most car insurance cost per month? The average cost of car insurance in the US ranges from $180 to $7,302 per year, depending on coverage, driver profile, location and provider chosen. On the same subject : Here Are The Cars That Buy The Highest Insurance Rates For 2022. Those considered high risk due to a speeding ticket, DUI/DWI, accident or poor credit pay an average of between $209 and $319 per month for full coverage.

Why is my car insurance over $200? Car accidents and traffic violations are common explanations for an increase in insurance rates, but other reasons your car insurance rate may go up include changing your address, adding a new vehicle or driver, increases in claims in your zip code and increases in auto repair costs. /replacement costs.

How much do you have to pay per month for insurance?

Has car insurance gone up in 2024?

Why does Geico keep raising my rates? Geico may have increased your rates due to changes in your policy or circumstances. Read also : How much does car insurance cost?. Examples include adding a new type of coverage, qualifying for an additional type of discount, being involved in an accident or purchasing a new car.

Why is car insurance so expensive now? A confluence of forces was to blame: the Covid pandemic disrupted supply chains, pushing used car prices to record highs and making spare parts difficult to obtain; Drivers coming out of practice and lockdown caused more serious wrecks; and technological advances like motion sensors made even the simplest parts, like a…

Will car insurance rates increase in 2024? According to a report from Bankrate, the average annual premium for full-coverage car insurance has increased to $2,543 by 2024, a 26% increase from the previous year.

Did home insurance go up in 2024?

While an intense hurricane season has the potential to cause premium increases next year, Insurify predicts that Americans will see a more modest 6% premium increase in 2024, bringing the average annual homeowners insurance rate to $2,522 by the end of the year. See the article : Why car insurance premiums will continue to rise in 2024.

Has car insurance gone up in Ireland?

According to figures from the CSO and the Central Bank of Ireland, car insurance premiums actually fell between 2021 and 2022, before rising slightly again over the past year. Last year the number of road deaths was the highest in nine years, which would put upward pressure on insurance premiums.

Why are Irish motorists seeing a rise in car insurance costs? Aviva says the increasing number of vehicles with advanced technology is another reason for cost increases. Brian O’Connor, Chief Claims Officer at Aviva, said a positive recent development has been an increase in the number of people being prosecuted for insurance fraud and receiving prison sentences.

Why is car insurance suddenly so expensive? Your specific driver profile, which includes factors such as where you live, your age and your driver’s license, affects what you pay for car insurance. But rising auto repair costs and an increase in disaster-related claims are major reasons why auto insurance rates are rising for many motorists.

Is car insurance expensive in Ireland? Average car insurance price by county Similarly, some rural counties in Ireland have higher insurance premiums than others due to higher claims rates. Of the four counties in Ireland, Connacht has the lowest average premium price at an average of €638 and Leinster is the most expensive at €700.

Why is car insurance going up in Ireland?

These factors include a higher frequency of insurance claims, a higher percentage of uninsured drivers, and a greater risk of accidents due to the country’s narrow and winding roads. Additionally, the cost of car repairs and medical expenses in Ireland can be higher, leading to higher insurance premiums.

What is the average car insurance premium in Ireland? Between 2021 and 2022, the average premium costs per policy fell by 7% to €568. The average cost of a damage claim has increased by 20% in 2022. This means that the average cost of claims has increased by 35% since 2020. Claims as a percentage of premiums increased from 47% in 2022 to 61% in 2021.

Why has car insurance increased so much in Northern Ireland?

“There are a number of reasons for this, including fewer insurers offering cover in Northern Ireland, and a more rural landscape, resulting in higher mileage and therefore an increased risk of accidents.”

What is the average cost of car insurance in the UK? Based on an analysis of policies sold, the typical price paid in the first quarter of 2024 was £635, representing a 1% increase on the previous quarter, the ABI said. In the first quarter of 2023, the average premium paid for private car insurance was £478.

What is the average car insurance in Northern Ireland? The average cost of car insurance in Northern Ireland is now £1,051 – an increase of 57% (£387) in just 12 months – says confused.com.

How much will my insurance go up after an accident in Ireland?

How much does car insurance increase after a claim? Although the amount will depend on who is at fault, the severity of the accident and your own driving record, you can expect your car insurance to increase by approximately 20-50% after you make a claim.

Will I lose my no-claim bonus if I have an accident? If you decide to make a claim, your no-claim bonus will be affected until your insurer can recover the costs from the other driver’s insurer. But a no-claim bonus is only relevant when the policy is renewed annually.

Why is car insurance so expensive in Ireland? Irish car insurance is more expensive for two main reasons: limited competition and regulation. Because there are few companies offering insurance, prices can remain high. Government regulations and laws can also increase the cost of providing insurance, which is passed on to customers in higher premiums.

Why is my car insurance so high with a clean record in the UK?

When calculating your premium, insurers take all your personal information into account and assess how likely you are to make a claim. If they think your personal circumstances make you more likely to make a claim, they will consider you a higher risk and offer you a higher price.

Why is my car insurance so high in Britain? It may seem like a “guilty until proven guilty” approach to insurance, but unfortunately that is the way insurance works. This means that premiums can be especially high for people who are young, people who have had a previous driving conviction, and people who live in areas where many accidents and car thefts occur.

Why is British car insurance different? British car insurance usually covers the vehicle and not the driver. This means that you are not automatically insured for driving other people’s cars. However, some comprehensive insurance policies do allow this. When you take out car insurance in Great Britain, you indicate who is on the policy.

Why is British car insurance so expensive in 2024? The cost of parts and labor has risen due to inflation, meaning it costs insurers more to repair or replace vehicles. It is also more complicated to repair cars today because many of them use expensive technology and equipment. It’s still worth shopping around.

How to reduce car insurance cost in the UK?

20 tips to get cheaper car insurance

- Choose your car carefully. …

- Drive fewer kilometers. …

- Add a named director. …

- Protect your no-claim bonus. …

- Pay for car insurance in advance. …

- Increase your voluntary deductible. …

- Take administration costs into account. …

- Choose changes wisely.