Cheapest Chicago Car Insurance: Affordable Rates (2022)

Our data shows Country Economy typically offers the cheapest car insurance in Chicago, with an average rate of $34 for minimum coverage.

The cost of car insurance in Chicago is generally not as high as in cities like New York or Los Angeles, but it is still a good idea to compare companies to get the best price. After analyzing the best car insurance companies, we at the Home Media review team will show you how to find the cheapest car insurance in Chicago and save money.

Cheapest Car Insurance Chicago

Contents

- 1 Cheapest Car Insurance Chicago

- 2 Car Insurance Quotes in Chicago

- 3 Average Cost of Car Insurance in Chicago

- 4 Cheap Car Insurance in Chicago: Conclusion

- 5 How much does a car cost per month?

- 6 Did insurance premiums go up in 2022?

- 7 What is sr22 insurance?

- 8 Why are healthcare premiums so high?

Our database shows the cheapest auto insurance companies in Chicago include Country Economy, Advance, Homeowners Insurance and State Farm. This may interest you : California motorists may have higher car insurance rates. Keep in mind that average costs are based on a variety of factors and that your rates may vary.

Cheapest Liability Car Insurance in Chicago

If your main concern is getting the cheapest insurance possible, follow the minimum insurance required by Illinois. According to our average, Country Finance is the smallest provider of insurance, with an average of $34 per month or $408 per year. See the article : Car Insurance Market May See Big Moves: Big Giants HSBC, AXA, Zurich Insurance, Allianz. In addition, Auto Owners Insurance, Park State and Erie are also affordable, averaging around $40 per month.

Illinois requires basic levels of bodily injury liability ($25,000 per person and $50,000 per accident) and property damage liability ($20,000 per accident), which compensates others when you cause an accident. The state also requires uninsured motorist bodily injury coverage ($25,000 per person and $50,000 per accident), which takes care of your medical bills if an uninsured person causes an accident or you experience a hit and run.

Below, you can see 10 popular auto insurance companies ranked by their average minimum insurance cost in Chicago.

Cheapest Full-coverage Car Insurance in Chicago

Car Insurance Quotes in Chicago

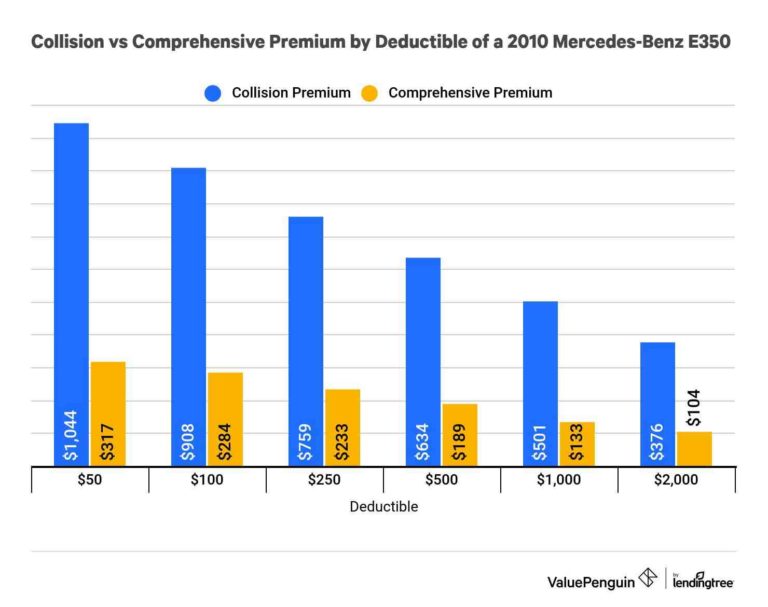

Car insurance rates can vary depending on factors such as your age, gender and driving history. On the same subject : Do you want to make your car insurance profitable? here’s everything you need to know. In this section, we will look at the average full auto insurance for different drivers.

Cheapest Car Insurance Chicago: Age and Marital Status

Average car insurance rates are higher for teens and young drivers in Chicago than for adults. Because young drivers are more likely to get into car accidents and get tickets. Additionally, single drivers tend to have higher car insurance premiums than married drivers.

Our data shows Geico is the cheapest provider for single 24-year-olds with a clean driving record. Geico pays an average of $1,051 a year for this age group.

Cheapest Car Insurance Chicago: Gender

Your gender may affect what you pay for car insurance to a small degree. Generally, men pay less than women, but this varies by company. Below, you can see how average rates can vary by up to $250 a year for full coverage coverage.

Cheapest Car Insurance Chicago: High-risk Drivers

Having a speeding ticket, at-fault accident or DUI on your record makes you a dangerous driver to car insurance companies.

Car Insurance Prices in Chicago: Speeding Ticket

According to our estimates, Erie Insurance offers the best rates in Chicago if you have a speeding ticket on your record. Erie drivers with speeding tickets pay about $149 a month or $1,784 a year for full coverage on average.

Car Insurance Prices in Chicago: At-fault Accident

Generally, an at-fault accident will raise your auto insurance premium more than a speeding ticket. In this case, American Family Insurance is the company with the cheapest rates, which are $163 per month or $1,952 per year on average.

Car Insurance Prices in Chicago: DUI

Being convicted of a DUI significantly increases your risk rating in the eyes of insurance companies. That said, some providers still offer lower rates. The cheapest car insurance in Chicago for drivers with a DUI include Advance, State Farm and American Family Insurance, according to our estimates.

Average Cost of Car Insurance in Chicago

On average, Chicago drivers pay about $1,730 a year for full coverage policies, according to our data. Unfortunately, this is the same as the national average for full coverage. As a big city, Chicago tends to have car insurance rates that are actually on the affordable end of the spectrum.

Car Insurance Prices in Chicago: What Affects Them?

Car insurance rates are customized for each driver. The cheapest car insurance company for one person may be expensive for another, and vice versa. Many factors affect the cost of car insurance, from your credit history and ZIP code to the type of car you drive.

Factors that affect what you pay for Chicago car insurance include:

How To Get Cheap Car Insurance in Chicago

While you can’t change many factors that affect the cost of car insurance, you can get affordable insurance by keeping a few things in mind.

Cheap Car Insurance in Chicago: Conclusion

Now that you have an idea of which auto insurance companies typically offer low rates for different types of drivers in the Windy City, compare auto insurance rates from a handful to find the best option for you.

Cheapest Auto Insurance in Chicago: FAQ

Below are some frequently asked questions about auto insurance in Chicago:

Medicare beneficiaries will see their Part B premiums drop in 2023, the first time in more than a decade that the tab is lower than last year, the Centers for Medicare and Medicaid Services announced Tuesday. Monthly premiums will be $164.90 in 2023, a decrease of $5.20 from 2022.

How much does a car cost per month?

The average monthly new car payment was $667 in the second quarter of 2022, according to credit reporting agency Experian. But that’s far from the true cost of owning a car. For cars driven 15,000 miles a year, the average car ownership costs were $10,728 a year, or $894 a month, in 2022, according to AAA.

Is 600 a month too much for a car? How much do you spend on a car? If you’re taking out a personal loan to pay for your car, it’s a good idea to limit your car loan to between 10% and 15% of your home loan. If you take home $4,000 a month, you’d want your car payment to be no more than $400 to $600.

How much should I spend monthly on a car?

In general, experts recommend spending 10%–15% of your income on transportation, including car payments, insurance, and fuel. For example, if your household income is $4,000 per month, then you should spend $400 to $600 on transportation. To be sure, that number is simply a guide.

Is 450 a month a lot for a car payment?

You have to look at the overall level of your finances. Car payments should not exceed 10% of your take-home pay. So unless you’re taking home more than $4500/mo, $450 is too much for a car payment.

Is $500 a month a high car payment?

A $500 monthly car loan payment in 2019 would definitely be too much. But in 2022, when the average monthly payment is $648, try your luck if you only have $500!

How much a month is too much for a car payment?

According to experts, the car payment is too much if the car payment is more than 30% of your gross income. Remember, a car payment isn’t your only car expense! Be sure to consider fuel and maintenance costs. Make sure your car loan is no more than 15%-20% of your total income.

What’s a normal monthly car payment?

The average monthly car payment for new cars is $667. The average monthly payment for a used car is $515. 38.22 percent of consumers financed a new car in the second quarter of 2022.

As with almost every purchase that consumers make now, the average cost of car insurance may rise for many drivers throughout 2022. Nationally, auto insurance rates are increasing by an average of 4.9 percent, according to filings for the rate. approved by S&P Global Intelligence.

.

What is sr22 insurance?

The SR-22 is a certificate of financial responsibility required of some drivers by state or court order. It serves as proof that the driver has purchased the minimum auto insurance coverage in the state. Depending on your state and the state you live in, the FR-44 may take the place of the SR-22.

What does SR-22 cover in Ohio? An SR22 bond is required to cover bodily injury ($12,500 for 1 person injured and $25,000 per accident where 2 or more are injured) and property damage ($7,500). It is liability insurance for you as a driver when you are in an accident and are at fault.

Who has the cheapest SR-22?

Companies with the Cheapest SR-22 Insurance Quotes for 2022

- Progressive is the cheapest SR-22 insurance provider that is widely available to most drivers, averaging $1,058 per year.

- State Parks is the second cheapest SR-22 provider available to most drivers, with an average cost of $1,208 per year.

Who has the best rates for SR-22 insurance?

Major companies like USAA, State Farm and Progressive offer the lowest prices for SR-22 drivers. Regional companies such as Farm Bureau, Erie and American Family also offer SR-22 discounts if you live in an area served by these companies.

How much is a SR-22 in Nevada?

SR-22 insurance in Nevada costs an average of $968 per year, an 11% increase over standard auto insurance rates. In addition to the increased fees, it costs between $15 and $25 to file an SR-22 form in Nevada, depending on the insurance company.

How long do you have to have a SR-22 in South Carolina?

In South Carolina, drivers are usually required to maintain SR-22 insurance for three years, although this can be longer depending on the crime you have been convicted of or if you have no insurance.

How long is SR-22 required Texas?

You must have a valid SR-22 for two years from the date of your last offense, or the date of your conviction. Failure to maintain SR-22 for two years without coverage may result in additional enforcement actions and/or reinstatement charges.

How long is an SR-22 required?

SR-22 is required for three years. Failure to do so will result in the suspension of your driver’s license.

How do I get an SR-22 removed in Texas?

You can get your SR-22 removed from Texas after 2 years by notifying your insurance company, which will cancel the SR-22 filing in the state. Sometimes, the DMV will send you a notice telling you when your SR-22 is due.

How much does an SR-22 cost in Texas?

On average, the minimum SR-22 insurance coverage in Texas costs $988 per year when an SR-22 is filed due to a DUI. On the other hand, the average Texas auto insurance policy without SR-22 costs about $643 per year.

Does an SR-22 make insurance go up?

SR-22 itself does not increase the cost of car insurance. However, a violation of the SR-22 requirement will affect your car insurance premium. In short, it’s your abuse and not the SR-22 that will raise your price.

How long do you have to have an SR-22 in Virginia?

In Virginia, drivers are required to have SR-22 coverage for three years, although this period can be extended if you commit another serious violation or allow your SR-22 coverage to expire. Insurance companies are legally required to notify the Virginia DMV if you cancel or do not renew your SR-22 policy.

How long is SR-22 required in Missouri?

How soon do I need to file an SR-22/proof of insurance? If you have a suspended Motor Vehicle Accident Conviction (Missouri or Out of State), you must keep the insurance on file with the Driver’s License Bureau for two years from the date of suspension.

How long do you have to have SR-22 in South Carolina?

In South Carolina, drivers are usually required to maintain SR-22 insurance for three years, although this can be longer depending on the crime you have been convicted of or if you have no insurance.

The cost of health care is the single largest factor behind US health care costs, accounting for 90% of spending. These costs reflect the cost of care for those with chronic or long-term medical conditions, the elderly and the increased cost of new drugs, procedures and technologies.

What are the 3 main factors used in determining health insurance premiums? Five factors can affect a plan’s monthly premiums: location, age, tobacco use, plan category, and whether the plan covers dependents. Note: FYI Your health, medical history, or gender cannot affect your premium.

Is health insurance really that expensive?

BY Anna Porretta Updated October 01, 2022 In 2020, the national average cost of health insurance is $456 per person and $1,152 per family per month. However, costs vary across a wide selection of health plans.

Is it worth it to pay for health insurance?

Health insurance helps secure your financial future For many young people like you, paying for your health insurance is a new thing and may seem like a trivial matter. But the opposite is actually the case. Having good health insurance is one of the most important parts of your financial plan.

Why is healthcare so expensive 2022?

There are many possible reasons for increasing the cost of health care: The introduction of new health care technology can lead to better, more expensive procedures and products. The complexity of the US health care system can lead to administrative waste in the insurance and provider payment system.

Why is healthcare so expensive even with insurance?

The US health care system is complex and most costs are market driven. High, unregulated prescription drug costs and health care provider salaries are higher than in other Western countries, hospital care is 31% of national health care costs.

Americans spend a lot of money each year on health care, and the cost continues to rise. In part, this increase is due to government policy and the creation of national programs such as Medicare and Medicaid. There are also short-term factors, such as the financial crisis of 2020, that are driving up the cost of health insurance.

Rising premiums, higher deductibles and co-payments, and rising prescription drug prices lead to higher health care costs. According to the Centers for Medicare & Medicaid Services1, by 2021, health care costs will skyrocket to $4.3 trillion.

7 Effective Ways to Save on Group Health Insurance Plans

- hire more workers. …

- Employ the Youth. …

- Provide preventive wellness. …

- Remove the Dental and Sight cover. …

- Pay for a Health Savings Account. …

- Choose a Plan with Out-of-Pocket Terms. …

- Compare Insurance Providers.

Why is healthcare so expensive even with insurance?

Cutler explores the three driving forces behind high health care costsâ administrative costs, corporate greed and price gouging, and high use of expensive health technologyâ and possible solutions to them.