How do I buy insurance?

Do insurance companies use credit scores?

Contents

- 1 Do insurance companies use credit scores?

- 2 How do you understand insurance?

- 3 Can you cash out a life insurance policy before death?

- 4 Do all auto insurance companies check credit?

Most U.S. insurance companies use credit-based insurance scores along with your driving history, claims history, and many other factors to establish eligibility for payment plans and help determine insurance rates. Read also : What is Temporary Car Insurance and Do I Need It? | The Ascension. ‘assurance.

Do insurance companies use FICO scores? The vast majority of insurers use credit score as a factor, including all major companies. Your credit score, also known as a FICO score, is calculated based on five factors, all related to borrowing history and current status. Credit scores range from 300 to 850.

What kind of credit check do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit bureaus – Experian, TransUnion or Equifax. Read also : Car insurance costs determined on the basis of an assessment News pressrepublican.com.

How do insurers use credit scores?

Overview: Insurers use credit-based insurance scores primarily for consumer underwriting and evaluation. Underwriting is the process by which the insurer determines whether a consumer is eligible for coverage and pricing is the process by which the amount of premium to be charged to a consumer is determined.

Does insurance company run a credit check?

Insurance companies check your credit score to assess the risk they will take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

Is insurance credit check a hard or soft?

An insurer reviewing your credit history or credit-based insurance ratings will cause an informal inquiry into your credit report. Hard and soft inquiries will stay on your credit report for about two years.

Do insurance companies check your credit?

Insurance companies check your credit score to assess the risk they will take to insure you. To see also : 7 Types of Car Insurance and Coverage. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

Do all car insurance companies check credit?

All major auto insurance companies — including GEICO, Progressive, and State Farm — perform a credit check during the quote process. In fact, credit is one of the primary pricing factors used by underwriters when determining auto insurance rates.

How do insurers use credit scores?

Overview: Insurers use credit-based insurance scores primarily for consumer underwriting and evaluation. Underwriting is the process by which the insurer determines whether a consumer is eligible for coverage and pricing is the process by which the amount of premium to be charged to a consumer is determined.

How do insurance companies use credit scores?

Car insurance companies use them to help determine the likelihood of an insurance claim in the future. Most U.S. insurance companies use credit-based insurance scores along with your driving history, claims history, and many other factors to establish eligibility for payment plans and help determine insurance rates. ‘assurance.

Can credit reports be used for insurance?

Yes. A federal law, the Fair Credit Reporting Act (FCRA), states that insurance companies have a “permitted purpose” to view your credit information without your permission. Insurance companies must also comply with national insurance laws when using credit information in the underwriting and rating process.

Can insurers see your credit score?

It’s true that insurance companies check your credit score when they submit a quote to you. However, what they do is called a “soft pull” – a type of inquiry that won’t affect your credit score. You will be able to see these requests on your personal credit reports, but that’s it.

How do you understand insurance?

Insurance is a way to manage your risk. When you buy insurance, you are buying protection against unexpected financial loss. The insurance company pays you or someone you choose if something bad happens to you. If you do not have insurance and an accident occurs, you may be responsible for all related costs.

Can you cash out a life insurance policy before death?

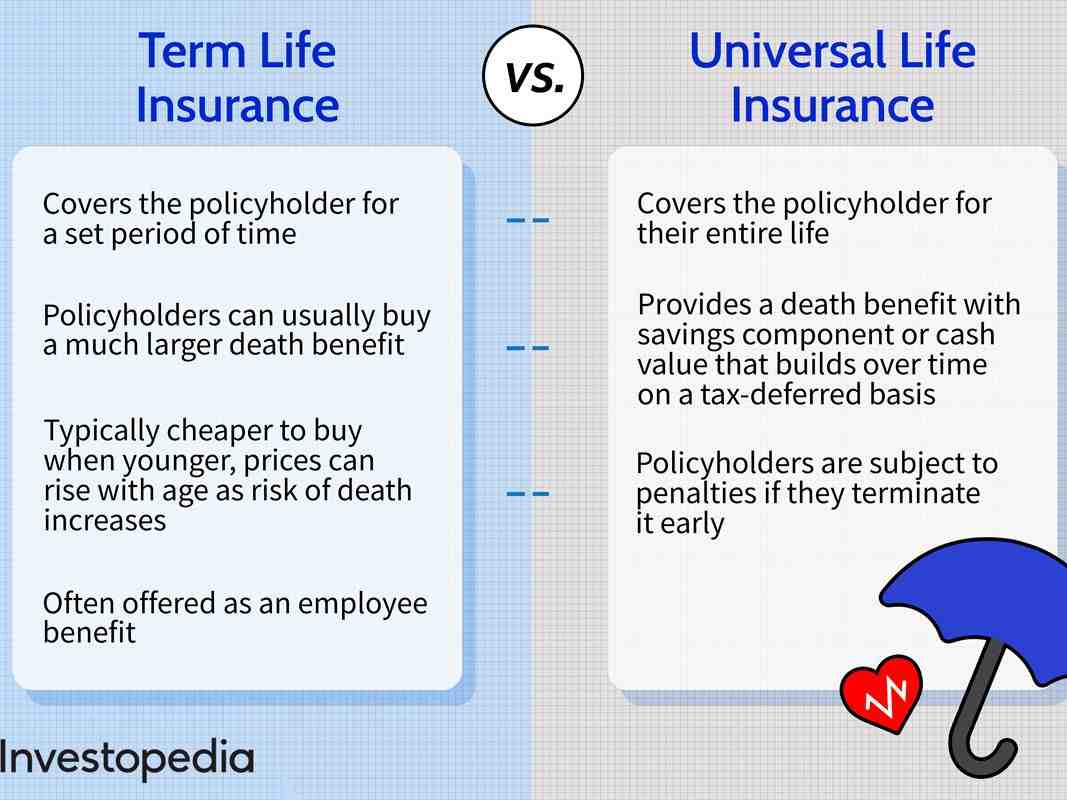

Can a life insurance policy be cashed in before death? If you have a permanent life insurance policy, then yes, you can withdraw money before you die. There are three main ways to do this. First, you can take out a loan on your policy (repayment is optional).

Is there a penalty for cashing in life insurance? If your policy has been classified as MEC, withdrawals are generally taxed according to the rules applicable to annuities – cash disbursements are considered to be made first from interest and are subject to income tax and possibly tax. a 10% early withdrawal penalty if you are under age 59.5 at the time of withdrawal.

Can you cash in a life insurance policy at any time?

Can you cash in a life insurance policy? You can cash in a life insurance policy during your lifetime as long as you have a permanent policy that accumulates cash value or a convertible term policy that can be converted into a policy that accumulates cash value.

How much will I receive if I surrender my life insurance policy?

If you close after 2/3 years, you will be guaranteed 30% of the premiums paid. If you close between 4 and 7 years, you will receive 50% of the premiums paid. If you redeem within the last two policy years, you can get up to 90% of the premiums.

Do I get money back if I cancel my life insurance?

Do you get your money back if you cancel your life insurance? The answer to this question is usually no. Protection insurance is a simple product that protects you financially against death and illness while you pay premiums. If you don’t pay your insurance premiums, you are not protected.

When should you cash out a whole life insurance policy?

Most advisers say policyholders should give their policy at least 10 to 15 years to develop before tapping into cash value for retirement income. Talk to your life insurance agent or financial advisor to see if this tactic is right for you.

What happens if I cash out my whole life insurance?

Your cash value is a savings account funded by a portion of your premiums. When you cash in a whole life policy, you don’t get your full premiums back; you will receive the full cash value of the policy.

When should I get rid of whole life insurance?

“If you’ve contributed to a policy for 20 or 30 years, the best return you’ll get is the death benefit,” says Huntley. He suggests asking beneficiaries before you dispose of a policy to see if they want to pay the premiums, as they will ultimately receive the life insurance payout.

What happens when a whole life policy is paid up?

Paid-up life insurance is a fully paid-up life insurance policy that remains in effect and for which you no longer have to pay premiums. It remains in force until the death of the insured or if you cancel the policy. Paid-up life insurance is only an option for certain whole life policies.

Do all auto insurance companies check credit?

All major auto insurance companies — including GEICO, Progressive, and State Farm — perform a credit check during the quote process. In fact, credit is one of the primary pricing factors used by underwriters when determining auto insurance rates.

What car insurance does not go through credit score? Dillo Insurance and Cure Auto Insurance are examples of non-standard insurance providers that do not check credit scores. Additionally, state laws in California, Hawaii, Michigan, and Massachusetts prohibit insurance companies from using credit scores to determine insurance premiums.

Does a insurance company run a credit check?

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called an information request that does not show up to lenders.

What kind of credit check do insurance companies use?

Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit bureaus – Experian, TransUnion or Equifax.

Do all car insurance companies check credit?

All major auto insurance companies — including GEICO, Progressive, and State Farm — perform a credit check during the quote process. In fact, credit is one of the primary pricing factors used by underwriters when determining auto insurance rates.

Does insurance do a hard credit pull?

No, there is no “hard credit pull” when you get a car insurance quote, so shopping around won’t impact your credit score. A firm credit application usually occurs when you apply for credit, such as a mortgage or a credit card.

Do auto insurance companies check your credit?

Insurance companies check your credit score to assess the risk they will take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

What role does the Insurance Bureau of Canada IBC have in the insurance industry?

BAC and its members are here to help protect businesses against risk and find solutions to ensure commercial insurance remains affordable.

Does getting an insurance quote do anything?

However, what they do is called a “soft pull” – a type of inquiry that won’t affect your credit score. You may see these requests on your personal credit reports, but that’s it. These requests are not visible to lenders and have no effect on your credit score.