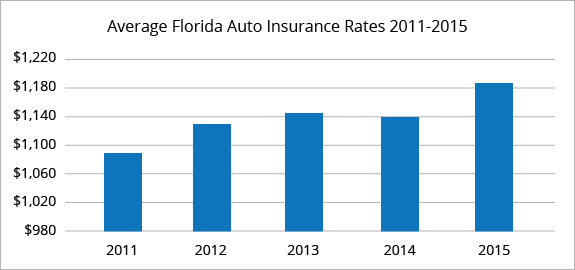

Florida car insurance among the most expensive in the United States

TAMPA, Florida (WFLA) – Property coverage is not the only type of coverage for which Florida has a cost concern. According to a study by Bankrate, the average vehicle insurance in Florida is nearly $ 1,000 higher than the national average.

“Florida has one of the highest average full-coverage annual car insurance rates in the country, reaching $ 991 more than the national average,” the study reads. Compared to other states, Florida also has one of the highest car accident fatalities in the United States. Data analyzed by WorldPopulationReview ranked Florida as the state with the third highest fatality rate in the country.

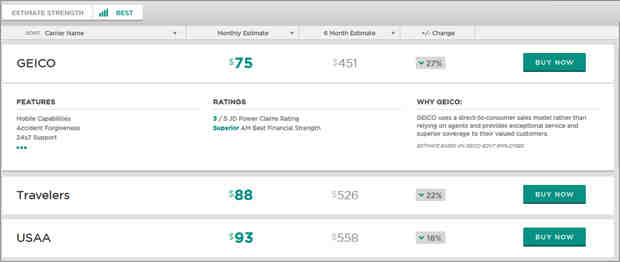

According to Bankrate, the national average for full coverage is $ 1,771. “New York, Louisiana and Florida are on average the three most expensive states in terms of car insurance,” the company said. Bankrate said Florida’s vehicle insurance rates are 56 percent higher than the national average.

Bankrate said the average cost of insurance in Florida was $ 2,364 per year for full coverage as of December 31, 2021. In 2022, it increased to $ 2,762 per year. For drivers, Tampa is even taller.

At an annual cost of $ 3,459 to fully cover, monthly premiums averaged $ 288. Bankrate said part of the cost problem is the number of uninsured drivers in the state.

The 2019 data showed that 20.4% of drivers in Florida were uninsured. For comparison, the national average in 2019, according to the Institute of Insurance Information, was 12.6%. According to their data collected by the Insurance Research Council, in 2018 every eight driver was uninsured.

In Lakeland, the average cost of insuring full insurance is reportedly $ 2,520.

The most expensive city in Florida for car insurance is Hialeah, which has an annual coverage of $ 3,777.

Florida is also a blameless state. This means, according to Bankrate, that no one is “found guilty” when an accident occurs. When an accident occurs, both drivers must file their own car insurance to cover any potential medical costs, no matter who may have caused the accident. This does not mean that the consequences of the accident are over.

“Blameless countries may still determine liability after an accident, and the party responsible may be liable for property damage and medical expenses that exceed a certain threshold, depending on the state,” according to Bankrate.

Florida also requires protection from motor vehicle injury. Bankrate says this means Florida drivers must have insurance “to cover medical expenses for you and your passengers and lost wages.” If you break something in an accident or are responsible for property damage, your insurance will likely have to pay for the repair as well. This is independent of the PIP coverage.

The high accident rate in Florida is not a new problem. In 2015-2021, there were over 700,000 hit and run failures. Just over 1,600 of them ended in a road accident, according to the Florida Department of Road Safety and Motor Vehicles. In 2021, 310 people were killed. The Florida Highway Patrol is still investigating 131 of them.

“Hit-and-flight accidents and deaths are on the rise in our state – wreaking havoc on Florida families and communities,” said Terry L. Rhodes, executive director of the FLHSMV. “Drivers who choose to flee after being involved in an accident that results in property damage, injury or death are not only breaking the law – they show a blatant disregard for the life and property of others. Please, stay where you are and call for help – it could save your life. “