How to get car insurance for new drivers

ON THIS PAGE

Jump to

Who needs new driver car insurance?

Contents

- 1 Who needs new driver car insurance?

- 2 Factors that determine car insurance rates for new drivers

- 3 Types of car insurance for new drivers

- 4 How to get car insurance for new drivers

- 5 Frequently asked questions

- 6 Can I buy a car and register it in someone else name?

- 7 Can I change car insurance at any time?

- 8 Is it hard to switch car insurance?

- 9 What information do you need to set up insurance?

Factors that determine car insurance rates for new drivers

Types of car insurance for new drivers

Minimum coverage car insurance policies

Open the page navigation See the article : Shreveport car insurance is up 25 percent this year, according to the study.

Full coverage car insurance policies

Many people look forward to the day when they can lead. It’s a huge stop, and for the first time, you’ll have to control your own vehicle and enjoy the freedom of the road. But after passing your driver’s test, you can’t just jump behind the wheel of your new car. You need to get a car insurance policy first.

Additional endorsement options

Drivers are legally required to carry a minimum amount of car insurance in almost every state, and new drivers are no exception. But while you may need to purchase a car insurance policy as a new driver, getting a new driver car insurance policy can be much easier, and much less expensive, than you think. See the article : When can northern Michigan drivers expect a $400 auto insurance refund?. . That’s because new drivers generally have a number of options for acquiring car insurance. So if you’ve ever wondered how to get car insurance as a new driver, or what your policy options are, here’s what you need to know.

How to get car insurance for new drivers

While you may be thinking of new drivers as teenagers who have recently graduated, there are actually a few different groups that can be considered “new drivers” by car insurance companies. Read also : The states where motorists pay the most for car insurance. These include:

Frequently asked questions

These new drivers generally pay higher than average rates for their car insurance policies. For example, the average cost of car insurance is $ 1,771 per year for a full coverage policy, but an 18-year-old driver on his or her own policy pays an average of $ 4,946 a year for the same coverage. This is due, in part, to the increased risk involved with insuring younger, less experienced drivers.

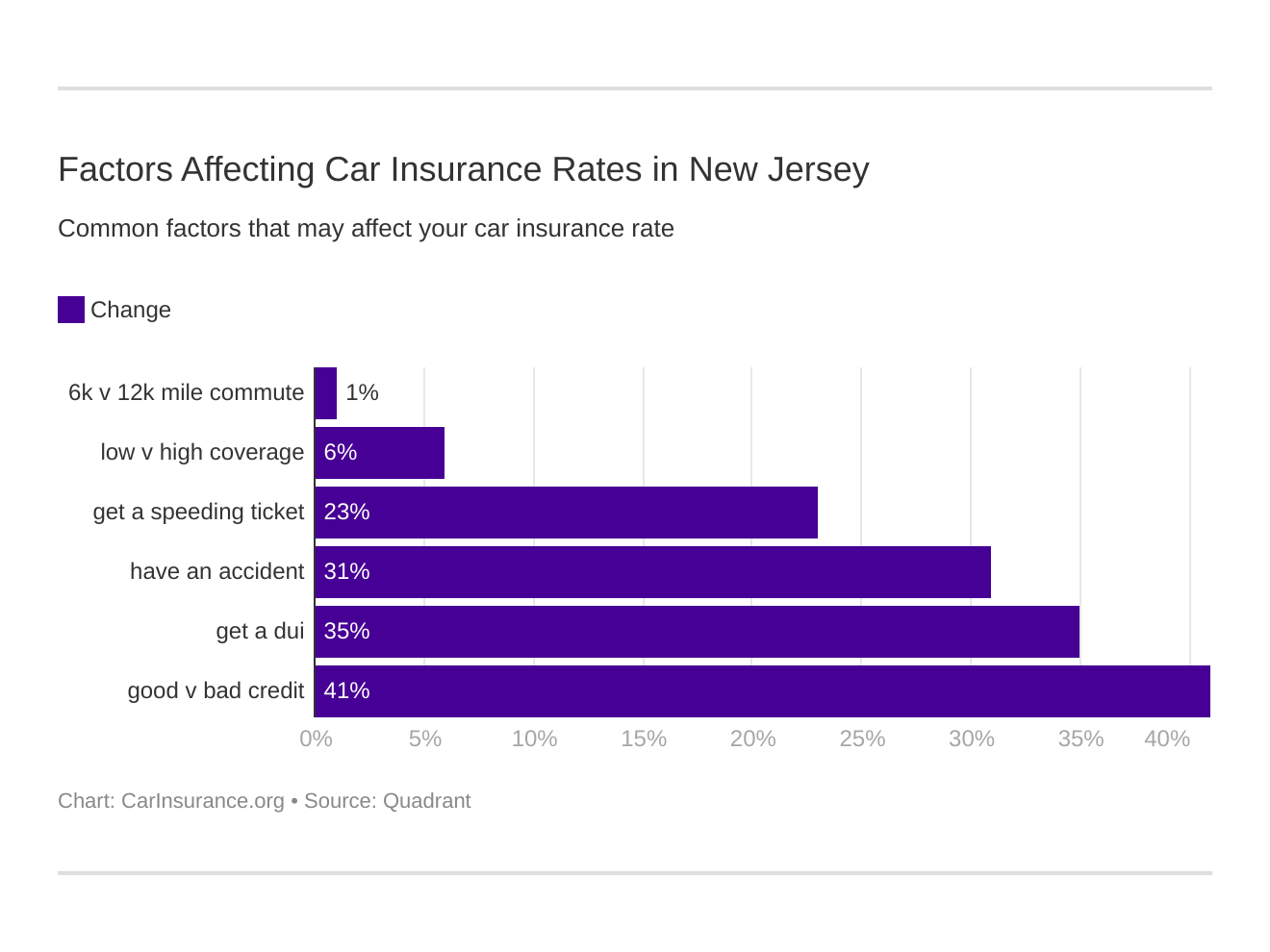

Before buying car insurance as a new driver, it is important to understand the factors that impact your rates. Two important factors are your age and your driving record. If you are under the age of 18 and have not had a clean driving record for more than a year, your premiums will probably be higher than if you are over 25 and have a clean driving record. .

Other factors that can be used to determine your car insurance rates include your ZIP code, marital status, and vehicle. If you live in certain states, your gender and credit score can also be used to assess your car insurance premiums.

Can I buy a car and register it in someone else name?

When looking for car insurance for new drivers, it is important to look at all types of car insurance coverage. Insurance companies typically offer minimum and full coverage auto policies, as well as additional approvals that can be used to customize your policy.

While the minimum requirements for car insurance coverage vary by state, most minimum coverage policies include:

Does a car have to be in your name to insure it?

A comprehensive car insurance policy offers more protection for your finances compared to the minimum coverage, including coverage for the cost of repairing or replacing your vehicle. A basic comprehensive coverage policy generally includes:

How do I change ownership of a car in France?

In addition to the minimum and full car insurance, you may also have the option to add additional approvals to your policy. These may include:

- As a new driver, you have options when it comes to car insurance coverage. This can make the process of obtaining a car insurance policy intimidating. Knowing what steps you need to take to get your first car insurance policy can help. These include:

- The best new car insurance company will not be the same for every driver. For many new drivers, the best car insurance company is the one that offers the best coverage at the lowest price. For others, it may be a car insurance company that offers the widest range of discounts, or it may be the company with the highest quality of customer service. If you want to find the best car insurance company for your needs, it can be helpful to buy, compare quotes, and determine which factors matter most to you.

- Car insurance requirements vary by state, but in general, new drivers are required to carry at least a minimum amount of car insurance to drive legally. The minimum amount and type of coverage varies from state to state.

How long does it take to get carte grise?

Age is one of the many factors that can affect your car insurance rate. In general, younger, more inexperienced drivers generally pay more for car insurance than drivers with more time behind the wheel. However, the use of age as an assessment factor is prohibited in Hawaii and Massachusetts, so your age cannot be included in your rates in those two states. Other factors that can affect your rates include your credit score (in most states), your driving record, and the type of car you drive.

How do I register my car online in France?

If you buy a car for someone else, you have the option to have the loan in your name or to sign it with the individual for whom you are buying it. The only way to buy the vehicle as a surprise is to put it on the loan in your name. The title may be registered under both names.

How do I insure a car that is not in my name?

Can I finance a car and put it in another name? No, in general, you can’t take out a loan on behalf of someone else. Doing this is fraud. Instead, you can take out a loan with the other person. In some cases, you may have a power of attorney for another person and you may sign legal documents for them.

Can I change car insurance at any time?

In some cases, yes, you can insure a car that is not yours. If you borrow a car from someone, rent a car, or use a work vehicle, you may be able to get non-proprietary insurance coverage – however, keep in mind that this is a cover of liability only which does not cover damages. to the car he is driving.

Documents for the transfer of ownership of the vehicles in France

Can you change car insurance mid policy?

A complete Cerfa 13750 * 07 certificate application form.

Can you switch mid term insurance?

Form Cerfa 15776 * 02 completed (document signed by the seller and by you, “declaration of assignment”)

Do you have to cancel car insurance when you switch?

The original gray card is crossed out, dated and signed by the previous owner.

Can I change my car insurance policy at any time?

You will receive your final gray card by registered mail approximately one week after the approval of your application. If anything significant changes to the vehicle (fuel used, number of seats, etc.), the gray card must be updated.

Is it hard to switch car insurance?

Since the end of 2017, formalities relating to the registration of a car – and other vehicles – in France have moved online. To obtain a registration document (known as a gray card) or to notify a change of ownership or address, you must apply via the ANTS website immatriculation.ants.gouv.fr.

If you are looking for the easiest way to insure a car that is not in your name, you can add the owner of the vehicle to your insurance policy as an additional interest. When you do this, your premiums will not increase as they will only increase your insurable interest.

Do you have to cancel car insurance when you switch?

Even if the standard car insurance lasts 12 months, you can still make changes to your policy in part. No professor expects you to change your car just the day your insurance is due to renew. Fortunately, it’s a fairly simple process and your updated policy will cover you until your existing renewal date.

Can you cancel car insurance at any time?

Is there a penalty for changing insurance? In general, you will not be penalized for changing your car insurance company, no matter how many times you change insurers. Although most companies will allow you to cancel for free at any time, waiting until the end of your policy will avoid any cancellation fees.

Can I just switch car insurance anytime?

Can you change your car insurance policy? Yes. You can change your car insurance at any time. But it is a good idea to check with your current insurer to see if they pay cancellation fees.

What happens if you dont cancel car insurance?

The short answer is yes, you can change your car insurance halfway through the policy. In fact, you can change car insurance companies whenever you want. With sufficient notice, car insurance companies generally allow you to cancel your policies for your current coverage at any point.

Is there a downside to switching insurance companies?

Remember to cancel your old car insurance policy Once you have purchased a new policy, you must immediately contact your former insurer and cancel your old policy. You will receive a refund for any unused part of your policy.

Is there a penalty for switching insurance?

A: As long as you’re a Nominee, you can make adjustments to your car policy whenever you want – you don’t have to wait until the renewal time. You can make revolving changes throughout the year and only pay for the part you use.

Is it hard to change insurance companies?

Switching car insurance companies is easy, and people do it all the time. However, it is a good idea to talk to your current insurer and see if there is a cancellation fee. If your insurance agent finds out that you want to cancel, they may also offer to look for extra discounts or give you a lower rate.

Does it hurt your credit to switch insurance companies?

Can you change your car insurance policy? Can you change your car insurance policy? Yes. You can change your car insurance at any time. But it is a good idea to check with your current insurer to see if they pay cancellation fees.

How long does it take to switch over insurance?

Remember to cancel your old car insurance policy Once you have purchased a new policy, you must immediately contact your former insurer and cancel your old policy. You will receive a refund for any unused part of your policy.

Do you have to cancel old insurance when you switch?

Fortunately, car insurance companies generally give you the right to cancel your policy at any time, as long as you provide proper notice. While most car insurers will reimburse your unused premium, some may charge a fee if you choose to cancel half of your policy.

Is it hard to switch car insurance?

Switching car insurance companies can save a significant amount of money, and there is very little downside to buying at the lowest price. Changing car insurance is fairly simple, and you can do so at any time, including the average policy, not just when your insurance is about to be renewed.

What information do you need to set up insurance?

If you do not cancel your policy in a timely manner and do not make the payment, you will be canceled for non-payment eventually. Most car insurance companies pay a cancellation fee, which can range from $ 25 to 10% of the remaining policy premium. Non-payment cancellations may reflect little on an individual’s credit record.

- The simple answer is no. There are no negative effects that directly result from changing your car insurance. In fact, there are many reasons why drivers may want to make a change.

- No, changing your car insurance policy is not a bad thing. There is no penalty for changing, as long as you maintain continuous coverage and avoid a lapse.

- Fortunately, changing carriers is not difficult. Bankrate’s insurance editorial team can help you learn how to change your car insurance in eight simple steps. If you are experiencing a major life change, such as getting married or buying a new vehicle, you may want to consider changing your car insurance company.

- Under normal circumstances, changes in insurance companies will not affect your credit score. Under normal circumstances, changes in insurance companies will not affect your credit score.

- The time it takes to change your car insurance company depends on how you cancel and how you sign up with a new provider. Generally, however, it may take 15-30 minutes to cancel your policy, while signing up with a new provider may take less than 15-60 minutes.

- It is typically your responsibility to cancel coverage with your previous insurer. Your new insurance company may provide proof of insurance to your old company if necessary, but they are generally not authorized to cancel a policy with another insurer on your behalf.

Switching car insurance companies can save a significant amount of money, and there is very little downside to buying at the lowest price. Changing car insurance is fairly simple, and you can do so at any time, including the average policy, not just when your insurance is about to be renewed.

What are the 3 typical requirements in an insurance policy?

What documents do you need to get car insurance?

What are insurance requirements?

Your driver’s license. …

What are the 3 limits of insurance policies?

Your social security number. …

What are the main components of an insurance policy?

Your bank information. …