There are some insurance providers who, in determining the applicant’s existing medical condition, will take full account of their medical history. Some other providers may only consider the applicant’s medical history for a period dating back to the last 4 years.

How do you scare insurance adjusters?

Contents

- 1 How do you scare insurance adjusters?

- 2 What are the most common claims for workers compensation?

- 3 How witness credibility affects a car accident claim?

- 4 What happens if you lie to car insurance company?

The best way to scare insurance carriers or adjusters is to have an attorney by your side to fight for you. See the article : Car insurance costs are now higher for many Michigan drivers than in 2019 – and less fair for Detroit drivers. You should not settle for less.

Are insurance adjusters a liar? Can Insurance Qualifiers Lie to You? Yes, insurance adjusters can lie to you. In fact, many are even encouraged to do so. An assessor may tell you that their driver is not liable for the accident when they know it is.

How do you beat an insurance adjuster?

Dispute over an insurance claim is best dealt with calmly and courteously. First, you can write a letter to the independent adjuster explaining why you think their total settlement is not enough compared to what you calculated. On the same subject : What is the cheapest car insurance type?. Even if you are upset, don’t show it.

What should you not say to an adjuster?

Never admit fault to insurance assessors. The top 5 things not to tell an insurance assessor is to admit fault, say you haven’t been hurt, describe your injuries, guess what happened, or say anything on the record.

Are insurance adjusters evil?

So are insurance adjusters bad? The short answer is NO, Insurance assessors work for insurance companies, whose job it is to minimize your car accident injuries even though their insurer was at fault, or they may not offer to pay you at all.

How do you outsmart an insurance adjuster?

Dealing with and outsourcing Car Insurance Modifiers

- Remember, You do not have to sign a medical declaration. …

- Know That What You Told Us Will Be Used Against You. …

- Understand That Settlement Is Permanent. …

- Correspondence Can Be Key. …

- Be Prepared for Rights Reservation. …

- Documenting Your Losses. …

- Choose Your Own Body Shop.

What should you not say to an adjuster?

Never admit fault to insurance assessors. To see also : UK motor insurance premiums in first quarter at highest level since 2020 – survey. The top 5 things not to tell an insurance assessor is to admit fault, say you haven’t been hurt, describe your injuries, guess what happened, or say anything on the record.

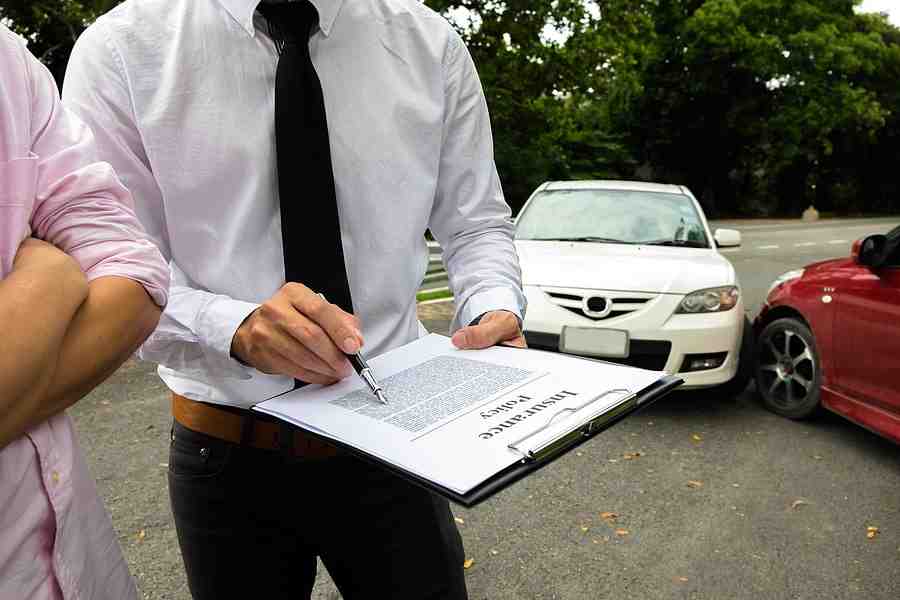

Can you negotiate with an insurance adjuster?

Discuss with your insurance assessor However, if you feel the offer for the value of your vehicle is too low, you can start negotiating with your claims assessor. If you decide to negotiate, you may want to be prepared to show how you compiled your desired payment number.

What should a home insurance adjuster not say?

You should not tell a claims assessor or anyone else if you have already retained an attorney. Refer them to your attorney. You can offer an insurance assessor your basic information, such as your name, address, and phone number, if you do not already have an attorney.

Do insurance companies try to trick you?

Often, the insurance company will offer you a lowball settlement and trick you into believing that is the most you are entitled to. While this offer may initially seem attractive, insurance companies will almost always offer you only a fraction of the value of your case.

How do insurance companies know if your lying?

Number of accidents in the past Although it may be tempting to lie to a new insurance provider about your driving record, there is a good chance they will find out the truth. Insurance companies will check your driving record once you have applied for insurance.

Do insurance companies try to get out of paying?

Insurance companies will seek to reduce or eliminate payments for injuries caused by the actions of an insured person. After being injured, accident victims want nothing more than to move on from the traumatic experience.

Do insurance companies cheat you?

The main way insurance companies cheat people is by offering low ball recovery amounts after a car accident. Instead of providing full coverage, companies will offer lowball amounts in the hope that clients will take the bait and sign the deal.

What are the most common claims for workers compensation?

The 5 Most Common Workers’ Compensation Injuries

- Stress (30.06% of workers’ compensation claims)

- Objections (20.83% of claims)

- Cuts (11.79% of claims)

- Sprains (8.85% of claims)

- Potholes (5.50% of claims)

What are the most common workplace injuries? The most common work injuries are slips, trips, and falls, over-effort, and contact with equipment. All of these injuries can be prevented primarily by taking the right precautions and adhering to OSHA guidelines.

What are the 5 classifications of workers compensation?

The 5 types of Workers’ Compensation Claims in California that are typically filed are the 5 medical care, temporary disability, permanent disability, supplemental job displacement, and death benefits.

Why are there different classifications of workers compensation?

Distribution systems are based on the idea that employees employed by similar businesses are exposed to similar types of injuries. For example, roofing workers are subject to injuries caused by falls, burns, sun exposure, and lifting heavy objects.

What is WC classification?

Employee compensation class codes are used by insurance companies to identify specific categories of work and enable them to effectively estimate workers’ compensation rates for the appropriate risk associated with the work being done.

What are standard exception classifications?

Standard Exemption Classes describe jobs or occupations common to many businesses. These common occupations are not included in the basic classification unless specified in the classification wording.

What type of injuries represent the largest percentage of workers compensation claims?

The top five injuries as a percentage of total claims are: stress and sprains (30 percent) cuts or holes (19 percent) contusions (12 percent)

What is the number one injury in the workplace?

Trips, Slips and Falls Slips, trips and falls account for a third of all personal injuries in the workplace, and are the leading cause of all workers’ compensation claims. Types of injuries include head, back and neck injuries, broken bones, sores, sprains and pulled muscles.

What has the greatest impact on workers compensation rates?

B. Frequency of claims that have the greatest impact on Employee Compensation rates.

How witness credibility affects a car accident claim?

For example, if you have 10 non-credible witnesses, this is likely to be less valuable than having one credible neutral witness. In fact, having non-credible witnesses could damage your claim by associating you with dishonest or unreliable people.

What happens if you lie to car insurance company?

Deliberate lying to your insurance company is a form of fraud, and could result in fines, community service, or even jail time. If you lie to your insurance provider, you may be denied insurance, quote higher rates, or face penalties such as fines, community service, or even jail.

Is lying about car insurance a crime? You could face criminal penalties. A false insurance claim can result in imprisonment, substantial fines, and a permanent criminal record. Telling your insurance company may seem like a good idea at the time, but it’s really a form of insurance fraud.