Car insurance costs determined on the basis of an assessment News pressrepublican.com

I received an interesting email a few weeks ago from an agency called Autoinsurance.org, a free online resource for anyone interested in learning more about car insurance. At this website you can compare insurance rates from various insurance companies for free. I visited the website, but I didn’t do it for a comparison of rates but rather because the person who sent me an email asked an interesting question – he wrote: “you can be the best driver in the world and have the highest driving record clean, but it would still be more charged because ”and then added various factors that go into insurance rates. This website provided most of the information for this article.

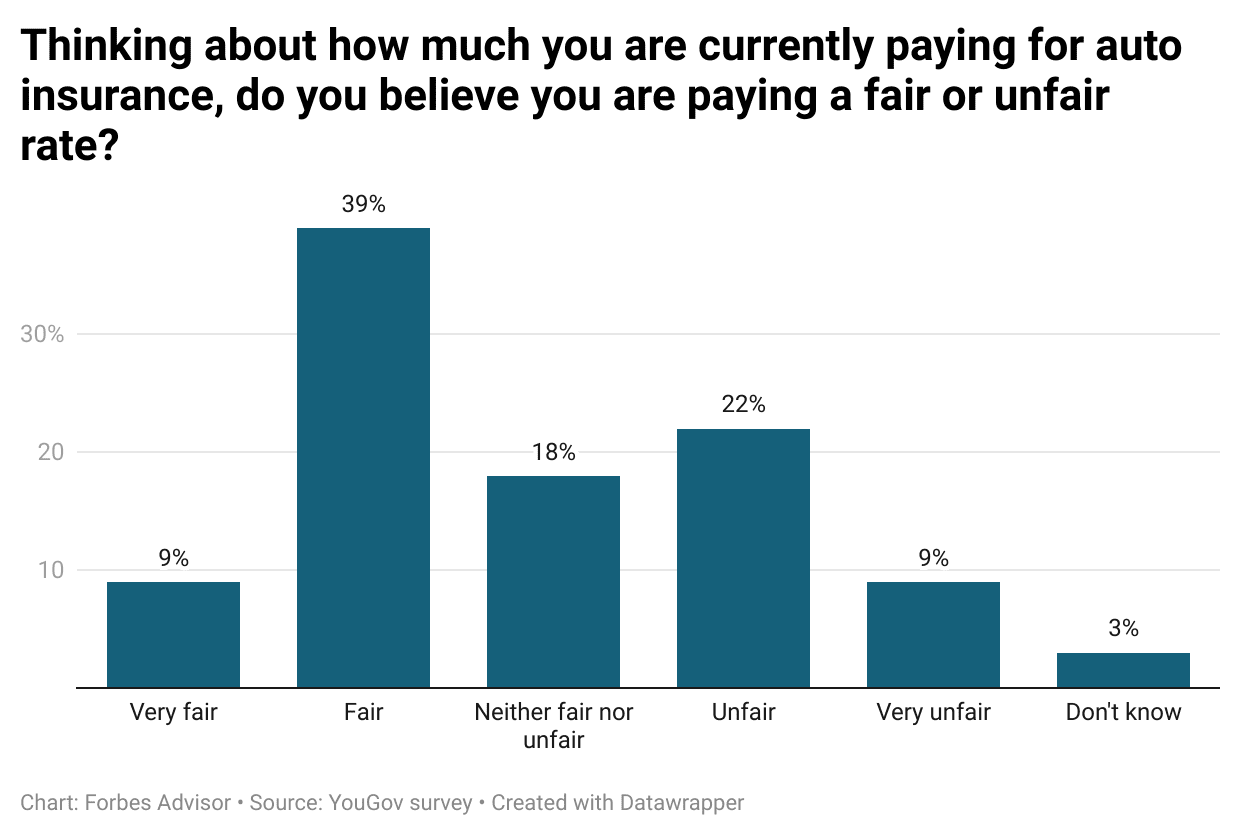

All drivers need insurance – it is required by law. So, how are the rates we pay determined? Are the rates fair? What are some of the non-driving factors that determine what we pay?

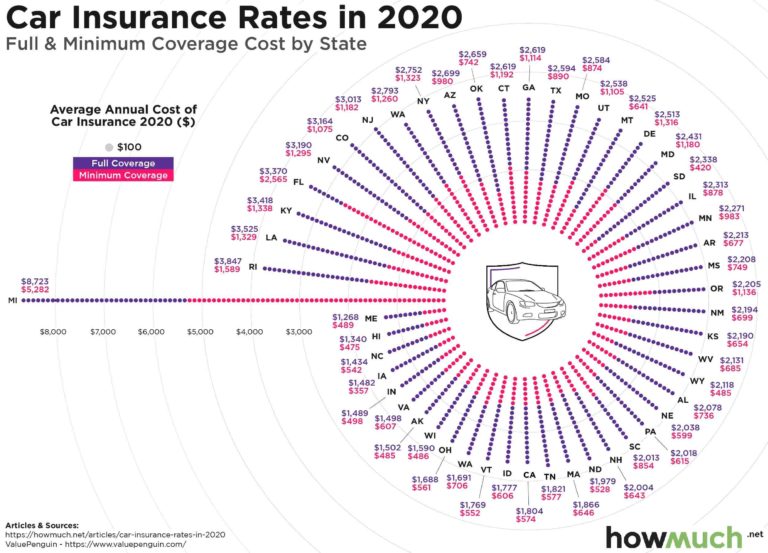

When I moved to Malone in 1975, my insurance rates dropped significantly. Nothing has changed except moving from the Utica to Malone area. Therefore, where you live affects the rate you pay. The driver’s ZIP code is one of the most crucial unrelated driving factors that insurers use to calculate rates. There are a number of reasons behind this factor. A driver may live in an area prone to crime, making his car more likely to be stolen or vandalized. Or they may live in a busy area with a higher than average crash rate.

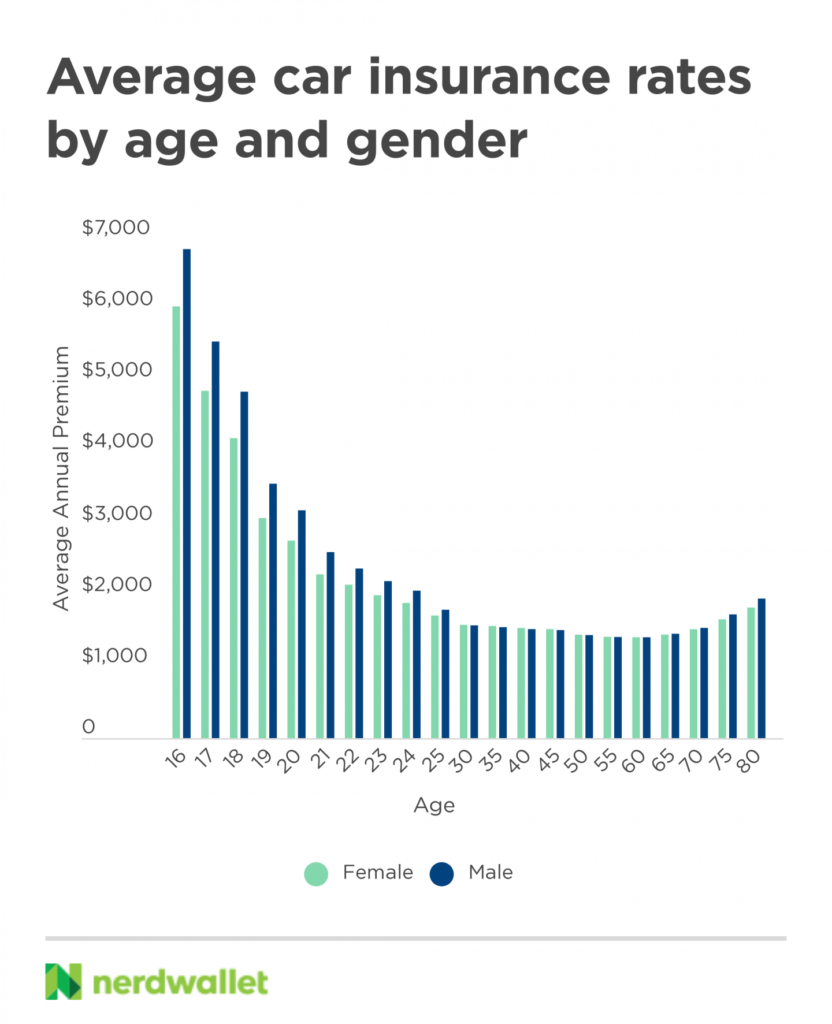

Age is another common factor that insurers use to determine rates. While at first it may not seem related to driving, insurers base rates on age by arguing that the more experienced drivers are, the less likely they are to crash. The result is that older and younger drivers are often charged more, especially teenagers. However, part of this age discrimination is based on crash data, as insurers look at age-related crash patterns.

Some insurers also use credit scores as a factor in their rate calculations. Drivers with a lower credit score will have slightly higher rates than drivers with a high credit score. The reasoning behind this is that drivers are more likely to make timely payments if they have a high credit score.

Both your occupation and your education are used together to determine how much you will pay. Professionals in skilled positions and executives who graduated from college tend to pay less for insurance than entry-level or blue-collar workers who only have a high school diploma. The Consumer Federation of America conducted an analysis to show that most major insurers charge their customers with less education and lower status employment at higher rates.

While a few states have banned insurers from using gender to determine car insurance rates, many insurers still practice this. Men often have higher rates than women, as crash data from sources such as the Highway Safety Insurance Institute (IIHS) often show that men are more likely to be in fatal crash by women. However, many argue that gender-based rates are outdated, and drivers should be charged based on the merit of their driving, not their gender.

The determination of insurance rates may or may not be fair, but at least the costs based on the rating have statistics behind it. However, while many non-driving factors are out of your control, safe driving and keeping a clean driving record can help you save on car insurance. It can also save your life.

– Dave Werner is vice president of the Franklin County Traffic Safety Board.

Why does car insurance keep increasing?

Contents [hide]

- 1 Why does car insurance keep increasing?

- 2 What factors affect life insurance rates?

- 3 Does Geico go up after 6 months?

- 4 What are the 5 basic types of auto insurance?

Rate hikes occur when an insurance company finds that their overall rates are too low due to the costs (losses) incurred by recent claims, and on industry trends toward more medical repairs and costs. Read also : How This All-Digital Provider Is Modernizing Auto Insurance. expensive.

Why did my car insurance go up for no reason? Car accidents and traffic violations are common explanations for an increase in the insurance rate, but there are other reasons why car insurance premiums increase including a change of address, a new vehicle and claims. in your zip code.

Why did car insurance increase 2020?

But the pandemic continues to change the industry, and an increase in insurance costs is now expected this year. See the article : Responsibility Vs. Comparison of car insurance with full coverage. Supply chain and labor shortage, high demand for new and used cars, increased reckless driving behavior and even natural disasters have created the perfect storm for a price increase.

Why did my car insurance go up when nothing changed?

Your new ZIP code may have higher crime rates, or a denser population, both of which may affect your premiums. Sometimes, even if nothing in your life has changed, your insurance premiums may still increase due to factors totally beyond your control.

Why did my car insurance go up in 2021?

Changing driving habits Roads were quieter and accidents were less frequent. As a result, many insurance companies have reimbursed some premiums to policyholders. â € œIn 2021, we saw a return to pre-pandemic driving patterns that led to a significant increase in car insurance claims and the severity of accidents.

Why did car insurance increase 2021?

Changing driving habits Roads were quieter and accidents were less frequent. As a result, many insurance companies have reimbursed some premiums to policyholders. See the article : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have. â € œIn 2021, we saw a return to pre-pandemic driving patterns that led to a significant increase in car insurance claims and the severity of accidents.

Why did my car insurance go up when nothing changed?

Your new ZIP code may have higher crime rates, or a denser population, both of which may affect your premiums. Sometimes, even if nothing in your life has changed, your insurance premiums may still increase due to factors totally beyond your control.

Why did my car insurance go up when nothing changed?

Your new ZIP code may have higher crime rates, or a denser population, both of which may affect your premiums. Sometimes, even if nothing in your life has changed, your insurance premiums may still increase due to factors totally beyond your control.

Is it normal for car insurance to go up every year?

Annual increases are very typical across the industry, but the way your risk factors are viewed by any given company can vary. To make sure you’re not paying too much, you need to know your coverage and discounts to make sure you’re getting the best price for the coverage you need.

What factors affect life insurance rates?

What are the most important factors in determining your life insurance rates?

- Age. Age is one of the biggest factors influencing life insurance premiums. …

- Sex. …

- Height and Weight. …

- Medical History. …

- Family History. …

- Smoking and Tobacco Use. …

- Work and hobbies. …

- Lifestyle Factors.

What are life insurance rates based on? Life insurance companies mostly base their rates on your age and health status, but they also take into account your job, your weight, whether you smoke and even your Your Family’s Health History

Does Geico go up after 6 months?

Does Geico increase rates on demand? Geico does not always increase your premium if you file a claim. They take into account your driving history, the number of claims you have had in the past, the amount of the payment and the type of claim, and whether you qualify for an amnesty before you raise your your rate.

Why does my insurance increase every 6 months? Increases in the car insurance rate are generally related to increases in the policyholder’s insurance risk. But another reason that Progressive could raise rates after 6 months is that insurance costs across the market have been rising over time.

Will car insurance go down after 6 months?

If you can keep your driving record clean and have a previous infraction that is due to expire in the next six months, your rates may decrease. A 6-month car insurance policy can also benefit drivers who soon pay off car loans as well as those who improve their credit.

Does car insurance go up after 6 months?

Yes, Progressive raises rates after 6 months in some cases. If you are a new Progressive customer, you will see your car insurance premium increase after the first 6 month policy period if you file a claim or if the traffic violation increases with your driving record during at that time.

How fast does car insurance go down?

In most cases, car insurance takes between 3 and 5 years to drop after a faulty accident. Three years is a common penalty period for property damage claims. Insurance companies penalize drivers for longer-term accidents that cause serious bodily harm or result from reckless or drunk driving.

Does your car insurance lower every year?

But assuming you’re a good driver, you’ll probably start seeing a reduction in your car insurance every time you renew your policy even before you turn 25. You can see an even bigger reduction once you hit 25, because that’s when insurers see a big drop in the number of claims submitted for each age group.

Does Geico car insurance go down after 6 months?

Your Geico car insurance policy may go up after six months. If you have been able to get through your policy without claiming, you may be eligible for a car insurance discount. If you keep your Geico car insurance for three years or more, you can get a loyalty discount.

Why does Geico do 6 month policies?

Why Do Insurers Offer Six-Month Car Insurance? Most insurers prefer a six-month car insurance policy to have the flexibility to recalculate your rates based on your driving record in the previous term.

Do Geico rates go down?

Yes, car insurance drops to 25 with Geico, as 25-year-olds are no longer considered as high risk as younger drivers. At the age of 25, it saves drivers an average of 8.53% on a Geico policy, based on quotes for a ZIP code across the country.

Why does Geico do 6 month policies?

Why Do Insurers Offer Six-Month Car Insurance? Most insurers prefer a six-month car insurance policy to have the flexibility to recalculate your rates based on your driving record in the previous term.

Is Geico a 6 month policy?

GEICO recently adopted a six-month car insurance policy, which allows customers to renew after the end of the six-month period.

Can I cancel Geico before 6 months?

You can cancel your Geico insurance policy at any time. The cancellation may take effect immediately or be set for a future date. Geico does not charge a cancellation fee.

Is it better to pay 6 months upfront car insurance?

Whether you choose a 6-month or a 12-month car insurance policy, it is always best to pay in full. When you make monthly payments, you will probably be charged a little more on your premiums and may also be subject to additional payments for payment processing if you pay electronically.

What are the 5 basic types of auto insurance?

The most common types of car insurance coverage include liability, collision, personal injury protection, uninsured and uninsured driver, comprehensive and medical payments.

What are the 3 parts of car insurance? Responsibility. Most car insurance policies have three main parts: personal injury liability insurance, property damage liability insurance and uninsured / less insured drivers coverage.

What are 4 main types of coverage and insurance?

Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you must have.

What is a type of insurance coverage?

Insurance coverage refers to the amount of risk or liability that is covered for an individual or entity through insurance services. The most common types of insurance coverage include car insurance, life insurance and homeowners insurance.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.