Partner Content: This content was created by a business partner of Dow Jones and researched and written independently by the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn more

Teenage drivers pay significantly more for car insurance than older drivers. They can expect to pay even more if they don’t follow the rules of the road.

Seeing a teenager behind the wheel of a car for the first time can be exciting and nerve-wracking. Seeing the price of teenage drivers insurance is probably the last one. But why are young drivers so expensive to insure?

In this article, we at the Home Media review team will examine the coverage needs of teenage drivers and what factors affect the price of a car insurance policy. Our research team has thoroughly reviewed providers to find the best car insurance companies, so we also provide our recommendations for coverage.

What Is Car Insurance for Teenagers?

Contents

Although you may have heard the terms “teen drivers insurance” or “teen car insurance”, technically there is no type of car insurance policy exclusively for teenagers. Whether a driver is 16 years old or 96 years old, they must meet the state’s minimum liability insurance requirements. This may interest you : Is State Farm overpriced?. If the car is financed, a lienholder will likely require collision insurance and comprehensive coverage.

What’s the Best Auto Insurance for Teenage Drivers?

Determining the appropriate level of coverage for teenage drivers requires a knowledge of the basic coverage levels for car insurance. See the article : Who is cheaper than Geico?. The sections below contain basic information about each of the main coverage types:

Liability Insurance for Teenage Drivers

When buying coverage for a teenage driver or helping a new driver purchase their own policy, it’s helpful to know the different types of insurance. Almost every state requires some form of liability car insurance, which covers damage to others if a driver is at fault. On the same subject : FOX13 INVESTIGATOR: How the student’s report card can save you money on car insurance. Here are the main parts of liability coverage:

The minimum level of liability coverage varies from state to state. For example, motorists in North Carolina are expected to carry 30/60/25 coverage, meaning that a policy would pay up to $30,000 per person for bodily injury, $60,000 per accident for bodily injury and $25,000 per accident for damages.

Collision Auto Insurance for Teenagers

Collision insurance protects your vehicle in the event of a collision, regardless of who is at fault. Although collision coverage is not required by state law, a lender will likely require it when financing a vehicle because it protects the investment.

Collision coverage reimburses you for damage to your car and gives you a payout up to the current cash value (ACV) of the vehicle if it’s considered a total loss. However, collision insurance does not cover damage in non-moving situations.

Here are some situations that involve a collision insurance claim:

Comprehensive Car Insurance for Teen Drivers

Comprehensive insurance is another common requirement for drivers financing a vehicle. Unlike collision insurance, it is geared more toward non-driving scenarios.

Comprehensive coverage reimburses you for damages in the event of:

Other Car Insurance Coverage Levels for Teens

Other types of insurance policies include:

How Much Is Car Insurance for Teens?

According to our full coverage rate estimates, teen car insurance averages $5,827 per year or $486 per month. Rates are higher for teenage drivers compared to other age groups for several reasons, which we explore below.

Teenage Car Insurance Rates vs. Other Age Groups

Here’s how car insurance for teenage drivers stacks up against other age groups:

What Affects Car Insurance Costs for New Drivers?

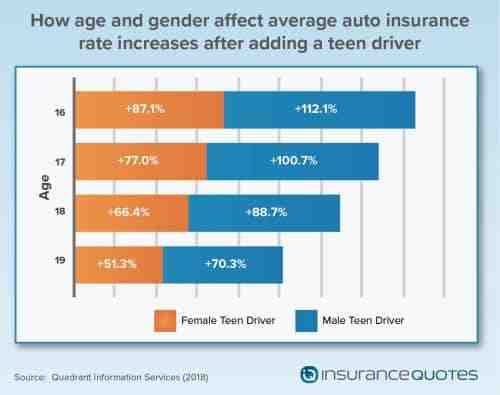

As we mentioned above, age and driving records affect the price of insurance, but insurers also weigh other factors. Local insurance minimums affect the price, and also characteristics such as the recorded gender on the driver’s license in most states.

Here is a list of items that insurance providers check when estimating premiums:

Why Are Teens More Expensive To Insure?

Teenage driver insurance costs more for several reasons. Insurance providers look at factors such as age and driving experience when deciding insurance premiums, and being younger with little or no experience behind the wheel leads to higher car insurance rates.

That’s because data shows that younger, inexperienced drivers are usually more involved in serious accidents. In the United States, car accidents are the second leading cause of death among teenagers, according to the Centers for Disease Control and Prevention (CDC). The CDC also says that the risk of accidents is highest in the first few months that teens have their driver’s license.

A report by the Insurance Institute for Highway Safety (IIHS) said that over 2,300 teenagers between the ages of 13 and 19 were killed in car accidents in 2019. Per mile driven, teenage drivers ages 16 to 19 have crash rates nearly three times higher than drivers 20 and older, according to the IIHS.

Do Teenage Drivers Need Car Insurance?

Drivers should ensure that their insurance policies provide adequate financial protection, but increasing coverage limits for teenagers may be a good idea, as they are more likely to be involved in accidents.

Why Purchasing Enough Liability Coverage Is Important

Buying the state-required minimum liability coverage isn’t enough to protect you from lawsuits, and sometimes it’s not enough to cover an accident, according to the Insurance Information Institute (III).

If a state only requires $50,000 in bodily injury per accident and a driver causes $70,000 worth of medical bills, they are on the hook for the remaining balance. Depending on the value of your assets, it may be worth increasing the coverage to $100,000 or more. This can help ensure greater peace of mind when it comes to your teen’s driving habits.

You Should Also Consider Accident Forgiveness

Accident forgiveness keeps your insurance rate the same after the first at-fault accident on your policy. The “forgiveness” varies by state and insurer, and an insurer usually has to claim free for several years to be eligible or pay to add it to their policy.

Because some insurance companies include accident forgiveness for free and others offer it as an inexpensive add-on, it can save you money overall if your young driver has a car accident. This type of insurance is not available from all providers.

Finally, if a car is still being financed, you’ll likely need to maintain comprehensive coverage and collision insurance until the loan is paid off—regardless of who’s driving.

How To Save on Auto Insurance for Teens

Although teenage drivers usually pay more for insurance coverage, there are some ways to lower insurance costs. You should discuss how much the policy will cost with your teen. This is also an opportunity to reinforce good driving habits and compare car insurance quotes to get the best rate.

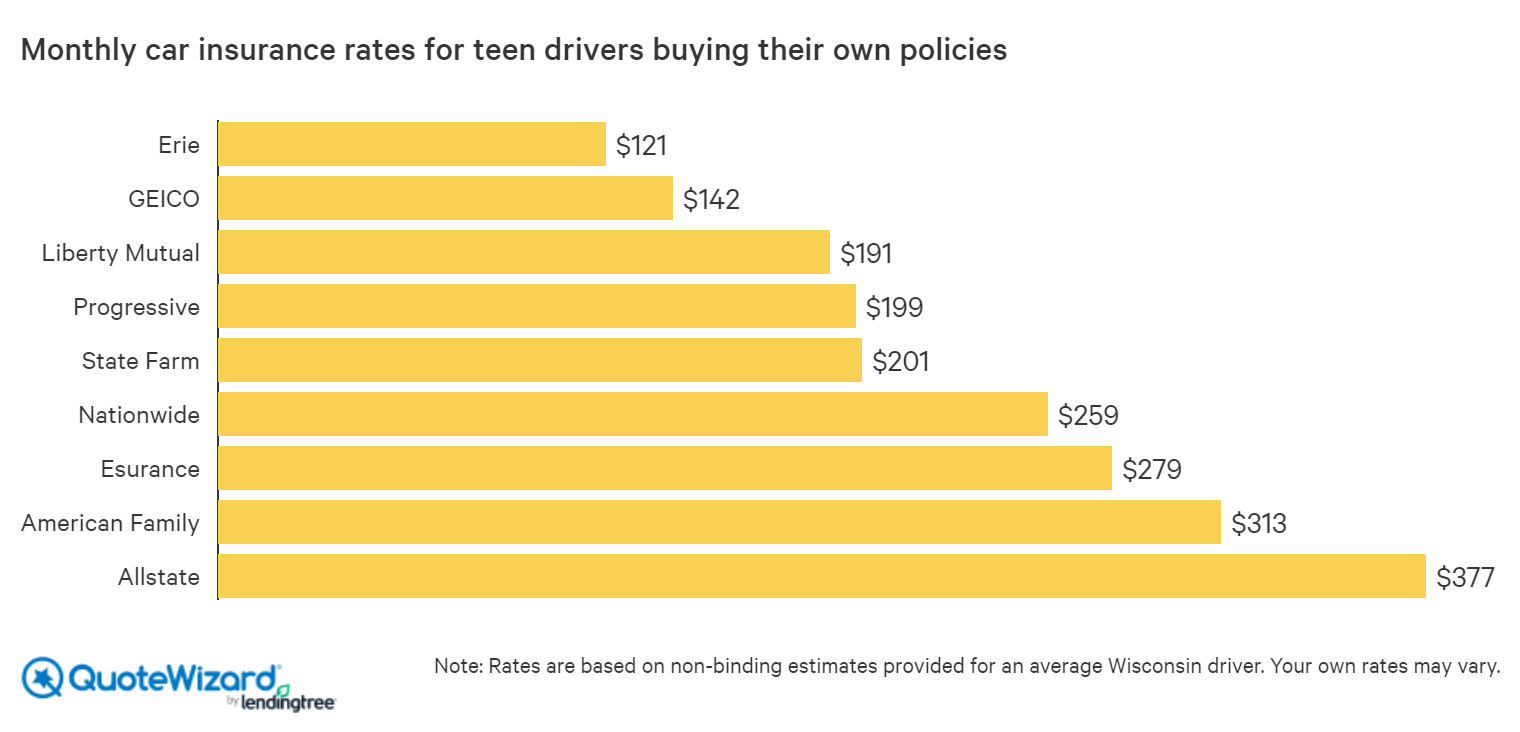

Stay on a Parent’s Policy

Adding a teen to an existing policy is typically less expensive than a young driver purchasing their own coverage, according to III. Having an experienced driver as a policy holder will help them qualify for a better rate and can give you a wider selection of discounts. That said, adding a teenager still means a bump in your insurance premium.

Look for Discounts

One way to offset the price increase that follows a young driver is with discounts. Insurance providers offer different ways to reduce car insurance costs based on customer demographics or the types of vehicles they own.

Here are some common car insurance discounts:

Choose a Higher Deductible

A deductible is the amount of money a policyholder pays up front for a claim before the insurance coverage takes over. Having a low deductible means paying less money when you file a claim, but it usually comes with a higher insurance premium.

While increasing your deductible can lower your premium, remember that a claim is more likely if you have a teenager on your policy.

Teenage Car Insurance: Conclusion

Young drivers can expect to pay significantly more for car insurance coverage. Because teenage drivers lack the necessary experience on the road and are more likely to get into car accidents, insurance providers will always charge higher rates.

While the overall cost can be high, there are still several ways you can reduce teen car insurance costs, such as being aware of discount opportunities, comparing offers and participating in app-based safe driving programs.

What’s the Best Insurance for First-time Drivers?

Insuring a teenage driver can be a balancing act between price and quality of coverage. Our insurance experts recommend getting auto insurance quotes from different companies and looking at comparisons like State Farm vs. Geico to see which providers meet your coverage needs.

Our Recommendations for Car Insurance

We’ve identified State Farm and Geico as smart choices for young drivers. You can read more about them below.

State Farm Auto Insurance: Most Popular Provider

State Farm earns our top spot for student coverage because of its discounts and A++ financial strength rating from AM Best. Students can get 25% of their policy with the good student discount, as long as they have a GPA of at least 3.0 or are in the top 20% of their class. State Farm also rewards customers of all ages with discounts for good driving and anti-theft devices.

In terms of costs, we give State Farm 9.0 out of 10.0 stars. The company also has solid ratings for customer service. In the J.D. Power 2022 U.S. Insurance Shopping Study℠ scored State Farm first place in overall customer satisfaction for major insurance companies.

Geico Auto Insurance: Editor’s Choice

Geico has built a reputation around keeping costs low, and the Better Business Bureau (BBB) gives it an A+ rating for customer service. According to the National Association of Insurance Commissioners (NAIC), Geico was the second largest auto insurance company in the country in 2021.

Similar to State Farm, Geico offers discounts for good driving and good grades. The Geico Mobile App also provides an easy way to view policy information or file a claim.

Read more: Geico Insurance Review

Car Insurance for Teenagers: FAQ

Our Methodology

Because consumers rely on us to provide objective and accurate information, we have created a comprehensive rating system to formulate our ranking of the best car insurance companies. We collected data on dozens of car insurance providers to rank the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points on the list.

Here are the factors our ratings take into account:

* Data correct at the time of publication.

Can I remove my son from my car insurance when he goes to college?

Many car insurance companies will allow you to remove a child who has left for college – as long as the school they attend is over 100 miles away. If the school is less than 100 miles, car insurers think there is a good possibility that your child will come home on a fairly frequent basis and use your car.

What are the consequences of gambling addiction? Problematic behavior On the other hand, people who play excessively risk a loss of control and the development of an addiction. They are therefore exposed to different risks, notably to problems in terms of mental and physical health as well as to social and financial difficulties.

Quels sont les différents types de joueurs ?

The different types of players

- The accomplices. These players like to play a bout in bout, or even finish it 100%. …

- The Explorers. For this type of player, everything is in the path and not in the destination. …

- The killers. Legend: Fortnite is a game highly appreciated for its competitive aspect. …

- The Socializers.

Comment être plus fort sur les jeux vidéos ?

Taking regular breaks in everything that requires cognitive effort is an effective way to allow the brain to assimilate more information and recharge it. Duffman approves: “Burnout is a big risk that coaches have experienced in League of Legends.

Qui sont les joueurs de poker ?

On the poker side, the type of online player is mostly male (73.8%), aged 26 to 35 years (26.9%) and playing 2 to 3 times a week (26.8%) for sessions that include between 1 and 2 hours (33.3%). Un joueur sur quatre indicated playing one or two tables at the same time.

Pourquoi les gens jouent aux jeux d’argent ?

The first reason that motivates people to aller les jeux d’argent, c’est le gain. People play to win. The game is not laborious and the income can be substantial in a short time. This is what pushes people to miser again and again to try to make their money more profitable.

Who is cheaper than GEICO?

| Company | Take advantage | Average |

|---|---|---|

| USA | Best value for military | for 116.58 US dollars |

| Insurance | Best value for online policies | for 123.16 US dollars |

| Kemper Direct | Best value for policy packages | for 143.58 US dollars |

| Progressive | Best value for safe drivers | for 143.66 US dollars |

How can I afford a car at 16?

One easy way to buy a car as a 16-year-old is to create a note between yourself and a family member. In exchange for making monthly payments on a purchase price, the seller offers you the car. This concept is similar to getting a loan from a bank for your car and making monthly payments.

Do females get cheaper car insurance?

Women’s car insurance is generally cheaper than men’s because insurers have found a statistical correlation between the gender of the driver and the cost and frequency of car insurance claims. On average, men simply drive more than women.

Why do females pay less for car insurance? On average, young men pay much more for car insurance than young women. This is because car insurance providers find men to be riskier drivers than women, especially if they are younger.

Which gender pay more for car insurance?

Men tend to pay more for car insurance overall, although the difference is slight – about 1%. The difference is most pronounced for teenagers and young adults.

Which age group pays more for car insurance married or single?

Singles may have more fun, but they also pay more than their married friends for car insurance. A single 20-year-old pays 21% more than a married 20-year-old for the same policy, a new study by InsuranceQuotes.com found.

Which age group has the most for car insurance?

Statistically, drivers under 25 and over 65 pay more for car insurance than middle-aged adults. The reason: Teenagers are three times as likely as drivers age 20 and older to get into a crash, giving them the highest premiums of any age group.

What age group has the cheapest car insurance?

Find cheap car insurance quotes in your area Quotes for teenagers are three times as expensive as quotes for drivers in their mid-30s and closer to four times the rate for drivers in their mid-50s. When young drivers gain more experience and reach the age of 25, their car insurance costs drop by 33%.

Is car insurance cheaper for females?

Women tend to pay less for car insurance than men. And it should come as no surprise that young drivers pay the most. Age correlates with driving experience and the risk of getting into a car accident.