How can insurance companies save money?

Contents

Car Insurance

- Shop for your car insurance. This may interest you : How can I get cheaper car insurance?.

- Compare insurance costs before buying a car.

- Pick what you will be removed from.

- Reduce your insurance coverage on your old car.

- Combine your insurance and / or stay with the same company.

- Maintain a good credit history.

- Take advantage of the limited mile discount.

- Ask about group insurance.

What can save you the most when it comes to car insurance? A good driver with a good price can save more than $ 100 a month, on average, by finding the cheapest insurer rather than the most expensive in the state, NerdWallet research found. Conversations can be even greater for drivers with less credit or some recent mishap error.

Where do insurance companies invest their money?

Insurance companies are the largest investor in bonds, but they also invest in stocks, mortgages and short-term interest rates. Read also : Is GEICO always the cheapest?.

Do insurance companies offer investments?

In particular, US insurance companies intend to invest in long-term, risk-free assets. Their long-term investment is used to meet future expectations. As a result, US insurance companies are investing for a long time.

Do insurance companies invest in private equity?

Insurance companies represent an important source of capital for private fund managers. They account for 8% of all LPs pursued by Investor Intelligence, and contribute 9%, or $ 128bn, of the total investment invested in the private sector (as of June 2011).

Where do insurance companies make most of their money?

Most insurance companies generate income in two ways: By charging for an exchange to take out insurance, and then re-investing those funds into other for-profit assets. Like all private companies, insurance companies try to market effectively and reduce management costs.

What factors can decrease your insurance rates?

Other factors that may affect the cost of auto insurance are your car, driving habits, demographic and coverage, boundaries and exclusions you choose. This may interest you : Are people happy with GEICO?. These may include things like your age, theft prevention features in your car and driving record.

Who owns GEICO?

GEICO is a Berkshire Hathaway company that provides coverage for more than 24 million vehicles owned by more than 15 million policyholders as of 2017. To see also : How can I get cheaper car insurance?. GEICO has enrolled private passenger insurance in all 50 states of the United States and the District of Columbia.

Is Geico an American company? Public Employment Insurance Company (GEICO / ˈɡaɪkoʊ /) is a privately held US auto insurance company headquartered in Chevy Chase, Maryland. It is the second largest car insurance in the United States, after the State War.

Is Geico owned by intact?

Intact Financial Corporation has completed the acquisition of JEVCO Insurance Company. On the same subject : Why is car insurance so expensive?.

Is there GEICO in Canada?

Geico insurance does not work in Canada. They do not offer insurance policies to the Canadian market. However, US drivers with Geico car insurance are covered while driving in Canada. Your report is valid in Canada.

What company owns GEICO?

What insurance companies does intact own?

Direct Payment is provided by insurance through its subsidiary insurance companies Belair Insurance and Belair Insurance (operating as Belairdirect), as well as working with additional brokers, insurance services, and recovery parts.

Is GEICO less expensive than USAA?

Geico national average and USAA offer less insurance than average value. To see also : Is GEICO the most expensive?. The price of Geico is the lowest among American insurers for the minimum coverage, but the USAA price is still the cheapest.

Is USAA cheaper than other companies?

Is USAA more expensive?

USAA is usually the cheapest option although it offers a small discount altogether. This may interest you : Is Geico really the cheapest?. Keep in mind that car insurance costs vary greatly and depend on factors such as your car, your location, your credit score, driving history, deductions and more.

How much is USAA per month?

Below is a list of average rates paid by drivers with USAA. On average, USAA charges about $ 126.66 per month.

Is USAA cheaper than most?

Drivers can save 34% when choosing USAA for minimum coverage. Their prices are down 34% higher than the national average, although Geico, Farm State, and Travelers also have low competition rates below average.

What is so great about USAA?

USAA has been a valued bank for years. They offer a wide range of value-added services as a benchmark for all accounts. These include free checking and deposit accounts with free balance, free checks, free reward credit card, over-protection and seed protection, free online payment, and much more.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges $ 390 per year on average for minimum liability policies. Read also : What is the lowest insurance group?. This is 35% cheaper than the state average. The average price for the lowest car insurance in California is $ 604 per year, or $ 50 per month.

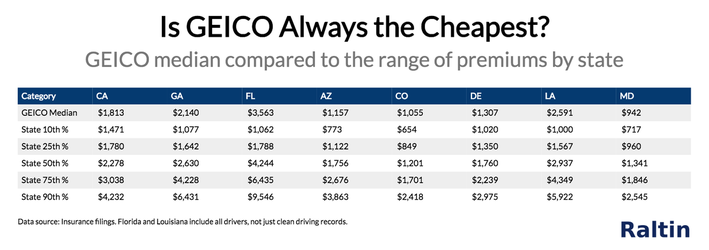

Is GEICO always the cheapest?

GEICO is cheap because it sells insurance directly to buyers and offers great discounts. GEICO is not the cheapest insurer out there, though. For example, GEICO ranks 21st among the cheapest car insurance among 46 major companies, based on the 2019 GEICO WalletHub car insurance review.

Does GEICO save you money?

Of course, one of the quickest ways you can save money is by changing your car insurance to GEICO. After all, it only takes 15 minutes to get the value, and new GEICO customers are reporting an average saving of over $ 500 a year.

Are people happy with GEICO?

Bottom line: Is Geico an Insurance Company? Yes, Geico is a major insurance company for drivers of all types, as well as one of the best insurance companies in the world. In addition to private and commercial insurance policies, Geico offers other types of coverage, including home and life insurance.

Is it ever OK to not have insurance?

The risk of going uninsured is associated with high cost. To see also : Which is a type of insurance to avoid?. Some of the major risks you may face through uninsured are: Cost of health insurance – Without health insurance you may be charged extra for care which your program will cover.

Do you really need insurance? Insurance is a way to protect your life, your health, your income, and your roof when things go wrong. There are many different types of insurance available, and it may be difficult to find one that fits your needs.

Why do so many people not have insurance?

Lack of insurance is attributed to a number of factors, including rising health care costs, economic stagnation, staff-based insurance damage, and declining public programs. Developing effective strategies to reduce insurance costs requires understanding why people do not have insurance.

What was the most common reason for lack of insurance among adults?

Among the uninsured adults aged 18â 64, 64, the most common reason for being uninsured at present is that coverage is not cheap. The number of uninsured adults who are uninsured due to low coverage has increased by age, from 66.8% among those aged 18 29 29 to 80.9% among those aged 50â 64 64 64.

Why are there so many Americans without health insurance?

The high cost of insurance is the reason many people today do not buy health insurance despite the creation of the ACA. In fact, almost 73% of those uninsured in 2019 say this is due to the high cost of health insurance.

Why is being uninsured a problem?

Uninsured people may also die from certain adverse conditions. Uninsured adults who have suffered a stroke, shortness of breath, fracture, or seizures are more likely to suffer from illness as a result of illness and are more likely to die.