Basic car insurance | Lifestyle | washtimesherald.com

Road traffic regulations are designed to make everyone on the road as safe as possible. This motivation is also behind the law governing car insurance, which is required in Canada and the vast majority of US states.

What is auto insurance?

Contents

- 1 What is auto insurance?

- 2 Compulsory vs. mandatory coverage

- 3 Premiums vary

- 4 Getting insurance

- 5 What are liabilities in insurance?

- 6 Which type of car insurance is best?

- 7 How many types of car insurance are there?

- 8 How can I lower my car insurance premiums?

Car insurance is something most drivers have, but very few, if any, hope to take advantage of. According to Insure.com, car insurance is a contract between the policyholder and the insurance company that protects an individual from financial loss in the event of vehicle theft or involved in an accident. The Insurance Information Institute says car insurance provides property, liability, and coverage coverage. Read also : California motorists may have higher car insurance rates. Property insurance covers damage to or replacement of the vehicle. Liability coverage covers the policyholder’s legal liability to others for personal injury or property damage. Medical insurance covers the costs of treating injuries, rehabilitation and sometimes even a funeral or lost earnings.

Compulsory vs. mandatory coverage

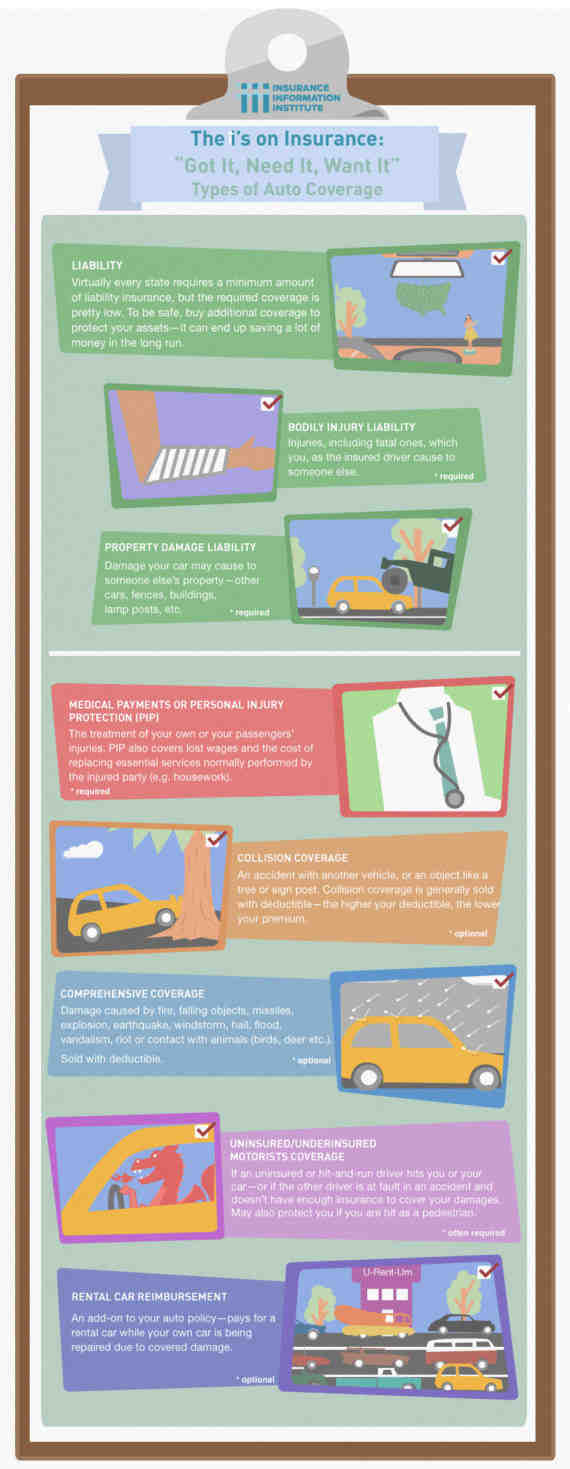

Depending on where the policy holder lives, there are certain insurances that are compulsory, or compulsory insurances, which are the minimum amounts required by law. Optional covers can also be purchased to suit your needs. Compulsory insurance may vary depending on the location, age of the driver, type of vehicle and the type of financing that vehicle has. See the article : Survey: Most Drivers Don’t Understand Their Car Insurance Coverage. It’s best to discuss coverage with your auto insurance agent to find out what types of coverage you will need and get a quote. The six basic types of coverage include:

· Insurance of uninsured and underinsured drivers

Insurance is usually sold with deductions as set out in III. Policyholders may opt for higher deductions to lower the cost of premiums. Additional factors that will affect the cost of insurance include the driver’s age, driving history, and the location where the vehicle is stored or used. Read also : Will car insurance cover hail damage?. Credit score and gender can also affect premiums. Defensive driving courses and securing the vehicle with anti-theft devices can help reduce premiums.

Car insurance costs vary widely, so shop around and compare offers. Combining car insurance with other policies, such as home insurance or umbrella policies, can help lower rates.

Getting insurance

To obtain an insurance policy, an agent will need the year, make and model of the insured vehicle. You will need a VIN for the most accurate quote.

You must be a registered car owner to take out car insurance. Some states allow independent and dependent drivers at the age of 16 or 17 to own a car for themselves. Some parents choose to combine their teenagers’ coverage as the premiums may be cheaper. Teenagers are more risky in the eyes of insurance companies due to their inexperience and perceived recklessness. These factors are reflected in the cost of the contributions.

Insurance is something every driver should have. Drivers can research their options to find rules that fit their needs and budgets.

What are liabilities in insurance?

Third party liability insurance refers to an insurance product that provides the insured with protection against claims for personal injury and damage to other persons or property. The third party liability insurance policies cover all legal costs and payments for which the insured is responsible if deemed legally responsible.

What is the difference between full insurance and liability? What is liability insurance versus full insurance? The third party liability insurance will cover damage to other vehicles or injury to other people while driving. Fully insured policies include liability insurance but also additional protection against damage to your own vehicle.

What are the 3 components of liability insurance?

Responsibility. Most auto insurance policies have three main parts: personal injury insurance, property damage insurance, and uninsured / underinsured drivers.

What are the two components of liability insurance?

Vehicle liability insurance has two components always together: personal injury insurance and property damage insurance. Vehicle liability insurance is your primary coverage that covers injury or damage to other people or property if you are at fault for an accident.

What is included in liability?

Liabilities recorded on the right side of the balance sheet include loans, liabilities, mortgages, deferred income, bonds, guarantees and accruals.

What is the type of liability insurance?

The three main types of liability insurance are: General Liability. Professional responsibility. Employer Responsibility.

Which type of car insurance is best?

What is better car insurance? Taking out comprehensive car insurance is always advisable, as it provides full protection not only of someone else’s car, eg third party liability insurance, but also of damage to your own car, as well as any injuries to the owner of the driver.

What type of car insurance is the most important? Today, there are many different types of car insurance. The most important of them are civil, comprehensive and collision liability. We will call them the Big Three. Think of them as the basics – with a reach you can’t afford without.

What is the best car insurance type to get?

Fully comprehensive This is the highest level of coverage you can have. It includes you, your car and others involved in the accident. It covers the entire policy against fire and third party theft, but also protects you as the driver and can pay for damage to your car.

What type of coverage is best for car insurance?

Key Takeaways. You should have the highest level of liability insurance you can afford, with 100/300/100 being the best level of coverage for most drivers. You may need to have additional insurances to protect your vehicle, including full collision and gap coverage.

What are the 3 types of car insurance?

The three types of motor insurance that are commonly offered are third-party liability, comprehensive and collision insurance. Drivers may still purchase other types of car insurance, such as personal injury protection and the uninsured / underinsured driver, but these are not available in every state.

What are 4 main types of coverage and insurance?

Most experts agree that life, health, long-term disability, and car insurance are the four types of coverage you must have. Always check with your employer first to access your insurance.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance, and car insurance are five types that everyone should have.

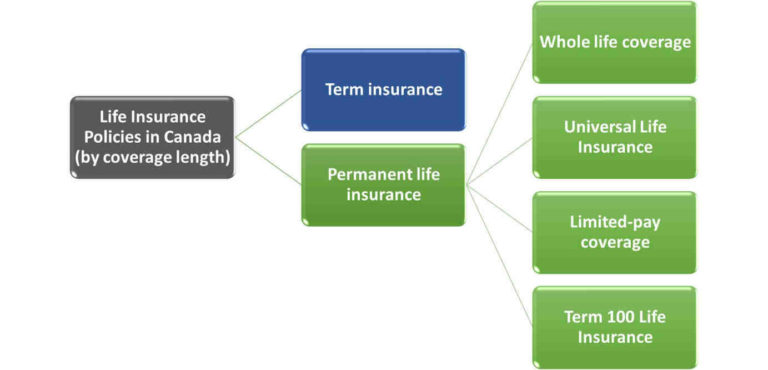

What are the three 3 main types of insurance?

- Health insurance. It allows the insured person to cover the costs of treatment during a visit to the doctor and other serious costs usually associated with operations. …

- Life insurance. …

- Property rental or insurance.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability that is insured for an individual or entity through an insurance service. The most common types of insurance cover include car insurance, life insurance, and home insurance.

What are the 3 types of car insurance?

The three types of motor insurance that are commonly offered are third-party liability, comprehensive and collision insurance. Drivers may still purchase other types of car insurance, such as personal injury protection and the uninsured / underinsured driver, but these are not available in every state.

What are the 5 basic types of auto insurance?

The most common types of car insurance include liability, collision, personal injury, uninsured and underinsured drivers, comprehensive, and medical.

What are the 3 types of car insurance in UK?

There are three levels of car insurance: Full. Third party. Third party, fire and theft.

How many types of car insurance are there?

The 3 Types of Car Insurance Policies In India, all general insurance companies offer three types of car insurance policies.

What are the 5 basic types of car insurance? The most common types of car insurance include liability, collision, personal injury, uninsured and underinsured drivers, comprehensive, and medical.

How many different types of car insurance are there?

The six common car insurance options are: third party liability insurance, uninsured and underinsured driver insurance, full insurance, collision insurance, medical payment insurance, and personal injury protection. Depending on where you live, some of these insurances are compulsory and others are optional.

What are the 7 different types of car insurance?

Here is a list of the seven types and what you need to know about each of them.

- Insurance of civil responsibility. …

- Collision insurance. …

- Comprehensive insurance. …

- Protection of the uninsured driver. …

- Medical protection / protection against personal injury. …

- No-fault insurance. …

- Gap insurance.

What are the 8 types of car insurance?

The main 8 types of car insurance to know

- Coverage only with liability.

- Collision coverage.

- Liability for property damage.

- Liability for personal injury.

- Comprehensive coverage.

- Uninsured / underinsured driver insurance.

- Coverage of medical payments.

- Protection against personal injuries.

What is the most common type of car insurance?

Personal Injury Coverage (BI) is the most common type of auto insurance as it is required in almost every state.

How many car insurance types are there?

The five types of car insurance are liability, motor own damage, collision, uninsured / underinsured driver and personal injury / medical charges. These are the most common types of car insurance, although many insurance companies also offer other types of coverage, such as gap coverage and rental reimbursement.

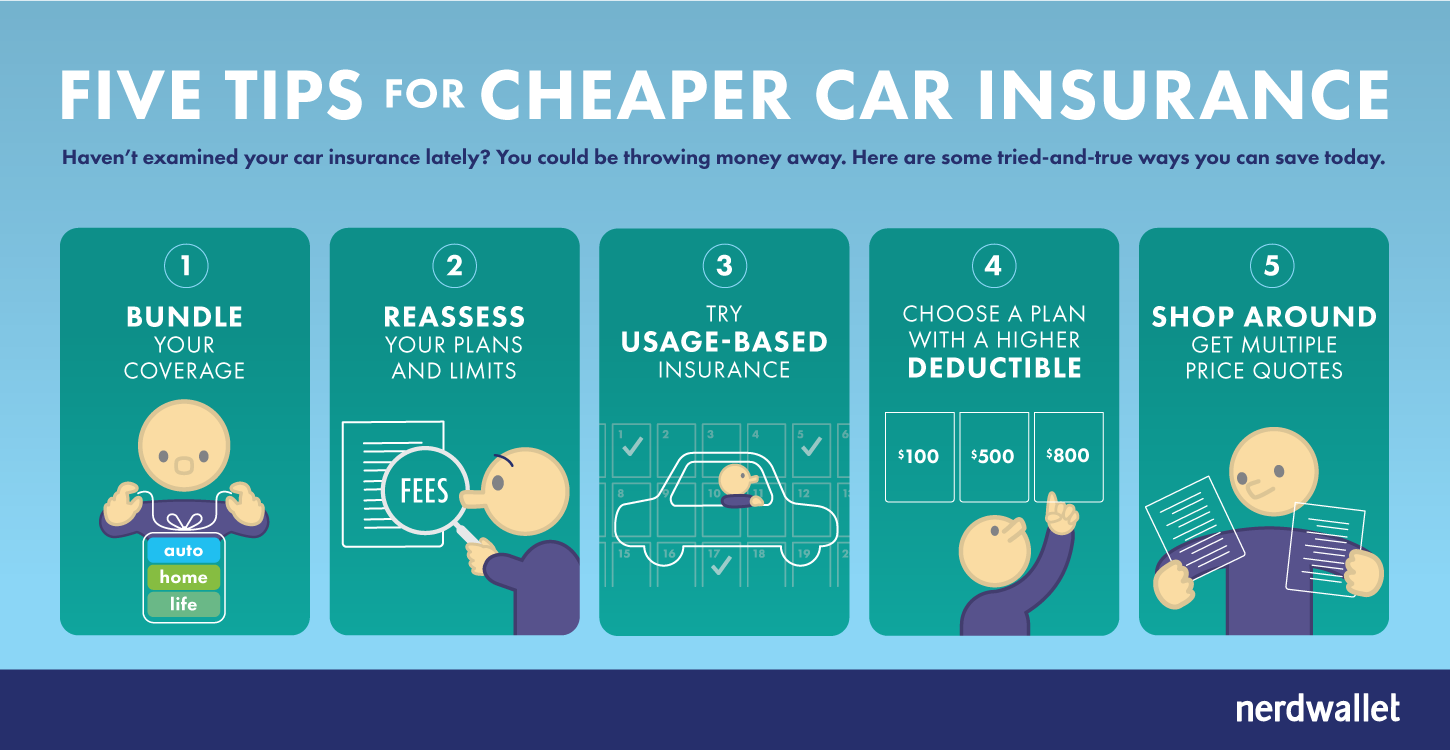

Listed below are other things you can do to lower your insurance costs.

- Shop. …

- Before you buy a car, compare insurance costs. …

- Ask for higher deductions. …

- Reduce the range on older cars. …

- Buy home owners and car insurance from the same insurer. …

- Maintain a good credit history. …

- Take advantage of low mileage discounts.

Can you ask for a reduction in car insurance? While you can’t negotiate your car insurance costs, there are other steps you can take to save money when it comes to premiums. Also, if you have been involved in an accident, you may be able to negotiate a payout as long as you do your research.

If your car or home insurance premiums seem high, you can lower them. Changing your deduction level, making a few small home improvements, or simply asking for a lower rate can mean more savings for you.

Some of the factors that can affect your car insurance premiums include your car, your driving habits, demographic factors, and your chosen insurances, limits and deductions. These factors can include things such as age, anti-theft features for your car, and driving history.

Common reasons for high car insurance costs include your driving history, age, insurance options, where you live, the car you drive, credit history, or no rebates. The average car insurance premium also increased, increasing by more than 50% in the last 10 years.