How long does it take for an insurance company to reply to a demand?

Contents

- 1 How long does it take for an insurance company to reply to a demand?

- 2 What should you not say to a claims adjuster?

- 3 Will GEICO drop you after an accident?

- 4 How long does it take progressive to investigate a claim?

In the best case, the insurance company will respond to your formal notice within 30 days. On the same subject : How long does GEICO check take?. However, you usually have to wait a few weeks to a few months because there is no law that sets a time limit.

How long does an insurer have to respond to a claim? California Insurance Claim Deadline 40 days to make a decision on claim after receiving completed proof of loss forms.

How long does it take for Progressive to respond to a demand letter?

In general, Progressive responds to package requests within an average of thirty days. On the same subject : How good is GEICO with claims?. Given this, it may take a few months to begin the negotiation process after you initially file your claim with an experienced attorney.

What should I expect after a demand letter?

After you send a demand letter, several things can happen: the insurance company accepts your claim and the settlement continues. You will receive the compensation you requested and sign a liability waiver in return.

How long does it take progressive to investigate a claim?

We resolve many property damage claims within 7-14 days, but repair times can vary significantly depending on your vehicle, damage, etc. Either way, we’ll work quickly and efficiently so you can get back to your normal routine.

How long does progressive take to respond to demand letter?

Our analysis of over 100 auto accident claims found that Progressive had the fastest average time to respond to demand letters. In a sample of four cases, Progressive’s average response time to our formal notice was 30 days.

What is the next step after a demand letter?

In rare cases, this may be due to the defendant not responding to the formal notice. Either way, the next step for most lawyers is to take legal action. On the same subject : Is Geico insurance a good company?. It is crucial that lawyers begin this process quickly once it becomes clear that a settlement will not be possible.

What happens after you send a demand letter?

There is generally no time limit to reach a settlement after sending a formal notice. The sender gives the receiver a deadline. This is the time frame they expect the recipient to respond to. Both parties can come to the table to reach an agreement and settle the problem after sending the original demand letter.

What happens if someone ignores a demand letter?

The fact that you ignored the letter of formal notice will be used against you in court. The demand will likely end up being presented to the court and jury in any subsequent litigation, and your response to the demand will be judged accordingly.

How long does it take to hear back from a demand letter?

Once you have written your formal notice and sent it to the insurance company, the response time may vary. Typically, you can expect a response within a few weeks. However, this process can sometimes take up to a few months.

How long does it take for an insurance company to offer a settlement?

Most insurance companies aim to settle claims within 30 days. Quick settlement, however, may not result in the best possible results for you.

Why do insurance companies take so long to settle?

Typically, the money an insurance company receives in the form of premiums goes into investment accounts that earn interest. The insurance company holds this money until it pays a policyholder, so an insurance company can delay a payment to secure as much interest income as possible.

How long does it take for an insurance company to make an offer?

Often, insurance companies will submit an offer in response to a claim within three days to three weeks. The time difference will depend on the reasons for your claims and whether it includes non-economic damages.

How long does it take to reach a settlement?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements may take much longer to resolve. By partnering with a qualified legal advisor, you can speed up the negotiation process and get compensation sooner.

What should you not say to a claims adjuster?

Only discuss the basic facts of the accident, i.e. where the accident happened; the date and time of the accident; the type of accident; i.e. a motorcycle, motor vehicle, etc.

Can you chat with an insurance adjuster? After reviewing their argument, you can form a counter-argument. A fitter can, however, provide a few things you need to be prepared for. When entering into negotiations with the insurance company and/or adjuster, you should have a desired settlement in mind, as well as a minimum settlement that you will accept.

How do you argue with an insurance adjuster?

5 steps to take if you disagree with your adjuster after a car accident

- Review your auto insurance policy. …

- Gather all documents related to your claim. …

- Make sure you have provided all the necessary information. …

- Collect your medical records. …

- Learn more about your insurance claim.

How do you beat an insurance adjuster?

Calmly and politely is the best way to approach an insurance claim dispute. First, you can write a letter to the independent adjuster explaining why you think their total settlement is not sufficient compared to what you have calculated. Even if you’re upset, don’t show it.

What should you not say to an insurance company?

Avoid using phrases like “it was my fault”, “I’m sorry” or “I apologize”. Don’t apologize to your insurer, the other driver, or the law. enforcement. Even if you’re just being polite and not intentionally admitting wrongdoing, these types of words and phrases will be used against you.

What should you not say to an insurance adjuster?

The top 5 things not to say to an adjuster are to admit fault, say you are not injured, describe your injuries, speculate what happened or say anything. either on file. Doing any of these things after a car accident can jeopardize your insurance and personal injury claim.

What should I tell my claims adjuster?

Provide only limited personal information All you have to do is provide the adjuster with your full name, address and telephone number. You can also tell them what type of work you do and where you work. But at this point, you don’t need to explain or discuss anything else about your job, schedule, or income.

How do I get the most out of my insurance adjuster?

Develop your claims strategy based on your reasonable understanding of your policy coverages, endorsements, exclusions and limits. Document everything. Present your position and documentation to your adjuster. Negotiate for the settlement you want, need and deserve.

What should you not say to a claims adjuster?

The top 5 things not to say to an adjuster are to admit fault, say you are not injured, describe your injuries, speculate what happened or say anything. either on file. Doing any of these things after a car accident can jeopardize your insurance and personal injury claim.

How do I get the most out of my insurance adjuster?

Develop your claims strategy based on your reasonable understanding of your policy coverages, endorsements, exclusions and limits. Document everything. Present your position and documentation to your adjuster. Negotiate for the settlement you want, need and deserve.

How do you negotiate with a claims adjuster?

Show the expert that you’re willing to renegotiate your offer by lowering it slightly, and they’ll usually follow by raising theirs. This can be done multiple times until a final offer is accepted. Keep in mind that the adjuster is a human being like you.

What should you not say to an insurance adjuster?

The top 5 things not to say to an adjuster are to admit fault, say you are not injured, describe your injuries, speculate what happened or say anything. either on file. Doing any of these things after a car accident can jeopardize your insurance and personal injury claim.

How do you beat an insurance adjuster?

Calmly and politely is the best way to approach an insurance claim dispute. First, you can write a letter to the independent adjuster explaining why you think their total settlement is not sufficient compared to what you have calculated. Even if you’re upset, don’t show it.

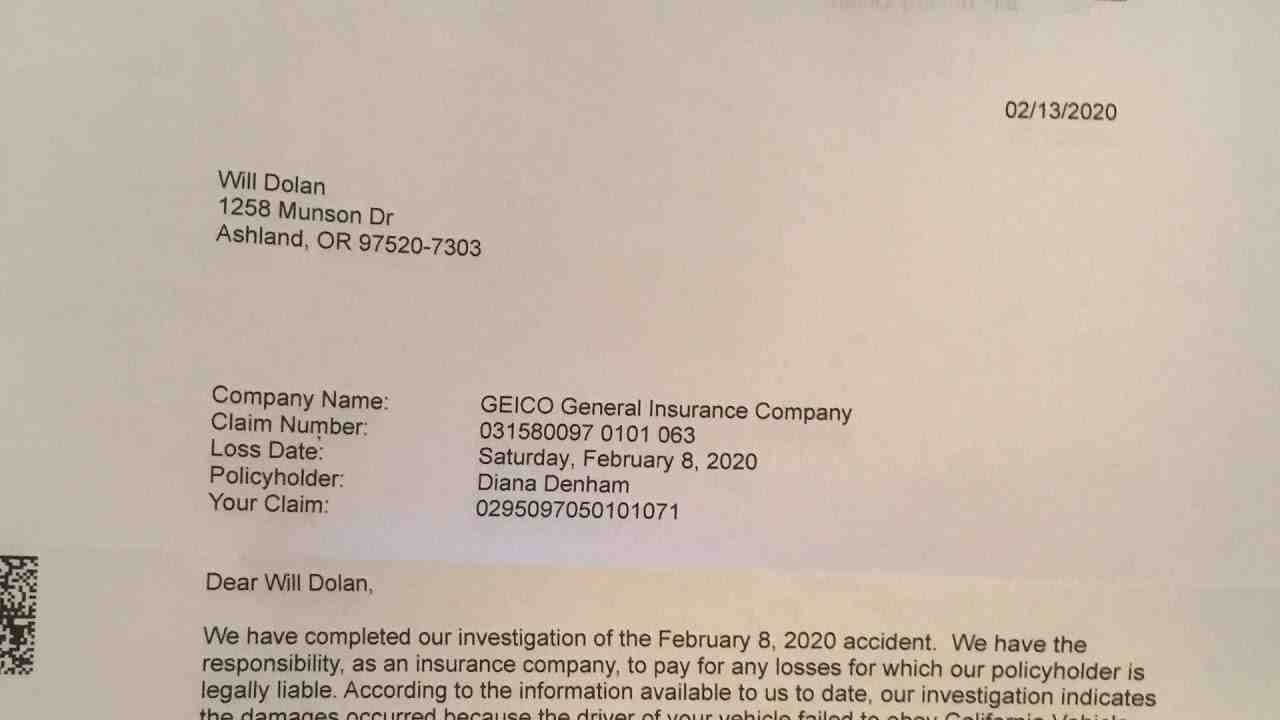

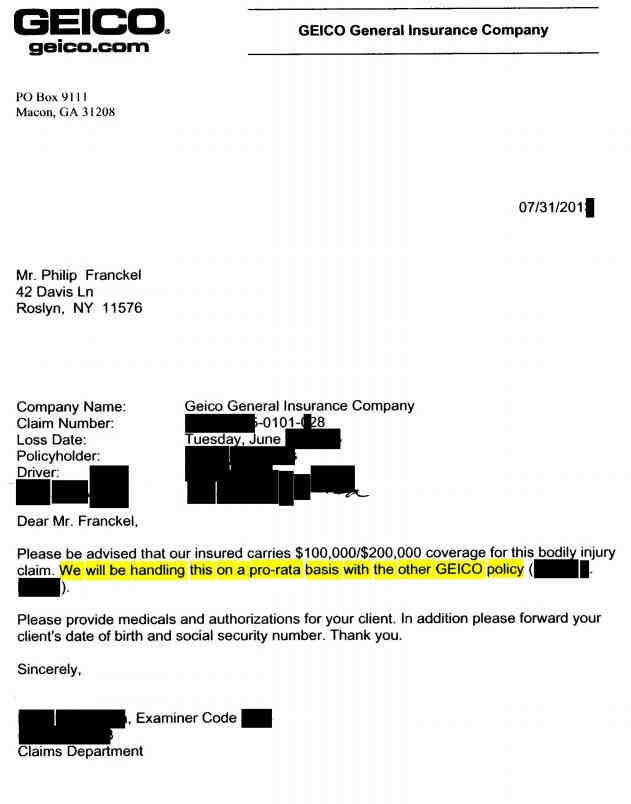

Will GEICO drop you after an accident?

With accident forgiveness on your GEICO auto insurance policy, your insurance rate won’t increase as a result of your first at-fault accident. We waive the surcharge associated with the first at-fault accident caused by an eligible driver on your policy. GEICO accident forgiveness is per policy, not per driver.

Can the insurance company drop you off after a claim? Car insurance companies can drop you as a customer if you submit a claim following an accident – but the good news is that you’re more likely to face non-renewal rather than cancellation .

How many accidents can you have before GEICO drop you?

“GEICO and most other standard carriers have a three-year, 36-month rule. If you have three or more at-fault accidents within 36 months, your policy will not be renewed. If all of your accidents happened within three years, you may need to purchase a new carrier before your next renewal.

Will GEICO Drop me after 2 accidents?

Geico insurance will increase approximately 45% after your first accident resulting in a claim of $750 or more. If this is your second accident in less than three years, your insurance will increase at least twice as much, depending on the total cost of the loss.

Can an insurance company drop you for too many accidents?

Both standard and non-standard insurers can drop you if you have too many accidents in a certain amount of time. Any accident you file a claim for can affect your insurance rates and whether you can renew your policy or get a new one.

How many accidents can you have before your insurance drops you?

How many auto insurance claims can be filed per year? There is no limit to the number of claims you can file. However, most insurance companies will drop you as a customer after three claims in a three-year period, regardless of the type of claim.

Why did GEICO cancel my policy?

The tricky part is what comes next: many companies have the same guidelines that dictate who they will sell insurance coverage to. If GEICO cancels your coverage because you’ve had too many claims, you may not be able to get coverage from Progressive for the same reason.

What happens if Geico cancels your policy?

You generally have 10 to 20 days between the date of the termination notice and the date you are no longer covered. The exact duration differs by state. After that, your insurance will officially expire and you will no longer be able to drive your car legally.

How long before Geico cancels my insurance?

Geico has a nine-day grace period if you cannot make your payment on time. After that, your policy could be void. Geico doesn’t have late payment fees, but if you miss a payment, they’ll send a formal notice of cancellation within 14 days of the original due date.

Is it hard to get car insurance after being Cancelled?

Is it difficult to take out car insurance after a cancellation? If your car insurance was canceled due to too many traffic violations or an offense like a DUI, you will have to pay more for new insurance. You may not be able to find any from standard or high-risk insurers.

Will my insurance Drop me after 2 accidents?

Both standard and non-standard insurers can drop you if you have too many accidents in a certain amount of time. Any accident you file a claim for can affect your insurance rates and whether you can renew your policy or get a new one.

At what point will insurance drop you?

According to the Insurance Information Institute, insurers cannot cancel policies that are older than 60 days, but there are exceptions. Insurers can drop you if you don’t pay the premium, misrepresent on the application, or have your driver’s license suspended or revoked.

Will Geico Drop me after 2 accidents?

Geico insurance will increase approximately 45% after your first accident resulting in a claim of $750 or more. If this is your second accident in less than three years, your insurance will increase at least twice as much, depending on the total cost of the loss.

How many claims before your insurance drops you?

How many auto insurance claims can be filed per year? There is no limit to the number of claims you can file. However, most insurance companies will drop you as a customer after three claims in a three-year period, regardless of the type of claim.

How long does it take progressive to investigate a claim?

We resolve many property damage claims within 7-14 days, but repair times can vary significantly depending on your vehicle, damage, etc. Either way, we’ll work quickly and efficiently so you can get back to your normal routine.

How does Progressive handle complaints? Our Progressive representatives help you through the process and ensure that your repairs are handled quickly and efficiently. We are working to get you back on the road as soon as possible. You can file a claim through our mobile app, online or by calling 1-800-776-4737. We just need some basic information from you to get started.

Does progressive pay well on claims?

Graduated Rates After an Accident Drivers with an accident on their record can find that Progressive rates are 16% higher than the national average. They ranked seventh in our study, claiming a spot ahead of Farmers and Allstate.

Does Progressive settle claims?

This is a company that is very likely to make you file a complaint. But a lawsuit almost invariably softens that insurance company’s resolve. Progressive has a long history, at least in Maryland, of fair settlement payouts in personal injury claims after a lawsuit is filed.

Does Progressive insurance pay out?

A few days after an accident, a progressive adjuster may offer you a check for a small amount. They usually offer between $1,000 and $3,000 to settle your personal injury case. (One fitter, who is not from Progressive, referred to this process as “removal.”)

Does Progressive send you a check?

If you decide you prefer to receive payment, it will be sent to you less any deductible. If you initially preferred to receive payment, but change your mind and decide to repair, let us know so we can help manage the repair process.

How long does progressive take to respond to demand letter?

Our analysis of over 100 auto accident claims found that Progressive had the fastest average time to respond to demand letters. In a sample of four cases, Progressive’s average response time to our formal notice was 30 days.

What should I expect after a demand letter?

After you send a demand letter, several things can happen: the insurance company accepts your claim and the settlement continues. You will receive the compensation you requested and sign a liability waiver in return.