Does progressive run a credit check for a quote?

Contents

Will checking my creditworthiness during the offer affect my credit rating? Not. The progressive query will only be visible to you and the credit reporting agency. To see also : Is my insurance void if I go over mileage?. Other companies reviewing your credit report will not see the query.

Do insurance companies give you your credit for the offer? It is true that insurance companies check your credit score when they make you an offer. However, what they do is called a ‘soft pull’ – a type of query that will not affect your credit score. You’ll be able to see these queries in your personal credit reports, but that’s it.

Does progressive do a hard pull for quote?

Which insurance companies do not use credit scores? All major car insurance companies – including GEICO, Progressive and State Farm – check creditworthiness during the bidding process.

Does insurance do a hard credit pull? See the article : Car insurance costs are now higher for many Michigan drivers than in 2019 – and less fair for Detroit drivers.

No, there is no “hard credit” when you get a car insurance offer, so the purchase will not affect your credit score. Difficult credit withdrawal generally occurs when you apply for a loan, such as a mortgage or credit card.

Does Progressive base rates on credit score?

Not. The credit score is based on your ability to repay the amounts you borrowed. The result of the insurance predicts the probability that you will become involved in a future accident or insurance claim – based on information collected from policyholders with similar credit characteristics who had previous claims with us.

Is an insurance quote a hard inquiry?

Although insurance companies check your creditworthiness during the bidding process, they use a type of query called soft withdrawal that does not appear to lenders. You can get as many inquiries as you want without negative consequences on your credit score.

Does auto insurance check your credit?

Car insurance companies use them to determine the probability of insurance claims in the future. To see also : Lemonade Car Insurance Review 2022 – Forbes Advisor. Most U.S. insurance companies use credit-based insurance results along with your driving history, indemnity history, and many other factors to determine eligibility for payment plans and help determine insurance rates.

Are car insurance quotes based on credit score?

A higher credit score reduces your car insurance rates, often significantly, with almost every company and in most states. However, getting an offer does not affect your creditworthiness. Your credit score is a key part of determining the rates you pay for car insurance.

Does State Farm use credit scores?

All major car insurance companies – including GEICO, Progressive and State Farm – check creditworthiness during the bidding process. In fact, credit is one of the main rating factors used by insurers in determining car insurance rates.

Does Allstate use credit scores?

Applying for car insurance will result in a mild inquiry about your credit report, which will not affect your credit score as a firm query when you apply for a loan. This query is usually asked in order to create a credit score for you. Insurers like Allstate use this rating to help determine your rates.

What car insurance does not go by credit score?

Dillo Insurance and Cure Auto Insurance are examples of non-standard insurance providers that do not check credit scores. In addition, state laws in California, Hawaii, Michigan and Massachusetts prohibit insurance companies from using credit scores as a way to determine insurance premiums.

How do insurers use credit scores?

Overview: Insurers use credit-based insurance results primarily in insurance and consumer assessment. Insurance is the process by which an insurer determines whether a consumer qualifies for coverage, and appraisal is the process of determining how much premiums a consumer will charge.

Can credit reports be used for insurance? That. Federal law, the Fair Credit Reporting Act (FCRA), states that insurance companies have a ‘permitted purpose’ to view your credit information without your permission. Insurance companies must also comply with state insurance laws when using credit data in the takeover and rating process.

How do insurance companies use credit scores?

Car insurance companies use them to determine the probability of insurance claims in the future. Most U.S. insurance companies use credit-based insurance results along with your driving history, indemnity history, and many other factors to determine eligibility for payment plans and help determine insurance rates.

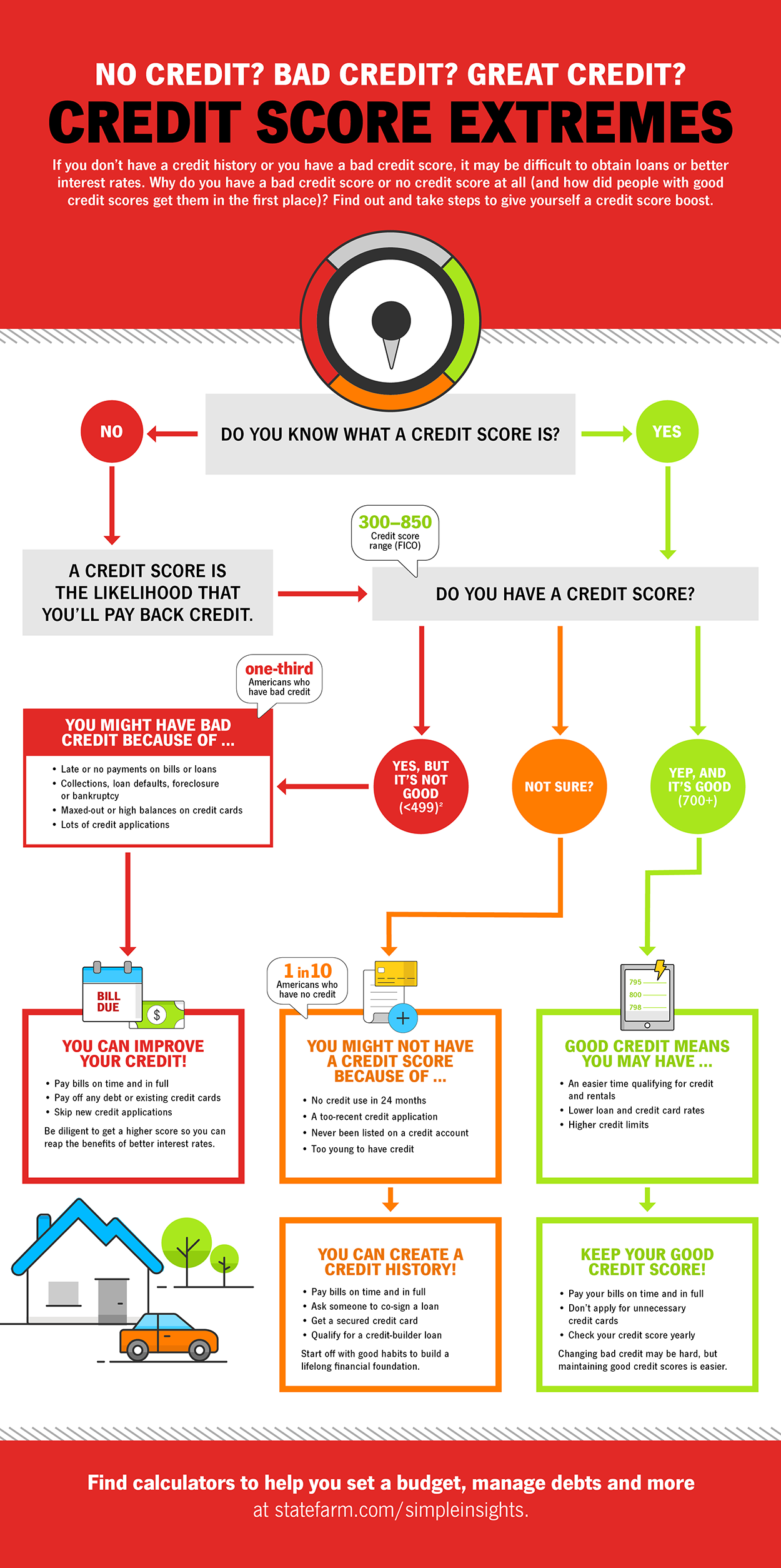

What credit score is used by insurance companies?

Similar to general credit scores, creditworthiness-based insurance scores are largely based on your credit report from one of the major credit bureaus – Experian, TransUnion or Equifax.

Do insurance companies use FICO scores?

The vast majority of insurers use credit rating as a factor, including all major companies. Your credit score, also called the FICO score, is calculated based on five factors, all of which relate to your borrowing history and current situation. Credit scores range from 300 to 850.

What kind of credit check do insurance companies use?

Similar to general credit scores, creditworthiness-based insurance scores are largely based on your credit report from one of the major credit bureaus – Experian, TransUnion or Equifax.

Does insurance company run a credit check?

Insurance companies check your credit score to assess the risk they will take to insure you. Studies have shown that those with lower credit ratings are more likely to file more claims or have more expensive insurance claims, while those with higher credit ratings are less likely to do so.

Is insurance credit check a hard or soft?

An insurer looking at your credit history or credit-based insurance results will result in a mild inquiry about your credit report. Both hard and soft queries will remain in your credit report for approximately two years.

Does car insurance go by credit score?

While your car insurance policy will never affect your credit score, it can be the opposite. According to the National Association of Insurance Commissioners, 95% of car insurance holders use what is called a credit score of insurance to calculate premiums in countries where such practices are allowed.

Do all car insurance companies check credit? All major car insurance companies – including GEICO, Progressive and State Farm – check creditworthiness during the bidding process. In fact, credit is one of the main rating factors used by insurers in determining car insurance rates.

Does credit score affect car insurance?

Your credit score is a key part of determining the rates you pay for car insurance. Better credit often gives you better rates, and worse credit makes your coverage more expensive. Bad loans could more than double insurance rates, according to a national analysis of the best insurers.

Do insurance companies use FICO scores?

The vast majority of insurers use credit rating as a factor, including all major companies. Your credit score, also called the FICO score, is calculated based on five factors, all of which relate to your borrowing history and current situation. Credit scores range from 300 to 850.

What is a good FICO score for car insurance?

So what is a good credit score for getting a car insurance policy at competitive rates? A score in the ‘good’ range – between 670 and 739, according to the FICO scoring model – is generally considered to be the basis for competitive pricing.

Do insurance companies do a hard or soft credit check?

Although insurance companies check your creditworthiness during the bidding process, they use a type of query called soft withdrawal that does not appear to lenders. You can get as many inquiries as you want without negative consequences on your credit score.

Are credit scores used for insurance?

California. Insurance companies in California do not use credit scores or your credit history to insure or evaluate a car park, nor to set rates for homeowners insurance. As a result, your credit will not affect your ability to get or renew a policy or how much you pay premiums.

What is a good credit score for insurance?

Insurance points range between a minimum of 200 and a maximum of 997. Insurance points of 770 or more are favorable and scores of 500 or less are poor. Although rare, there are a few people who have perfect insurance results. The results are not permanent and can be influenced by various factors.

What is a good driving score?

In short, if you have a rating of 88, yes, you could be considered a B driver – well above average. However, unlike high school, your Smart Driver score is not permanent.

What is a sure result? FICO® Safe Driving Rating Just as the FICO® Rating is a standard measure of consumer credit risk, the FICO Safe Driving Rating provides a measure of driver risk and safety based on driving behavior, which facilitates consistency and fairness.

What is a good driver score?

In short, if you have a rating of 88, yes, you could be considered a B driver – well above average. However, unlike high school, your Smart Driver score is not permanent. With regular feedback and tips to improve your score, you can increase your Smart Driver score over time.

What is a good drive safe and save score?

Drive Safe & Save can reduce up to a third of your premium, but you will have to drive very, very carefully to get that much discount. Unless you’re a very safe or casual driver, the more likely scenario is that you’ll save somewhere around 10% to 15% – and even then you’ll have to drive carefully.

What do the drive pulse scores mean?

What is the average driver score?

Drivers are, on average, slightly safer drivers than men, with an average safety rating of 78, compared to an average male rating of 77. Young drivers under the age of 21 have a similar safe driving rating as drivers over the age of 21.

What is the average driver score?

Drivers are, on average, slightly safer drivers than men, with an average safety rating of 78, compared to an average male rating of 77. Young drivers under the age of 21 have a similar safe driving rating as drivers over the age of 21.

What is a smart drive score?

Each time you complete a trip in your car, OnStar Smart Driver calculates the result for that trip. Your Smart Driver score is based on behaviors that researchers have found to be associated with an increased risk of collisions: Abrupt braking. Distance traveled. Time of day.

What’s the highest drive easy score?

You will be able to see your score and components directly in the DriveEasy Pro app once you start driving. The highest driver rating is 100.

What is a good drive safe and save score?

Drive Safe & Save can reduce up to a third of your premium, but you will have to drive very, very carefully to get that much discount. Unless you’re a very safe or casual driver, the more likely scenario is that you’ll save somewhere around 10% to 15% – and even then you’ll have to drive carefully.

What is a good drive safe and save score?

Drive Safe & Save can reduce up to a third of your premium, but you will have to drive very, very carefully to get that much discount. Unless you’re a very safe or casual driver, the more likely scenario is that you’ll save somewhere around 10% to 15% – and even then you’ll have to drive carefully.

What is drive safe?

DriveSafe.PH is a social learning platform that makes defense driving education available to future Filipino drivers, who would like to take the first step in road safety. Find a driving school.

How do I connect to drive safe?

How can I complete the setup?

- Make sure you have downloaded the Drive Safe & Save app (send SAVE to 78836 for the download link).

- Log in to the app using your driver’s license information or your statefarm.com® user ID and password.

- The Bluetooth beacon will arrive in the mail a few days after check-in.

What do the devices on Drive Safe and Save do?

Drive Safe and Save tracks how fast you brake and rewards you for slow braking, proving that you have kept a safe distance instead of braking fast to avoid a collision. Turning – Telematics can track fast, sharp turns, which is not safe driving behavior.