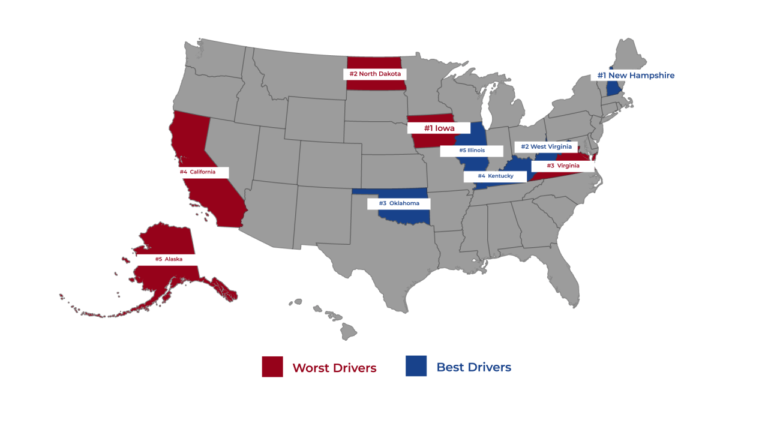

Report: Florida is ranked 2nd highest for car insurance costs

Florida drivers spend more of their salary on car insurance than everyone else in the United States. That’s according to a new Bankrate.com report that says drivers in Sunshine State spend a staggering 4.42% of their annual revenue on car insurance. The only state that spends most of its money on insuring its vehicles is…