How much does car insurance cost?

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our lender partners, who we will always identify, all opinions are our own. By refinancing your mortgage, the total financial costs may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, referred to here as “Credible”.

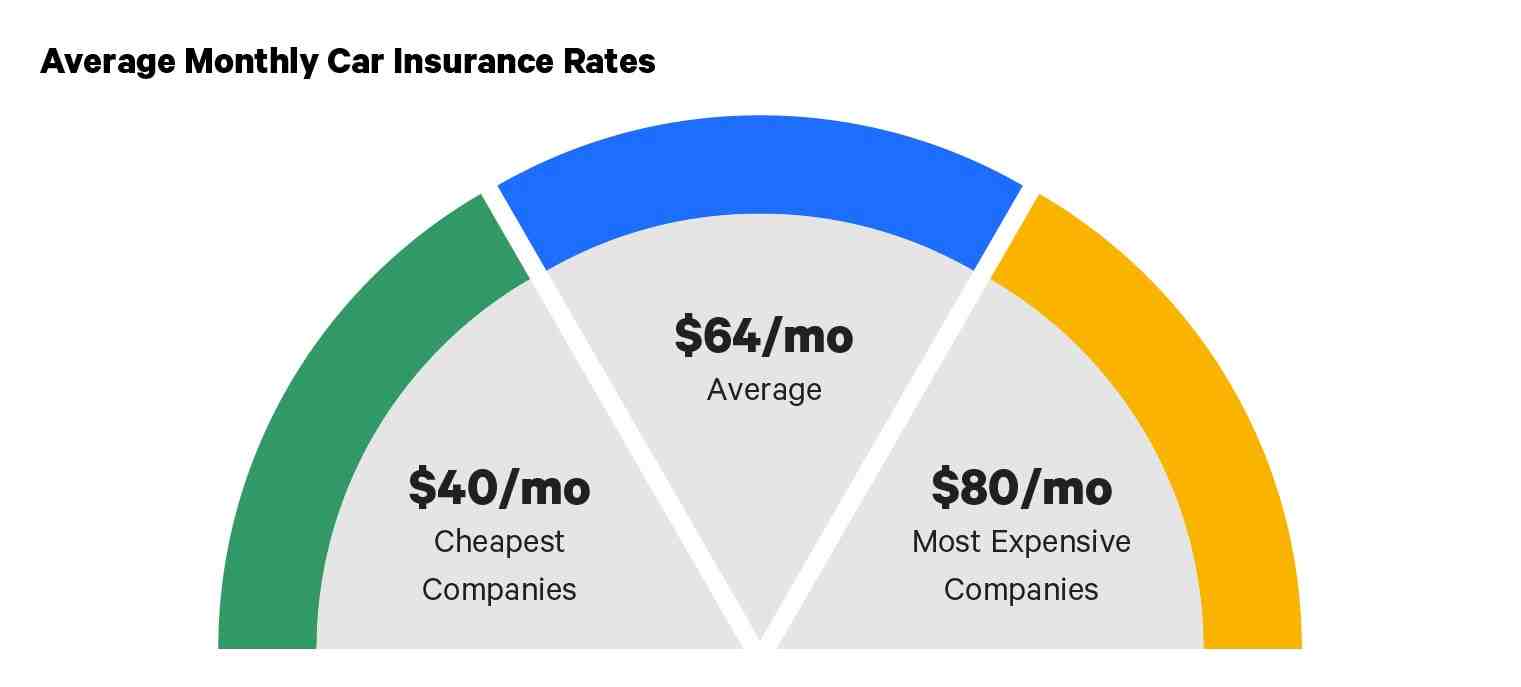

The amount you pay for car insurance depends on your driving history, car type and location, among other factors. In 2019, the national average auto insurance premium was $1,070 per year, according to the National Association of Insurance Commissioners.

Let’s dive deeper into the average cost of auto insurance by state, as well as the factors that affect how much you’ll pay.

Here’s what you need to know about average car insurance costs:

How much is car insurance?

Contents

- 1 How much is car insurance?

- 2 Factors that affect car insurance costs

- 3 Average car insurance cost by state

- 4 How to save on car insurance

- 5 How to purchase car insurance

- 6 Why is it important to have car insurance?

- 7 How much is insurance for a mo?

- 8 What happens if the person at fault in an accident has no insurance in Missouri?

- 9 How long do you have to insure a new car in Missouri?

The amount you will pay for your car insurance premium depends on many factors. You can pay more or less than the national average of $1,070. On the same subject : Is Progressive or Geico cheaper?. Auto insurance providers set your rate based on how likely they are to pay claims, along with things like your age, gender and driving history.

Compare car insurance from top carriers

Factors that affect car insurance costs

All auto insurance carriers have their own unique pricing method. To see also : Sedan vs. Coupe: Which is the cheapest car to insure?. However, some common factors that insurers use when determining your car insurance premium include:

Check it out: Can you get car insurance with a learner’s permit?

Average car insurance cost by state

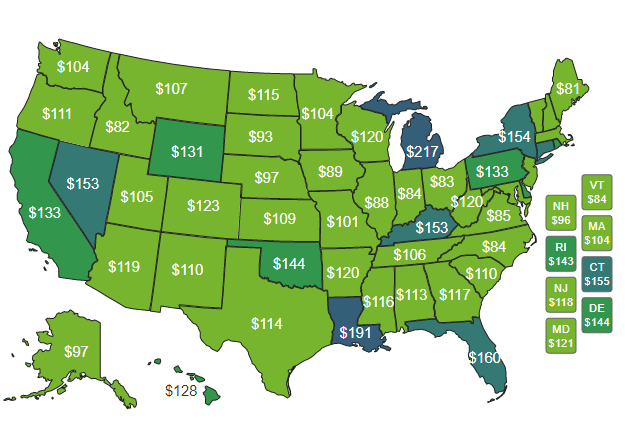

Car insurance costs can vary greatly by state. Read also : When can northern Michigan drivers expect a $400 auto insurance refund?. To help you get a better idea of how much different types of car insurance policies might cost in your state, the table below shows the average premium costs for full coverage (liability, collision and comprehensive) and liability coverage in all 50 states, as of 2019

Annual premiums are based on the latest data from the National Association of Insurance Commissioners. We’ve also noted the current minimum coverage levels by state so you can be aware of how much coverage you need to get. Minimum coverage levels by state are based on data from the Insurance Information Institute and Progressive.

How to save on car insurance

Car insurance is a big expense for drivers. Here are some steps you can take to save money on your policy:

When you’re ready to compare auto insurance quotes, we can help. Credible makes it easy to get quotes from multiple insurance companies.

Compare car insurance from the best providers

How to purchase car insurance

Learning about the average cost of car insurance is a great first step towards finding the right policy for your needs. When you’re ready to buy car insurance, you’ll generally follow these steps:

Disclaimer: All insurance related services are offered through Young Alfred.

Jacqueline DeMarco has been writing about personal finance for over seven years and is a contributor to Credible magazine. She has contributed content to more than a dozen financial brands, including LendingTree, Credit Karma, Fundera, Chime, MagnifyMoney, Student Loan Hero, ValuePenguin, SoFi and Northwestern Mutual.

At what age is car insurance the cheapest? Car insurance is significantly cheaper for older drivers. Drivers in their 60s tend to have the cheapest car insurance premiums, with a slight increase in premiums for drivers 70 and older.

Why is it important to have car insurance?

Auto insurance helps protect your passengers. Medical insurance and personal injury protection can help you pay medical bills if you are injured in an accident. It can also help cover your passengers’ accident expenses.

Is it important to have car insurance? The primary reason you need car insurance is your liability, i.e. liability for any damage you cause. Although you can carry optional comprehensive coverage and collision insurance for your vehicle, the coverages required by law in most states are bodily injury and property damage insurance.

What are the pros and cons of having insurance?

Business owners must look at the potential risks to determine if the benefits outweigh the drawbacks.

- Advantage: Covers business assets. …

- Disadvantage: Refuses requests or pays slowly. …

- Benefit: Protects against liability. …

- Disadvantage: increases costs. …

- Benefit: Replaces income.

What are the pros of insurance?

Insurance covers individual loss, but social loss cannot be eliminated. If a person’s property is damaged in a fire, they will provide compensation. The loss of goods will remain as a social loss. Insurance cannot eliminate loss, but it can reduce the risk for an individual.

What are advantages and disadvantages of life insurance?

The #1 benefit of life insurance is financial protection for your loved ones if you die. The biggest disadvantage of life insurance is the price, which is more affordable than you think.

How much is insurance for a mo?

The average cost of a fully insured policy in Missouri is $1,859 per year, but State Farm offers a rate that is nearly 40% lower at $1,130 per year or $94 per month. American Family – whose rates are $1,583 per year – also offers below the national average.

How much does a car cost per month? According to data from Kelley Blue Book and LendingTree, in 2021 the average car costs $42,258 with an average payment of $563 per month. However, in addition to the sticker price and payments, there are gas, insurance, oil changes and other costs that car owners must consider.

How much is car insurance per month Missouri?

On average, auto insurance with minimum coverage costs $54 per month or $648 per year in Missouri. Prices for full coverage average $155 per month or $1,859 per year.

Is auto insurance expensive in Missouri?

The average cost of car insurance in Missouri is $1,334 per year – 6.5% less than the national average. Your car insurance premiums are affected by factors beyond the state line. Auto insurance premiums take into account a number of factors, including your marital status, driving history, credit rating, gender and age.

How much is a monthly payment for car insurance?

According to NerdWallet’s 2022 rate analysis, the national average for car insurance costs is $1,630 per year. This means that the average car insurance rate is about $136 per month.

What is Missouri state minimum auto insurance?

The minimum level of coverage required by state law is: $25,000 per person for bodily injury. $50,000 per accident for bodily injury. $25,000 per property accident.

How much does insurance cost for a mo?

The average cost of car insurance in Missouri is $1,334 per year – 6.5% less than the national average. Your car insurance premiums are affected by factors beyond the state line. Auto insurance premiums take into account a number of factors, including your marital status, driving history, credit rating, gender and age.

How much is a ticket for no insurance in Missouri?

$300 fine, 15 days in jail and 4 points on your driving record for a Missouri “No Insurance†ticket. It is illegal to drive an uninsured vehicle in Missouri, and a judge can fine you up to $300, put you in jail for 15 days, suspend your driver’s license, or issue a probation order against you for each violation.

What is the cost of getting an insurance policy?

In 2020, the national average cost of health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among a wide variety of health plans. Understanding the relationship between health insurance and costs can help you choose the right health insurance for you.

What is the minimum type of insurance you must carry in the state of Missouri?

The minimum level of coverage required by state law is: $25,000 per person for bodily injury. $50,000 per accident for bodily injury. $25,000 per property accident.

How much is a ticket for no insurance in Missouri?

$300 fine, 15 days in jail and 4 points on your driving record for a Missouri “No Insurance†ticket. It is illegal to drive an uninsured vehicle in Missouri, and a judge can fine you up to $300, put you in jail for 15 days, suspend your driver’s license, or issue a probation order against you for each violation.

Can you go to jail for not having car insurance in Missouri?

Yes, you can go to jail for driving without insurance in Missouri. Drivers caught driving without insurance in Missouri can face up to 15 days in jail after their first and subsequent offenses, along with consequences such as license and registration suspension.

What fine do you get for not having insurance?

Penalties for driving without insurance You can receive a fixed penalty of £300 and six penalty points on your driving license if you are caught driving a vehicle that you are not insured for. If the case goes to court, you could face an unlimited fine and be disqualified from driving.

How many points is no insurance in Missouri?

Missouri point system. Each conviction for driving without insurance will add four points to your driving record. If you accumulate 12 points in 12 months, your license can be revoked for one year.

What happens if the person at fault in an accident has no insurance in Missouri?

Compensation for uninsured drivers in St. Louis, Missouri If you happen to be involved in an accident and do not have insurance for yourself and your car, your license will be suspended and you will be liable for fines.

Is Missouri a no-fault state? Missouri is a “fault” car accident The state of Missouri follows a traditional “fault” system when it comes to financial responsibility for losses resulting from a car accident: injuries, lost income, vehicle damage, and so on.

What if you’re in a car accident with no insurance but are not at fault in California?

If you are not at fault for the accident and do not have insurance, you can expect to receive a ticket for driving without adequate coverage. Depending on whether you’ve been caught without insurance before, you could be fined up to $500. When you factor in additional penalties and fees, you could end up paying up to $1,000.

What happens if I have a car accident without insurance?

Get into an accident without insurance If you cause an accident while driving without insurance, you’ll have to pay for your own repairs and potentially the repairs of others involved out of your own pocket. You will also face a fine for driving without insurance.

What if you’re in a car accident with no insurance but are not at fault Texas?

Your Legal Options as an Uninsured Driver If you don’t have insurance in Texas, you have two options for getting compensation for accidents you didn’t cause. You can file a claim with the at-fault driver’s insurance company, or you can file an injury lawsuit in Texas civil court.

What happens if you don’t have car insurance in California?

Driving without insurance is a misdemeanor and is punishable by a fine between $100 and $200 plus all other state assessments and fees. However, if the driver is subsequently ticketed for driving without insurance within 3 years of the first offence, the fine will be between $200 and $500.

What happens if you have no insurance but the other driver was at fault in Missouri?

Uninsured Motorist Accidents in Missouri While it may not seem fair that your insurance company has to pay if someone else is at fault, remember two things: 1) You only pay for this coverage in the event of an uninsured motorist accident, and 2) Your insurance company can seek compensation from the at-fault party. .

What if you’re in a car accident with no insurance but are not at fault Texas?

Your Legal Options as an Uninsured Driver If you don’t have insurance in Texas, you have two options for getting compensation for accidents you didn’t cause. You can file a claim with the at-fault driver’s insurance company, or you can file an injury lawsuit in Texas civil court.

What is the fine for driving without insurance in Missouri?

Depending on the circumstances, you could face serious penalties if you are caught driving without the required insurance in Missouri. You could lose your driving privileges for an entire year and be forced to pay a $400 reinstatement fee, on top of a $500 fine and/or 15 days in jail.

Is Missouri a no pay no play state?

Sep 7, 2021 In 2013 Missouri enacted Section § 303.390 also known as the âPlay, No Playâ law. This law prohibits uninsured drivers from collecting compensation for non-economic losses when they are involved in a traffic accident.

What is the penalty for not having car insurance in Missouri?

Depending on the circumstances, you could face serious penalties if you are caught driving without the required insurance in Missouri. You could lose your driving privileges for an entire year and be forced to pay a $400 reinstatement fee, on top of a $500 fine and/or 15 days in jail.

What happens if you get caught with no car insurance?

Penalties for driving without insurance You can receive a fixed penalty of £300 and six penalty points on your driving license if you are caught driving a vehicle that you are not insured for. If the case goes to court, you could face an unlimited fine and be disqualified from driving.

Can you go to jail for not having car insurance in Missouri?

Yes, you can go to jail for driving without insurance in Missouri. Drivers caught driving without insurance in Missouri can face up to 15 days in jail after their first and subsequent offenses, along with consequences such as license and registration suspension.

What happens if you don’t have car insurance in Missouri?

If convicted of ‘failure to show proof of insurance’, one of three things will happen to the driver: The court will send the judgment to the Internal Revenue Service and the conviction will be placed on the driver’s driving record. The four points will be assessed against the driver’s driving record.

How long do you have to insure a new car in Missouri?

The grace period for new car insurance in Missouri is 2 to 30 days in most cases. A new car grace period is how long insured drivers are allowed to drive a newly purchased vehicle before adding it to their existing car insurance policy.

Do I have to insure my car right away? When do you need towing insurance? Whether you’re buying a car from a car dealer or a private seller, you’ll need insurance from the moment you start driving. Non-driving insurance is a great option If you’ve bought a new car and can’t wait to start driving, but you don’t have annual insurance yet.

Do you have to have insurance to register a car in Missouri?

Motor Vehicle Owner Responsibilities Missouri residents are required to show proof of insurance when registering a motor vehicle or renewing license plates. All motor vehicle owners must also have proof of insurance in their vehicle(s).

What you need to get plates in Missouri?

If you are purchasing new license plates for your vehicle, you will need to bring the following items to any Missouri license office:

- Certificate of Ownership, duly signed by you (see instructions), or Manufacturer’s Statement of Origin (MSO);

- Signed Missouri State Title and License Application (Form 108);

Can you register a car without insurance in Missouri?

WalletHub, a financial company You can’t register a car without insurance in Missouri. Proof of insurance is required at the time of registration. In Missouri, you are required to have $25,000 in bodily injury liability coverage, up to $50,000 per accident, along with $25,000 in property damage liability coverage.

Can you register a car for someone else in Missouri?

Yes, HOWEVER, you will need the necessary documents to register the vehicle if your name is not on the title.

What is Missouri state minimum auto insurance?

Missouri auto insurance requirements mandate that all drivers must have 25/50/25 liability coverage. This means your car insurance should have minimum coverage limits of $25,000 per person and $50,000 per accident for bodily injury, with a minimum of $25,000 for property damage.

What is the minimum amount of insurance you should have?

Summary of recommended coverage It is a good recommendation for all drivers to have a minimum of 100/300/100 liability coverage. If you can’t afford that much liability insurance, you may want to have the highest level of liability coverage you can afford.

Which type of auto insurance is required in Missouri?

If you own or operate a motor vehicle in Missouri, you are required by law to insure that car with coverage for injuries you cause to another at a minimum of $25,000 per person, $50,000 per accident, and $25,000 for property damage.

What is full coverage auto insurance in MO?

Full coverage insurance in Missouri is typically defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage.

How long is insurance mandatory on a new car?

Bumper-to-bumper insurance, including coverage for the driver, passengers and vehicle owner, should be mandatory for 5 years. The rule will apply to new vehicles sold from September 1.

How long do you have to insure a new car in Virginia?

Answer given. In Virginia, you legally have 30 days to notify your insurance company of your new purchase.

How long are you covered in a new car?

Generally speaking, there is a 14-30 day window to add and insure your vehicle from the date of purchase. If you happen to miss this window, you can still insure your vehicle, but any damage you might claim from the date of purchase will be denied.

How long do you have to insure a new car in GA?

The grace period for new car insurance in Georgia is in most cases 2 to 30 days. A new car grace period is how long insured drivers are allowed to drive a newly purchased vehicle before adding it to their existing car insurance policy.