GEICO is cheap because it sells insurance directly to consumers and offers many discounts. However, GEICO is not the cheapest insurer on the market. For example, GEICO ranks 21st for the cheapest car insurance among the 46 largest companies, according to GEICO’s 2019 WalletHub car insurance review.

How much is insurance for a 16 year old?

Contents

- 1 How much is insurance for a 16 year old?

- 2 Are people happy with GEICO?

- 3 Do expensive cars cost more to insure?

- 4 Is Liberty Mutual cheaper than GEICO?

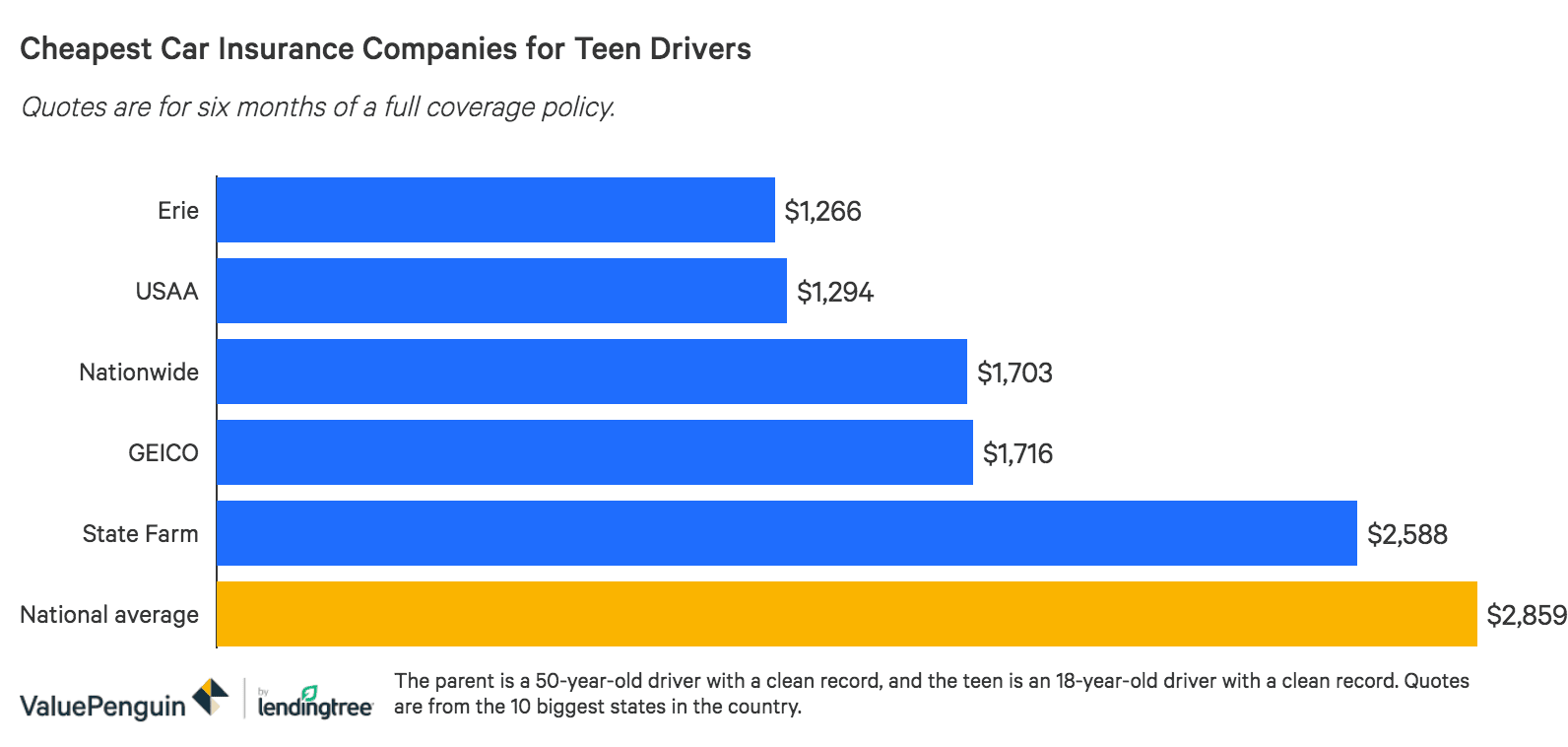

Car Insurance Cost for a 16-Year-Old We found that 16-year-olds can expect to pay an average of $ 813 a month for car insurance. To see also : How can I get cheaper car insurance?. Among the various insurers we analyzed, rates ranged from $ 311 to $ 1,141 per month for full coverage, highlighting the importance of getting quotes from multiple insurers.

How much does Camaro insurance cost for a 16-year-old? Teenage insurance can be very expensive. Chevrolet Camaro car insurance costs $ 7,594 per year for a 16-year-old driver, $ 7,064 per year for a 17-year-old driver, and $ 6,584 per year for an 18-year-old driver.

How much is insurance on a Jeep Cherokee for a 16 year old?

| Year | 16-19 years | 20-29 years |

|---|---|---|

| 2020 | 370.57 USD / month | 149.07 USD / month |

| 2019 | $ 224.05 / month | 161.51 USD / month |

| 2018 | 225.52 USD / month | 157.42 USD / month |

| 2017 | 374.45 USD / month | 153.40 USD / month |

Are sports cars more expensive to insure?

Higher Sports Car Insurance Prepare to pay higher insurance premiums. On the same subject : Does GEICO save you money?. Insurance companies know that sports car owners drive faster than drivers in general and are therefore at risk of accidents more often – and more severely – than minivan drivers, for example.

What makes a car more expensive to insure?

The car you drive – the cost of your car is a major factor in the cost of its insurance. Other variables include the likelihood of theft, the cost of repairs, the size of the engine, and the overall security of the car. Cars equipped with high-quality safety equipment may qualify for premium discounts.

Is insurance higher on trucks or sports cars?

Sports car insurance is generally cheaper than truck insurance In almost all cases, sports car insurance will be significantly cheaper than truck insurance. However, luxury sports cars can cost much more.

How much does insurance on a sports car cost?

Sports cars are one of the most expensive vehicles to insure. The average cost of sports car insurance is $ 203 per month.

How much would insurance be for a 16 year old with a Mustang?

Mustang insurance rates by age Mustang insurance is much more expensive for younger, less experienced drivers. The average amount we found for the 16-year-olds was $ 991 a month – almost five times more than the 30-year-old can expect. This may interest you : Are people happy with GEICO?. 18-year-olds can expect to pay $ 773 a month for Mustang insurance.

Are Ford Mustangs expensive to insure?

Comparing rates nationwide, Mustang owners pay an average of $ 2,188 a year for full car insurance. This is 31% more than the average car owner in the United States, who can expect to pay an average of $ 1,674 per year.

Is a Ford Mustang a good car for a teenager?

The Ford Mustang is a safe and reliable car, but also very strong and as such is not a good first car for a teenager or a new driver. Mustang insurance, maintenance, and gasoline will cost significantly more than a standard sedan or hatchback.

How much would insurance be on a Mustang for an 18 year old?

Mustang insurance for an 18-year-old usually costs between $ 3,281 and $ 10,411 per year. Young drivers are believed to be at greater risk than those over the age of 26.

Are people happy with GEICO?

Bottom line: Is Geico a good insurance company? Yes, Geico is a good insurance company for drivers of all types and also one of the best insurance companies out there. To see also : Is GEICO always the cheapest?. In addition to personal and commercial auto insurance policies, Geico offers several other types of protection, including home insurance and life insurance.

Is GEICO a class A insurer? Standard & Poor’s (S&P) has awarded all GEICO affiliates an AA rating for financial strength – a very high rating. GEICO has earned the prestigious Standard & Poor’s safety label. This means GEICO has undergone the most stringent S&P review and received the highest ratings for financial strength.

Is GEICO good at settling claims?

The jury concluded that GEICO had not acted in bad faith in failing to settle the personal injury case of Linda Ford v Kristin Spiers. That said, GEICO continues to settle most of its personal injury claims. On the same subject : What is the lowest insurance group?. You will see below that I have processed multiple personal injury claims with GEICO.

Is GEICO good about paying claims?

Geico’s complaint process is also more in line with the industry average. The company scored 881 out of 1000 possible in the J.D. Power in 2021 U.S. Auto Claims Satisfaction Study ™ (mean 882). That’s 10 points more than Geico scored in the same 2020 study.

Does GEICO negotiate?

Please note that GEICO’s claims adjusters are qualified to negotiate. Their job is to keep money in GEICO’s pockets. On the other hand, GEICO’s claims that should be settled are likely to be settled. Each side may take a while to come to an agreement, but that is the nature of negotiation.

How fast does GEICO settle claims?

We can’t pretend the car insurance claims process is fun, but we can promise you that we’ll make it as seamless as possible. In fact, your claim can be processed within 48 hours. We are proud to be able to offer you personal care around the clock.

Why is GEICO so good?

Geico’s success as an insurance company comes from offering consumers independence and low prices, as well as implementing effective advertising campaigns that highlight savings. On the same subject : Is GEICO the most expensive?. The main driver of Geico’s success is the insurer’s innovative and user-friendly initiatives.

What is Geico insurance known for?

Now GEICO is a truly countrywide company providing protection to drivers in all 50 states and the District of Columbia. To further assist customers, GEICO has opened a second location in Buffalo, New York, for its expanding GEICO insurance agency business, offering homeowners, tenants, boats and other types of coverage.

Is GEICO really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the statewide average. The average cost of California minimum coverage car insurance is $ 604 per year or $ 50 per month.

Is it worth switching to GEICO?

Yes, Geico is a good insurance company for most drivers. Our annual car insurance rate survey found Geico to be one of the cheapest car insurers in the country, ranking second in our Cheapest Car Insurers ranking, and manages to keep premiums low while offering good customer service.

Is GEICO even good?

Yes, Geico is a good insurance company for most drivers. … Moreover, our customer satisfaction survey found Geico’s customers to be among the most likely to recommend the company’s car insurance to friends and family. Geico came third in our Ranking of the Best Car Insurers.

Does Geico have a good reputation?

Geico has an A-rating from the Better Business Bureau (BBB) and an A-rating from AM Best, indicating good business practice and an excellent ability to meet customer claims. Customer reviews of Geico’s insurance are also generally positive.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the statewide average. The average cost of California minimum coverage car insurance is $ 604 per year or $ 50 per month.

Do expensive cars cost more to insure?

And as a rule, more expensive cars cost more in insurance due to the increased costs associated with repairing them, replacing parts – especially for foreign brands – or replacing the vehicle in the event of a total loss.

How much does Maserati insurance cost?

What car brands are considered luxury for insurance?

Luxury car insurance covers high-cost and performance vehicles produced by a luxury manufacturer such as BMW, Mercedes-Benz and Lexus.

What is considered a luxury car brand?

List Audi, BMW, Cadillac, Infiniti, Lexus, Lincoln and Mercedes-Benz and most will likely think of them as luxury brands because of their reputation, how they are sold, the features they offer, and their price ranges.

Does car insurance go up with a luxury car?

If you are insuring a luxury car, expect to pay more for insurance than for a standard car. As luxury cars are generally more expensive than standard vehicles, insurance costs are also higher.

How much more expensive is it to insure a luxury car?

Luxury vehicle insurance costs an average of $ 3,492 per year. However, other factors such as age, location and driving history can affect the overall range of the car. Luxury cars can be more expensive than regular cars because the parts needed to repair them can be more expensive.

Do More expensive cars cost more to insure?

High-end cars, higher premiums In general, more expensive cars are more expensive to insure because of the increased costs associated with repairing them, replacing parts – especially for foreign brands – or replacing the vehicle in the event of a total loss.

Which car brand has the most expensive insurance?

1. BMW i8. The BMW i8 is the most expensive insurance vehicle in the country. As a high-performance vehicle, the manufacturer’s suggested retail price (MSRP) is $ 147,500 with an average annual insurance cost of $ 4,303.

Why do expensive cars have higher insurance?

Insurance for sports cars, luxury cars, and high-performance cars can be more expensive as they are also higher repaired, they can be stolen more often, and they can be involved in more accidents.

Are high mileage cars more expensive to insure?

Car insurance with higher mileage is usually cheaper. We found premiums decline by an average of 2.5% for each year a car ages. If you want to save money on car ownership and insurance costs, give up on a shiny new car and consider a used car.

How much more expensive is it to insure a luxury car?

Luxury vehicle insurance costs an average of $ 3,492 per year. However, other factors such as age, location and driving history can affect the overall range of the car. Luxury cars can be more expensive than regular cars because the parts needed to repair them can be more expensive.

Are sports cars or luxury cars more expensive to insure?

Why would my insurance be higher if I owned a sports car? With high prices, exclusive parts and high-speed engines, sports cars are considered a greater risk for insurance companies. Your sports car insurance premium may be higher because: Sports cars may be more likely to be stolen.

Why do expensive cars have higher insurance?

Insurance for sports cars, luxury cars, and high-performance cars can be more expensive as they are also higher repaired, they can be stolen more often, and they can be involved in more accidents.

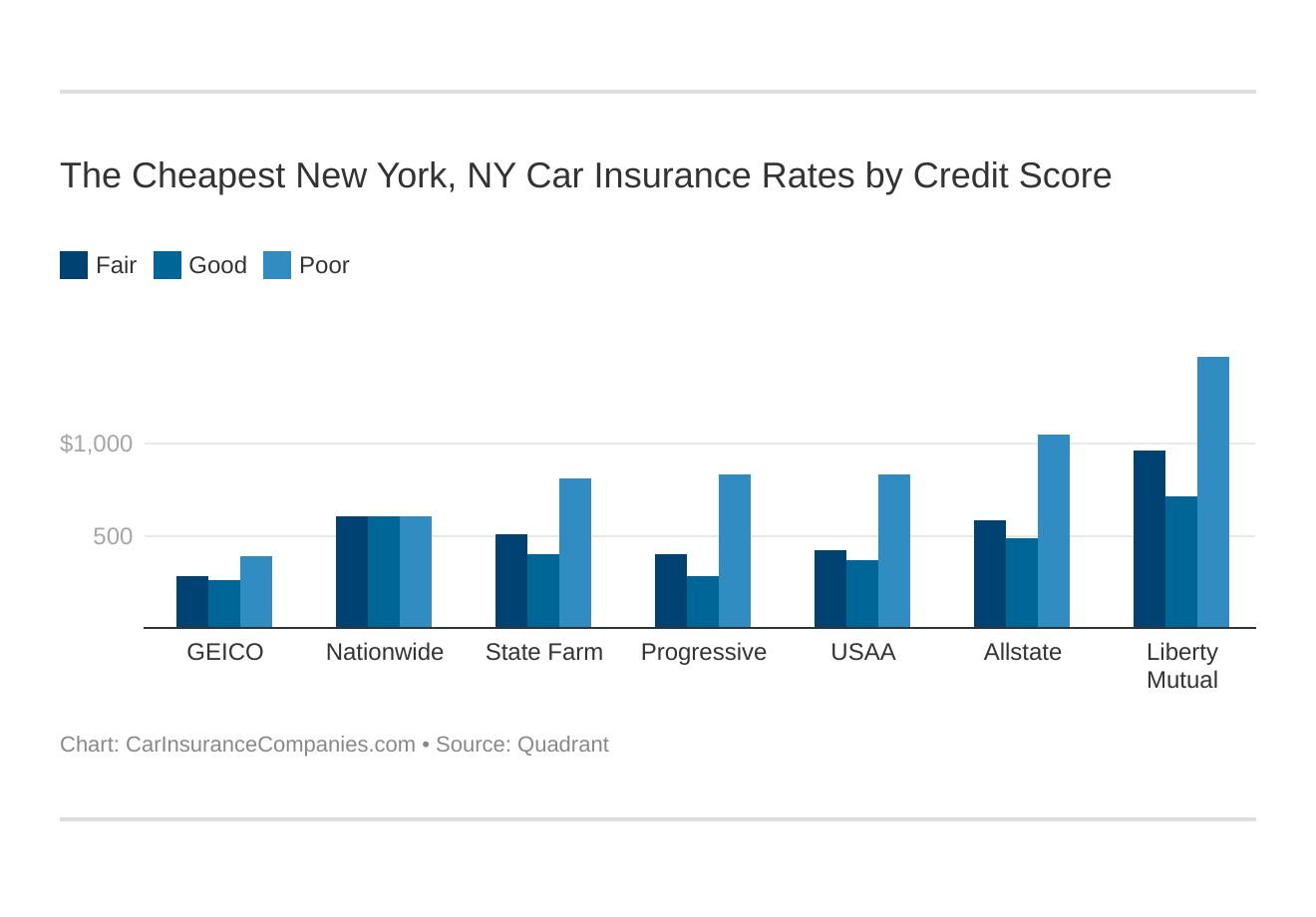

Is Liberty Mutual cheaper than GEICO?

On average, GEICO offers more affordable rates than Liberty Mutual for drivers with a credit rating of less than 580. Drivers with outstanding credit ratings – with a score of 800 or above – should consider GEICO, which typically outperforms Liberty Mutual by $ 728 per year.

Is Liberty Insurance Cheaper Than Geico? On average, GEICO offers more affordable rates than Liberty Mutual to drivers with a credit rating below 580. Drivers with outstanding credit ratings – with a score of 800 or better – should consider GEICO, which typically outperforms Liberty Mutual by $ 728 per year.

Is Geico and Liberty Mutual the same?

Liberty Mutual’s insurance options look identical to those offered by Geico as Geico does not have their own insurance policies – instead, Geico uses an insurance company to insure its clients, and Liberty Mutual is one of the home insurers for Geico.

Who owns GEICO insurance company?

What companies is GEICO affiliated with?

Governmental Employee Insurance Company (GEICO) and its affiliates:

- Financial Corporation of Government Employees,

- GEICO Advantage Insurance Company,

- Company affected by GEICO,

- GEICO Choice insurance company,

- Poviat Mutual Insurance Company GEICO,

- GEICO Financial Services, GmbH,

- General Insurance Company GEICO,

Who is Liberty Mutual affiliated with?

Liberty Mutual Group Inc. is a subsidiary of Liberty Mutual Holding Company Inc., a Massachusetts-based holding company.

Who is cheaper than Geico?

The best for cheap car insurance: State Farm State Farm is the best option for most drivers looking for the cheapest car insurance. The rates offered by State Farm for a full coverage policy were $ 427 more affordable annually than Geico’s, and were even cheaper than those offered by Progressive, Allstate, or Farmers.

Why is Geico The cheapest?

Geico is cheap because it saves money by not having the right staff to service its customers. Customers can save money but pay in other ways, e.g. very long waits on the customer service line, appraisers who do not call back, do not reply to SMS etc.

How is Liberty Mutual insurance ranked?

Liberty Mutual was founded in 1912 and is now the fifth largest non-life insurer in the United States with direct premiums written in 2020 of $ 36.2 billion, according to the Insurance Information Institute.

Where does Liberty Mutual rank for insurance?

Full Review Liberty Mutual is the sixth largest car insurer in the country based on imputed direct premiums. In addition to car insurance, Liberty Mutual offers a wide range of personal and commercial insurance policies. Liberty Mutual is one of NerdWallet’s premier insurance companies.

Is Liberty Mutual good at paying out claims?

Liberty Mutual also has an A (excellent) rating by AM Best, indicating her financial capacity to pay the claims. The company also has a strong reputation with the Better Business Bureau (BBB), rated B.

Is Liberty insurance a good company?

Liberty Mutual Insurance Review Liberty Mutual is a good insurance company and has been rated 3.3 / 5 by WalletHub editors based on insurance offerings, ratings from organizations such as J.D. Power and recent customer reviews.