Cheap Chicago Car Insurance (2022)

If you need auto insurance in Chicago, it’s time to do some research and find a company that offers the lowest rates.

Because of the busy urban area, Chicago pays more than the national average for car insurance. To help you find the best Chicago car insurance for your car and your budget, our rating team has researched and reviewed the best car insurance providers in the country.

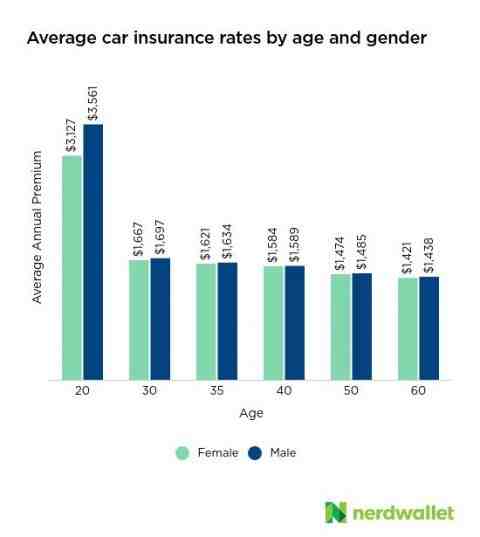

Whenever you’re shopping for car insurance, we recommend getting quotes from multiple providers so you can compare coverage and rates. In addition to the insurance company you choose, factors such as your age, vehicle make and model, and driving history can affect your premium, so what’s best for your neighbor may not be best for you.

Use our tool below or call (844) 246-8209 to start comparing personalized auto insurance quotes:

Best Cheap Chicago Car Insurance

Contents

- 1 Best Cheap Chicago Car Insurance

- 2 Alternative Chicago Car Insurance

- 3 What Are Chicago’s Car Insurance Requirements?

- 4 What Is The Average Cost Of Car Insurance In Illinois?

- 5 What Is It Like Driving In Chicago, I.L.?

- 6 What Causes Higher Chicago Car Insurance Rates?

- 7 Methodology

- 8 Is it cheaper to insure an older or newer car?

- 9 How much is full coverage auto insurance in Illinois?

- 10 How much is liability insurance for a car Illinois?

- 11 How much did car insurance go up in 2021?

We agree that car insurance rates are one of the main factors when choosing a provider, but it can’t be everything you evaluate. This may interest you : Why are Geico rates so low?. It is also important to evaluate the company’s reputation, customer reviews, as well as available coverage options.

After all, it’s great to pay a low rate, but what happens when you need to pay off a claim? Will you get the money or will you be left stranded?

Here are some reliable insurance companies we have reviewed that also offer cheap auto insurance quotes. If you’re looking to save money, these options are the best place to start.

*You may notice that some car insurance companies are listed above those with higher ratings. That’s because our ratings take into account national factors, while our rankings look specifically at which insurance providers are the best for car insurance in Chicago, I.L.

State Farm is the nation’s largest auto insurance provider and covers more than 65 million policies. It also ranks 36th on the Fortune 500 list, further proving that the company isn’t going anywhere anytime soon. While State Farm offers slightly higher rates in other states, it is one of the cheapest for car insurance in Chicago. Although the rate goes up after an accident, it’s not nearly as much as some other companies.

With State Farm car insurance, you can get all the standard coverage that most companies offer. Some are required under financial responsibility laws that vary from state to state, while others are still good to have.

These are the six standard types of auto insurance:

Of the above coverages, BI/PD is required by almost all states. Some states also require uninsured/underinsured driver or health insurance. All no-fault conditions require PIP since it covers the driver regardless of who is at fault.

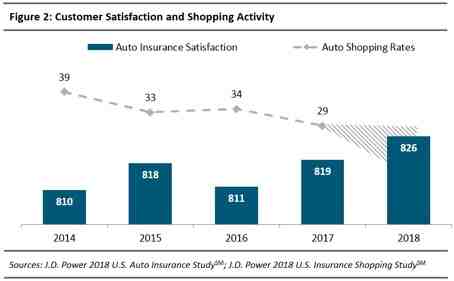

Let’s take a closer look at State Farm’s reputation. The company has an A+ Better Business Bureau (BBB) rating. In addition, the 2021 Automotive Claims Satisfaction Study and the 2021 US Auto Insurance Study by J.D. Power prove that this organization is an industry leader.

Along with that reputation, State Farm offers several additional benefits to drivers in Chicago.

When it comes to technology, State Farm offers a lot of options with its Chicago auto insurance.

To learn more about the car insurance provider, check out our State Farm car insurance review.

American Family ranks as the 15th largest auto insurance provider in the country, according to the National Association of Insurance Commissioners, and covers nearly nine million policies, which is impressive considering it’s not offered in every state. Plus, this insurance provider is ranked #306 on the Fortune 500 list, so it’s not just a no-name company to worry about.

If you’re a safe driver or don’t need a lot of coverage, American Family should be able to provide you with one of the cheapest insurance rates.

We are pleased with American Family’s BBB rating. Additionally, it comes with average or better reviews on the 2021 American Auto Claims Satisfaction Study and the 2021 American Auto Insurance Study by J.D. Power, in every region where it is offered.

Just like State Farm, you’ll also find some additional benefits on top of the standard types of coverage.

The company may be smaller than State Farm, but it offers just as much technology.

To learn more about the car insurance provider, check out our American Family Auto Insurance review.

#3 Progressive Insurance

We also recommend Progressive when it comes to Chicago auto insurance. Progressive is one of the leading auto insurance providers in the US and has received an A+ rating from AM Best, which means it has superior financial ability to settle insurance claims. Read also : How much is average car insurance?. In 2019 alone, Progressive wrote more than $31 billion in insurance premiums, according to the National Association of Insurance Commissioners (NAIC). The company also received a J.D. Power Claims Servicing rated 3.0 out of 5.0.

As one of the largest insurance providers, the company offers a number of different coverage options. In addition to the standard types of car insurance, Progressive also offers:

Progressive also offers many money-saving features, including:

To learn more about the car insurance provider, check out our progressive car insurance review.

Another car insurance provider to consider is Country Financial. Founded in 1925 as a fire and lightning insurance provider, the provider has grown to include multiple insurance products such as auto, home and property insurance, life insurance, business, specialty products, farm and ranch insurance and crop insurance. The company is headquartered in Bloomington, Illinois.

Overall, Country Financial has average rates and is in good financial standing. When we dug deeper into Country Financial’s customer service and reputation, we found that J.D. The Power 2021 US Automotive Claims Satisfaction Study recently ranked the company third in customer satisfaction with automotive claims. Country Financial received a score of 850 on a 1,000-point scale in the study, which evaluated the responses of more than 11,000 auto insurance customers who filed claims in the last six months before taking the survey. We believe that a company’s high rating is an indication that it is committed to treating its customers well and meeting their expectations.

When it comes to coverage, Country Financial auto insurance has several additional coverage add-ons that can give you extra confidence on the road.

All in all, Country Financial is a viable option for car insurance in Chicago. It has been in business for a long time and has good financial stability with an A+ rating from AM Best.

The country’s auto insurance finance costs appear to be average for the industry. Unique discount offers such as engaged couple discounts and employment discounts can qualify you for significant savings on your premiums if you qualify. At the same time, Country Financial does not offer accident forgiveness benefits or ride-sharing coverage, which can be a drawback.

To learn more about the car insurance provider, check out our Country Financial car insurance review.

Another company we recommend for Illinois drivers is Geico. This provider is the second largest auto insurance company in the US and is known for its affordability and smooth claims experience, providing auto insurance to millions of people.

The company has an A++ rating from AM Best, the highest rating possible. This means that Geico can easily handle its financial burden of covering so many policies. Also, Geico has an A+ rating from the BBB, and there are many five-star Geico reviews online from satisfied customers.

With a New Hampshire car insurance policy, you can also get the following additional options:

Here are the discounts you can get with Geico:

We recommend Geico for car insurance in Chicago because of the many add-ons and discounts, which allow you to tailor your car insurance to your needs. It is also one of the most affordable car insurance companies, after USAA.

To learn more about the car insurance provider, check out our Geico car insurance review.

To start comparing auto insurance providers in Chicago, simply enter your zip code into our tool below or call (844) 246-8209 to start comparing personalized auto insurance quotes:

Alternative Chicago Car Insurance

Some people cannot get standard car insurance in Chicago. If you are a high-risk driver with a DUI or accident on your record, you may be forced to go through an Illinois car insurance plan instead. On the same subject : Tips for lowering car insurance prices. This is also the only option for some drivers with bad credit.

If you want cheap Chicago car insurance and don’t have a bad record, you don’t want to go this route. The policies offered by this insurance agency are extremely expensive and not suitable for the everyday driver. Instead, it is best to consider one of the best cheap car insurance providers in Chicago.

What Are Chicago’s Car Insurance Requirements?

Chicago is the largest city in Illinois. Drivers in the Windy City must follow the same state-mandated insurance guidelines as everyone else in Illinois. The state of Illinois mandates that all drivers have this minimum amount of coverage.

This level of coverage ensures you stay legal in Chicago. However, it leaves you vulnerable in many ways. First, these policies will not cover damage to your vehicle or your medical bills as a result of an accident you caused. Furthermore, if you cause an accident that ends up costing more than these limits, you could be responsible for the difference.

Illinois is not a tortfeasor state, but it still uses a system to determine liability. If you cause an accident that causes a total loss for the luxury car owner or another person requires extensive rehabilitation, you won’t want to deal with the financial burden of those situations.

That’s why it makes sense to add some of the following policy options to your plan.

What Is The Average Cost Of Car Insurance In Illinois?

According to the National Association of Insurance Commissioners (NAIC), car insurance rates in Illinois in 2017 averaged $897.07 per year. That’s lower than the national average of $1,004.68, which ranks Illinois 25th out of all US states for auto insurance.

Here’s a breakdown of the cost of car insurance coverage in Illinois that year, according to the Insurance Information Institute:

*To calculate average costs, the NAIC assumed that all insured vehicles would have liability coverage, but not necessarily collision or comprehensive. Total annual expenditure measures how much consumers actually spend.

What Is It Like Driving In Chicago, I.L.?

Ridesharing is popular in Chicago, with more than 60,000 riders. Still, more people are turning to driving or other forms of transportation as carpoolers are now getting banned for parking tickets, according to National Public Radio.

According to Forbes, Chicago also has one of the most congested road systems in the country. Chicago’s crash rate is also higher than the national average, with 26 percent of incidents during the first half of 2018 resulting from hit-and-runs.

Some of the accidents were probably caused by bad weather conditions. After all, in 2018, Chicago received nearly fifty inches of precipitation and has about 125 days of rain, sleet, snow, or hail per year, according to weather.com. This bad weather leads to wet brakes, reduced visibility and slippery roads.

What Causes Higher Chicago Car Insurance Rates?

When it comes to getting a car insurance quote, several criteria go into the overall price, no matter where you live. Most service providers look at the following information.

However, one of the most important factors is location. Insurers look at your zip code to determine the risk involved. If you live in an area riddled with uninsured drivers, theft and crime, you’ll pay more. Based on the Chicago crime maps, it’s fair to assume that these zip codes are affected.

Here are the most expensive zip codes in Chicago for car insurance:

Here are the cheapest Chicago zip codes for car insurance:

Use our tool below or call (844) 246-8209 to start comparing auto insurance quotes in your area:

Methodology

In an effort to provide consumers with accurate and unbiased information, our expert review team collects data from dozens of auto insurance providers to formulate a ranking of the best insurers. Companies receive a score in each of the following categories, as well as an overall weighted rating of 5.0 stars.

Is it cheaper to insure an older or newer car?

In general, car insurance for older cars can be cheaper than insuring newer vehicles of the same make and model if a used car is cheaper to repair or replace. A car loses value over time, its value decreases, which reduces the maximum amount that the insurance company would have to pay in the event of an accident.

Which insurance is best for an old car? What is the best insurance for old cars? Hagerty, Grundy, American Collectors, American Modern and Heacock offer the best auto insurance for vintage cars. These companies are the best option for classic car insurance because of their fair prices, affordability and experience in the industry.

Is a 20 year old car a classic?

For insurance and registration purposes, the age of a classic car is in most cases at least 20 years, but no more than 40 years. If you’re going to register (and insure) it as a classic, it should have kept the original design and specs.

What do you call a 20 year old vehicle?

Usually, the nickname classic car refers to vehicles older than 20 years. Vintage cars are older than 45 years, and vintage cars were manufactured between 1919 and 1930.

Are 20 year old cars reliable?

Reliability depends on the vehicle and how many kilometers have been driven. We wouldn’t go too far beyond the mid-to-late 1990s for any car, as parts can be harder to find after a car is 20 years old.

How many years does a car have to be old to be a classic?

The starting age range of a classic car can generally be anywhere from at least 10 to 25 years, but there is no agreed upon minimum age that categorizes a car as a classic. Insurance companies, collector car clubs, and state BMVs and DMVs all have their own methods for defining a classic car.

Who usually has the lowest car insurance?

Of the nine major auto insurers in our annual study, USAA, Geico and State Farm consistently have the lowest annual rates for the driver groups we surveyed. This includes premiums for good drivers as well as those who may have received a speeding ticket.

How much lower does car insurance go down at 25?

Usually, yes. With Progressive rates drop by 9% on average at age 25. But there are other cost factors that affect your car insurance, such as your claims history. So if you have an accident before you turn 25, your rate may not drop.

Why is my car insurance so low?

Your driving record â The better your record, the lower your premium. If you have had accidents or serious traffic violations, you will likely pay more than if you have a clean driving record.

Is Geico really the cheapest?

Geico is the cheapest major auto insurer in the country, according to NerdWallet’s latest analysis of minimum coverage rates. Geico’s average annual rate was $354, or about $29 a month.

Is it cheaper to insure an older car?

Are older cars cheaper to insure? Yes, most older cars are cheaper to insure, especially in terms of comprehensive and collision insurance. Cars lose value as they age, so potential insurance payouts after an accident also drop. This is not the case with many classic or collector cars.

Why are older cars more expensive on insurance?

Consider repair and replacement costs: Older vehicles can be more expensive to insure because parts can be more expensive to repair due to hard-to-find parts. Consider how much you will have to spend to fix your older car.

What is a 20 year old car considered?

Usually, the nickname classic car refers to vehicles older than 20 years. Vintage cars are over 45 years old, and vintage cars are those manufactured between 1919 and 1930. However, as with many topics in the automotive world, not everyone can agree on a single definition.

How much is full coverage auto insurance in Illinois?

The average cost of full coverage auto insurance in Illinois is $1,383 a year, or about $115 a month, according to a NerdWallet analysis. Minimum coverage in Illinois averages $512 a year, but we found that you can probably get a cheaper policy.

Is full coverage the most expensive? Comprehensive coverage is more expensive because it includes liability coverage plus collision and comprehensive coverage, which protects you from damage to your car in most types of accidents. If you have a car loan or lease, your lender will usually require full coverage.

Is car insurance more expensive in Illinois?

| Level of coverage | Average annual rate |

|---|---|

| State minimum â Liability only | 422 dollars |

| State Minimum â $1,000 Comprehensive/Collision | 936 dollars |

Is car insurance in Illinois expensive?

The average cost of car insurance in Illinois is $1,134 per year, one of the cheapest rates in the country and significantly cheaper than the national average of $1,424. These averages refer to multiple companies and locations for a single sample of drivers.

Is car insurance going up in Illinois?

State Farm, Allstate and Progressive — the three largest auto insurers in Illinois — all filed rate hikes with the state Department of Insurance this year, a dramatic shift from the rebates and rate cuts that proliferated during the 2020 pandemic.

Which state has the highest cost of auto insurance?

Average auto insurance price comparison by state Michigan has the highest rates for auto insurance, with drivers paying an average of $4,386 per year for minimum coverage. Iowa has the cheapest auto insurance – drivers in the state pay an average of just $382 a year for minimum coverage.

What is considered full coverage auto insurance in Illinois?

Full coverage insurance in Illinois is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $20,000 in property damage coverage.

What is classified as full coverage?

Full coverage car insurance is a term that describes having all the major parts of car insurance including bodily injury, property damage, uninsured motorist, PIP, collision and comprehensive. You are usually legally required to carry about half of these coverages.

What’s the difference between collision and full coverage?

Comprehensive coverage protects your vehicle from unexpected damage, such as a tree branch falling on it or an animal hitting it, while collision coverage protects against collision with another vehicle or object.

How much liability insurance do I need in Illinois?

You are in compliance with the law if you have liability insurance in the following minimum amounts: $25,000 for injuries or death of one person in an accident. $50,000 for injury or death of more than one person in an accident. $20,000 for damaging another person’s property.

How much is full coverage in Illinois?

The average cost of car insurance in Illinois is $1,946 per year for full coverage, or about $162 per month on average. For minimum coverage, the average annual cost of car insurance in Illinois is $454 per year, or about $38 per month on average.

Is getting full coverage worth it?

Full coverage car insurance is worth buying in many situations. When you include comprehensive and collision insurance policies, you are covering the actual cash value of your car. This means that if your vehicle is killed in a car accident, you will get about as much for it as if you had sold it.

How can I get full coverage cheaper?

How to get cheap insurance with full coverage

- Choose consistent liability limits. …

- Choose the same deductible for comprehensive insurance and collision insurance. …

- Set the same coverage limits for all other coverages, such as uninsured/underinsured motorist coverage, personal injury coverage, and more.

How much is liability insurance for a car Illinois?

| Level of coverage | Average annual rate |

|---|---|

| $50K/$100K/$50K Bodily Injury/Property Damage — $500 Comprehensive/Collision | 1120 dollars |

| Specify the minimum — liability only | 422 dollars |

| State Minimum — $1000 Comprehensive/Collision | 936 dollars |

| State Minimum — $500 Comprehensive/Collision | 1057 dollars |

Is liability insurance required by law in Illinois? Illinois law (625 ILCS 5/7-601) requires all vehicle owners to carry minimum amounts of automobile liability insurance. In addition, lending institutions may require physical damage insurance (collision coverage) for the financed vehicle.

Is liability insurance is mandatory for Illinois drivers?

At-fault drivers typically rely on liability insurance to pay for damages, which is why Illinois law requires car owners and drivers to carry a minimum amount of liability insurance.

When did Illinois make car insurance mandatory?

The measure was signed into law in 1988 after 17 years of opposition in the General Assembly, mostly from the insurance industry and some urban lawmakers. It entered into force on January 1, 1990.

Can you drive without insurance Illinois?

Also, Illinois drivers must have uninsured motorist coverage with the same minimum limits. Not having adequate insurance is considered a petty misdemeanor, which means it is only punishable by a fine – no jail time. If you are caught driving without insurance, you could face a fine of up to $1,000.

What is liability insurance in Illinois?

In Illinois, liability car insurance is mandatory for all drivers. Liability insurance only covers the other car and/or the driver and passengers of that car when you are found to be at fault for the accident. Liability insurance will not cover your out-of-pocket expenses for personal injury or property damage.

Is car insurance in Illinois expensive?

The average cost of car insurance in Illinois is $1,134 per year, one of the cheapest rates in the country and significantly cheaper than the national average of $1,424. These averages refer to multiple companies and locations for a single sample of drivers.

In what state is auto insurance most expensive?

Florida is the most expensive state for auto insurance with average auto premiums of $2,560 per year – up about 23% from 2021 rates, according to Insure.com’s 2022 analysis. Namely, drivers in no-fault states like Florida and Michigan , pay more for auto insurance than drivers in other states.

Who has the lowest car insurance rates in Illinois?

In Illinois, drivers with a clean record pay an average of $1,325 statewide. Geico has the cheapest car insurance for good drivers, with an average annual rate of $838. On the other hand, Allstate has the most expensive insurance in Illinois with an average annual rate of $2,213.

Is car insurance high in Illinois?

Average car insurance rates in Illinois are 24% lower for minimum coverage. The average cost of car insurance with minimum coverage in Illinois is $454 per year, while the national average is $565 per year for minimum coverage.

How much is car insurance per month in Illinois?

The average cost of car insurance in Illinois is $1,946 per year for full coverage, or about $162 per month on average. For minimum coverage, the average annual cost of car insurance in Illinois is $454 per year, or about $38 per month on average.

Who has the lowest car insurance rates in Illinois?

In Illinois, drivers with a clean record pay an average of $1,325 statewide. Geico has the cheapest car insurance for good drivers, with an average annual rate of $838. On the other hand, Allstate has the most expensive insurance in Illinois with an average annual rate of $2,213.

How much is car insurance per month in Chicago?

Car insurance with minimum coverage costs an average of $108 per month in Chicago. The average cost of full coverage car insurance in Chicago is $228 per month. However, how much you pay for car insurance depends on several factors, so your monthly premium may be higher or lower than these amounts.

How much a month is good for car insurance?

According to NerdWallet’s 2022 rate analysis, the national average for car insurance costs is $1,630 per year. This means that the average car insurance rate is about $136 per month.

How much did car insurance go up in 2021?

The State of Auto Insurance in 2021 Auto insurance rates fell for the first time in more than a decade – down 1.7% across the US for 2021. However, premiums are still 106% more expensive compared to 2011.

Did Geico prices go up in 2022? InvestigateTV – Auto insurance rates aren’t immune to inflation, as experts predict the price will rise for many in 2022. Several major auto insurers, including Allstate, Progressive, Geico and State Farm, have already raised rates in early 2022 in many states, according to to Bankrata.

How much did car insurance go up in 2022?

The State of Auto Insurance in 2022 Auto insurance rates have risen again after falling last year — consumers can expect an average increase of 0.6% across the U.S. for 2022. And the average cost of full coverage auto insurance in the U.S. reached is $1,935 per year.

Why did insurance go up so much?

The number of traffic accidents has increased, which has led to more insurance claims. This higher claims volume, along with higher vehicle repair and replacement costs, is ultimately what drives up insurance rates across the industry.

Based on S&P data from January 1, 2022 to May 18, 2022, insurance companies were granted rate increases in nearly every state, with an average rate increase of 4.48%.

What can you do to make your insurance rates go down?

Here are some ways to save on car insurance1

- Increase your deductible.

- Check the discounts you qualify for.

- Compare auto insurance quotes.

- Maintain a good driving record.

- Participate in the safe driving program.

- Take a defensive driving course.

- Explore payment options.

- Improve your credit score.

Why did my homeowners insurance go up 2022?

Record High Inflation But the fact is that home insurance premiums are rising everywhere due to skyrocketing labor and building material costs thanks to supply chain problems and record high inflation in 2021 and 2022.

Why did my car insurance increase 2021?

The streets were quieter and there were fewer accidents. As a result, many insurance companies returned part of the premiums to policyholders. “In 2021, we saw a return to pre-pandemic driving patterns, leading to a significant increase in auto insurance claims and accident severity.

Why did my car insurance go up when nothing changed?

It is also possible for your car insurance to go up without any changes to your driving history or policy. If your rates seem to have gone up for no reason, it could be because the company had to pay out a lot of claims at once (like after a hurricane) or because things are more expensive in general.

How much did car insurance go up in 2022?

As with nearly every purchase consumers make now, the average price of auto insurance is likely to increase for many drivers during 2022. Nationally, auto insurance rates are rising an average of 4.9 percent, according to approved rate data from S&P Global Market Intelligence .

Why did my car insurance go up suddenly?

Car accidents and traffic violations are common explanations for insurance rate increases, but there are other reasons why car insurance premiums go up, including a change of address, a new vehicle, and claims in your zip code.