Car Insurance to Grow 8.4% in 2023

Traffic on the 110 Freeway in Los Angeles, Tuesday, November 22, 2022. Photo: Jae C. Hong (AP)

From new car prices to gas prices, getting on the open road has become increasingly expensive (along with everything else).

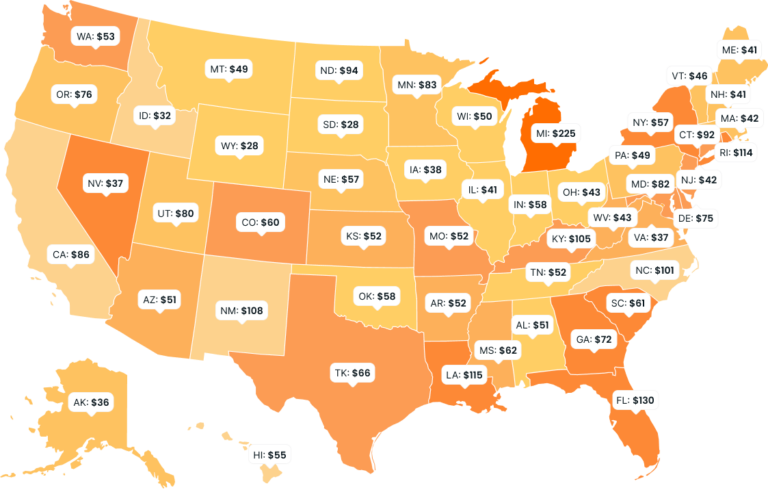

That’s according to LendingTree’s research arm, ValuePenguin, which aggregated 3.6 million auto insurance records across 41,000 zip codes. It found that the average annual cost of car insurance in the US will reach $1,780 for 2023.

The states that will see the biggest jumps are Illinois, Arizona, Georgia and New Hampshire—all of which see percentage increases among young people. All states saw an increase of less than one percent, however. California, D.C., Hawaii, Vermont and Wyoming are out of the low rise. Vermont is the cheapest place to insure a car at $1,104.

Michigan, however, remains the most expensive place in the country to insure a car—by and large. The average Michigan driver pays $4,788 a year—168 percent more expensive than the national average. Detroit drivers bear the brunt of this cost, some paying as much as 36 percent of their income on auto insurance. Florida is the next most expensive at an average of $2,856 per year.

The hikes are not due to things we are all familiar with, such as supply constraints or greedy CEOs (although you can be sure that also plays a role) but due to the growth of electric cars . EVs and newer, more technologically advanced vehicles are more expensive to repair and therefore more expensive to insure. There is also an increase in the number of natural disasters that wipe out cars thanks to that old chestnut, climate change. The study also mentioned the increase in people returning to work. The miles traveled annually by car in America have increased since the start of the COVID lockdowns.

New cars come with the latest safety features and are very reliable, although they can come with a higher price and insurance costs. Used cars are usually cheaper because of the higher depreciation their initial years are behind and you may not need as much insurance.

Why does GEICO do 6 month policies?

Contents

- 1 Why does GEICO do 6 month policies?

- 2 Is it cheaper to buy a new or used car?

- 3 Are car insurance premiums going up in 2023?

- 4 Is insurance for new cars higher?

Is it cheaper to buy a new or used car?

In general, used cars are cheaper than new cars. But the price has increased dramatically in the last few years. This may interest you : Car insurance costs keep rising and it’s likely to get worse – here’s why. New car payments jump from an average monthly of $554 in 2019 to $667 in 2022, a difference of 18.5%.

Why is it better to buy a used car than a new car? Here are the top reasons why you should buy a used car: Save money on the purchase price – if you can live without that new car smell . Reduced booking shock for customers who haven’t been out looking for six years on average. Discount on a vehicle that is at least three years old.

Is it worth buying new car in 2022?

Low cost: Although it may seem counterintuitive, buying a new car can save you money in the long run. Buying a new car in 2022 means not only getting a lower price but also getting a car that is under warranty. Read also : Why are Geico rates so low?. This means that if there is a problem with your car, you will not have to pay for the repair.

Is it financially better to buy a new or used car 2022?

Used cars offer buyers value and savings, which are exciting benefits for drivers who may not have a large budget, but still want one. always drive a good car. You will probably save money. There is no doubt about it, most used cars sell for less than a new car of the same make and model.

Will the car shortage get better in 2022?

While the worst of the automotive crisis may be behind us, automotive analysts are predicting that chip shortages and other limitations will limit production until further notice. until 2023. Car sales are expected to increase in the second half of 2022 and may return to pre-covid levels, for higher volumes in 2023 and 2024.

Will car prices drop in 2022 new cars?

Average prices increased by 42.5% in September 2022 vs. February 2020. Used car prices appear to have risen, but new car prices are set to remain high at the end of 2022. In 2023, prices are expected to drop by 2.5% to 5% for new cars and 10% to 20% for used cars.

Is it financially better to buy a new or used car 2022?

Used cars offer buyers value and savings, which are exciting benefits for drivers who may not have a large budget, but still want one. always drive a good car. This may interest you : Bill increasing minimum car insurance coverage clears legislature. You will probably save money. There is no doubt about it, most used cars sell for less than a new car of the same make and model.

Should I buy a used car now or wait until 2023?

Whether you’re shopping for a new car or a used car. New car prices are rising, breaking records every month. Used car prices are starting to drop, and our experts tell us that both trends could converge by 2023.

Will used cars be cheaper in 2023?

But 2023 may finally bring some relief. As demand continues and data improves, prices are expected to moderate. Prices could drop by 5% for new cars and 10% to 20% for used cars, according to a November report from bank JP Morgan.

Is it better financially to buy a new or used car?

New cars cost an average of $700 a month and used cars average $525, according to Experian’s State of Automotive Finance Market for the third quarter of 2022. If you’re trying to save money on your first purchase, A used car is a good choice.

Why was Kevin Hunter in the hospital?

Kevin has severe double pneumonia and is in the ICU on life support. Please pray for a full and speedy recovery for Kevin and do what you can to support his family.

Who is Kevin Hunter the homework guy?

Kevin Hunter AKA “The Homework Guy,” renowned Auto Expert, offers car buying advice to millions of people.

Insurify’s latest report on auto insurance trends predicts that the average auto insurance premium will increase another 7% to $1,895 by 2023, based on historical and the current situation.

Quelle est la meilleure assurance la moins chère?

Quelle est l’assurance la moins chère du marché ?

The guarantee au tiers : the guarantee la moins chère du marché The guarantee of auto au tiers refers to the minimum guarantee of the obligatoire. Included in the guarantee is the response between the people and the unique situation of the matériels that cause aux tiers and au mobilier urbain.

Quelle est l’assurance la moins chère en Suisse ?

Comme vous pouvez le constater, parmi ces differents assureurs, l’assurance voiture la moins chère en Suisse est l’assurance Smile.

Is insurance for new cars higher?

How much is insurance for a new car? Generally, getting a new car will increase your value because it is worth more than your old car.

Is insurance more expensive on a new car? Car insurance rates drop by 3.4% for every year your car ages. An eight-year-old car is about 25% cheaper to insure than a new car. For example, a new Honda Accord can cost $74 more per month to insure than an eight-year-old Honda Accord.

Why does New car increase insurance?

If you buy a more expensive car, your new car may cost more because it is more likely to be stolen and more expensive to repair or replace than your first car.

Is it more expensive to insure a new or old car?

In general, auto insurance for used cars may be cheaper than insuring new cars of the same make and model if the used car is cheaper. used to repair or replace. The value of the car depreciates over time, reducing the maximum amount an insurance company must pay in the event of an accident.

Why do new cars cost more to insure?

Due to their value, repair costs, risk of theft and other factors, it may cost more to insure a new car than a used car. If you finance your new car, the lender will require you to carry more insurance than the legal amount, which often results in higher of wages.