How much does Car Insurance cost per State?

It’s important to insure yourself in the event of an accident, but choosing the right insurer can be difficult, so you need to be careful with the choices.

Buying or owning a car comes with its own set of expenses: fuel costs, regular maintenance and, most importantly, car insurance premiums.

On average, every driver in the United States pays $ 1,070 annually for car insurance. It is not a small amount, and it varies according to age, sex, and status. Are you wondering how much you will have to pay depending on which US state you live in?

Discover the average car insurance rates in each state below and some critical information about your vehicle insurance.

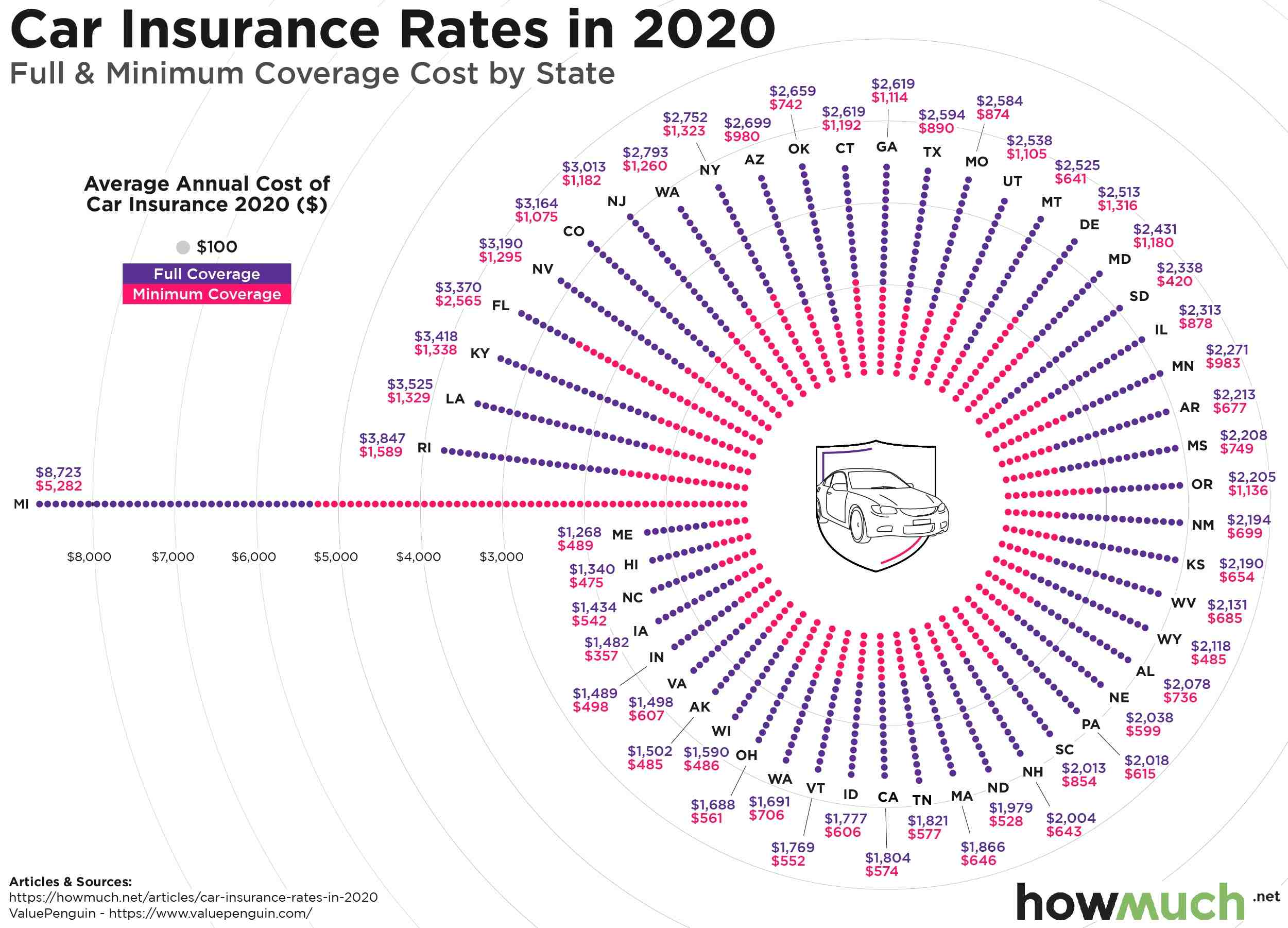

Average Car Insurance Cost By State

Contents

- 1 Average Car Insurance Cost By State

- 2 Factors Affecting Your Car Insurance

- 3 Is car insurance the same in all 50 states?

- 4 What state cost the most for car insurance?

- 5 Is 500 a month too much for car insurance?

- 6 Can I get Florida car insurance with an out of state license?

Each state has its own rules and regulations on auto insurance. To see also : New car insurance market for drivers could experience a major shift: Allianz, AIG, Metlife, AXA: New driver car insurance market 2022.. Awards vary state by state because the following differ:

States can determine what type of coverage a particular driver needs. Additionally, each state has its own set of approved auto insurance companies from which drivers can purchase insurance.

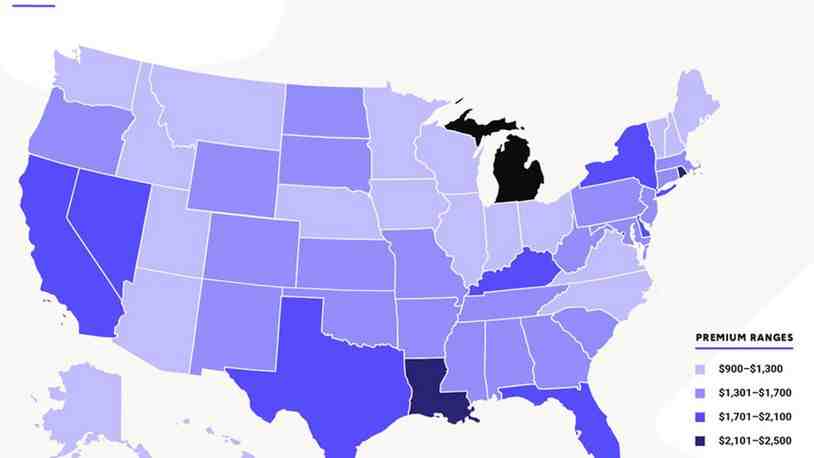

Under current laws, states like New Hampshire require zero insurance. At the same time, car insurance costs in Michigan can be incredibly high due to its innocent policy. In Louisiana, insurance premiums are also very expensive because state attorneys file lawsuits for even small accidents.

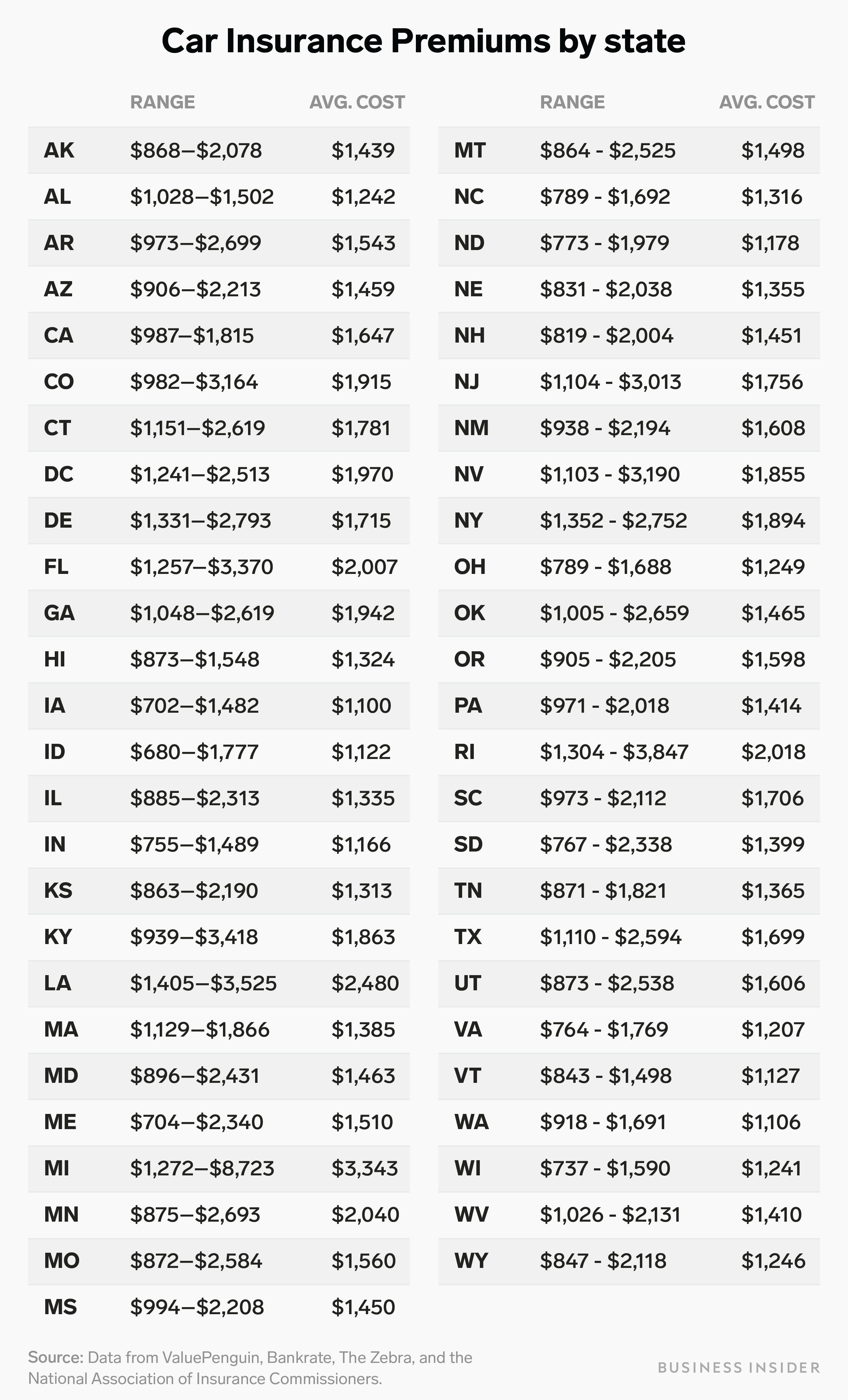

See the table below for a comprehensive list of average car insurance costs in each state:

While these are the average costs for each state, you can always look for affordable auto insurance. For example, if you want cheap Chicago Auto Insurance, you need to look for the insurance company with the lowest premium and the best coverage.

Also pay attention to offers, student discounts, telematics discounts and possibilities to link your insurance. By doing this, you can sometimes save hundreds of dollars.

Factors Affecting Your Car Insurance

Location or state is not the only factor that affects your car insurance. See the article : What happens if someone hits your car and drives off?. Sometimes, you will pay more than other drivers in the same state.

Here are some factors that auto insurance companies consider when deciding your premium amount.

Gender: Male drivers usually pay more for car insurance than females. For transgender people, some providers decide on coverage based on the gender mentioned on the driver’s license.

Age: Older drivers enjoy low-cost auto insurance because they are considered experienced and less likely to be involved in accidents. Teenagers are usually the most expensive drivers when it comes to insurance premiums.

Driving History: Your driving history, previous accident records and DUI are all taken into account when setting higher fares. In fact, in severe cases of frequent damage and reckless driving, insurers could completely deny you coverage.

Coverage Type: Minimum coverage plans usually include only bodily injury and property damage liability. This means you will pay a smaller premium, but may not receive benefits such as reimbursement of train costs, car coverage, rents and in some cases even protection against personal injury. Full coverage auto insurance will give you all these benefits but will cost more.

While location plays a crucial role in determining your auto insurance premiums, several other factors also come into play.

For example, the average car insurance cost is neither too high nor too low. But if you’re in a big city like Chicago and have had rough driving experiences in the past, are younger, or are male, you may want to look for affordable Chicago auto insurance companies; otherwise, you will end up with an excessive cost.

Anyway, if you want to save money on insurance, look for the cheapest car insurance and use offers where you can.

Is car insurance the same in all 50 states?

No, there is no separate multi-state auto insurance, as standard auto insurance generally provides “out-of-state” coverage in all 50 states. See the article : Michigan auto insurance coverage last season: What to do if you have not received yours. There is also no multi-state auto insurance that comes from two or more states.

Which state is the highest in auto insurance? Key Takes

- The most expensive state for comprehensive auto insurance is Michigan, at about $ 4,003, more than three times the national average of $ 1,265.

- The least expensive state for full-fledged auto insurance is Maine, at about $ 589, 53.4% below the national average.

Is car insurance the same in every state?

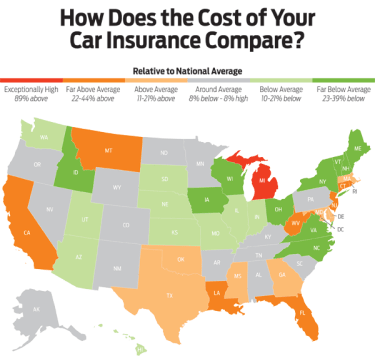

Car insurance rates vary from state to state because there are a number of factors affecting premiums.

Is insurance the same in every state?

It varies. Some states may limit the number of insurance companies selling on their Marketplace. They hope it will improve the quality of the plans offered. Other states may take a different approach and allow any insurance company certified as a Qualified Health Plan to sell plans.

Why insurance is different from state to state?

The main reason is that insurance requirements vary from state to state. Some jurisdictions only require drivers to have liability, even if they still pay for their vehicle.

Does car insurance vary state to state?

There are many factors that are responsible for the difference in the cost of auto insurance premiums between states. One factor to blame is the population. If the area in which a person lives is densely populated, there will be more cars on the road and this will increase the likelihood that an accident will occur.

Which US states don’t require car insurance?

New Hampshire and Alaska: Rogue New Hampshire is the only state that does not require residents to have insurance, or even prove they could cover their liability in an accident, according to the Insurance Information Institute and Property Casualty Insurers Association of America.

What happens if you don’t have car insurance in America?

Fines. If you are caught driving without car insurance, at least you can expect a fine that can run anywhere from $ 100 to $ 1,500, depending on your condition. License suspended. In some states, your license will be revoked and may not be reinstalled until you obtain auto insurance.

Is insurance mandatory for car in USA?

In the United States, car insurance covering liability for injuries and property damage is mandatory in most states, but different states enforce the insurance requirement differently.

Is it illegal to not have insurance in Florida?

Driving without insurance is illegal in Florida, and it is a serious problem that could result in the suspension or revocation of your driver’s license.

Why is car insurance different in different states?

Because auto insurance is regulated at the state level, states have different requirements for the minimum coverage drivers must have to drive legally. There are typically five types of insurance that states may require drivers to carry, including: Personal Injury (BI) Personal Injury (PD)

What state has the highest car insurance rates?

Among all the states, Louisiana is the most expensive state with an average auto insurance premium of $ 2,839 per year, a 19% increase in rates by 2020. On the other hand, Maine, with an average insurance premium of $ 858 per year, is the state with the cheapest auto insurance rates.

Why is the auto insurance different in different states?

Local laws, regulations and other factors can drastically impact insurance costs, which means wide variations in auto insurance rates across a state. For example, as of this writing, Maine has the cheapest rates in the nation, with an average annual premium of $ 589.

Can you insure different cars in different states?

No, you must have car insurance in the state where you live. If you relocate, you must update your insurance company with your new address as soon as possible. The company can deny your claims if you live in another state.

What state cost the most for car insurance?

Michigan. Wolverine State has by far the highest car insurance in the country: Drivers pay an average of $ 4,386 a year for minimum coverage – 459% higher than the national average.

Is 500 a month too much for car insurance?

Best Auto Insurance Policies With a $ 500 Deduction According to The Zebra, a $ 500 deduction is the auto insurance industry standard. On average, drivers can expect to pay just over $ 900, or about $ 150 a month, for a six-month policy that includes a $ 500 deduction.

Is $ 200 a month a lot for car insurance? Yes, $ 200 a month for car insurance is quite expensive, especially for minimal coverage. The average cost of auto insurance ranges from about $ 60 per month for state minimum coverage to $ 166 per month for full coverage.

What should I be paying a month for car insurance?

Drivers in the U.S. pay an average of $ 1,771 a year for comprehensive auto insurance, or about $ 148 a month, according to Bankrate’s 2022 analysis of average quoted premiums from Quadrant Information Services. Minimum coverage costs an average of $ 545 per year.

What is the average monthly payment for insurance?

The national average cost of insurance is $ 65 per month for minimum coverage, or $ 785 per year.

Is 100 a month for car insurance good?

Is $ 100 a month for car insurance good? The average annual rate for 100/300/100 coverage with comprehensive and collision and $ 500 deduction is $ 1,758. That’s about $ 146.50 a month. So if you can find a policy for less than that amount, like under $ 100, it would be considered an affordable rate.

How much is insurance usually a month?

The national average cost of insurance is $ 65 per month for minimum coverage, or $ 785 per year. Your rate varies depending on where you live, what coverage you have and your travel history.

Is insurance cheaper once you are 25?

In general, younger drivers tend to pay more for car insurance — but when you reach the age of 25, the cost of your insurance can go down. According to CarInsurance.com, the average annual premium for a 24-year-old male with full coverage is $ 2,273. At age 25, that average drops to $ 1,989, a decrease of about 12.5%.

At what age is car insurance cheapest?

At what age is car insurance the cheapest? Car insurance is significantly cheaper for older drivers. Drivers around the age of 60 usually have the cheapest car insurance premiums, with a slight increase in premiums for drivers 70 years and older.

Is 100 a month for car insurance good?

Is $ 100 a month for car insurance good? The average annual rate for 100/300/100 coverage with comprehensive and collision and $ 500 deduction is $ 1,758. That’s about $ 146.50 a month. So if you can find a policy for less than that amount, like under $ 100, it would be considered an affordable rate.

How much do you spend on car insurance per month?

The national average cost of auto insurance is $ 1,630 a year, according to NerdWallet’s 2022 estimate analysis. That results in an average car insurance of about $ 136 a month.

Is insurance cheaper once you are 25?

In general, younger drivers tend to pay more for car insurance — but when you reach the age of 25, the cost of your insurance can go down. According to CarInsurance.com, the average annual premium for a 24-year-old male with full coverage is $ 2,273. At age 25, that average drops to $ 1,989, a decrease of about 12.5%.

At what age is car insurance cheapest?

At what age is car insurance the cheapest? Car insurance is significantly cheaper for older drivers. Drivers around the age of 60 usually have the cheapest car insurance premiums, with a slight increase in premiums for drivers 70 years and older.

Is 100 a month for car insurance good?

Is $ 100 a month for car insurance good? The average annual rate for 100/300/100 coverage with comprehensive and collision and $ 500 deduction is $ 1,758. That’s about $ 146.50 a month. So if you can find a policy for less than that amount, like under $ 100, it would be considered an affordable rate.

Can I get Florida car insurance with an out of state license?

Yes, it may be possible to purchase, register and insure a car in one state while holding a driver’s license in another state. There would have to be a good reason to do that.

How long do you have to change car insurance when you move to Florida? Usually, you will have 30 to 90 days to change your car insurance when you move to a new state. While you can – and should – plan ahead, you don’t want to cancel your current policy until the move is made.

Do I need a Florida drivers license to get Florida car insurance?

In Florida, you must obtain a state driver’s license before you can register your car within the state. You will also need to purchase auto insurance that meets the state minimum requirements for auto insurance.

Can you register a car in FL with an out-of-state license?

Registration of an Out-of-State Vehicle If you have an out-of-state motor vehicle, you must: Obtain a driver’s license in Florida. Get car insurance in Florida. Get OS control and official odometer archiving.

Can you register and insure a car without a license in Florida?

The answer is no. Concessions require buyers to have a valid driver’s license to finance a new vehicle.

Can I register my car in Florida without a Florida license?

A Florida driver’s license is required to register a vehicle in Florida.

Can a snowbird register a vehicle in Florida?

Answer given by Plus, you have good news about your cars. A snowbird can register a car in Florida. Florida does not require proof of residence to register a car, so you can do it, and you must do so if the car is in Florida for at least 90 days of the year.

Can I register a car in Florida if I am not a resident?

Housing. Florida does not require proof of residence to register a vehicle.

Can I register a car in Florida if I don’t have a Florida license?

The answer is no. Concessions require buyers to have a valid driver’s license to finance a new vehicle.

Can I register a car in Florida from out of state?

In the state of Florida, a vehicle must have a valid registration to operate on Florida roads, and a vehicle with out-of-state registrations is required by law to be registered within 10 days of the owner or becoming employed, placing children in a public school. , or establishing housing.

Can a non resident insure a car in Florida?

The vehicle you own must have a Florida registration and license plate and be insured with Florida policy when a non-resident: accepts employment or engages in a business, profession, or occupation in Florida; or. recruits children to be educated in a Florida public school.

Do you need a Florida license to insure a car in Florida?

Florida-authorized drivers must purchase auto insurance from a licensed insurance company located in Florida. You must carry uninterrupted insurance while the vehicle is registered with you.

Can a non US resident get car insurance?

Some insurance companies strictly work with U.S. drivers. However, many major companies, including Progressive, are willing to offer auto insurance for foreigners in the United States who have a recognized foreign license or IDP. As long as you have a valid driver’s license in the United States, you can purchase car insurance.