Inflation affects car insurance rates

Posted: April 14, 2022 at 12:36 PM CDT | Updated: 15 hours ago

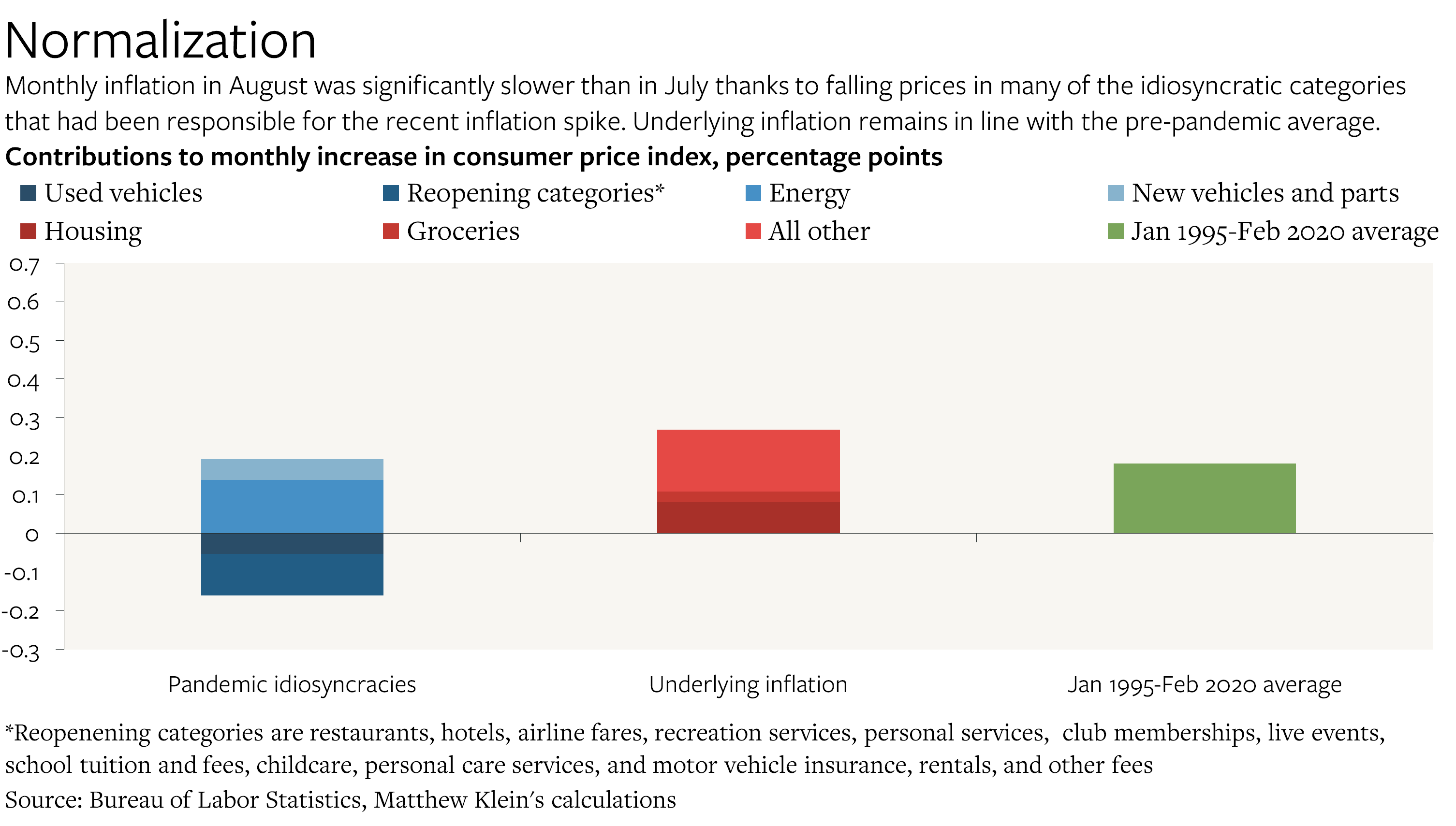

MEMPHIS, Tenn. (WMC) – Inflation has an impact on all aspects of life, including rising car insurance rates.

Rod Griffin, Senior Director of Consumer Education at Experian, joined Action News 5’s Amanda Hanson at the digital desk to talk about what drives the increase, along with some simple ways to reduce costs.

Watch the full interview in the video player above.

Copyright 2022 WMC. All rights reserved.

Click here to subscribe to our newsletter!

Click here to report a spelling or grammar error. Please include the title.

Key tips. Your age, driving history, credit score, address, occupation, and car use may affect the cost of your car insurance. You can see your car insurance go down with age, especially between the ages of 18 and 25, if your insurance company offers age discounts.

What makes the biggest impact on auto insurance rates?

Contents

The biggest factors affecting car insurance rates are the requirements of state coverage, age and make and model of car. This may interest you : 2022 Car Insurance Overview – Forbes Advisor. The more coverage you need to buy in your state and the more valuable your vehicle is, the more you will pay for car insurance.

What makes your insurance grow the most? Car accidents and traffic violations are common explanations for an increase in the insurance rate, but there are other reasons why car insurance premiums are rising, including a change in car insurance premiums. address, a new vehicle and claims in your zip code.

What factors will most likely influence the cost of car insurance?

Some factors that may affect your car insurance premiums are your car, your driving habits, demographics and the coverage, limits and deductibles you choose. Read also : A $ 400 Michigan auto insurance refund is coming: 8 key questions you might have. These factors can include things like your age, anti-theft features in your car and your driving record.

What is the biggest factor in car insurance?

Your driving experience is the most important factor in calculating the cost of your insurance. Read also : Why Do Drivers Want More Car Insurance?. This includes things like speeding offenses, which suggest that you take less time to assess the road and are therefore more likely to be involved in an accident.

What are the rating factors in motor insurance?

Declared value of the insured (IDV). Cubic capacity of the vehicle. Geographical Areas. Age of vehicle.

What is a factor in insurance?

The underlying premium factor is the acquisition cost, underwriting costs, profit and loss conversion factor added to the insurance charge for a policy. The base premium factor is used in the calculation of the retrospective premiums and does not take into account the account tax or the costs of adjusting the claims.

What factors are most important for car insurance rates?

What are the most important factors for car insurance rates?

- Years old. Age is a very significant assessment factor, especially for young drivers. …

- Driving history. This evaluation factor is simple. …

- Credit score. …

- Years of driving experience. …

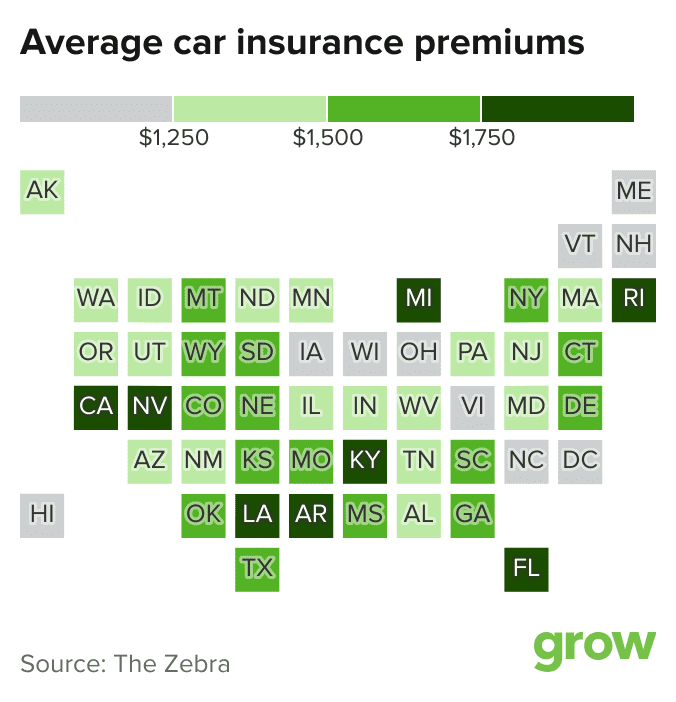

- Locu. …

- Genre. …

- Insurance history. …

- Annual mileage.

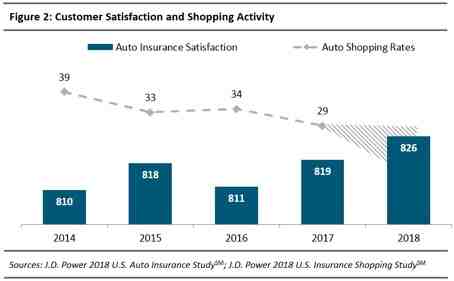

If you have any type of insurance – whether for your home, your car or your health – it is likely that you received a renewal invoice in the mail and asked, “Why has my insurance premium increased?” While some increases in premiums can be attributed to the increase in fees across the board, which happens when an insurer is …

How can you lower your monthly premium? Listed below are other things you can do to lower your insurance costs.

- Shop around. …

- Before you buy a car, compare the insurance costs. …

- Ask for higher deductibles. …

- Reduce coverage on older vehicles. …

- Buy your property and car coverage from the same insurer. …

- Keep a good credit record. …

- Take advantage of low mileage discounts.

The national average in 2020 for single coverage is $ 448 per month, for family coverage, $ 1,041 per month, according to our study. A Bronze Plan may be right for you if your primary goal is to protect yourself financially from the high cost of a serious illness or injury and even pay a modest premium.

If your credit score drops due to increased debt, decreased income, late or late payments, excessive credit requests, or some other reason, your insurance company may choose to increase your premiums to protect you. .

Some factors that may affect your car insurance premiums are your car, your driving habits, demographics and the coverage, limits and deductibles you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

Why is my car insurance so high?

Common causes of excessively expensive insurance rates include your age, driving record, credit history, coverage options, what car you drive and where you live. Anything that insurers can link to an increased likelihood of you being in an accident and filing a claim will result in car insurance premiums.

Who is the best insurance company in France?

What is the French equivalent of the AA?

Roadside assistance in France France does not have the equivalent of AA or RAC, but many insurance companies provide breakdown insurance.

Can I insure a car in France with a UK Licence?

Car insurance in Europe does not work in the global market. UK car insurance companies consider that once someone is resident in France, then their UK car insurance can be considered invalid. So if you have just arrived in France with a right hand car with UK license plates, you need to find an insurer here in France.

Can a non resident insure a car in France?

Non-residents can drive foreign cars covered by insurance from their country of origin, as long as the insurance meets the French minimum requirements. You will need a green card showing that you have sufficient coverage for your vehicle.

Can a UK resident own a car in France?

Can You Buy a Car in Europe as a Foreigner? Buying a car in Europe as a foreigner is possible, but legal ownership is not. Registering a car in your name without an address and / or residence is almost impossible in any European country.

Can I drive a French car in France with a UK license?

If you intend to stay in France for more than 1 year, you must exchange your UK license for a French license during this initial 1 year period. You do not need to take a driving test. Driving in France.

Is Saga car insurance on comparison sites?

Saga Plus is the premium car insurance product, with more benefits than Saga Select and Saga Standard. Standard Saga is only available through comparison sites and comes rich with essential features.

How do insurance companies generate revenue?

Most insurance companies generate returns in two ways: Charge premiums in exchange for insurance coverage, then reinvest those premiums in other interest-bearing assets. Like all private companies, insurance companies try to trade effectively and minimize administrative costs.

What are the main sources of income for an insurance company? The main source of income for insurers is from insurance premiums, while the largest component of the cost to insurers is claim payments. Over the years, insurers actually pay more in claims and associated expenses than they earn in premiums, resulting in a loss of underwriting.

Do insurance companies have revenue?

Insurance companies generate revenue through the insurance policies they write down (including insurance premiums) and from the returns generated by their investment activities. The costs that insurance companies incur are the typical costs that all businesses incur, such as operating costs.

Do insurance companies typically make a profit?

Insurance companies earn only $ 0.08 out of every $ 1 in profit – and that profit margin has been consistent over the last seven years from 2007 to 2013.

What is the revenue for insurance companies?

The insurance industry at a glance The net premiums of the U.S. insurance industry totaled $ 1.28 trillion in 2020, with premiums recorded by property insurers / accidents (P / C) accounting for 51 percent, and premiums from life / annuity insurers accounting for 49 percent, according to. at S&P Global Market Intelligence.