Published September 1, 2022 6:30 pm

Carjackings threaten public safety and raise insurance rates

Contents

- 1 Carjackings threaten public safety and raise insurance rates

- 2 DC man’s car stolen by tow truck outside his home

- 3 What are three ways to reduce your car insurance premiums?

- 4 Who is the top five insurance company?

- 5 Which insurance company has the highest customer satisfaction?

- 6 Does it matter which insurance company you use?

Car thefts and the rash of car chases that have plagued the DC region since late 2020 aren’t just affecting public safety — they can now hit the wallet, too. To see also : Budget Insurance Launches High-Risk Driver Insurance Plan – PR Newswire APAC.

WASHINGTON – Two days after a man told FOX 5 his brand new Honda Accord Hybrid was stolen at a tow truck in Southeast D.C., a Georgetown woman says something similar happened to her.

Home surveillance video from Feb. 28 shows a dark-colored tow truck pulling the Chevy Corvette away from 27th St. NW just before 3:40 a.m. The car’s alarm can be heard rumbling in the background.

Jaclyn Baker, the car’s owner, tells FOX 5 that she bought the Corvette brand new in 2016. The car was recovered in May, according to a police report.

These types of crimes, both carjackings and the rash of car chases that have plagued the D.C. region since late 2020, don’t just affect public safety — they can now hit wallets, too.

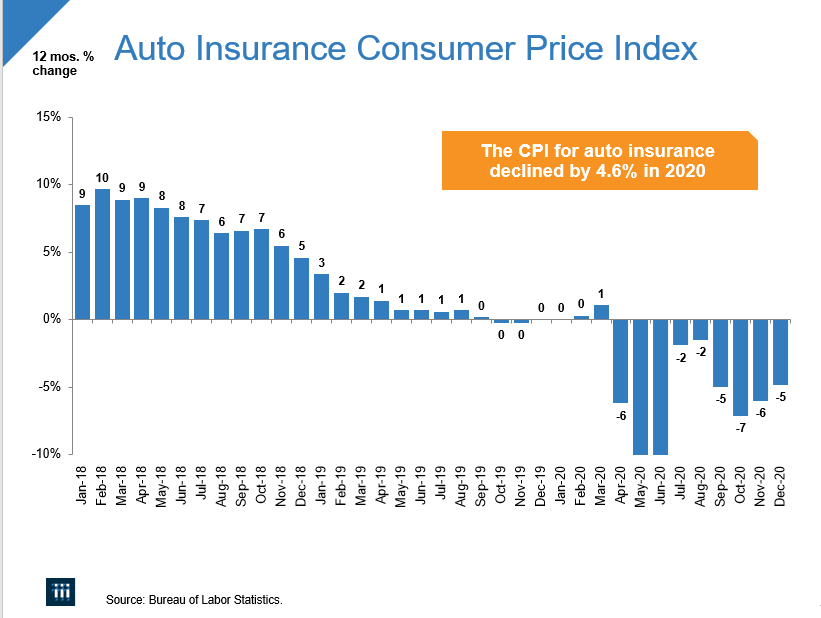

“Car thefts are up across the country and inflation is just like anyone who goes to the grocery store can see the impact of inflation,” said Bob Passmore with American Property Causality Insurance. “Car insurance is no different because the cost of things that car insurance pays for like medical care and collision repair and total vehicle costs have all gone up. So that’s going to have an impact on rates.”

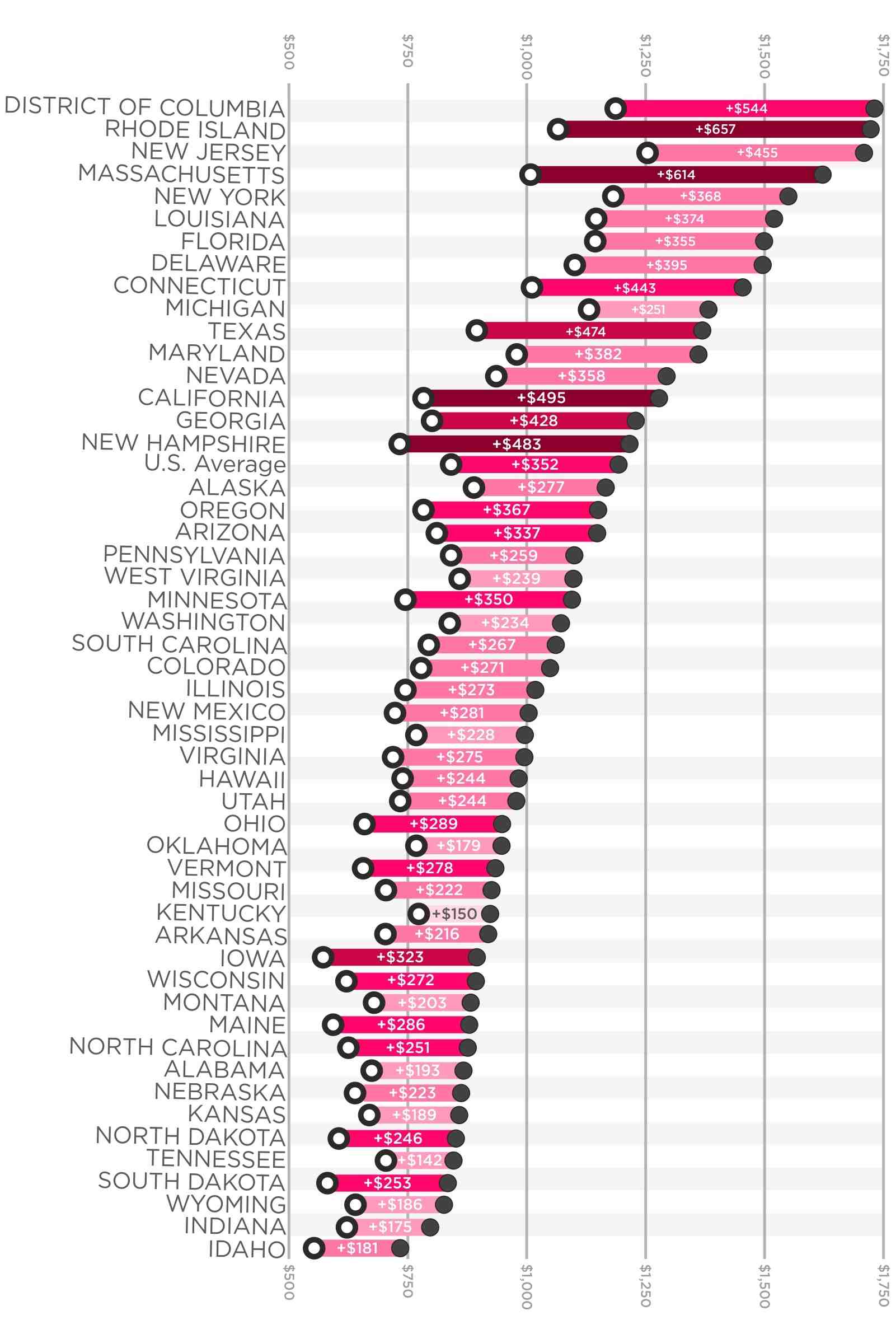

A recent DC-area politician pointed out this problem, tweeting that even with “a clean driving record,” as of September 1st, his car insurance would jump 37% due to inflation and the increase in DC car chases.

D.C. police statistics show car thefts only increased about 3% from this time last year. Police recorded 329 carjackings so far this year with a 52% increase in the statistics from 2022 to 2021. MPD also notes a 73% increase in the number of carjackings with weapons.

Passmore tells FOX 5 that insurance companies consider car thefts and car chases to be in the same category. Another problem is the fact that the prices of used cars have gone up, which means that car insurance companies have to sell more with the higher volume of car thefts.

Officials are quick to note that these car problems are not unique to the DC area. However, a new Hot Spots report issued by the National Crime Insurance Bureau shows that Washington D.C. had the second highest total theft rate last year.

The report says that Washington, D.C. reported 651 thefts per 100,000 people in 2021 compared to 562.98 in 2020.

DC man’s car stolen by tow truck outside his home

D.C. police are investigating after a man reported his car was wheeled away by thieves in a tow truck early Sunday. Read also : Does car insurance need to be in name of registered owner?. FOX 5’s Lindsay Watts reports with the details.

When FOX 5 asked Baker, the Corvette owner, who she feels is responsible for doing more to fix the problem, she said “everyone.”

“The people themselves. It has to stop,” she said.

More car accidents and more drivers on the road are other contributors to the increase in car insurance prices.

Passmore says there are some indications that inflation is easing. However, higher prices may persist as long as other car problems continue to occur.

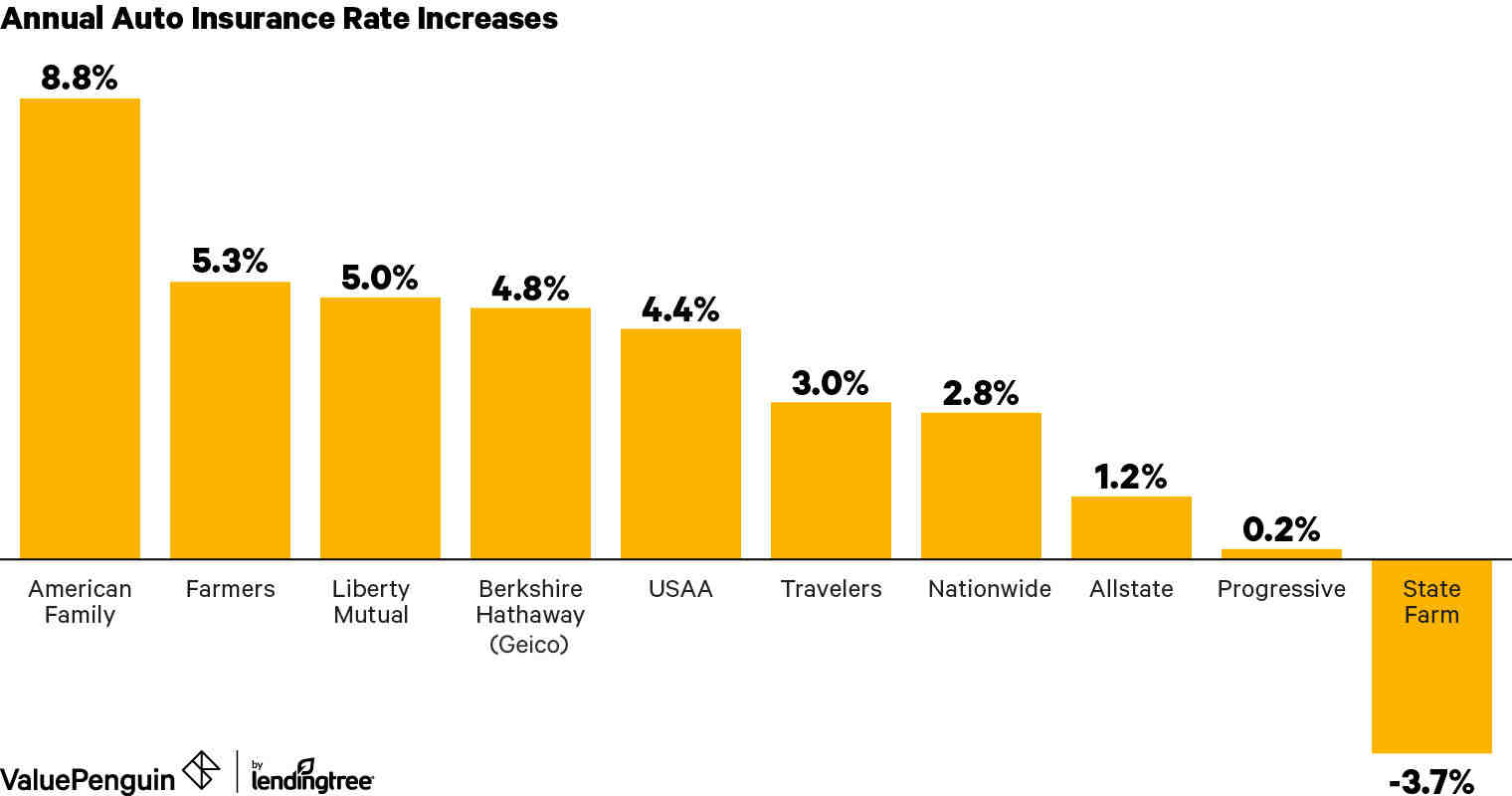

He told FOX 5 it’s always possible to buy a new car insurance plan, but to make sure you compare line by line to make sure you’re getting the best plan.

Below you will find other things you can do to reduce your insurance costs. To see also : Are men better drivers?.

- Shop around. …

- Before buying a car, compare insurance costs. …

- Ask for higher deductibles. …

- Reduce coverage on older cars. …

- Buy homeowners and auto coverage from the same insurance company. …

- Maintain a good credit record. …

- Take advantage of low mileage discounts.

In what way can you reduce the insurance premium? The best ways to lower your car insurance premiums are to compare rates among insurers, take advantage of all the discounts you can and adjust your coverage to fit your budget. For example, drivers can save 64% by switching from full cover to minimum cover.

What are 3 main factors when determining your car insurance rate?

The biggest factors that affect the prices of car insurance are government coverage requirements, age and the make and model of the car. The more coverage you have to buy in your state and the more valuable your vehicle, the more you pay for auto insurance.

What are 3 factors that determine your cost of insurance?

Some factors that can affect your car insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

Who is the top five insurance company?

The five largest homeowner insurance companies in the United States are State Farm, Allstate, USAA, Liberty Mutual and Farmers.

What is the number 1 insurance company in the world?

Which insurance company has the highest customer satisfaction?

USAA. USAA is the best insurance company in our rankings. According to our 2022 survey, USAA customers report the highest level of customer satisfaction and are most likely to renew their policies and recommend USAA to other drivers.

Which insurance companies have the most complaints? Geico customers were the most likely to complain about claims (53.6%), while Chubb customers were the least (38.6%). Nationwide had the most favorable complaint index for auto insurance, while Chubb did best for home insurance.

Does it matter which insurance company you use?

As a general rule, you should buy from a company that is licensed in your state, because then you can count on your state’s insurance department to help you if there is a problem. To find out which companies are licensed in your state, contact your state insurance department.

What should you not say to an insurance company? Avoid using phrases like “it was my fault”, “I’m sorry”, or “I’m sorry”. Don’t ask your insurance company, the other driver or the law enforcement for excuses. Even if you are just being polite and not intentionally admitting fault, these types of words and expressions will be used against you.

Is it better to stay with one insurance company?

The biggest benefit of switching car insurance providers is saving money on your premiums. Even if you found the cheapest rate when you first signed up for insurance, the company that gave you the lowest rate two years ago may not be the best option now.

Is it beneficial to stay with the same insurance company?

Loyalty discounts This discount varies from company to company. If you change insurance company, you will miss out on this discount on the premium on renewal. Staying with the same insurance company will thus give you good discounts over time.

Should I have all my insurance with one company?

You should have less trouble managing multiple policies when they come from the same company. Insurance security. If you’ve made a car insurance claim or been ticketed, having other policies with the same company can reduce the chances of your insurance company losing you.

Should you keep the same car insurance?

Most experts do not recommend having two policies for the same vehicle. You have to pay two separate premiums, which is very expensive, with no added benefit.

Yes. There are specialized consumer reporting agencies that collect information about the insurance claims you’ve made on property and casualty insurance policies, such as homeowners and auto policies.

Do insurance companies talk to each other?

Answer given by Although auto insurance companies don’t talk directly to each other, they do share information. All auto insurance companies can access your claim history through a database called the Comprehensive Loss Underwriting Exchange (CLUE).

Are insurance companies confidential?

Answer given by Fortunately, your information is kept safe by insurance companies unless you allow them to share it in some other way. Most of the personal information you provide on car insurance is confidential and laws are in place to protect your information.

Key Takeaway Insurers don’t share information, but they all have access to MVR and CLUE reports to help them determine how risky you are to insure.