Several major auto insurers, including Allstate, Progressive, Geico and State Farm, raised rates in late 2021 or early 2022 in many states. Allstate and its subsidiaries, for example, have had 20 approved rate increases in 13 states since November 2021.

Why does my car insurance keep going up every 6 months?

Contents

- 1 Why does my car insurance keep going up every 6 months?

- 2 Is it cheaper to pay car insurance every 6 months?

- 3 Will insurance premiums increase in 2021?

- 4 Do Geico rates go down?

Increases in the car insurance rate are usually associated with an increase in the policyholder’s insurance risk. On the same subject : Does GEICO have a low mileage discount?. But another reason Progressive could raise rates after 6 months is that market-wide insurance costs have been rising over time.

Why did my car insurance go up for no reason? Car accidents and traffic violations are common explanations for the increase in the insurance rate, but there are other reasons why car insurance premiums go up, such as a change of address, a new vehicle and claims in your zip code.

Why did my car insurance go up when nothing changed?

Your new zip code may have higher crime rates or be more densely populated, both of which can affect your premiums. This may interest you : Will GEICO Drop me after 2 accidents?. Sometimes, even if nothing has changed in your life, your insurance premiums may still increase due to factors beyond your control.

Why did my car insurance go up in 2021?

Changing Driving Habits The streets were quieter and there were fewer accidents. As a result, many insurance companies reimburse some premiums to policyholders. “In 2021, we saw a return to pre-pandemic driving patterns that led to a significant increase in car insurance claims and the severity of accidents.

Why did car insurance increase 2020?

The combination of record-breaking natural disasters, an increase in distracted driving accidents and the growing prevalence of technology-laden vehicles that are expensive to repair means that insurers are likely to raise rates by 2020.

Does car insurance lower every 6 months?

The evaluation of your insurance policy every six or 12 months will update possible discounts and coverage options, such as collision and full coverage, which will match the declining value of your car. To see also : Is Liberty Mutual cheaper than GEICO?.

Do insurance rates go down after 6 months?

If you can keep your driving record clean and have a previous violation that expires in the next six months, your rates could go down. A 6-month car insurance policy can also benefit drivers who will soon pay off a car loan, as well as those who improve their credit.

How fast does car insurance go down?

In most cases, car insurance takes 3 to 5 years to go down after a culpable accident. Three years is a common penalty period for property damage claims. Insurance companies penalize drivers longer for accidents that cause serious bodily injury or resulting from reckless or drunk driving.

Does car insurance get cheaper every year?

While most of us think that 25 is the magic number for car insurance rates, the truth is that as long as a young driver keeps a clean record, most companies will lower their rates a bit each year. before that.

Is it normal for car insurance to go up every year?

Annual increases are very typical across the industry, but the way any particular company views your risk factors may vary. Read also : Is GEICO the most expensive?. To make sure you don’t pay too much, you should know your coverage and discounts to make sure you get the best price for the coverage you need.

How much should insurance go up each year?

On average, car insurance premiums increased by 2% between 2018 and 2019, the most recent year for which data are available.

Does car insurance go up or down every year?

While most of us think that 25 is the magic number for car insurance rates, the truth is that as long as a young driver keeps a clean record, most companies will lower their rates a bit each year. before that.

Is it cheaper to pay car insurance every 6 months?

In most cases, a six-month policy will be cheaper than a 12-month policy for you to pay for coverage in a shorter period of time. However, if you compare the price of car insurance on a monthly basis, it may not be very different between a six-month policy and a 12-month policy.

Is it better to pay for full or monthly car insurance? In general, you will pay less for your policy if you can pay in full. But if paying a lot in advance would put you in a tight financial position, for example, you won’t be able to pay the car insurance deductible, making monthly car insurance payments is probably a better option for you. .

Can you pay your car insurance every 6 months?

Even if you are not locked into your car insurance policy, a shorter policy period offers more flexibility than an annual policy. If you’re not happy with your current insurance provider, but want to avoid cancellation fees or a coverage period, you may simply not renew it at the end of your six-month period.

Is it cheaper to pay car insurance every 6 months?

Whether you choose a 6-month or a 12-month car insurance policy, it is always best to pay in full. When you make monthly payments, you will probably be charged a little more than your premiums and may also be subject to additional payment processing fees if you pay electronically.

Can you pay insurance every 6 months?

Why You Can Trust Bankrate When you purchase a car insurance policy, it remains valid for a specified period of time. The most common policy periods are six months and 12 months. Depending on the car insurance company, you may choose the period of your policy, but not all providers offer you an option.

What is a 6 month insurance policy?

A six-month insurance policy simply means that you will be covered by the agreed-upon limits on any rate that your insurer has provided to you in your contract for a full six months. At the end of this six-month period, your provider will re-evaluate your rates.

Should I shop for car insurance every 6 months?

The longer you keep a clean driving record, the better car insurance rates you can get. Shop every six months to make sure you’re making the most of your impeccable driving history.

Should I shop around for car insurance every year?

If you want to get the best deal on car insurance coverage, consider buying a new rate every year. Insurance companies regularly adjust their prices, so buying car insurance annually can help you save money and become more of an insurance expert.

Is it OK to switch auto insurance every 6 months?

There are some cost-saving benefits to switching your car insurance provider every 6 months. However, unless the cost savings are significant, switching your car insurance provider every 6 months is probably not worth it. However, it is always a good idea to explore your options.

How often should you shop around for car insurance?

Try to compare car insurance rates at least once a year to get the best deal. But you do not have to wait until the end of your policy to make the change. You can change companies at any time: mid-term, end of term, or even two days after term.

Is it cheaper to pay car insurance all at once?

Paying insurance premiums annually is almost always the least expensive option. Many companies offer you a discount to pay in full because it costs more for the insurance company if an policyholder pays their premiums monthly, as this requires manual processing each month to keep the policy active.

Is it better to pay car insurance monthly or every 6 months?

Whether you choose a 6-month or a 12-month car insurance policy, it is always best to pay in full. When you make monthly payments, you will probably be charged a little more than your premiums and may also be subject to additional payment processing fees if you pay electronically.

Is it cheaper to pay car insurance in full Geico?

Geico does not have a full payment discount, at least not an official “discount”. But drivers who pay in full in advance will save money because Geico charges installments if you choose one of their multi-payment plans.

Is it better to pay monthly or annually?

If you want the most affordable option with a smaller commitment, it is best to pay once a month. But if you want to minimize the number of payments and save money on interest over time, it may be worth doing it every two years.

The PolicyX.com report shows a large 9.75% difference in the value of the term index between the first quarter of 2021 and the fourth quarter. In the fourth quarter of 2021, the average annual premium for an insured sum of Rs 1 crore increased to Rs 30,720 from Rs 29,443 in the third quarter.

How much does the cost of health care increase each year? The average increase in individual health insurance has been around 4.5% per year for the past five years.

California Individual Market Rate Change for 2022 This three-year period marked the launch of the California State Grants Program, promoting coverage to meet the needs of those who lose insurance due to the pandemic of COVID-19 and the recent launch of the US Rescue Plan. .

For fiscal years 2021 and 2022, the American Rescue Plan extended eligibility for premium tax credits to people of all income levels. If your 2022 income is higher than the amount you estimated when you signed up, you may have to repay some or all of the excess credit.

Why is health insurance so expensive 2022?

For states with larger rate increases, insurers cite a general jump in health care costs, including the prices of prescription drugs, as drivers. “She adds:” Other factors mentioned by insurers include the COVID-19 pandemic ongoing, with an increase in vaccine administration and the impact of the delta variant causing …

As has been the case in recent years, the average changes in individual and family health insurance rates for 2022 are mostly modest. The national average increase is about 3.5%, and there are new insurers entering the markets in most states.

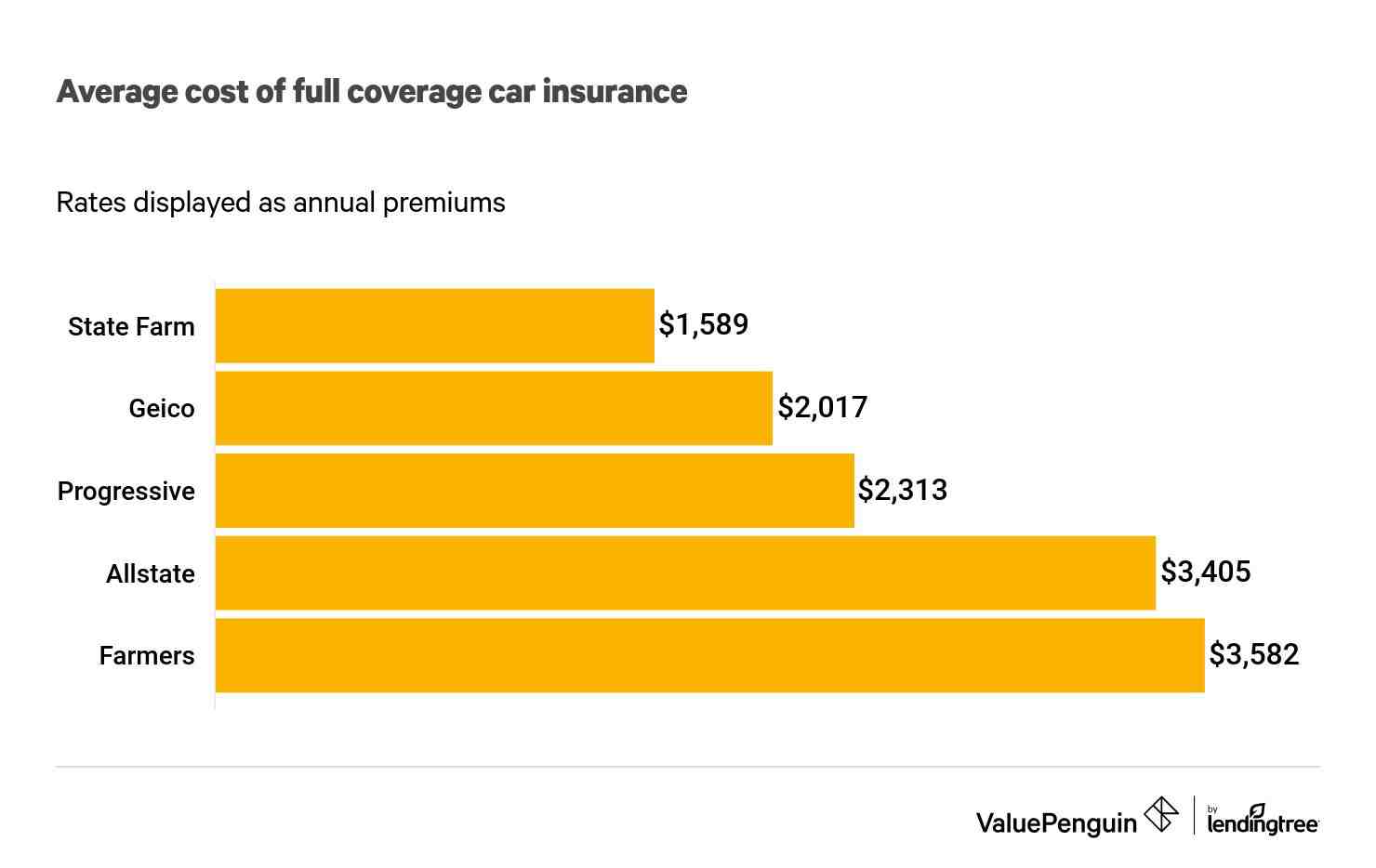

Extensive Bankrate research has revealed that by 2022, the average cost of car insurance is likely to increase for many drivers. Several major auto insurers, including Allstate, Progressive, Geico and State Farm, raised rates in late 2021 or early 2022 in many states.

How much should insurance increase each year?

| Course | Annual average premium | % year-on-year exchange rate |

|---|---|---|

| 2016 | $ 1,368 | 6.90% |

| 2017 | $ 1,437 | 5.00% |

| 2018 | $ 1,521 | 5.8% |

| 2019 | $ 1,548 | 1.8% |

Why is health insurance so expensive 2022?

For states with larger rate increases, insurers cite a general jump in health care costs, including the prices of prescription drugs, as drivers. “She adds:” Other factors mentioned by insurers include the COVID-19 pandemic ongoing, with an increase in vaccine administration and the impact of the delta variant causing …

Is homeowners insurance going up in 2022?

The average cost of homeowners insurance in the United States in 2022 is $ 1,393 per year for a $ 250,000 home coverage policy. This is a 6% increase over the 2021 average price of $ 1,312 per year.

Why is health insurance so expensive in 2022?

For states with larger rate increases, insurers cite a general jump in health care costs, including the prices of prescription drugs, as drivers. “She adds:” Other factors mentioned by insurers include the COVID-19 pandemic ongoing, with an increase in vaccine administration and the impact of the delta variant causing …

How much does healthcare cost in the US in 2022?

How much does health insurance cost? In 2022, the average cost of health insurance is $ 541 a month for a silver plan. However, costs will vary by location.

Do Geico rates go down?

Yes, car insurance goes down to 25 with Geico, as young people under 25 are no longer considered as risky as younger drivers. At the age of 25, drivers save an average of 8.53% on a Geico policy, according to nationwide zip code quotes.

Why are Geico rates so high? Geico is so expensive because car insurance is expensive in general, due to rising costs for insurers. But at $ 506 a year, the average Geico car insurance policy is actually cheaper than most domestic competitors. In fact, Geico ranks first in WalletHub’s analysis of the top 10 cheapest car insurance companies.

Will Geico lower my rate?

You can reduce the cost of Geico car insurance by taking advantage of Geico discounts, opting for a higher deductible and improving your driving history, among other things. Some Geico discounts are worth up to 40% off, and customers can apply multiple discounts to one policy to save even more.

Does Geico negotiate?

Please note that GEICO claims adjusters are good for bargaining. His job is to keep the money in GEICO’s pockets. On the other hand, the GEICO states that they should probably be resolved. Each party may have to give a little to reach an agreement, but that is the nature of the negotiation.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most California drivers. The company charges an average of $ 390 a year for a minimum liability policy. This is 35% cheaper than the state average. The average cost of minimum coverage car insurance in California is $ 604 a year, or $ 50 a month.

Does Geico go up after 6 months?

Does Geico raise rates after a claim? Geico does not always increase your premium if you file a claim. They take into account your driving history, the number of claims you have had in the past, the amount of payment and the type of claim, and whether you are entitled to forgive the accident before raising your rate.

Does Geico go up after 6 months?

Does Geico raise rates after a claim? Geico does not always increase your premium if you file a claim. They take into account your driving history, the number of claims you have had in the past, the amount of payment and the type of claim, and whether you are entitled to forgive the accident before raising your rate.

Does Geico lower your insurance after 6 months?

Your Geico car insurance policy may increase after six months. If you have been able to pass your policy without making any claims, you may be entitled to a car insurance discount. If you keep your Geico car insurance for three years or more, you can get a loyalty discount.

Does your insurance decrease every 6 months?

While turning 25 does not guarantee a reduction in premiums, 25 is the age at which many insurance companies reduce the amount paid by younger drivers. Even after age 25, insurance premiums tend to go down as you get older, so reviewing every six months can still save you money.

â € œThe overall cost of doing business is rising for virtually every business in the United States, including insurance companies. And because the ‘cost of doing business’ is part of the calculation of premiums, consumers can generally expect higher premiums in 2022.

Will my car insurance rate go down?

While most of us think that 25 is the magic number for car insurance rates, the truth is that as long as a young driver keeps a clean record, most companies will lower their rates a bit each year. before that. … â € œTheyâ € TMre years of driving experience and a clean track record that help reduce premiumsâ €

How can I get my insurance rates to go down?

Here are some other things you can do to reduce your insurance costs.

- Shop around. …

- Before you buy a car, compare the costs of insurance. …

- Request higher deductibles. …

- Reduces coverage for older cars. …

- Buy your owners and your car coverage from the same insurer. …

- Maintain a good credit history. …

- Take advantage of low mileage discounts.

While most of us think that 25 is the magic number for car insurance rates, the truth is that as long as a young driver keeps a clean record, most companies will lower their rates a bit each year. before that.

Does car insurance go down over time?

Car insurance rates may fluctuate over time, but you may be able to take some steps to help reduce your premiums. Knowing some of the factors that insurers consider when setting rates can help you make smart decisions about your policy and potential savings.