When did Buffett buy GEICO?

Contents

- 1 When did Buffett buy GEICO?

- 2 Is Geico owned by Berkshire Hathaway?

- 3 Is GEICO a stock or mutual company?

- 4 How much did Warren Buffett invest in Verizon?

1996 – Warren Buffett buys excellent GEICO stock, making GEICO a subsidiary of Berkshire Hathaway, Inc. Read also : When did Berkshire Hathaway buy GEICO?.

Who owns Geico insurance company?

Why did Warren Buffett buy Geico?

In his article, The Security I Like Best, Buffett outlined three reasons why Geico was so attractive: valuation, growth and profit margins. Read also : What is the difference between GEICO advantage and GEICO choice?. In the article, Buffett noted that the stock was trading only eight times forward earnings at the time, based on 1950 earnings, an unfortunate year for the industry.

How much did Buffett buy GEICO for?

Believing in Byrne’s ability and GEICO ‘s key competitive advantages remained intact, Buffett rose on the price of GEICO’s tormented share, buying $ 4.1 million in GEICO shares and another $ 19.4 million in convertible preference stock.

Why did GEICO stop using the gecko?

9 Kelsey Grammer Original Voice Actress GEICO Gecko With basic computer animation and originally portrayed by Kelsey Grammer, GEICO Gecko made its television screen debut on August 29, 1999, during a Screen Actors Guild strike that prevented live use. actors.

Does Warren Buffett Own GEICO insurance?

Geico is owned by Berkshire Hathaway, Inc., and led by renowned investor Warren Buffet. Shares of Geico stock have been held by Warren Buffett since 1951, and Geico became a wholly owned subsidiary of Berkshire Hathaway in 1996.

How much did Warren Buffett pay for Geico?

Believing in Byrne’s ability and GEICO ‘s key competitive advantages remained intact, Buffett rose on the price of GEICO’s tormented share, buying $ 4.1 million in GEICO shares and another $ 19. To see also : Is GEICO owned by Progressive?.4 million in convertible preference stock.

Does Warren Buffett Own Geico insurance?

Geico is owned by Berkshire Hathaway, Inc., and led by renowned investor Warren Buffet. Shares of Geico stock have been held by Warren Buffett since 1951, and Geico became a wholly owned subsidiary of Berkshire Hathaway in 1996.

How much money is Geico worth?

A subsidiary of Berkshire Hathaway, Inc., GEICO has assets of more than $ 32 billion.

How much did Warren Buffett invest in Geico?

From Aunt Alice to $ 35 billion He also wrote a short column about the company for the major financial publication of the day (original here; opens as PDF) and began buying Geico shares for himself – $ 10,282 in total – before it was sold. the whole thing for about 50 percent profit next year.

Is Geico owned by Warren Buffett?

Geico is owned by Berkshire Hathaway, Inc., and led by renowned investor Warren Buffet. Shares of Geico stock have been held by Warren Buffett since 1951, and Geico became a wholly owned subsidiary of Berkshire Hathaway in 1996.

When did Warren Buffet purchase GEICO?

1996 – Warren Buffett buys excellent GEICO stock, making it a subsidiary of Berkshire Hathaway, Inc. GEICO is 1999 – The famous GEICO Gecko® launches GEICO’s popular advertising campaign.

What insurance company does Warren Buffett Own?

Buffett is often referred to as the “Oracle of Omaha” to demonstrate his investment potential. However, within Berkshire Hathaway, there are three insurance entities: GEICO (Government Employee Insurance Company), General Re, and Berkshire Hathaway Re.

How much of GEICO does Warren Buffett Own?

How Much GEICO Stock does Berkshire Have? Berkshire Hathaway owns 100 percent of GEICO, and as a result has enjoyed massive looting. The initial share of $ 45.7 million was short at 50 percent of the company, and in 1995 it added $ 2.3 billion to the other half, worth $ 4.7 billion to the company.

Is Geico owned by Berkshire Hathaway?

GEICO is an indirect, wholly owned subsidiary of Berkshire Hathaway, Inc.

Who are the insurance companies at Berkshire Hathaway? However, within Berkshire Hathaway, there are three insurance entities: GEICO (Government Employee Insurance Company), General Re, and Berkshire Hathaway Re. The last two are reinsurers.

Did Berkshire Hathaway buy GEICO?

1996 – Warren Buffett buys outstanding GEICO stock, making GEICO a subsidiary of Berkshire Hathaway, Inc.

How much of Geico does Berkshire Hathaway own?

Berkshire Hathaway owns 100 percent of GEICO, and as a result has enjoyed massive looting. The initial share of $ 45.7 million was short at 50 percent of the company, and in 1995 it added $ 2.3 billion to the other half, worth $ 4.7 billion to the company. That gave Buffett a 5,136 percent gain on investing in GEICO.

How much of GEICO does Berkshire Hathaway own?

Berkshire Hathaway owns 100 percent of GEICO, and as a result has enjoyed massive looting. The initial share of $ 45.7 million was short at 50 percent of the company, and in 1995 it added $ 2.3 billion to the other half, worth $ 4.7 billion to the company. That gave Buffett a 5,136 percent gain on investing in GEICO.

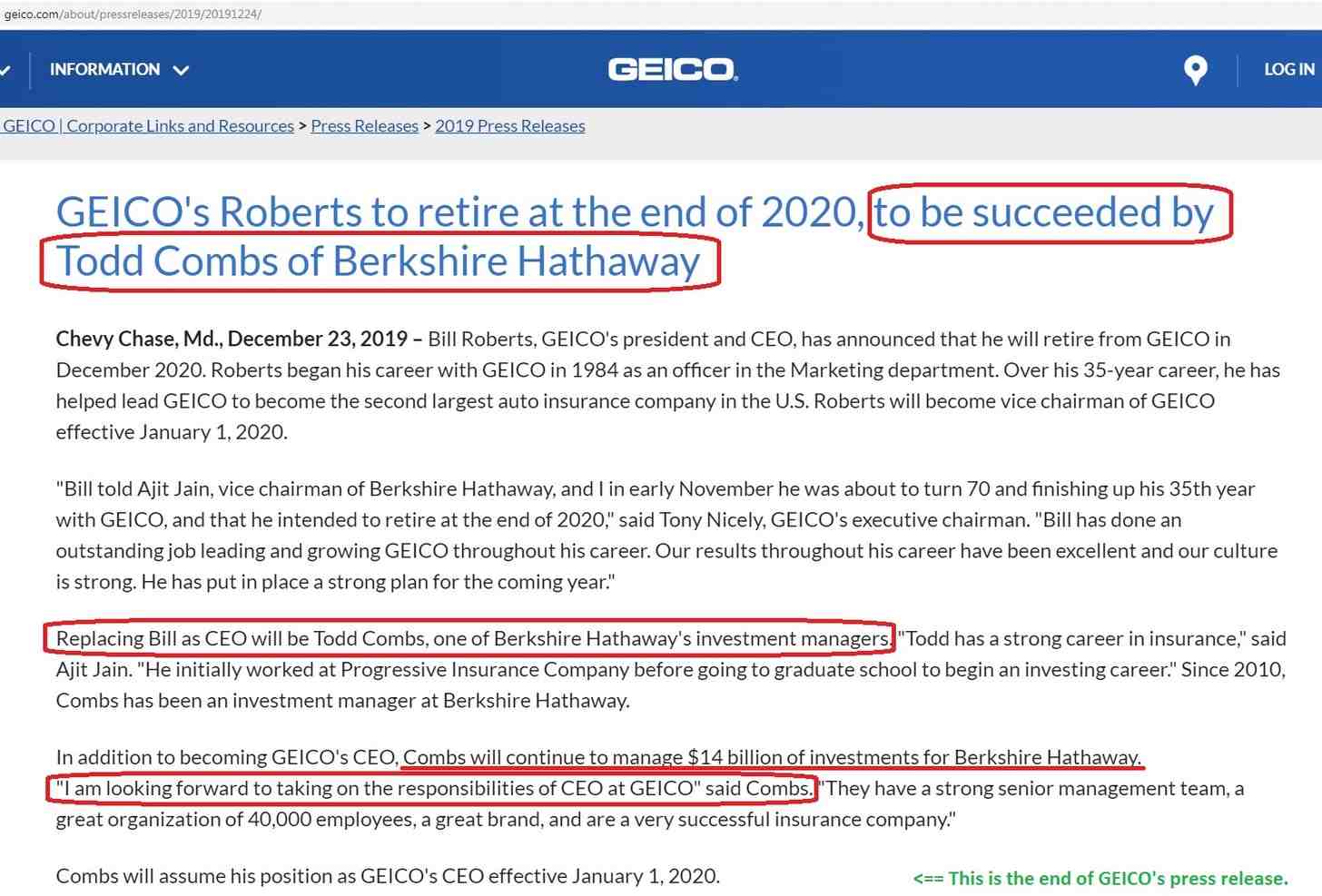

Who owns GEICO insurance 2020?

GEICO is a wholly owned subsidiary of Berkshire Hathaway that provides coverage to more than 24 million motor vehicles owned by more than 15 million policyholders since 2017. GEICO writes private passenger car insurance in all 50 U.S. states and the District of Columbia.

Who owns the majority of GEICO?

Shares of Geico stock have been held by Warren Buffett since 1951, and Geico became a wholly owned subsidiary of Berkshire Hathaway in 1996. Geico is the second largest car insurer in the US providing coverage for more than 28 million vehicles and over 17 million car policyholder. .

How much did Berkshire Hathaway buy GEICO?

Berkshire to Buy $ 2.3 Billion Geico Rest: Insurance: The $ 70-a-share sale is seen in part as a way for Warren Buffett, 64, to find a successor. Berkshire Hathaway Inc., the company controlled by billionaire investor Warren Buffett, said Friday it will buy the shares of insurer Geico Corp.

Is GEICO a stock or mutual company?

Government Employee Insurance Company (GEICO / ˈɡaɪkoʊ /) is an American private car insurance company headquartered in Chevy Chase, Maryland. It is the second largest car insurer in the United States, after State Farm.

Is GEICO stock or mutual?

Is GEICO a publicly traded company?

Geico, the insurance company, is not directly traded publicly, so you cannot buy Geico stock directly through your broker. But its parent company, called Berkshire Hathway, is publicly traded. There are two classes of stock that you can buy through a brokerage of your choice.

How much did Warren Buffett buy GEICO for?

Invest Smarter with The Motley Fool With faith in Byrne’s ability and the remaining competitive advantages of GEICO intact, Buffett raised the price of the distressed GEICO share, buying $ 4.1 million in GEICO shares and another $ 19.4 million in convertible preference stock.

Can I buy GEICO stock?

Can You Buy Shares in GEICO? You cannot buy shares directly in GEICO. It is a wholly owned subsidiary of Berkshire Hathaway. The only way to join GEICO is to get a policy and invest in Berkshire Hathaway stock.

Does Warren Buffett Own GEICO insurance?

Geico is owned by Berkshire Hathaway, Inc., and led by renowned investor Warren Buffet. Shares of Geico stock have been held by Warren Buffett since 1951, and Geico became a wholly owned subsidiary of Berkshire Hathaway in 1996.

Is GEICO owned by Liberty Mutual?

Liberty Mutual coverage options look similar to Geico’s because Geico does not have its own insurance policies, ”instead, Geico uses an underwriting company to provide insurance to its customers, and Liberty Mutual is one of Geico’s home insurance underwriters.

Is GEICO owned by Allstate?

No, Geico is not owned by Allstate. Geico is a wholly owned subsidiary of Berkshire Hathaway, a publicly traded company owned by its shareholders, and Allstate is a separate publicly traded company.

What companies does Liberty Mutual own?

Subsidiaries

- American Fire & Casualty.

- America’s First Insurance.

- Colorado Casualty.

- Consolidated Insurance Company.

- Golden Eagle Insurance.

- Indiana Insurance.

- Freedom of Respect.

- Liberty Surety first.

Who is Liberty Mutual affiliated with?

Liberty Mutual Group Inc. is a subsidiary of Liberty Mutual Holding Company Inc., a Massachusetts mutual holding company.

How much did Warren Buffett invest in Verizon?

Legendary investor Warren Buffett, who is one of Apple ‘s largest shareholders, made a multi – billion dollar bet on Verizon in the fourth quarter. According to a filing published Tuesday, Buffett’s Berkshire Hathaway bought nearly 147 million shares of Verizon (worth $ 8 billion at current prices).

Did Warren Buffett invest in Verizon? Wall Street legend and Berkshire Hathaway CEO Warren Buffett bought a new stake in British insurance company Aeon and added to bets in supermarket chain Kroger and telecom giant Verizon Communications in the first quarter, according to a 13F Berkshire filing last week.

What stock did Warren Buffet Buy 1 billion?

He pointed out that the Buffett company had bought $ 1 billion in shares of Nubank, a Brazilian – based digital bank, and the largest such bank in Latin America.

What Stocks Did Warren Buffett buy recently?

Warren Buffett’s 10 stocks bought and sold:

- Sold: AbbVie Inc. (ABBV)

- Sold: Bristol-Myers Squibb Co. (BMY)

- Merchants: Chevron Corp. (CVX)

- Purchased: Nu Holdings Ltd. (NU)

- Purchased: Activision Blizzard Inc. (ATVI)

- Sold: Teva Pharmaceutical Industries Ltd. (TEVA)

- Sold: Marsh & McLennan Cos. Inc. …

- Sold: Sirius XM Holdings Inc.

What did Warren Buffett invest in to get rich?

In 1962, Buffett became a millionaire because of his partnerships, which in January 1962, had a surplus of $ 7,178,500, and Buffett owed over $ 1,025,000. He combined these partnerships into one. Buffett invested in a textile manufacturing firm, Berkshire Hathaway, and eventually took control.

What crypto did Warren Buffett invest in?

The decision to support Nubank is a major milestone for Berkshire Hathaway’s investment strategy. It’s an indicator that Warren Buffett’s firm is starting to move away from credit firms and focus more on fintech firms.

Why did Buffett invest in Verizon?

The first is “money is king.” Buffett loves to invest in companies with strong earnings. Secondly, he is an investor looking for value. Verizon seems to tick both of these boxes and can also be considered an essential service provider, making it ideal for both value and dividend investors.

Does Warren Buffett Like Verizon?

Buffett’s decision to buy Verizon was a surprise. He has criticized heavy asset companies in the past because they consume a huge amount of capital and tend to get low returns on this capital.

At what price did Warren Buffett buy Verizon?

Buying Verizon Stock at a Discount at Warren Buffett’s Price Based on Berkshire’s 13F filing, we can see that Warren Buffett bought in at about $ 59.24 per share. At the time of writing, Verizon last traded at $ 54.23. That means investors can buy it at a discount of more than 8% on Buffett’s purchase price.

At what price did Warren Buffett buy Verizon?

Buying Verizon Stock at a Discount at Warren Buffett’s Price Based on Berkshire’s 13F filing, we can see that Warren Buffett bought in at about $ 59.24 per share. At the time of writing, Verizon last traded at $ 54.23. That means investors can buy it at a discount of more than 8% on Buffett’s purchase price.

What price did Warren Buffett buy Verizon?

Warren Buffett Verizon Communications Inc. Verizon Communications first traded in Q1 2014. Since then Warren Buffett has bought shares three more times and sold shares twice. The estimated purchase price of the investor is $ 9.24 billion, resulting in a loss of 9.59%.

At what price Buffett bought Apple?

Berkshire Hathaway’s 5 per cent stake in Apple, bought at $ 36 billion in 2016, is now worth $ 160 billion, following the stock’s high, CNBC reported. In addition, the average annual dividend from Apple is around $ 775 million, he said.