Can I insurance a car that is not in my name?

Contents

- 1 Can I insurance a car that is not in my name?

- 2 Is gap insurance a monthly payment?

- 3 What does gap insurance mean?

- 4 What is positive gap?

Generally, you will be covered by their car insurance even if you are not listed as a regular driver of the vehicle. On the same subject : Does Geico have a good reputation?. This is called “permitted use:” the vehicle owner and the car insurance company allow you to drive the vehicle temporarily so that the insurance coverage covers you while you are using that vehicle.

How long does it take to get a carte grise in France? You will receive your final carte pigs by registered mail approximately one week after approval of your request. If you change anything meaningful about the car (fuel consumed, number of seats, etc.), the carte pigs need to be updated.

How much does it cost to re register a car in France?

| Department | Territory | Price per. tax horsepower (2022) |

|---|---|---|

| 58 â € “Nièvre | Burgundy-Franche-Comté | 51 € |

| 59 â € “Nord | Hauts-de-France | 33 € |

How long can I keep a UK registered car in France?

Vehicles from the United Kingdom can be temporarily imported into France for up to six months for a period of 12 months. On the same subject : Is Progressive a good company?. To stay on the right side of the law, the following documents should always be brought with you: Full, valid UK driving license.

How much does it cost to re register a UK car in France?

The certificate of conformity used to be free, but now there is generally a fee of around 130 euros.

How do I register my car after Brexit in France?

On arrival in France:

- Contact your local customs office to get your 846 A certificate.

- Book your car for inspection technology (if necessary)

- Apply for your Carte Grise.

- Once you have received your Carte Grise, ask for your French number plates.

What documents do I need for a carte grise?

Carte grise: registration certificate for the vehicle (original document) crossed out and signed by the seller. (with company stamp if the vehicle is sold by a company) Certificate issuance: Original transfer certificate signed by the seller (with company stamp if the vehicle is sold by a company)

How do I get a replacement carte grise?

Contact your local police station immediately to report the loss of your carte grise. To save time, you can download the declaration of loss of a carte grise online (Cerfa no. 13753 * 01). You can submit this form at your police station.

What documents do I need to register a car in France?

You must provide us with all of these documents plus the following:

- Proof of identity: usually the driving license, as you must have the right driving license to register a car.

- Proof of address: consumption bill, lease, property deedâ € ¦

- And finally proof of insurance.

How do I get a carte grise in France?

Once you have registered the change of ownership to your name, you will receive a Provisional Registration Certificate (CPI) which is valid for 30 days. You will receive your final carte pigs by registered mail approximately one week after approval of your request.

How do I get a certificate of conformity in France?

The correct place to obtain such a certificate is from the manufacturer’s base in France. Expect to pay €100 / €300, although prices vary. You may also find that your local prefecture is able to help, so check their website to see if they are able to do so.

Who can issue a Certificate of Conformity?

Means a document issued by a manufacturer certifying that a vehicle has been produced under the same production processes and systems as an example of the type that has obtained type approval.

How do I get an EU Certificate of Conformity?

The EU declaration of conformity shall be made available immediately upon request to the relevant market surveillance authority. The EU declaration of conformity must be translated into the language or languages required by the EU Member State in which the product is marketed.

Do I need a Certificate of Conformity for France?

One of the most important documents you will need is a certificate of conformity (certificat de conformité / attestation d’identification) that the car complies with technical standards in France. On older cars, obtain this certificate from the manufacturer.

Is gap insurance a monthly payment?

Our review of GAP coverage offered through car dealers and banks varies between $ 400 and $ 900 as a one-time fee, which is then added to the car loan. This is paid monthly during the loan and bears the borrowing rate. The loan period is often 60 months to 72 months.

How much is an intermediate payment? Here is an overview of your options: Buy through your regular car insurance company: When you buy gap insurance from your regular car insurance company, which provides your comprehensive and collision coverage, the gap insurance price is typically only $ 20 per year.

Is gap insurance paid upfront?

GAP insurance is often paid in advance, and the buyer is usually entitled to a refund of the unused portion of the premium if the vehicle is sold or refinanced before the end of the loan period. There are two ways to get GAP coverage.

How is gap insurance payout calculated?

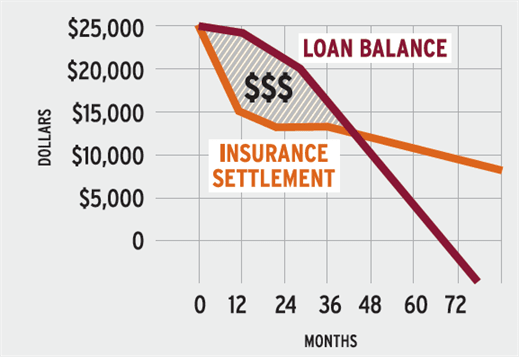

Gap insurance will pay the difference between the amount you still owe on a vehicle and the actual cash value (ACV) paid out by your car insurance company. Leasing / loan coverage typically has limits on how much it will pay out, such as 25% above the stipulated ACV for your vehicle. Both are minus your deductible.

Do you get your gap insurance money back?

Refunds. You will not get your full GAP coverage refunded to you once you have paid off on your car. When you prepay your GAP insurance premium, you are entitled to get the unused portion back if you pay your car ahead of time.

How much is progressive gap insurance monthly?

Yes, Progressive offers gap insurance for around $ 5 a month on average. If your car is pooled, Progressive’s gap insurance, also called loan / lease repayment coverage, covers the difference between your loan balance and what your car is worth, minus your deductible.

How is gap insurance calculated?

Even if you have financed your car, you only need hole coverage if the amount you owe is more than the value of the car. The best way to determine if you need gap coverage is to find the cash value of your car and deduct it from how much you owe.

Is it worth getting gap insurance on a car?

If there is any time when you owe more on your car than it is currently worth, gap insurance can certainly be worth the money. If you are selling less than 20% on a car, you would do well to get a gap insurance policy for at least the first few years you own it. Before then, you should owe less on the car than it is worth.

Does Gap Insurance Really Work?

So is GAP insurance worth it? If you owe a lot more on your car than it’s worth, it’s probably okay to keep GAP insurance until you’re no longer upside down. If you have GAP insurance, this means that you will be reimbursed for the difference between the value of your car and what you still owe.

How long should I keep gap insurance on my car?

You should continue the gap insurance coverage until your loan amount falls below the value of your car. You can also terminate the coverage when you sell or exchange a vehicle. You should wait to cancel until you have completed the sale or trade.

Is Gap insurance a waste of money?

What does gap insurance mean?

Gap insurance stands for Guaranteed Asset Protection insurance. It is an optional, additional cover that can help certain drivers cover the “gap” between the amount of money they owe on their car and the actual cash value (ACV) of their car, in the event of a covered incident where their car is declared total loss.

How does gap insurance repayment work? One-time payment: By paying off the repayment policy for the gap insurance in advance, you are entitled to a refund of the unused part. Monthly payments: If you pay your premiums monthly, you will not be able to get a refund for any previous months. However, you can get a small refund if you cancel early in the month.

What does gap insurance really cover?

Gap insurance is an optional car insurance cover that helps repay your car loan if your car is collected or stolen and you owe more than the depreciated value of the car.

Does gap insurance Really Work?

So is GAP insurance worth it? If you owe a lot more on your car than it’s worth, it’s probably okay to keep GAP insurance until you’re no longer upside down. If you have GAP insurance, this means that you will be reimbursed for the difference between the value of your car and what you still owe.

Is gap insurance a waste of money?

What does gap insurance exclude?

What Gap Insurance covers and does not cover. Gap insurance covers the negative equity on your car. This means the difference between your car loan balance and the actual cash value of your car. Like other types of insurance coverage, gap insurance has maximum benefit limits.

Is gap insurance really necessary?

If there is any time when you owe more on your car than it is currently worth, gap insurance can certainly be worth the money. If you are selling less than 20% on a car, you would do well to get a gap insurance policy for at least the first few years you own it. Before then, you should owe less on the car than it is worth.

Is getting gap insurance worth it?

Gap coverage is only worth it as long as you lease a car or if you owe more on a loan than your car is worth. You do not need gap insurance if you do not have a car loan or lease. You do not need a hole insurance forever. Drop gap insurance when your car loan is less than the value of your vehicle.

Is gap insurance a waste of money?

Is gap insurance a waste of money?

Is getting gap insurance worth it?

Gap coverage is only worth it as long as you lease a car or if you owe more on a loan than your car is worth. You do not need gap insurance if you do not have a car loan or lease. You do not need a hole insurance forever. Drop gap insurance when your car loan is less than the value of your vehicle.

Do you get money back from gap insurance?

You can usually get a repayment of a cover insurance if you pay off your loan early or swap your vehicle. Your repayment depends on the value of the car, the loan amount, the car’s mileage and your repayment period on the loan. Gap insurance reimbursements are usually issued within several weeks.

What is positive gap?

A positive gap, or larger than one, is the opposite, where a bank’s interest rate sensitive assets exceed its interest rate sensitive liabilities. A positive gap means that when rates rise, a bank’s profits or revenues are likely to rise. There are two types of interest rate gaps: fixed and variable.