Will GEICO lower my rate?

Contents

- 1 Will GEICO lower my rate?

- 2 Did GEICO raise their rates 2021?

- 3 What is the most expensive car insurance in the world?

- 4 Is GEICO bigger than State Farm?

You can lower your Geico car insurance costs by taking advantage of Geico discounts, higher deduction selection, and improving your driving record, among other things. Read also : How are GEICO rates so low?. Some Geico discounts are worth up to 40% off, and customers can apply multiple discounts to a policy to save more.

Does Geico wake up after 6 months? Does Geico raise rates after claims? Geico does not always raise your premium if you file a claim. They consider your driving history, the number of claims you have had in the past, the amount paid out and the type of claim, and whether you qualify for an accident pardon before raising your rate.

Does Geico negotiate?

You need to remember that GEICO claim adjuster is competent to negotiate. Their job is to keep money in GEICO’s pockets. To see also : How can I get cheaper car insurance?. On the other hand, GEICO claims are likely to be settled which should be settled. Each side may have to give a little to reach an agreement, but that is the nature of the negotiation.

Can you negotiate with your insurance company?

While you cannot negotiate your car insurance rate, you have no contractual obligation to stay with your insurance company. If you find a cheaper rate elsewhere, you can switch insurance providers. Depending on when you cancel and the fine print of your car insurance policy, you may incur fees.

Does GEICO lowball?

GEICO claim adjusters are renowned for making low hundred ball set offers on almost every accident claim. The first settlement offer you receive from a GEICO adjuster is usually extremely low, sometimes half the true value of the claim.

How long does it take for GEICO to settle?

Well, adjust your expectations – for the better. You are now working with GEICO! We cannot pretend that the car insurance claims process is fun, but we can assure you that we will be as challenging as possible. In fact, your claim can be settled in as little as 48 hours.

Why are Geico rates so high?

Geico is as expensive as car insurance in general, due to rising costs for insurers. But at $ 506 a year, Geico’s average car insurance policy is actually cheaper than most national competitors. Read also : What is the lowest insurance group?. In fact, Geico ranks first in WalletHub’s analysis of the 10 cheapest car insurance companies.

Is Geico the most expensive?

| Company | Average Annual Rate |

|---|---|

| Geico | $ 1,719 |

| State Farm | $ 2,803 |

| The National Average | $ 2,227 |

Did Geico raise their rates 2021?

Several major car insurers, including Allstate, Progressive, Geico and State Farm, increased rates in late 2021 or early 2022 in many states. Allstate and its subsidiaries, for example, have approved 20 rate increases in 13 states since November 2021.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the state average. The average cost of car insurance with minimal coverage in California is $ 604 per year, or $ 50 per month.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the state average. The average cost of car insurance with minimal coverage in California is $ 604 per year, or $ 50 per month.

Are people happy with GEICO?

Bottom Line: Is Geico a Good Insurance Company? Yes, Geico is a good insurance company for drivers of all types, as well as one of the best insurance companies overall. In addition to personal and commercial car insurance policies, Geico offers several other types of coverage, including home and life insurance.

Is GEICO always the cheapest?

GEICO is cheap because it sells insurance directly to consumers and offers lots of discounts. GEICO is not the cheapest insurer out there, however. For example, GEICO is ranked 21st for the cheapest car insurance among 46 major companies, based on the 2019 GEICO WalletHub car insurance review.

Is GEICO the most expensive?

| Company | Average Annual Rate |

|---|---|

| Geico | $ 1,719 |

| State Farm | $ 2,803 |

| The National Average | $ 2,227 |

Did GEICO raise their rates 2021?

Several major car insurers, including Allstate, Progressive, Geico and State Farm, increased rates in late 2021 or early 2022 in many states. Allstate and its subsidiaries, for example, have approved 20 rate increases in 13 states since November 2021.

Why are Geico rates so high? Geico is as expensive as car insurance in general, due to rising costs for insurers. But at $ 506 a year, Geico’s average car insurance policy is actually cheaper than most national competitors. In fact, Geico ranks first in WalletHub’s analysis of the 10 cheapest car insurance companies.

Why did my auto insurance go up for no reason?

Car accidents and traffic violations are common explanations for rising insurance rates, but there are other reasons why car insurance premiums rise including change of address, new vehicle, and claims in your zip code.

Why did my car insurance go up when nothing changed?

Your new ZIP code may have higher crime rates, or a more densely populated population, both of which may affect your premiums. Sometimes, even if your life has not changed, your insurance premiums can still go up due to circumstances beyond your control.

Why does my car insurance keep going up every 6 months?

Increases in the rate of car insurance are usually associated with increases in the policyholder’s insurance risk. But another reason Progressive may raise rates after 6 months is that insurance costs across the market are rising over time.

Why did car insurance increase 2020?

Insurers are likely to increase rates in 2020 due to record-setting natural disasters, an increase in stray driving accidents and an increasing prevalence of high-tech loaded vehicles that are costly for insurers to repair.

“The total cost of doing business is rising for almost every company in the US, including insurance companies. And because ‘the cost of doing business’ is part of calculating premiums, consumers can generally expect higher premiums in 2022.â €

Why did my car insurance go up when nothing changed?

Your new ZIP code may have higher crime rates, or a more densely populated population, both of which may affect your premiums. Sometimes, even if your life has not changed, your insurance premiums can still go up due to circumstances beyond your control.

Geico rates rise when drivers get more coverage, when they have an accident, when they get a speeding ticket or when they file a claim. Certain life events, such as adding a teenage driver to your policy, may also increase your rates.

Rates of rate occur when an insurance company discovers that its overall rates are too low in light of the costs (losses) incurred from recently submitted claims, and industry trends towards more expensive repair and medical costs.

Does Geico increase rates?

Geico rates rise when drivers get more coverage, when they have an accident, when they get a speeding ticket or when they file a claim. Certain life events, such as adding a teenage driver to your policy, may also increase your rates. In addition, discounts can be lost, which can increase your premium.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for a minimum liability policy. That’s 35% cheaper than the state average. The average cost of car insurance with minimal coverage in California is $ 604 per year, or $ 50 per month.

What is the most expensive car insurance in the world?

1. BMW i8. The BMW i8 is the most expensive vehicle to insure in the country. As a high-performance vehicle, the manufacturer suggested a retail price (MSRP) of $ 147,500, and its average annual insurance cost is $ 4,303.

Which country has the most expensive insurance? As with all previous issues of our Cost of Health Insurance report, the US is ranked as the most expensive country in the world for family health insurance with an average premium of USD 34,298. Hong Kong is second again with an average cost of USD 18,494; 53.9% of the average US household premium.

Which car insurance is the most expensive?

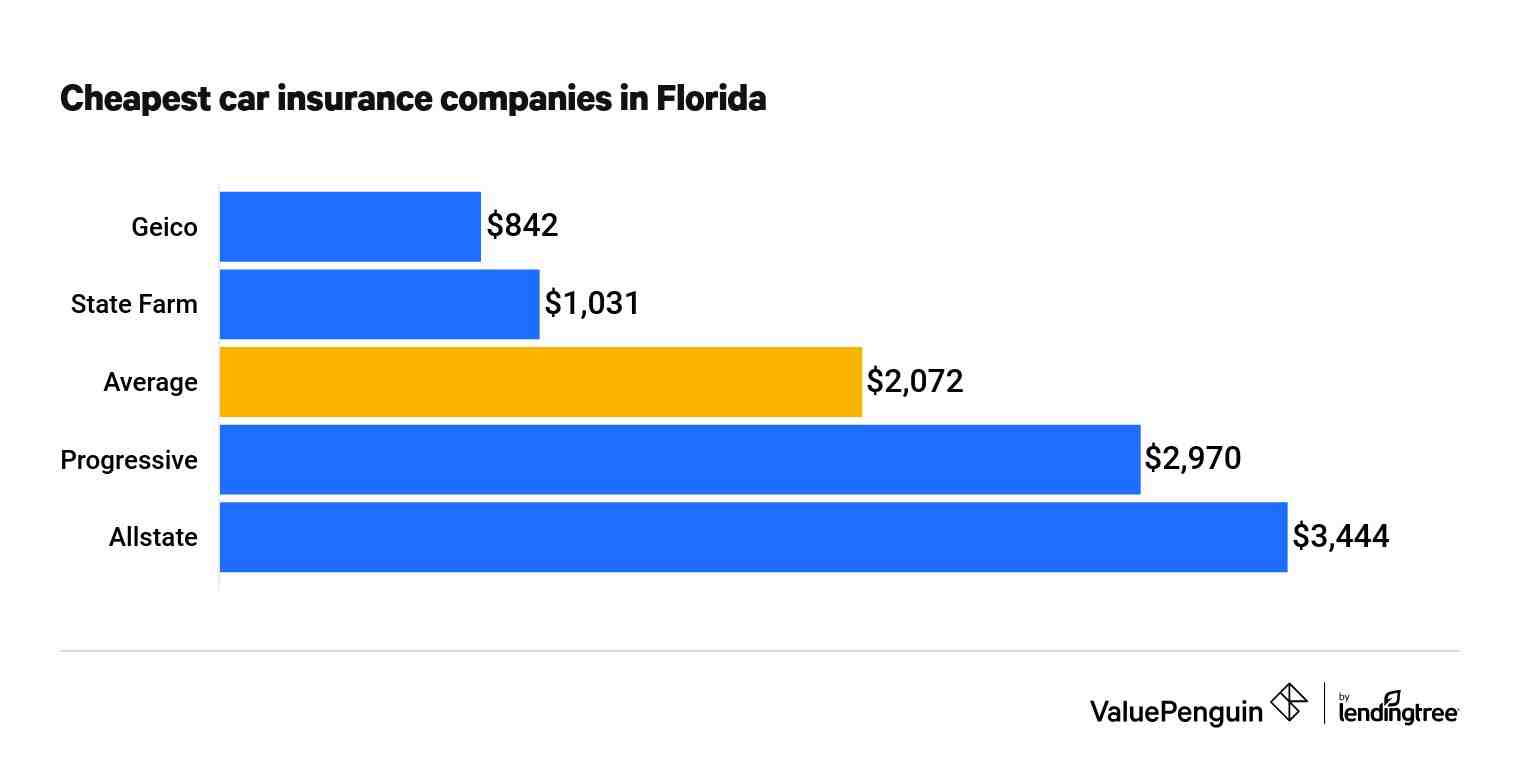

Louisiana is the most expensive state – owned car insurance full coverage at an average of $ 2,986 per year, followed by Florida and Nevada. Iowa is the cheapest state in terms of minimum coverage required, at an average annual car insurance rate of $ 237, followed by South Dakota and Idaho.

What is the cheapest car insurance type?

State-minimum liability coverage is the cheapest type of car insurance. Liability insurance alone is $ 1,333 cheaper on average than a full coverage policy.

What is the most expensive kind of insurance?

Full life insurance is considered to be the most expensive type of life insurance. Its premiums can be as much as five to 10 times more expensive than term life insurance premiums.

Which auto insurance company is the most expensive?

| Cover | Allstate | Geico |

|---|---|---|

| Minimum coverage car insurance | $ 1,135 | $ 780 |

| Full coverage | $ 3,405 | $ 2,017 |

| Full coverage with one accident | $ 5,227 | $ 3,194 |

Who has the most expensive insurance policy?

Back in 2014, an anonymous billionaire from Silicon Valley bought the world’s largest life insurance policy, paying around £ 148 million to protect his “significant” assets. Any theories about who he might be with?

What is the most expensive insurance policy?

Twwentieth Century Fox insured the feet of actress Betty Grables for $ 1 million each. What is remarkable is that this was during the 1940s – when a million dollars was equivalent to about a billion dollars today. Kim Kardashian’s back is insured for a reported $ 21 million dollar.

Who has the most expensive life insurance policy?

Guinness record holder: The most valuable life insurance policy ever sold, according to Guinness World Records, is worth a total of $ 201 million for the life of a prominent US billionaire living in the Silicon Valley area of California. actively known in the technology space.

How do I get a 10 million dollar life insurance policy?

For example, those under the age of 30 must make at least $ 250,000 (income × 40) per year to qualify for a 10-million dollar policy, and those in the 60s (income × 10) ) make a million a year. be eligible for the same coverage.

Is GEICO bigger than State Farm?

Comparison of State Farm and Geico State Farm is currently the largest car insurer in the U.S. according to the National Association of Insurance Commissioners (NAIC), followed closely by Geico. Both companies have a strong financial reputation and customer service ratings.

How big is Geico? A subsidiary of Berkshire Hathaway, Inc., GEICO has assets of more than $ 32 billion.

Who is the largest insurance company in the United States?

Prudential Financial was the largest insurance company in the United States in 2019, with total assets of just over 940 billion US dollars. Berkshire Hathaway and Metlife finished second and third, respectively.

What is the largest insurance company?

| Ranking | Name of Insurance Company | Domicile |

|---|---|---|

| 1 | UnitedHealth Group Incorporated (1) | United States |

| 2 | Ping An Ins (Group) Co. China Ltd. | China |

| 3 | AXA S.A. | France |

| 4 | Chinese Life Assurance Company (Group). | China |

What is the second largest insurance company in the United States?

Berkshire Hathaway Inc is the second largest insurer in the US in terms of total assets. It provides a wide range of property & casualty insurance and reinsurance services through many subsidiaries.

What is the number 1 insurance company in the world?

# 1 Berkshire Hathaway (BRK.) Provides primary insurance, as well as reinsurance on property and casualty risks through companies such as GEICO, Berkshire Hathaway Reinsurance Group, Berkshire Hathaway Primary Group, General Re, National Indemnity Company and others.

Is Geico a big insurance company?

Geico is the largest carrier of car insurance in nine states, with Allstate and MAPFRE responsible for one state each.

Who is the number 1 insurance company in America?

| Degree | Car insurance company | Market share% |

|---|---|---|

| 1 | State Farm | 16.73 |

| 2 | Allstate | 9.88 |

| 3 | Progressive | 9.71 |

| 4 | Geico (Berkshire Hathaway Inc. | 9.49 |

Where does Geico rank in insurance?

Geico ranks third on our list of top car insurance companies. Many respondents cite “solid service and coverage [options]” as reasons for awarding high scores, and Geico’s notable features include “ease of online policy administration” and other user-friendly features. car insurance policies.

Will Geico overtake State Farm?

According to Crain’s Chicago Business, if the average growth rates of both companies continue, GEICO State Farm will outperform the nation’s most significant car insurer in 2022.

Is State Farm overpriced?

Is State Farm Expensive? By our rates estimate, State Farm is one of the most affordable suppliers out there. We found that total coverage rates from State Farm were around $ 1,339 per year, making it cheaper than providers such as Progressive, Nationwide and Allstate on average.

Does State Farm own GEICO?

Read our advertiser disclosure for more information. Berkshire Hathaway-owned State Farm and GEICO are the largest and second largest insurance companies in the country, respectively. 1 Both of these providers offer more than a dozen types of insurance, including personal and business policies.

Is State Farm losing money?

State Farm returned $ 2 billion in premiums to car insurance customers, and its profits for 2020 fell 33.1%, to $ 3.7 billion. The 99-year-old Illinois-based company also incurred a $ 1.6 billion underwriting loss in its homeowners’ insurance business “due to significant disaster activity across the country.”