Geico insurance will increase by about 45% after your first accident resulting in compensation of $ 750 or more. If this is your second accident in less than three years, your insurance will increase at least twice as much, depending on the total cost of the damage.

Are people happy with GEICO?

Contents

- 1 Are people happy with GEICO?

- 2 Who owns GEICO?

- 3 Is GEICO even good?

- 4 Is GEICO good at settling claims?

Conclusion: Is Geico a good insurance company? Yes, Geico is a good insurance company for drivers of all kinds, as well as one of the best insurance companies in general. To see also : Is Geico really the cheapest?. In addition to personal and commercial car insurance policies, Geico offers several other types of coverage, including home and life insurance.

Why is GEICO so good? Geico’s success as an insurance company stemmed from offering independence to consumers and low prices, as well as launching effective advertising campaigns that highlight savings. Leading among the forces behind Geico’s success are innovative insurer and customer-tailored initiatives.

Is GEICO good at settling claims?

The jury found that GEICO did not act in bad faith by failing to resolve Linda Ford’s bodily injury lawsuit against Kristin Spiers. However, GEICO is still dealing with most of its personal injury claims. This may interest you : How can I get cheaper car insurance?. Below you will see that I have resolved many personal injury claims with GEICO.

How fast does GEICO settle claims?

We can’t pretend that the process of claiming a car insurance is fun, but we can promise to make it as carefree as possible. In fact, your request can be resolved in just 48 hours. We are proud to offer you personal attention 24 hours a day.

How long does it take GEICO to pay a claim?

The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.) Like most things in life, it works best when everyone is playing nicely and collaborating.

Does GEICO negotiate?

You have to keep in mind that GEICO claims that controllers are skilled in negotiation. Their job is to keep money in GEICO’s pockets. On the other hand, GEICO claims that should be resolved are likely to be resolved. Each side may have to give a little to reach an agreement, but that is the nature of the negotiations.

Is GEICO even good?

Yes, Geico is a good car insurance company for most drivers. … Furthermore, our customer satisfaction survey showed that Geico customers are among the most likely to recommend this company’s car insurance to friends and family. Read also : What is the lowest insurance group?. Geico took third place in our ranking of the best car insurance companies.

Is Geico an A rated insurance company?

Standard & Poor’s (S&P) has given all GEICO affiliates an AA rating for financial strength – a very strong rating. And GEICO earned the Standard & Poor’s Security Circle label. This means that GEICO has passed the most rigorous review of S&P and achieved top marks for financial strength.

Does Geico have a good reputation?

Geico has an A rating from the Better Business Bureau (BBB) and a financial strength rating from AM Best, indicating good business practice and superior ability to meet customer obligations. Customer reviews of Geico insurance are also generally positive.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for the minimum liability policy. It is 35% cheaper than the national average. The average cost of insuring a car with minimal coverage in California is $ 604 a year, or $ 50 a month.

Is GEICO an A rated insurance company?

Standard & Poor’s (S&P) has given all GEICO affiliates an AA rating for financial strength – a very strong rating. And GEICO earned the Standard & Poor’s Security Circle label. This means that GEICO has passed the most rigorous review of S&P and achieved top marks for financial strength.

Who owns GEICO?

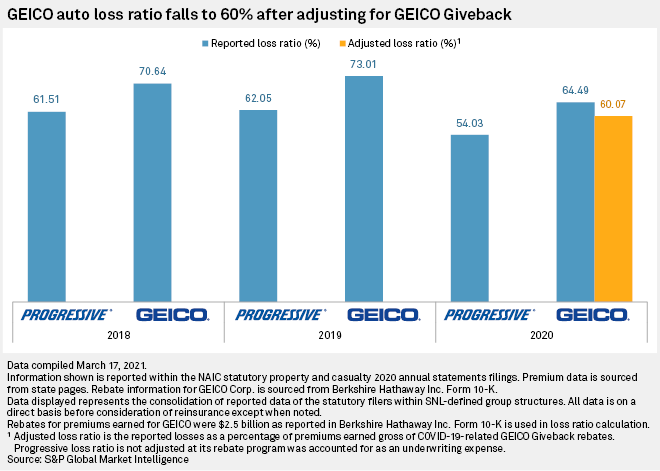

GEICO is a wholly owned subsidiary of Berkshire Hathaway that by 2017 provides coverage for more than 24 million motor vehicles owned by more than 15 million policyholders. GEICO writes private passenger car insurance in all 50 U.S. states and the District of Columbia.

Is Geico owned intact? Intact Financial Corporation completes acquisition of JEVCO Insurance Company.

Is Geico an American company?

The Civil Servants Insurance Company (GEICO / ˈɡaɪkoʊ) is a private American car insurance company based in Chevy Chase, Maryland. It is the second largest auto insurer in the United States, after State Farm.

Is GEICO owned by Allstate?

No, Geico is not owned by Allstate. Geico is a wholly-owned subsidiary of Berkshire Hathaway, which is a public company owned by its shareholders, while Allstate is a completely separate public company.

Is there GEICO in Canada?

Geico Insurance does not operate in Canada. They do not offer insurance policies to the Canadian market. However, American drivers with Geico car insurance are covered when driving in Canada. Your coverage is valid in Canada.

Where was GEICO founded?

Is GEICO even good?

Yes, Geico is a good car insurance company for most drivers. … Furthermore, our customer satisfaction survey showed that Geico customers are among the most likely to recommend this company’s car insurance to friends and family. Geico took third place in our ranking of the best car insurance companies.

Is Geico an A-rated insurance company? Standard & Poor’s (S&P) has given all GEICO affiliates an AA rating for financial strength – a very strong rating. And GEICO earned the Standard & Poor’s Security Circle label. This means that GEICO has passed the most rigorous review of S&P and achieved top marks for financial strength.

Does Geico have a good reputation?

Geico has an A rating from the Better Business Bureau (BBB) and a financial strength rating from AM Best, indicating good business practice and superior ability to meet customer obligations. Customer reviews of Geico insurance are also generally positive.

How does GEICO rank?

Geico received an overall satisfaction rating of 77 out of 100 from a group of its clients in a NerdWallet survey conducted online in July 2021. To put this into perspective, the average rating among seven insurers was 79 and the highest was 83.

Is Geico insurance a good company?

Yes, Geico is a good car insurance company for most drivers. Our annual car insurance rate study found that Geico is one of the cheapest car insurers in the country, ranked second on our list of cheapest insurance companies, and manages to keep premiums low while still offering good customer service.

Is GEICO an ethical company?

GEICO has been named a leader in ethical practices in the property / casualty industry. Berkshire Hathaway has been named a leader in ethical practices in the financial services industry.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $ 390 per year for the minimum liability policy. It is 35% cheaper than the national average. The average cost of insuring a car with minimal coverage in California is $ 604 a year, or $ 50 a month.

Does GEICO save you money?

Of course, one of the fastest ways to save money is to switch car insurance to GEICO. After all, it only takes 15 minutes to get an offer, and new GEICO customers say they save an average of over $ 500 a year.

Is GEICO the most expensive?

| Company | Average annual rate |

|---|---|

| Geico | $ 1,719 |

| State farm | $ 2,803 |

| National average | $ 2,227 |

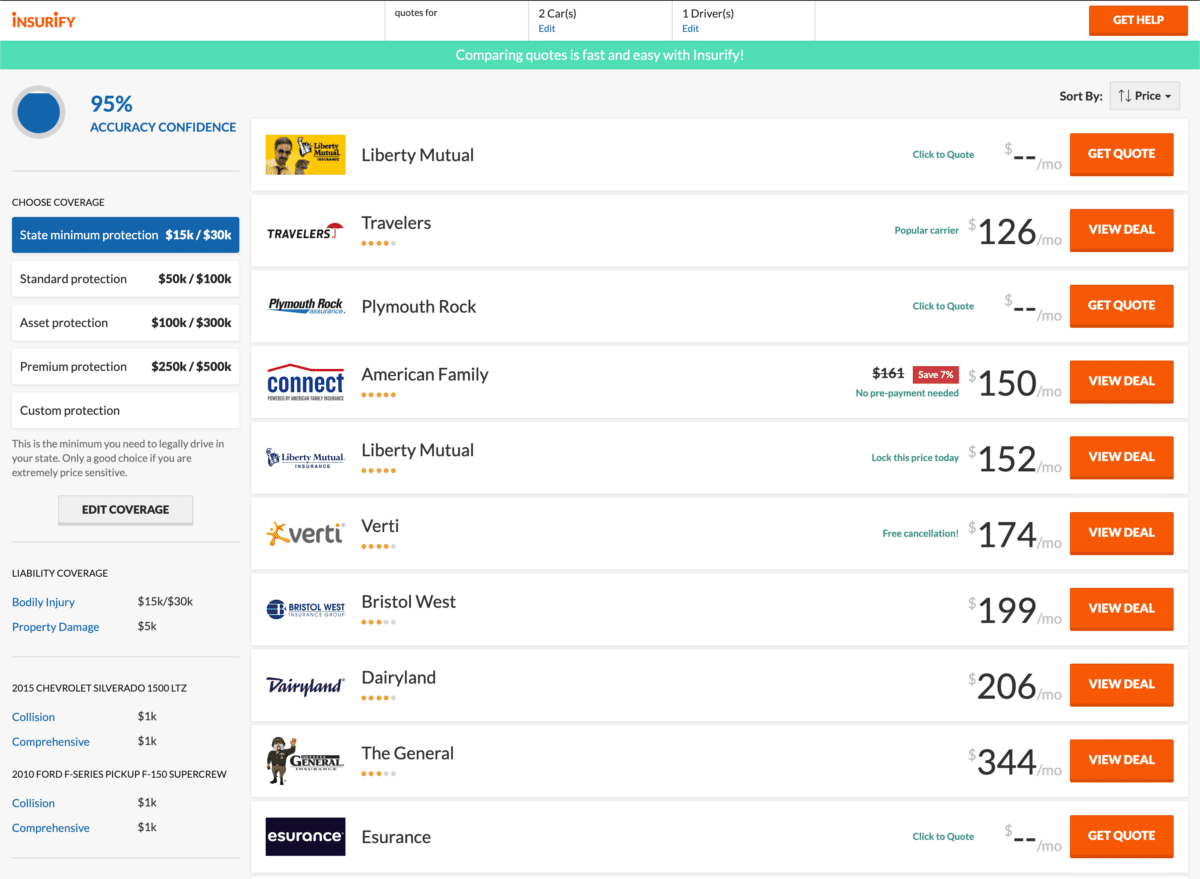

Is GEICO always the cheapest?

GEICO is cheap because it sells insurance directly to consumers and offers many discounts. GEICO, however, is not the cheapest fuse. For example, GEICO ranks 21st in terms of cheapest car insurance among 46 large companies, based on WalletHub’s review of GEICO car insurance for 2019.

Is GEICO good at settling claims?

The jury found that GEICO did not act in bad faith by failing to resolve Linda Ford’s bodily injury lawsuit against Kristin Spiers. However, GEICO is still dealing with most of its personal injury claims. Below you will see that I have resolved many personal injury claims with GEICO.

How much does GEICO need to pay the claim? The refund usually takes about six months, but sometimes it happens faster, depending on the circumstances. (GEICO claims are like snowflakes – they are all unique.) Like most things in life, it works best when everyone is playing nicely and collaborating.

Does GEICO negotiate?

You have to keep in mind that GEICO claims that controllers are skilled in negotiation. Their job is to keep money in GEICO’s pockets. On the other hand, GEICO claims that should be resolved are likely to be resolved. Each side may have to give a little to reach an agreement, but that is the nature of the negotiations.

How long does it take for GEICO to settle?

So adjust your expectations – for the better. Now work with GEICO! We can’t pretend that the process of claiming a car insurance is fun, but we can promise to make it as carefree as possible. In fact, your request can be resolved in just 48 hours.

Can you negotiate with your insurance company?

Although you cannot negotiate a car insurance rate, you are not contractually obliged to stay with your insurance company. If you find a cheaper price elsewhere, you can change your insurance provider. Depending on when you cancel and the fine print of your car insurance policy, you could charge fees.

Will GEICO lower my rate?

You can reduce the cost of Geico car insurance by, among other things, taking advantage of the Geico discount, opting for a larger franchise and improving your driving record. Some Geico discounts are worth as much as 40% off, and customers can apply more discounts on the policy to save even more.

How fast does GEICO settle claims?

We can’t pretend that the process of claiming a car insurance is fun, but we can promise to make it as carefree as possible. In fact, your request can be resolved in just 48 hours. We are proud to offer you personal attention 24 hours a day.

How long does it take to get a check from GEICO?

Checks are sent by mail within 48 hours of the completion of the accident investigation. If you experience an accident, you can initiate the GEICO claim process by submitting a claim online at geico.com or by calling (800) 841-3000 at any time. Receivables representatives are available 24/7.

How long does it take GEICO to send an adjuster?

Record your damage from several angles and place them at your request (we will guide you). 3. The carrier will review the photos, write an estimate and make the payment in just one business day.

Why is my car accident settlement taking so long from GEICO?

Many times it takes months for these settlements to arrive, and there may be an unnecessary struggle over guilt and responsibility, as well as a debate over the amount of damages sought. Geico is one such insurance company that is known for taking a long time to settle claims.

Is GEICO good about paying claims?

Geico’s claims process is more in line with the industry average. The company received a score of 881 out of a possible 1,000 points in J.D. Power’s 2021 car satisfaction study (average was 882). This is 10 points more than Geico scored in the same 2020 study.

Does GEICO deny claims?

Sometimes applications for GEICO car insurance are rejected for a legitimate reason. In many cases, however, the insured receives a letter of refusal that seems irrelevant to the specific claim you submitted. It is possible that you are dealing with a denial of a request in bad faith.