How many miles should a car have per year?

Contents

The United States Department of Transportation Federal Highway Administration said the average person drove 14,263 miles per year in 2019. That’s about 1,200 miles per month per driver or about 39 miles per day. See the article : 2022 Car Insurance Overview – Forbes Advisor. By comparison, the DOT said the average annual miles in 2018 were 13,476.

Is 15000 km a year a lot? 15,000 km per year is not much. In fact, it is considered the average by industry standards. However, it is slightly lower than the annual average mileage driven by American men of all age groups, and slightly higher than the annual average mileage driven by American women of all age groups.

How many miles should you drive a car in a year?

It is generally believed that the average mileage of a car is between 12,000 and 15,000 miles per year, according to AARP. See the article : What is raising the prices of car insurance?. That means you can expect a 5-year-old car to have between 60,000 and 70,000 kilometers on the odometer.

How many miles a day is normal for a car?

American drivers today move their vehicles on average significantly less than they did 16 years ago, but in 2017 they were still traveling an average of 40.9 miles per day and per driver.

How many miles should you drive a car?

With proper maintenance, cars can have a life expectancy of about 200,000 miles. But whether you achieve that in two or ten years, it doesn’t have to mean the end of your vehicle’s life.

How many miles should your car do in a year?

When you are looking for a car, mileage is an important point to consider. It is generally believed that the average mileage of a car is between 12,000 and 15,000 miles per year, according to AARP. That means you can expect a 5-year-old car to have between 60,000 and 70,000 kilometers on the odometer.

What happens if you lie about annual mileage?

Underestimating your mileage and having to make a claim could invalidate your policy and your insurance company could refuse to pay out. Read also : California motorists may have higher car insurance rates. If you are believed to have deliberately tricked your insurance company into getting cheaper auto insurance, it may be difficult to get coverage in the future.

Does the insurance track your kilometres? Insurance companies definitely check the mileage. It’s not because they’re just curious or want to teach you how to drive safely. It is because they have to calculate whether you are at high risk of an accident or not. Simple logic works here – the more you drive, the higher the risk of accidents.

Can I lie about my annual mileage?

Not so fast. This is called “fronting” and no auto insurer allows it. Don’t lie about the primary driver on a car’s policy.

How do insurance companies verify mileage?

In general, insurers will ask for an estimate of your total mileage, but they may also include an annual mileage for verification. If they choose to use databases or information from repair shops, they can have an accurate mileage at any time.

What happens if you go over your predicted mileage?

Exceeding your annual mileage may invalidate your policy. Other times it means you can’t claim as much as you thought. In some cases, insurers also charge a lump sum to cover the difference between your current policy price and what you would have been charged if your mileage was correct.

What should I put down for annual mileage?

Multiply the weekly mileage by 52 to get the annual mileage. Be sure to pick a week that is representative of your regular driving routine. Add 5 percent to the annual mileage to cover unplanned trips and as a margin of error.

How do insurance companies verify mileage?

In general, insurers will ask for an estimate of your total mileage, but they may also include an annual mileage for verification. If they choose to use databases or information from repair shops, they can have an accurate mileage at any time.

Why do insurance companies want to know how many miles you drive?

It is because they have to calculate whether you are at high risk of an accident or not. Simple logic works here – the more you drive, the higher the risk of accidents. That’s why they care so much about your annual mileage.

Can you lie about how many miles you drive to insurance?

No one gets hurt, right? Not so fast. This is called “fronting” and no auto insurer allows it. Don’t lie about the primary driver on a car’s policy.

What happens if you lie about your mileage?

When policyholders lie about how much they drive, insurers will work with erroneous data and inaccurately calculate risk. The result is a large amount of premium leakage for insurance companies every year. More than half of motorists report too few kilometers per year to insurance companies.

What is mileage verification?

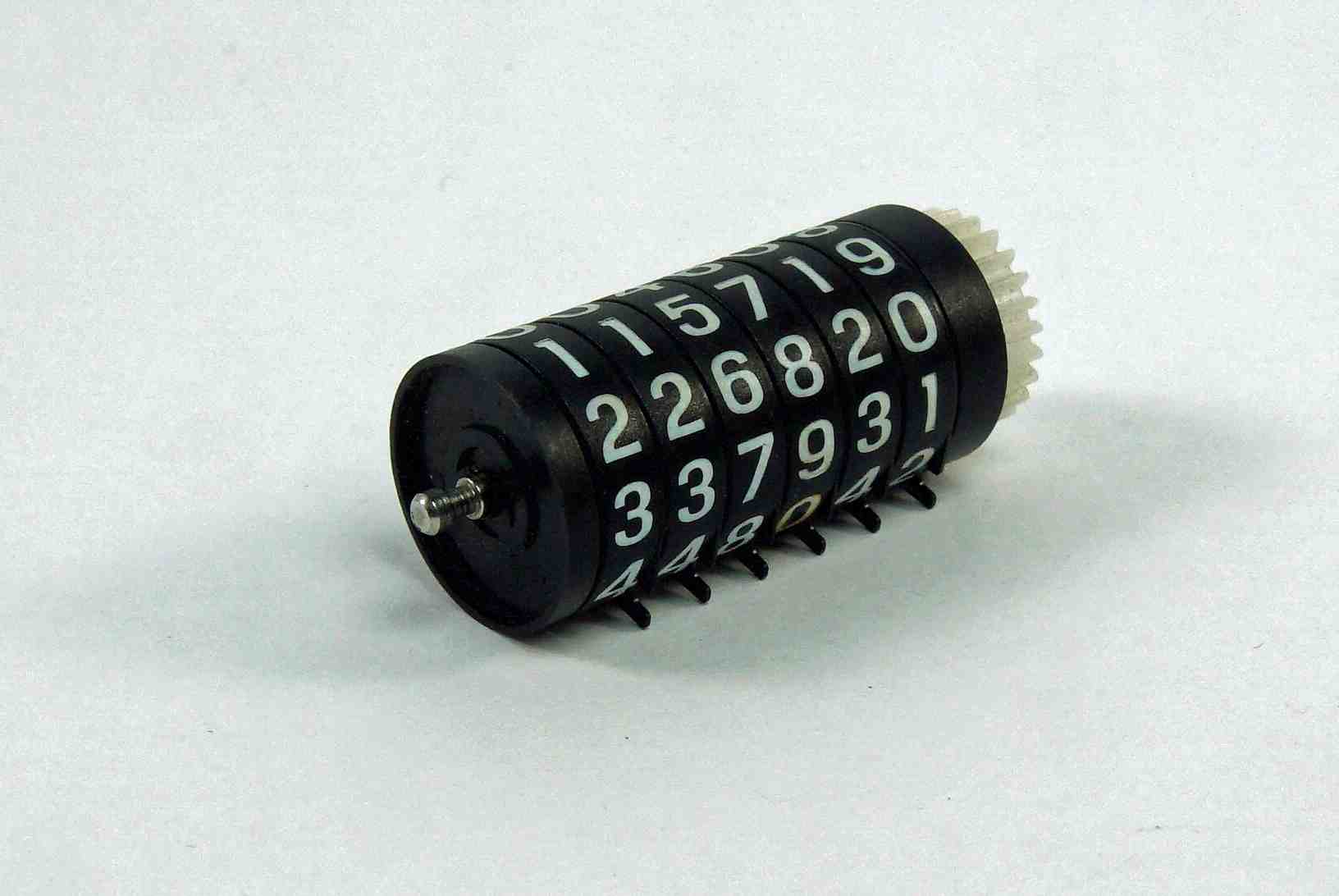

A odometer statement indicates the mileage of your vehicle. They are required when buying a new car or selling a used car. You will normally be required to complete an odometer statement to indicate the mileage of any vehicle that is less than 10 years old.

How do insurance companies check mileage? In general, insurers will ask for an estimate of your total mileage, but they may also include an annual mileage for verification. If they choose to use databases or information from repair shops, they can have an accurate mileage at any time.

Can mileage be faked?

Speedometer fraud is the disconnection, resetting, or modification of a vehicle’s odometer with the intent of changing its stated mileage. NHTSA estimates that more than 450,000 vehicles with false mileage are sold each year. This crime costs American car buyers more than $1 billion a year.

How do you tell if miles are fake?

If you suspect that a car’s mileage is not real, you can:

- Check the APK certificates and service documents for consistency of mileage.

- Contact previous owners listed in the logbook and ask what the mileage was when they sold the car.

- Get mileage information through a history check from a reputable dealer.

Can you cheat the mileage of a car?

Mechanical odometers on older cars can be rolled back manually, but the digital odometers in newer cars have to be hacked and reprogrammed. Neither method is particularly difficult, making this an attractive crime for unscrupulous used car dealers.

Can a dealership verify mileage?

The law requires car dealers (new and used) to disclose a vehicle’s actual mileage and inform the buyer if an odometer has been tampered with or destroyed, but there is a legal “loophole.”

What are verified miles?

The Auto Club’s Verified Mileage Program is available to insured drivers who agree to report their mileage at the beginning and end of each policy period or who agree to install a small “telematics” device in their vehicle that automatically monitors the mileage driven. registers .

How can you tell if mileage has been tampered with?

Find the obvious. Some signs of tampering include scuffs around the gauge cluster, a set of gauges or odometer that looks newer or cleaner than the rest of the dash, or a trip meter or other features that no longer work.

How do I know if my mileage is genuine?

If you suspect that a car’s mileage is not real, you can:

- Check the APK certificates and service documents for consistency of mileage.

- Contact previous owners listed in the logbook and ask what the mileage was when they sold the car.

- Get mileage information through a history check from a reputable dealer.

Can a dealership verify mileage?

The law requires car dealers (new and used) to disclose a vehicle’s actual mileage and inform the buyer if an odometer has been tampered with or destroyed, but there is a legal “loophole.”

What should I not tell about car insurance?

Avoid using phrases like “it was my fault,” “I’m sorry,” or “I’m sorry.” Don’t apologize to your insurer, the other driver, or law enforcement officers. Even if you’re just being polite and don’t intentionally admit mistakes, these kinds of words and expressions will be used against you.

Which insurers do not want you to know? 11 things auto insurers don’t want you to know

- Your car insurance should not be tied to the driver.

- The type of car you drive matters.

- Advance claims and questions increase the rates.

- You can check your report for errors.

- Your credit score affects your auto insurance costs.

- Where you live affects your premium account.

What are at least 2 things that can cause your car insurance to go up?

Some factors that can affect your auto insurance premiums include your car, your driving habits, demographic factors, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and your driving record.

What are 3 factors that affect the price of automobile insurance?

The biggest factors that affect auto insurance rates are state coverage requirements, age, and make and model of the car. The more coverage you need to buy in your state and the more valuable your vehicle is, the more you’ll pay for auto insurance.

What insurance should you avoid?

Avoid buying insurance you don’t need. Chances are, you’ll need life, health, auto, disability, and perhaps long-term care insurance. But don’t go into selling points that you need other, more expensive insurance policies that only give you coverage for a limited number of events.

What insurance do you really need?

Most experts agree that life, health, long-term disability and auto insurance are the four types of insurance you should have. Always check with your employer first to see if there is coverage. If your employer doesn’t offer the type of insurance you want, get quotes from several insurance companies.