How To Get Cheap Car Insurance

While finding the cheapest car insurance cost may not be a top priority for any driver, it is certainly not a bad idea to save money on car insurance while getting enough coverage. But finding cheap car insurance is not always as easy as you think – the cost can vary greatly from one driver to the next, for drivers who have the same mission and live in the same state.

This is because the cost of car insurance depends on many factors, including driving history, vehicle and model, your age, ZIP number, and even gender and credit value if you live in other states. In addition, each car insurance company uses different methods to calculate inventory. But while finding the cheapest car insurance quote can be difficult, there are strategies you can use to help you get the best value.

What factors can affect your car insurance rates?

Contents

- 1 What factors can affect your car insurance rates?

- 2 How to find cheap car insurance

- 3 Frequently asked questions

- 4 Why are Geico rates so low?

- 5 How fast does insurance go down?

- 6 How much should I be paying a month for car insurance?

- 7 What is the cheapest way to insure a car?

Motor insurance companies use a variety of rates to assess your value. This may interest you : 58% of drivers believe they are overpaying for car insurance, 29% have recently changed companies. These include your age, location, driving record, driving experience and credit rating in several states, along with other statistics and personal data.

Driving record

A clean driving record will result in less car insurance, while a driving record with a decision for a ticket or accident may result in a temporary increase in value. See the article : Responsibility Vs. Comparison of car insurance with full coverage. Maybe you can still get cheap car insurance with a few downsides on driving records, but you can still shop to find it.

Age

Your age can also affect the value of your car insurance. Young drivers with no driving experience are at greater risk in calculations for accidents and incidents on the road, so car insurance companies will usually charge a higher price to compensate for the risk. Read also : Is it cheaper to buy car insurance online or over the phone?. Costs usually start to decline after 25 years, but it can start to increase again for older drivers. Not all states allow you to consider age to determine the price, however, so whether your age affects your car insurance cost will depend on where you live.

Location

Where you live can also be a factor in determining your car insurance cost. In fact, the average car insurance cost can vary from hundreds of dollars or more from one state or city to another. For example, areas with the highest crime rate are considered the highest risk for insurers, so you may have to pay more than the average depending on your location. Some areas may have a higher risk than others, which may also affect your value.

Credit score

Some states allow car insurance companies to consider your insurance-based insurance company when calculating your value. If you pay bills late or not, or if you have any defects in your financial report, your car insurance company may take you as a dangerous driver. This generally results in higher than average payments for car insurance.

Vehicle

The design and model of the vehicle you are driving, as well as any safety features, can directly affect the cost of your car insurance. For example, some types of cars will be more expensive to insure on average due to the additional cost of replacement or repair. Alternatively, some companies may offer policies for certain types of vehicles, such as trucks, which generally come with the highest risk on the road. In these cases, drivers may receive coverage from other companies, which may make their policy costs more moderate.

Coverage options

The type of coverage you choose can also affect your cost. Overall, the cheapest car insurance is cheaper, but offers less coverage. Full car insurance is usually more expensive, but offers more coverage while you are on the road. Any additional coverage you add to your policy, or roadside assistance, road coverage, or something else in general, may increase the cost of your car insurance.

How to find cheap car insurance

If you want to get cheap car insurance, it may be helpful to get started by comparing estimates from several car insurance companies. If you shop around, you can find a system that fits your budget.

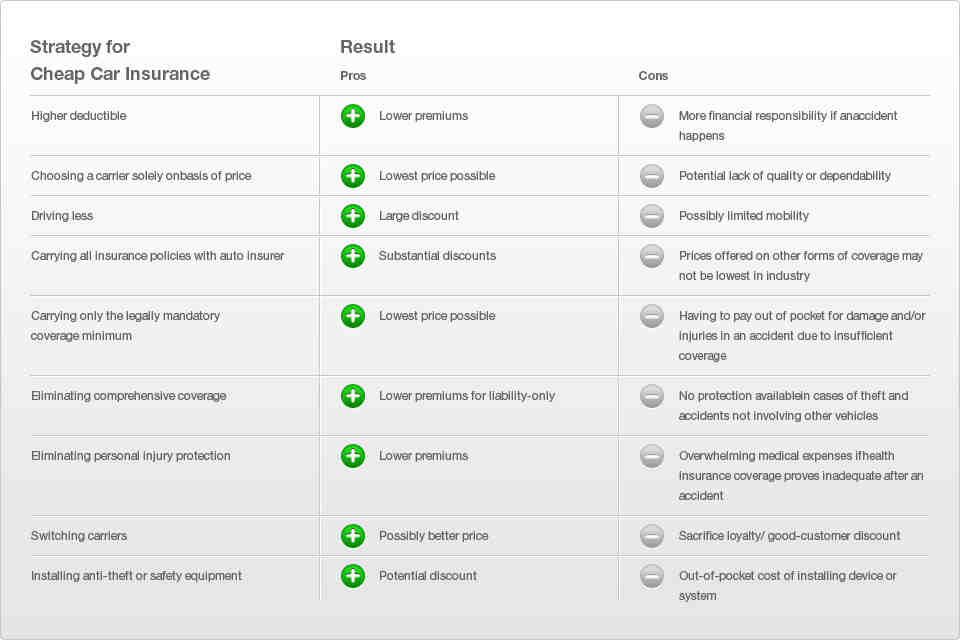

It may also be helpful to consider the following:

Frequently asked questions

By 2022, the average cost of car insurance is $ 1,771 per year for the full coverage purpose, and $ 545 per year for the minimum coverage plan, according to a Bankrate analysis of cost data from the Quadrant Data Service. However, it is important to understand that the cost of insurance can vary greatly for a number of reasons, so your cost may differ from the average national car insurance cost.

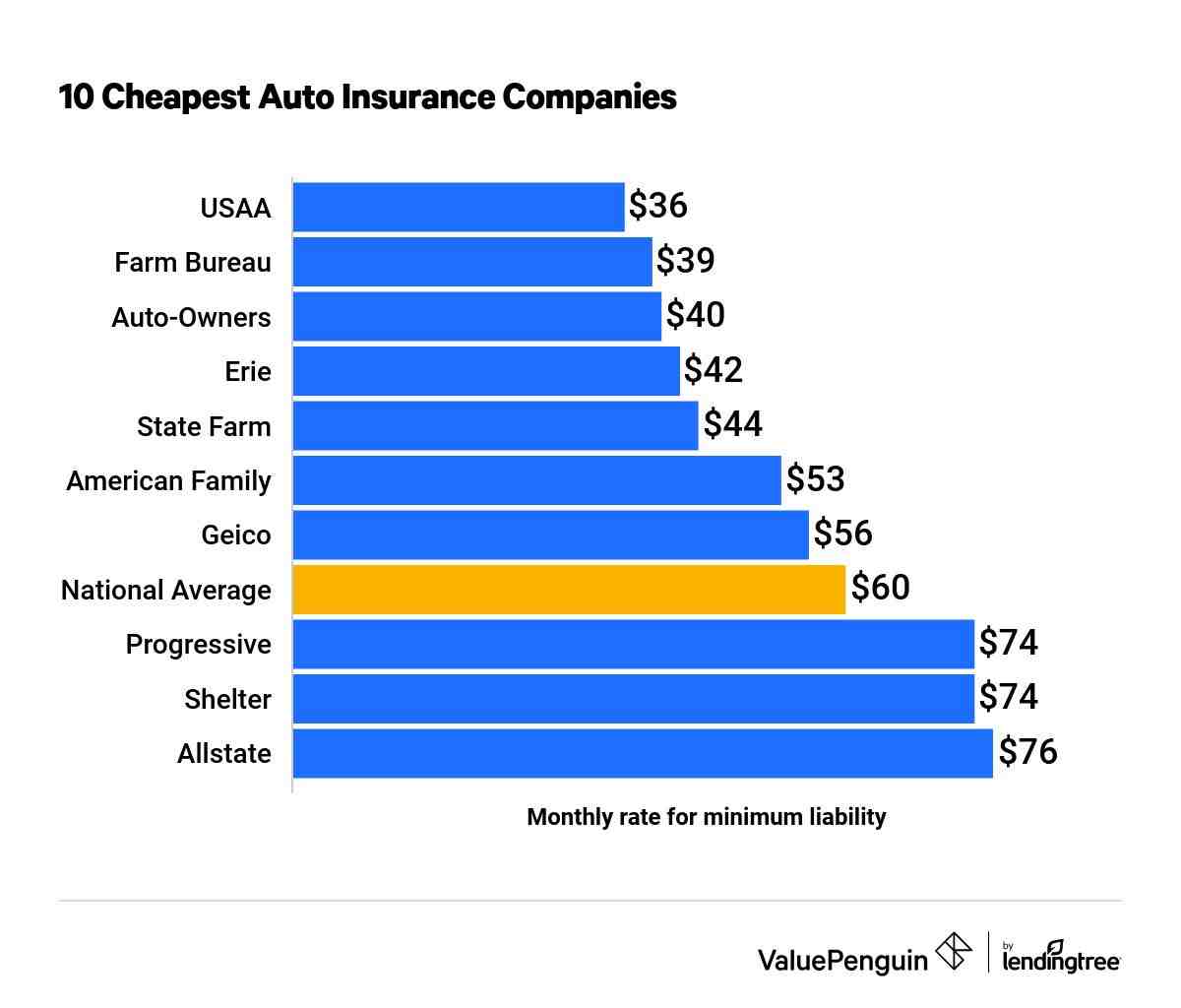

The cheapest car insurance company will be different for each driver. If you are looking for the cheapest car insurance plan for your needs, it can benefit you to shop and profit from many companies. Doing this can give you an idea of what the cheapest option is for your environment.

Why are Geico rates so low?

Geico is cheap because it sells insurance directly to buyers and offers great discounts. Direct-to-consumer insurance sales eliminate the cost of the medium and allow Geico to have fewer offices and local agents than companies like Farm State and Allstate.

Is GEICO cheap or expensive? Geico has the cheapest car insurance for most drivers in California. The company charges $ 390 per year on average for minimum liability policies. This is 35% cheaper than the state average. The average price for the lowest car insurance in California is $ 604 per year, or $ 50 per month.

Can I call GEICO to lower my rate?

Call (800) 861-8380 to speak to your insurance agent about additional discounts you may be eligible for. Or, if you are looking for a new policy, learn some tips to help you compare your car insurance policies and see all the major discounts you will be eligible with GEICO.

Does GEICO ever lower rates?

You can reduce the cost of your Geico car insurance by taking advantage of Geico discounts, larger optional discounts, enhanced driving records, and more. Some Geico discounts are worth up to 40% off, and customers can apply multiple discounts to the destination to save more.

Can I ask my car insurance for a lower rate?

Do not call the insurance company and ask for a lower car fee. You need to engage in dialogue with strategy and civilization, even if the initial response is negative. Be prepared to sue for the reason you are looking for less money, or because you are driving less, less money, or some other reason.

Can you negotiate with GEICO?

Can You Discuss Car Insurance Costs? The simple answer is, you can not negotiate the price since the prices and insurance industry are well controlled by each state. The insurer cannot change its value range without reviewing the state with the assurance that a change is required.

Are people happy with GEICO?

On average, 67% of Geico policyholders who responded to our survey said they were very satisfied with the reduced insurance coverage. Geico, like other insurers, offers many opportunities for drivers to save on their value.

How good is GEICO’s customer service?

Geico is an excellent insurance company rated by WalletHub editors at 4.5 / 5, based on insurance costs, customer reviews, and ratings from organizations such as J.D. Power and NAIC.

Who is GEICO’s biggest competitor?

GEICO competitors include Mutual Liberty Insurance, USAA, Land Insurance, Allstate and State Farm Insurance. GEICO ranks 3rd in the Diversity Score on the par with its competitors.

Is GEICO good at paying claims?

Geico has an A rating from the BBB and a Rs rating from AM Best, featuring excellent business performance and great ability to fulfill customer requirements. Geico insurance coverage from customers is also generally valid.

Can you negotiate with GEICO?

Can You Discuss Car Insurance Costs? The simple answer is, you can not negotiate the price since the prices and insurance industry are well controlled by each state. The insurer cannot change its value range without reviewing the state with the assurance that a change is required.

Can I negotiate an insurance offer?

Even if the offer seems reasonable at first glance, you should always negotiate. After you have checked the value of your car, come up with a number that you feel is appropriate for adjustment. It should be the least of what you want to receive.

Can I negotiate with Geico insurance?

You must keep in mind that GEICO claims mediators specialize in negotiation. Their job is to save money in the pocket of GEICO. On the other hand, the claim of GEICO that should be settled is likely to be settled. Each side may need to offer some taste to reach an agreement, but that is the nature of negotiation.

Is GEICO hard to settle with?

GEICO is a difficult company to deal with. If you do not understand it yet, you will. If you are trying to improve the value of your arbitration claim in Maryland, you want to have every weapon you can to understand the true value of your case.

How fast does insurance go down?

It takes 3 to 5 years before car insurance decreases after a fatal accident in most cases. Three years is a period of general punishment for property damage claims. Insurance companies punish drivers for long periods of time because of accidents that result in serious bodily harm or as a result of reckless or drunken driving.

How much does your car insurance cost? Key Takeaways. Your age, driving history, credit value, address, profession, and car usage can all affect your car insurance costs. You may find your car insurance decreased with age – especially between the ages of 18 and 25â € idan if the insurance company offers a discount.

Does car insurance go down after 24?

Usually, i. At Progressive, rates have dropped by 9% on average in 25 years. But there are other costs that affect your car insurance, such as your claim history. So if you are at the right risk before your 25th birthday, your number may not decrease.

Do insurance rates go down at 25?

Generally, less drivers pay more car insurance amma ”but once you reach the age of 25, the cost of your insurance plan may fall. According to CarInsurance.com, the average annual cost for a 24-year-old man with full coverage is $ 2,273. In 25 years, the average of this has fallen to $ 1,989, a decrease of almost 12.5%.

What age does car insurance start to decrease?

Drivers are seeing the cost of their car insurance begin to decline in almost 20 years, with the maximum drop coming in at almost 25 years. can make an impact. can drive.

Do insurance rates go down at 22?

Since insurers consider drivers under the 25 most dangerous, car insurance costs can be particularly expensive for this age group. However, only a few years and age differences can have a major impact on value. For example, when you turn 22, you will probably find that your annual income has dropped by an average of $ 307.

How long does it take for insurance price to go down?

The answer she gives. Dealing with the financial impact of an accident can be a real challenge, and unfortunately, it can take about three to five years before car insurance is reduced after an accident ”which is about how long the accident will be on you driving record.

How often does car insurance go down?

When does car insurance costs go down? From the age of 16 to 25, the cost of your car insurance will decrease on a regular basis for each year you maintain a clean driving record. The cost of car insurance has dropped by 25 years with a big margin. Prices fall slowly but surely up to 65 years, before rising again.

Does insurance go down the longer you have it?

Is car insurance declining over time? Yes, car insurance decreases over time. You may find that the cost of your car insurance decreases as you get older or you have younger drivers on board. And you can get a discount if you insure with one company for three to five years.

How long does it take to lower my car insurance?

â € karWhile increasing car insurance can be frustrating, as a rule, it carries the cost of your car insurance almost 3 to 5 years to decrease after an accident.

Will my insurance automatically go down?

As long as they keep the driving record clean, the cost of coverage they pay should decrease at the beginning of each new mission.

How can I make my insurance go down?

Listed below are some things you can do to reduce your insurance costs.

- Shopping nearby. …

- Before you buy a car, compare the cost of insurance. …

- Look for higher deductibles. …

- Reduce coverage on older cars. …

- Buy your homeowner with coverage from the same insurer. …

- Maintain a good credit record. …

- Take advantage of the limited mile discount.

Do insurance rates go down every year?

| Age | Annual Premium Average | Different from Last Year |

|---|---|---|

| 25 | $ 1,649 | – $ 272 |

How much should I be paying a month for car insurance?

The average national car insurance cost is $ 1,630 per year, according to NerdWallet’s 2022 estimate. This applies to the average car insurance cost of about $ 136 per month.

Can anyone drive an insurance car in France? Generally in France, the car is insured with the details of the main driver. Anyone can drive a car and benefit from the same insurance as the policy holder.

What insurance do I need to drive in France?

You must have at least a third party insurance policy (legal requirements), but it does not cover any costs incurred as a result of the accident. Make sure your policy is complete and that you have Car Insurance Certificates before departure.

Do you need an insurance green card to drive in France?

Do I need a card to drive in France? A green card from your car insurance provider is not required to drive in France. Of course, you need to have at least a third party insurance cover on your car before you can enter France.

Can I drive in France with UK insurance?

Yes matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar â â â â â â â â â â Bre Bre Bre Bre Bre duk duk Bre duk duk duk duk duk duk duk duk duk If you are planning a long trip, you may need to take out additional insurance.

Is car insurance more expensive in France?

The average annual car insurance cost in France in 2016 was almost ‚¬400, making it the fifth largest in the EU and above the EU average. Tous Risk prices are higher, usually in the region of ‚¬ 600â â kowace per year.

How much is insurance in France?

How Much Does a Health Insurance Cost? In France, the average health insurance cost per person is 40 EUR (US $ 45) per month. Of course, the price varies depending on the policy and: the stronger the policy is, the more you will have to pay for your health insurance. There are several types of health insurance plans.

Do I need extra insurance to drive in France?

From 2 August 2021, drivers will no longer need an insurance card to take their cars to France.

Do you need car insurance in France?

Introduction to car insurance in France You must ensure that all vehicles in France are at least the responsibility of a third party. You need to do this even with unused vehicles, unless all four wheels are removed. Lack of vehicle insurance can result in fines of up to ‚¬3,750.

Can you insure an English registered car in France?

It is very difficult to find the right insurance for your English car if you live in France for more than a few months a year. French insurers will not accept you unless you register the car in France. UK insurers generally limit the amount of time you are covered by up to 1 or 2 months.

How do I change my English car to French plates?

With the new Carte Grise go to your local garage and for a small fee they can change the plates. With carte grise you can also get car insurance in France, or renew your current French insurance with a new plate number. And there you have it! It is now registered in France!

How long can a UK registered car stay in Europe?

UK law still applies to UK registered vehicles if you drive less than 12 months. This means you need to make sure: Your car is paid for in the UK while it is out. do you have a current MOT.

Can I insure my UK car in Europe?

Yes matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar matukar â â â â â â â â â â Bre Bre Bre Bre Bre duk duk Bre duk duk duk duk duk duk duk duk duk If you are planning a long trip, you may need to take out additional insurance.

What is the cheapest way to insure a car?

8 Ways To Get The Best Car Insurance

- Do not assume every company is the cheapest. …

- Do not ignore local and regional insurers. …

- Ask about discounts. …

- Work on your values. …

- Skip the full coverage and crash for the old car. …

- Pick what you will be removed from. …

- Consider utility-based insurance or pay-per-mile.

What is the cheapest insurance option?