Best car insurance for college students 2022

Between tuition, books and housing, college costs a lot of money. It’s not cheap to get car insurance for college students, either; These drivers often face higher rates of insurance. There are deals available for young drivers who carefully consider their options, though.

We at the Home Media review team took an in-depth look at the best auto insurance companies in the country to find out which ones offer quality insurance at affordable prices for college students. In this guide, you will also find out what types of insurance are available and how to save on your car policy.

Best Car Insurance Companies for College Students

Contents

- 1 Best Car Insurance Companies for College Students

- 2 Types of Car Insurance for College Students

- 3 Why Is Car Insurance for College Students So Expensive?

- 4 How to Save on Car Insurance for College Students

- 5 Bottom Line: Car Insurance for College Students

- 6 Our Methodology

- 7 What is AB average GPA?

- 8 Does insurance go down at 21?

- 9 What is USAA premier driver level discount?

- 10 Does State Farm give discount for college students?

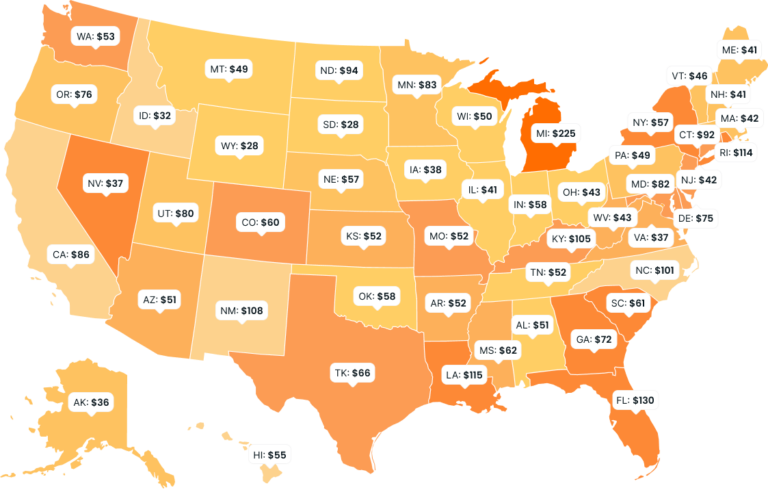

While car insurance for college students has never been more expensive, there is no reason to pay more for insurance. Read also : What are the five types of vehicle insurance?. Our estimate of average car insurance rates shows that young drivers can pay as little as $1,422 a year for full auto insurance, which is lower than the national average of $1,732 a year for adults.

Below are some insurance providers that offer a solid combination of affordable pricing, quality coverage and exceptional customer service:

*This rating is based on our general study, but providers were rated according to how they performed in our study of auto insurance for college students. Estimates in this chart and others are based on a driver profile of 24 years, the minimum age for which data is available.

#1 State Farm: Most Popular Provider

Better Business Bureau (BBB) rating: A+ This may interest you : Who owns Geico?.

AM Best financial ability: A++

J.D. Ability to claim satisfaction: 892/1,000

With a 15.9% market share according to the National Association of Insurance Commissioners (NAIC), State Park is the most popular auto insurance provider in the country. The company is especially good when it comes to car insurance for college students.

#2 USAA: Low Rates for Military

State Pharmacy offers students a number of opportunities to save money, including good student and absentee school discounts. The company also has two telematics programs, with Steer ClearⓇ specifically designed for new drivers. To see also : Etap Nigeria has acquired 1.5 million uniforms to facilitate the purchase of car insurance. In addition to monitoring driving behavior, Steer Clear includes a driver training course that typically leads to lower rates upon completion.

Continue reading: State Park insurance review

BBB rating: A+

AM Best financial ability: A++

#3 Geico: Editor’s Choice

J.D. Ability to claim satisfaction: 909/1,000

USAA typically offers some of the lowest rates on auto insurance, with college students often getting deals. The company also scores near the top in various insurance industry studies. Remember that USAA insurance is only available to military members, veterans and their families.

If you qualify, USAA is definitely worth a look. In addition to high-quality and affordable car insurance, college students may qualify for more discounts to keep costs down. The company also has several special products and policies for military members and military families that may be of benefit to them.

Continue reading: USAA insurance review

#4 Progressive: Low Rates for High-Risk Drivers

BBB rating: A+

AM Best financial ability: A++

J.D. Ability to claim satisfaction: 881/1,000

Geico won an editor’s choice award in a study of the best auto insurance companies for its excellent overall performance. The company offers highly rated insurance and affordable rates to a variety of drivers, including mostly college students.

Geico also offers a variety of insurance options including higher insurance limits that are convenient for inexperienced drivers. Students who don’t use their car often while in college can also benefit from a usage-based car insurance policy.

#5 Travelers: Most Coverage Options

Continue reading: Geico insurance review

BBB Rating: Not rated

AM Best financial ability: A+

J.D. Ability to claim satisfaction: 862/1,000

Types of Car Insurance for College Students

Although the company offers reasonable rates for most drivers, Progressive has specialized in serving high-risk drivers for decades. With the demographics of college students among the most at-risk groups, Progress is worth considering.

Standard Coverage Types for College Students

The company offers both student and long-distance student discounts, along with rare discounts specifically for young drivers. This can help lower Progressive auto insurance rates for young students.

Keep in mind that Progressive has a below average customer satisfaction rating because of how it handles claims. Our team reached out to Progressive for comment on the claims process but did not receive a response.

Additional Coverage Options for College Students

Continue reading: Review of development insurance

BBB rating: A

Why Is Car Insurance for College Students So Expensive?

AM Best financial ability: A++

J.D. Ability to claim satisfaction: 871/1,000

Factors That Affect Car Insurance Rates for College Students

Travelers is another great provider that offers reasonable rates on car insurance for college students. College students can take advantage of many discounts to keep insurance rates on the low end. In addition to student discounts, the company offers savings for completing a defensive driving course and insurance for hybrid or electric vehicles. And, the company’s optional accident forgiveness program can keep your premiums from rising after an accident.

Travelers receive fewer points in the claims process, receiving just 871 points out of 1,000 in the J.D. Power 2021 US Auto Claims Satisfaction Study℠. We reached out to Travelers for comment on their claims process but never received a response.

Continue reading: Travel insurance reviews

How to Save on Car Insurance for College Students

Aside from the costs, most of the details about car insurance for college students are the same as for other drivers. New drivers have the same minimum coverage requirements as others, and generally have the same coverage options and discounts.

Stay on a Family Insurance Policy

At the very least, you’ll need a car insurance policy that meets your state’s minimum coverage requirements. This usually includes liability car insurance and health insurance in some areas. Here’s a look at some of the components of a typical insurance plan, and what they cover:

In addition to this study, most experts recommend comprehensive insurance policies that include these important but optional options:

Leave the Car at Home

Insurance companies also offer extras to help manage other costs associated with car ownership. Many of these options cost just a few extra dollars a month and offer services that can be especially helpful for college students.

Maintain Good Grades

College students are not required to include these options when shopping for car insurance, but they may give some young drivers peace of mind.

Insurers base car insurance premiums on the likelihood that they will need to pay a claim after an accident. Drivers with high risk factors are more likely to get into an accident, so they generally pay more for insurance.

Take a Driving Course

Young drivers are the most involved in car accidents, especially fatal ones. According to data posted by the Insurance Institute for Highway Safety (IIHS), the fatal crash rate in the United States for drivers aged 16 to 19 is three times higher than for drivers aged 20 and older.

Seek Out Other Discounts

Age plays an important role in your premiums, but it is not the only factor. Insurers use many factors to determine how much drivers pay for insurance, so not all college students pay the same rate.

Reduce Your Coverage

Below, we’ve listed some of the most important factors that determine the price of your car insurance:

The best way to find out how much you will pay for car insurance as a university student is to compare car insurance quotes from multiple providers before you make a final decision.

Consider a Telematics Program

There is no way around the fact that car insurance for young college drivers is just more expensive. While you wait for rates to drop with age, there are a few steps you can take to lower the cost of auto insurance for college students.

In the United States, drivers can stay on their parents’ policies until age 26. It’s often cheaper to stick with your current car insurance plan than to buy your college student their own policy. Another reason is because most insurance companies charge less for additional plans than for individual policies.

Bottom Line: Car Insurance for College Students

There are potential downsides to adding a student to a parent’s auto insurance policy, though. If a person has earned a discount to avoid accidents and moving violations, for example, they can lose those savings if everyone in their car insurance is involved in one.

Some insurers offer discounts to full-time students who leave their car at home while attending school elsewhere. Students who rarely return home or don’t drive much when they do may also benefit from a usage-based auto insurance policy that costs per-mile.

Our Methodology

Many insurers offer discounts to students with strong grades in school, providing a great opportunity to save on auto insurance for college students. These “good student discounts” vary by company but generally follow one of the standards outlined below:

These are just guidelines. Be sure to check with your insurance agent to find out about the exact requirements of your provider.

Many insurers offer discounts for completing an approved defensive or driver’s education course, which helps students be more responsible on the road. Learning safe driving techniques can help young drivers avoid accidents and lower their car insurance rates.

We’ve mentioned student out of school discounts, good student discounts and driver training discounts, but insurance companies often offer more ways to save. These common auto insurance discounts can help you lower your auto insurance costs:

What is AB average GPA?

The types of insurance you have and how much of each you have are the main factors in determining the cost of your car insurance. Getting rid of unnecessary insurance is a quick way to lower rates.

The less insurance you have, the more risk you take. Given that young drivers such as college students are more likely to be involved in an accident, you will need to weigh that risk in your car insurance policy.

Is a 2.5 GPA AB average?

Telematics insurance programs use GPS-enabled mobile apps to track your driving habits. They check if you speed, how hard you brake or accelerate and how often you pick up your phone while driving.

Is a 2.5 A good GPA?

Insurance companies advertise telematics programs to save money on insurance. While some drivers find great savings from these programs, it’s important to note that they can also drive up prices.

What is a 2.5 average GPA?

Car insurance for college students is likely to be more expensive than older drivers. However, companies offer many ways for students and young drivers to save.

Is 2.5 A good GPA in college?

The only way to know for sure which company offers the best price is to get yourself a quick quote. You can compare car insurance rates online from many companies to see which one offers the best price. Before signing up, be sure to ask about available discounts.

Is all B’s 3.5 GPA?

Because customers rely on us to provide reasonable and accurate information, we have created a comprehensive rating system to make our ratings of the best car insurance companies. We’ve collected data on dozens of auto insurance providers to rate the companies on a variety of factors. The final result was an overall rating for each provider, with the insurers that scored the most at the top of the list.

What is your GPA with all Bs?

| Here are the factors our rating takes into account: | *Information correct at time of publication |

|---|---|

| To calculate your GPA, divide your total grade point average by the total number of letter grade units taken. Each credit unit is scored as follows: A+ = 4. A = 4. | A B average corresponds to a 3.0 GPA, which is roughly the average for a high school student. Keep in mind that this is the average for ALL high school students, not just students who plan to attend college. |

| Is the average 3.5 GPA AB? A 3.5 GPA, or Grade Point Average, equates to a letter grade of B on the 4.0 GPA scale, and a grade point average of 87–89. | 2.5 GPA = 80% grade point average = B letter grade. |

| Is a 2.5 GPA good? A 2.5 GPA means you earned high Cs and low Bs in all your classes. This GPA is below the 3.0 national average for high school students, and will likely make it difficult for you to get into all but the least selective colleges. 2.12% of schools have an average GPA below 2.5. | A 2.5 GPA, or grade point average, is equivalent to a letter grade of C on the 4.0 GPA scale, and a grade point average of 77–79. |

| A 2.5 GPA is equivalent to a C average, making it the starting GPA at many colleges and universities, even some of the more competitive institutions – although acceptance at that level will be a long shot. | Is a 3.5 GPA all B’s? If you have all As, your GPA is 4.0. If you have all Bs, your GPA is 3.0. If you have a mix of As and Bs your GPA is around 3.5. |

How many Bs is a 3.0 GPA?

Letter Level

How many Bs is a 3.6 GPA?

GPA

What GPA is an average of B?

| B | 3.3 | B |

|---|---|---|

| 3.0 | B- | 2.7 |

| C | 2.3 | A 3.0 GPA is a letter grade of B or 83–86% – GPA calculator. |

| 3.6 GPA is a letter grade of B or 87–89% – in the GPA calculator. | Letter Level | Percentage rank |

| 4.0 Scale | A- | 90-92 |

What is a average B?

3.7

How many B’s is a 3.0 GPA?

B

Is a 3.5 GPA all B’s?

87-89

Does insurance go down at 21?

3.3

B

Is your insurance supposed to go down when you turn 25?

83-86

Why does car insurance drop when you turn 25?

3.0

Why didn’t my insurance go down when I turned 25?

B-

Why is my car insurance so high at 21?

80-82

Why my car insurance is so high?

2.7

Why is car insurance so high for people under 25 years old?

B GPA. A letter grade of B corresponds to a 3.0 GPA, or Grade Point Average, on a 4.0 GPA scale, and a grade point average of 83–86.

Why is my insurance so high at 21?

A 3.0 GPA is a letter grade of B or 83–86% – GPA calculator.

Do insurance rates go down when you turn 21?

A 3.5 GPA, or Grade Point Average, is equivalent to a letter grade of B on a 4.0 GPA scale. This means 87-89%. The national average GPA is 3.0 which means 3.5 above average.

Who typically has the cheapest car insurance?

Is car insurance cheaper when you’re 21? Yes, car insurance rates generally drop after you turn 21. The average rate for a 21-year-old is 16% cheaper than the rate offered by a 20-year-old. Car insurance rates generally drop in your early 20s, with smaller drops into your late 20s.

What’s the best car insurance right now?

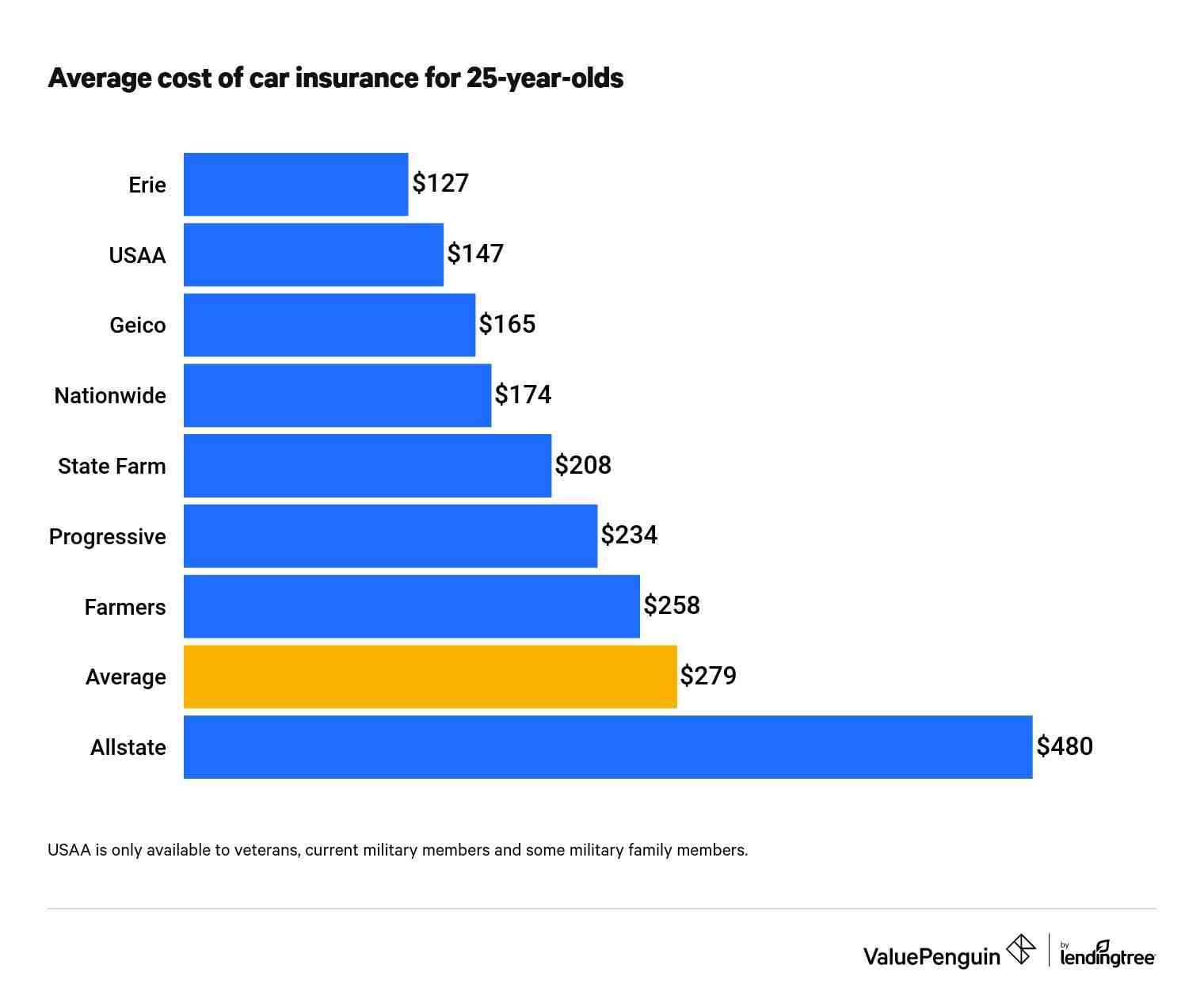

| At what age does car insurance start to decline? Drivers see car insurance premiums start to drop at age 20, with the biggest drop coming at age 25. Rates tend to rise for decades starting at age 35. When you pass At 65, however, age does seem to affect driving ability. | In general, younger drivers tend to pay more for car insurance “but once you reach the age of 25, your premiums will drop. According to CarInsurance.com, the average annual premium for a male 24 For a year old with full coverage it’s $2,273.At age 25, that average drops to $1,989, a drop of about 12.5%. | Yes, the cost of car insurance usually goes down when you are 25 years old, as you are no longer considered an insurance risk. But lower prices are not guaranteed for all drivers. |

|---|---|---|

| If your teen’s driving record includes multiple violations and/or at-fault accidents, your rates won’t drop after you turn 25. If you have a particularly poor driving record, your rates may even increase in your mid-twenties. | Very young or very old people are statistically more likely to cause car accidents than the average driver, so insurance companies charge the highest premiums. | Common reasons for high insurance rates include your age, driving record, credit history, insurance options, the car you drive and where you live. Anything that insurers can associate with the increased likelihood of you being in an accident and filing a claim will result in higher auto insurance premiums. |

| The reason insurance is higher for someone under the age of 25 is because younger drivers are statistically more likely to get into an accident than older drivers — and therefore are more risky for companies to insure. | If you are 21-years-old, you have less driving experience than an older driver. To compensate for the increased risk of causing an accident, car insurance companies usually charge you a higher premium if you are recently licensed. | Yes, car insurance goes down when you turn 21. Car insurance premiums drop by about 20% between the ages of 20 and 21 and car insurance premiums continue to drop every year throughout your 20s and 30s. The decline in the 21-year-old rate is the second largest age-related price change, on average. |

| Among the national insurers, USAA has the cheapest rates, at $36 per month, with State Park in second place, at $44 per month. The cheapest local company is Farm Bureau, at $39 a month. | Car Insurance Company | General Assessment |

| Our reward | #1 USA | 9.5 |

Who offers the best vehicle insurance?

Low military standards

What is USAA premier driver level discount?

#2 Geico

9.2

Does USAA offer good driver discounts?

Editor’s Choice

Does USAA have car discounts?

#3 State Park

Does USAA have a safe driver discount?

9.2

Does USAA offer low mileage discount?

The most popular provider

Is USAA auto insurance really cheaper?

#4 Progressive

How much is USAA car insurance a year?

9.2

Is USAA a good value?

Lower Rates for High Risk Drivers

How does USAA rank as an insurance company?

USA. USAA is the best insurance company in our rating. According to our 2022 survey, USAA customers report the highest levels of customer satisfaction and are more likely to renew their policies and recommend USAA to other drivers. USAA also has the lowest rates in our study, beating the national average of 35%.

Does USAA offer low mileage discount?

This tool tracks their driving habits and helps with USAA’s driving research program which earns those in the program a 5 percent discount. Senior Driver: If you have a good driving record for five years you will get this discount and qualify for accident forgiveness.

Is lower mileage better for insurance?

Does car insurance go down in 25 USAA? We analyzed quotes from four of the largest auto insurance companies – Geico, State Farm, USAA and Progressive – and found that while the car insurance rate is down by 25% for each of them, the amount is lower. happens is very different.

Does USAA have car discounts?

USAA offers good driver discounts but does not advertise a specific amount, as it varies by state. To get a good USAA discount, drivers must be accident-free for five years. This may even be at a time when another company has provided you with insurance.

How many miles is low mileage discount?

USAA Loan Discounts USAA offers members auto loan discounts when they purchase a new or used car through USAA’s Car Buying Service. The current offer is a 0.50% discount on a USAA car loan when you buy a car using the USAA Car Buying Service.

Does State Farm give discount for college students?

How much can I save with a safe driving program? Discounts will vary by insurance company and available discounts. For example, USAA’s SafePilot offers a 10% discount when you sign up, and up to 30% off your premium when your policy is renewed and your discount is calculated.

Yes, USAA offers low mileage discounts. USAA’s low mileage discount is meant to reward customers who drive less than average and will save policyholders money on premiums as long as they drive less than 12,000 miles a year. USAA isn’t disclosing the amount of the discount, though.

Does car insurance have student discount?

In addition to strong survey scores, USAA has the lowest rates and ranks first in our Cheapest Car Insurance Companies 2022 ranking. On average, USAA customers pay $1,000 a year for insurance, nearly 35% less than the national average.

What is GPA for good student discount for car insurance?

The cost of USAA car insurance for full coverage is around $74 per month or just $885 per year on average. USAA’s car insurance rates for minimum coverage are just $34 a month or $405 a year, on average.

Does your education level affect your car insurance?

USAA received an overall satisfaction score of 83 out of 100 from its customer pool, according to a NerdWallet survey conducted online in July 2021. For that, the average score of the seven insurers was 79, and the highest was 83.

Does Geico verify good student discount?

USAA has a financial strength rating of A (Superior) from AM Best and an A rating from the Better Business Bureau (BBB). In our 2022 car insurance survey of 1,000 consumers, 64% of USAA policyholders said they were very satisfied with the company, the highest of any insurer.

What is State Farm Class 50 discount?

Yes, USAA offers low mileage discounts. USAA’s low mileage discount is meant to reward customers who drive less than average and will save policyholders money on premiums as long as they drive less than 12,000 miles a year. USAA isn’t disclosing the amount of the discount, though.

What is the GPA requirement for State Farm Good student discount?

Driving 12,000 miles or less per year may earn you a low mileage insurance discount. In general, you’ll see the most savings if you drive less than 5,000 miles per year. According to Insure.com, someone who drives 10,000 miles a year will pay 4% less than someone who drives 12,000 miles.

How much is the California good driver discount State Farm?

USAA Loan Discounts USAA offers members auto loan discounts when they purchase a new or used car through USAA’s Car Buying Service. The current offer is a 0.50% discount on a USAA car loan when you buy a car using the USAA Car Buying Service.

Do you get a discount on car insurance when you turn 50?

Traditional Low-Mileage Discount: Offered by most insurance companies, this discount offers a discount for driving less miles. Typically, people who drive less than 7,500 miles per year or 10 miles or less per work day are eligible for this discount.

What are some things you get discounts on for being a college student?

Students with strong grades may qualify for a good student discount. If your child is in college, or is going to school soon, contact your insurance agent today.

- What should your GPA be for the State Farm student discount? The Park State Student Discount can save you up to 25% on your car insurance when a high school or college full-time student on your policy has a 3.0 GPA, is in the top 20% of their class, or is named to the Dean’s Honor Roll for the semester. provided.

- Most insurance companies offer good student discounts for single, full-time students up to the age of 25. Ask your agent if you qualify for a discount on your car insurance bill if you continue to get good grades in your higher education.

- Good Student Discount One definition of a “good student” used by many insurance companies is a student who maintains a “B” average (a 3.0 GPA). Students may certify their school performance by providing report cards and obtaining signatures from school administrators.

- Most studies show that drivers can save anywhere from $300 to $600 a year just by having some type of post-secondary education. Savings vary based on the amount of your education. Typically, a high school dropout will pay about $300 more per year for car insurance than someone with a twelfth grade education.

- A printed copy of your most recent college or high school transcript is sufficient proof of insurance. College freshmen who want to apply for a good student discount can take a standardized test and submit their percentile score to GEICO.

- State Car Insurance Over 50 The State Park reduces premiums by five percent for drivers over 55 who have taken an accident prevention course in the past three years. The program is called the State Farm Accident Prevention Discount.

- Outstanding Student Discount Had a grade point average of 3.0 (except 4.0) or higher. Made the Honor Roll or Honor Roll.