Another problem for American motorists: car insurance costs

Car insurance costs are rising

Rising gas prices are not the only currency US drivers are struggling with these days. Vehicle insurance now costs about $ 700 more than before the cancer outbreak, industry data show.

The average car driver will spend $ 1,771 on car insurance this year, nearly $ 100 from 2021, according to a new Bankrate study. But that has risen sharply since 2019, when annual premiums reached $ 1,070, according to the National Insurance Commissioners. This increases the cost of owning a car at the same time as buying, repairing a vehicle and getting more expensive fuel.

“The housing transportation budget has been in a financial crisis in the wake of inflation over the last 40 years, and almost every aspect of driving is becoming more expensive,” said bank analyst Sarah Foster.

Gas prices, which hit $ 4.33 a gallon on March 11, are now averaging about $ 4.22. Meanwhile, the average price of a new car has risen 12% from the previous year, according to the US Department of Labor. The new regular car costs $ 46,404, according to the Kelley Blue Book. The price of used cars has increased by 41% in the last year and now reaches nearly $ 29,000, according to Edmunds data.

The Bankrate survey surveyed the country’s 25 major cities to determine where drivers pay the most car insurance as a percentage of their annual income. It was found that motorists in Boston and Seattle are paying the lowest, at around 1.3% and 1.5% respectively. Drivers in Miami and Tampa, Florida, face the highest car insurance costs at 5.5% and 5% of their earnings, respectively, according to Bankrate.

Raising car insurance costs “is clearly an increase in commodity prices,” Foster told CBS News on Monday.

“Drivers have a variety of ways to reduce car insurance costs, and the urgency is even greater for those living in Miami, Tampa or Detroit, where drivers spend almost twice as much on insurance premiums as the national average,” she said. . “At the end of the day, insurance has no pairs. Each company will offer something different, meaning shopping comparison is the most important step to make sure you do not leave money on the table . “

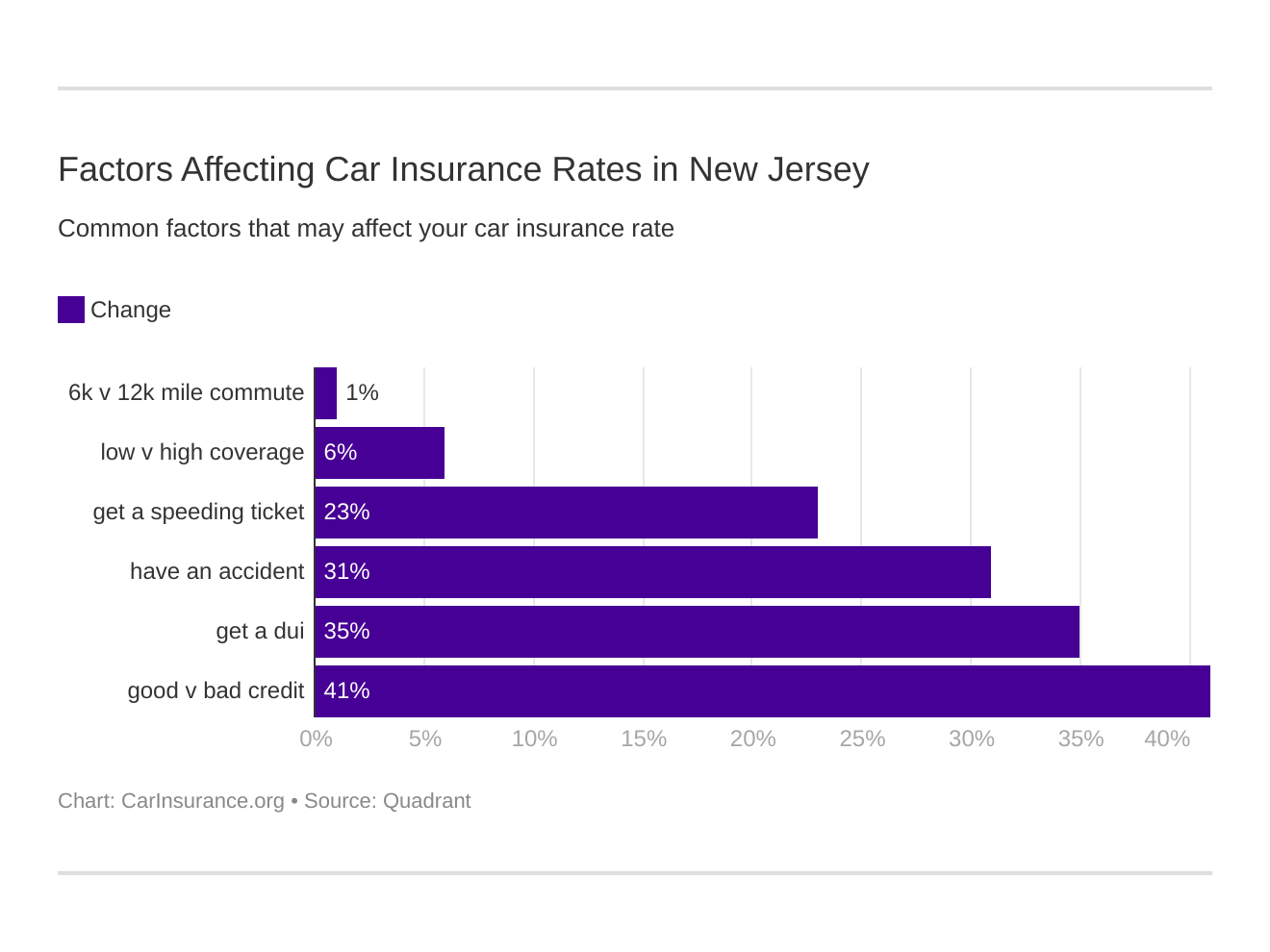

Generally, the cost of car insurance depends on the vehicle, the person’s driving record, where they live and other factors. Bankrate also found that adding youth in policy, getting faster tickets and getting lower prices often leads to lower car insurance costs.

There will be a shortage of drivers on the road in 2020 while COVID-19 will lead millions of Americans working from home and closing businesses. When driving declined, consumer advocacy groups pushed insurers to reimburse customers. Allstate, Farmers and others have finally returned at least $ 1 billion to their customers.

Insurance prices are currently rising as Americans take to the streets and increase their risk, according to the New York-based Insurance Information Center. Medium prices indicate rising car parts prices as the disease continues to unleash global supply chains, the group noted last month.

Khristopher J. Brooks is a CBS MoneyWatch reporter who covers business, consumer and financial stories ranging from economic instability and housing issues to bankruptcy and sports business.

Create your free account or sign up for more features.

Please enter your email address to continue

Please enter a valid email address to continue

Contents

- 1 How can I lower my car insurance premiums?

- 2 Why do premiums vary premium quizlet?

- 3 Do points increase your insurance?

- 4 Does car insurance depend on the car?

Listed below are some things you can do to reduce your insurance costs. This may interest you : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have.

- Shopping nearby. …

- Before you buy a car, compare the cost of insurance. …

- Look for higher deductibles. …

- Reduce coverage on older cars. …

- Buy your homeowner with coverage from the same insurer. …

- Maintain a good credit record. …

- Take advantage of the limited mile discount.

How do I cancel French car insurance? What document do I need to cancel my car insurance in France? If you sell your car in France, you need to send a Declaration de Cession signed by both parties to your insurance company. You must write ‘Vendue’, the date and time of sale in Carte Grise (French log book).

Do you get penalized for canceling car insurance?

Reimbursement: Most car insurance companies do not charge a refund, but some charge a $ 50 fee, or something called a j œ kuɗi kuɗi kuɗi kuɗi kuɗi â wanda wanda wanda wanda wanda wanda wanda wanda wanda wanda wanda â â â â â â â â â â â â â â â â â â â â political time. On the same subject : How Car Insurance Can Bring High Lemonade Stores.

Can you cancel your insurance policy at any time?

The answer is that you can actually cancel your insurance policy at any time. Sometimes the question comes, ‘Can I cancel my car insurance at any time?’ The answer is that you can actually cancel your insurance policy at any time.

What happens if I want to cancel my car insurance?

The regular car insurance policy takes 12 months but yes, you can cancel it at any time. Keep in mind that you will not be reimbursed automatically and the insurer may charge you a cancellation fee. Take care of the extra cost if you drive your car insurance system through a dealer though.

Does canceling car insurance hurt credit?

Don’t worry, canceling your car insurance will not hurt the value of your credit. But if you cancel your car insurance while you have the car, the next insurers will see that you have less coverage, which can increase your value.

Can you cancel vehicle insurance at any time?

Most car insurance policies state that you can cancel your policy at any time. You only need to send a written notice with the effect of the cancellation date. On the same subject : Safeco Car Insurance Review 2022 – Forbes Advisor. It is always good (and in most cases necessary) to notify the old insurer when you switch to the new insurer.

What is the code for promo?

Advertising numbers are a mixture of letters and numbers that connect a specific number. This code can be entered into the ecommerce website to receive discounts on products or services such as free shipping. It is a marketing strategy that gives customers a reason to make a purchase.

Can you hack promo codes?

A hacker can force the value of a coupon code field by trying all combinations of value letters of a certain height (usually 4 to 10 characters). Easier said than done, this technique is possible but has a very strong control over the hacker’s control.

Are promo codes legitimate?

A valid certificate will always come from the right source. Certificates of fraud circulating on Facebook or appearing in your email may be genuine, but will not appear on the company’s official website, website, or email account.

How do I unsubscribe from Mutuelle France?

You can stop the policy in any way, but it is better to do it by registered mail. Where it is an online contract, all you need to do is send an email, which the insurer needs to respond to, although you need to monitor to make sure it is not delayed.

What is mutuelle France?

Mutuelles of France are non-governmental organizations that have been operating in the country for at least 150 years. and other types of clothing.

Is mutuelle mandatory?

Everyone living in Belgium must join a ‘mutuelle’ or a health insurance provider. This guarantees the payment of most medical bills, medicines and hospital expenses.

How do I cancel mutuelle?

Cancel or Change your Mutuelle Health Insurance You also need to send a letter of termination by registering â € “Here is an example letterâ € and your insurance will be canceled within a month.

Why the cost of time insurance is different. – The longer the time, the higher the value. – Older insurers, higher value. – The higher the amount of insurance, the higher the value.

Is the cost of insurance different? While circumstances vary with each policy and insurance company, higher insurance costs may occur for a variety of reasons. Insurance companies have options that will best match the value proposition you pay to your risk of future insurance claims.

Insurance companies offer different options when you purchase an insurance plan. The more coverage you get, or the higher coverage you choose, the lower your insurance costs may be.

There are some things that are not in your control but can still affect your value, including: rising maintenance costs, increasing the number of attractive drivers on the road, more drivers on the road, faster speeds in your area, and more unsatisfactory drivers. insurance.

Car insurance prices change frequently for a number of reasons. These factors include driving records, drivers on policy, cars on policy, state laws, and accidents and crimes in your area. Driving Record â € “Your driving record is a major contributor to higher prices.

Your Limits and Discounts You may find that the more coverage you buy, the lower your cost may be. Your deductible â € adadin the amount you agreed to pay before your insurance started to help pay for the cover loss â € ”also plays a role in your amount.

Premium. Coverage is the amount paid to the insurance company for health insurance purposes. Payments are usually made monthly.

Literally, value is the price paid above and above some basic or actual value. Also, the price paid for protection against loss, risk, or harm (e.g., insurance or contract options). The word “premium” is derived from the Latin word praemium, which means “reward” or “gift.”

premium. the amount charged by the insurer; payment made for insurance / cost charged.

The cost of insurance is the amount of money that an individual or business must pay for the purpose of insurance. The insurance premium is the income for the insurance company, once it is received, and represents liability in that the insurer must provide coverage for the claims made on the policy.

Factors that can affect car insurance costs are: -Varity value: higher car value, higher value. -Repair vehicle record: the easiest car damage can be repaired, lower cost. -Your age: younger drivers are less experienced and pay higher wages.

-The higher the risk, the higher the value. -Actuaries base the value of life insurance on three factors: mortality, profit, and expenditure.

The cost of insurance is set by potential insurers for loss or reversal from management and is based on specific risk factors that are considered as predictive. Companies that take steps to reduce their risk also have a better chance of reducing their value.

As insured insurers, company insurers (i.e. insurer accountants) increase the value proposition. Actuaries base life insurance costs on three factors: mortality, profit, and expenses: Death is the risk of death from the applicant. It is a charge.

Do points increase your insurance?

However, considering all this, research shows three points could increase driver insurance rates by an average of 5%, while six points of judgment could push insurance costs above the average 25%.

Are 2 points on Increasing your insurance? Two points will increase the cost of driver insurance by almost 20% to 100%, depending on the state, insurance company and type of violation. Two points are awarded for minor vehicle violations, such as driving at night without headlights or turning illegally.

How much does 2 points affect insurance in Texas?

Texas also has a two-point scoring system that assesses every penalty or three in the event of an accident. If you accumulate six points or more in a year, you will pay an additional $ 100 for three years, plus $ 25 for each additional point.

How long does a ticket affect insurance in Texas?

If you are found guilty of a traffic violation, items related to this ticket will be added to your Texas driverâ € ”record and will remain in place for up to 3 years from the date of your conviction. Even a mere 2 points on your record can result in higher insurance costs.

How long do points stay on your record in Texas?

Texas Point System Collection points may result in suspension or other penalties, such as fines or even increased car insurance costs. All tickets and tickets are added to the driving record and will remain on your record for up to three years after the decision date.

Will 2 points affect my insurance in Michigan?

Michigan law does not provide for driving data, so once a ticket is on the driving record it is there to stay. However, there is good news. While your ticket price will be on the driving record forever, it will not affect your long-term insurance.

How much does 2 points increase insurance in Michigan?

This is a question that drivers may be concerned about if they have been abused and live in a state with a rational system or which the insurance company uses points to assess value. Drivers can expect points to increase their value proposition by six months and less by 20 percent to over 100 percent.

How long do points stay on your insurance in Michigan?

The contents of the vehicle are in the driving history for up to two years from the date of their sentencing. Insurance laws regulate the subject matter used by insurance companies.

What does 2 points on your license mean in Michigan?

Two things: Open the alcohol basket in the vehicle. All other movements violate traffic rules. Prevention of Pulmonary Tumor Test (PBT) by driver under 21 years of age.

How much will 2 points affect my insurance in NC?

The increased SDIP insurance premiums are as follows: 1 point = 25%, 2 points = 45%, 3 points = 65%, 4 points = 90%, 5 points = 120%, 6 points = 150%, 7 points = 180%, 8 points = 220%, points 9 = 260%, points 10 = 300%, points 11 = 350%, and 12 points for insurance equals 400% increase in your insurance value, ouch!

How do points affect insurance NC?

Even an increase of one point can result in a 30% increase in your insurance value. Four insurance items can mean an 80% increase, and when you have 12 points, you could face a 340% increase.

Will 2 points affect my insurance in NC?

Illegal passing rates, severe follow-up, accidents that result in property damage between $ 2,300 and $ 3,850, speeds of 10 mph or less than the maximum speed of 55 mph or higher are some of the offenses that can result in insurance coverage. two. This can cause your insurance premium to increase by 45 percent.

What does 2 points on your license mean in NC?

Speed over 10 mph at maximum speed at speeds between 56 and 75 mph â € “2 points. Speak 10 mph or less if maximum speed is 55 mph or above 2 points. 10 mph or less if maximum speed is below 55 mph â € “1 point.

Does car insurance depend on the car?

The car you are driving – The cost of your car is a big factor in the cost of insurance. Other variables include the possibility of theft, repair costs, engine size and a complete car safety record. Improved safety vehicles may be eligible for a significant discount.

Is car insurance more expensive than car insurance? You may have heard that red cars are more expensive to insure. However, according to the Insurance Data Center (III), the color of the car you are driving does not affect the cost of car insurance. Here are some tips to help you assess the value of your car and what to look for when shopping for car insurance.

Does insurance increase based on car?

Raising your price for car insurance can be frustrating, especially if you do not claim and have a clean driving record. But be aware that insurance costs are not raised voluntarily, and the reason for the increase in cost is almost always related to the risk of insurance.

Do More Expensive cars cost more to insure?

Cars are more expensive, more expensive and in principle, more expensive cars are more expensive than insurance because of the additional costs involved in repairing them, replacing parts â € “especially on foreign products â € ko or replacing them. vehicle in total loss mode.

What makes insurance high on a car?

Common reasons for expensive insurance costs include your age, driving record, financial history, coverage options, car you drive and where you live. Anything that insurers may relate to the possibility of adding that you will be at risk and filing a claim will result in a higher car insurance cost.

Does insurance go up depending on the car?

In many states, prices are currently rising. Your services, as a planner, can affect what you pay for, too. For example, if you add another car, or a young driver to your system, your price will increase. Alternatively, your price will go down if you drop either car or driver from your policy.

Does car insurance depend on the type of car?

Remember that car type is just one of the many factors that determine car insurance costs. Your credit history, ZIP number and more can also be included in your insurance coverage in most states. It also depends on the type and amount of coverage you choose.

Does your type of car affect insurance?

Your car design, your style, your trim, your age and body type all play a role in how much you pay for car insurance. An expensive car with more features and a larger engine will cost more to insure than a standard car with a higher safety value.

What type of cars make insurance higher?

This is why motor vehicles, which are more prone to accidents because of their high performance, are usually more expensive to insure. Cars that are expensive to repair â € ko or have a market value â € are also often subject to higher insurance costs.