Lawmakers advance car insurance bill package despite affordability concerns

A New Jersey Senate panel has advanced a legislative package to strengthen insurance coverage for victims of vehicle accidents – but critics warn it would increase premiums so high, low-income drivers could completely dump and uninsured insurance.

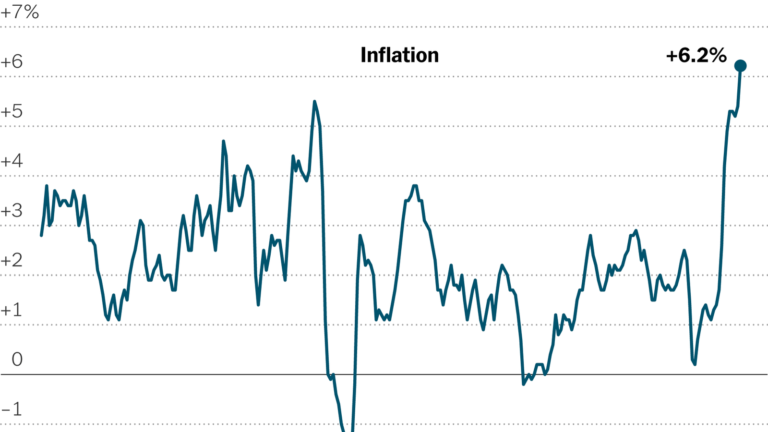

Most of those who heard about it during the nearly three-hour period warned that mandating more insurance coverage would hurt people already struggling with rising inflation, high gas prices, and other economic failures from the pandemic.

The bill, which sparked some of the liveliest debates, would increase the minimum amount of personal injury protection drivers who carry basic and standard auto insurance policies to $ 250,000. That is 16 times higher than the minimum $ 15,000 now required.

Gary LaSpisa, vice president of the New Jersey Insurance Board, said that this change affects approximately 46% of all New Jersey drivers who now opt for less coverage.

Another bill would prevent drivers from relying on their health insurance coverage for personal injury protection. That would affect 1.27 million drivers, LaSpisa said.

Combined, the two bills would lead to “excessive” premium increases and force drivers to get more insurance than they need or can afford, he said.

Chuck Bell of Consumer Reports estimates that the two bills could increase rates by as much as 90%.

“People will not be able to handle such sharp increases, and as a consequence, many more people will be driving without coverage,” Bell said. “Many of them will be drivers of color, who will then be subject to a traffic stop by the police. This is really going in the wrong direction, especially with inflation.

Rory Whelan, regional vice president of the National Association of Mutual Insurance Companies, reminded lawmakers that New Jersey now has the fewest uninsured drivers in the nation. He warned them that the bills would “turn back the clock” on the progress the state had made in ensuring that car insurance remained affordable for all drivers.

“Why would you want to increase premiums for average New Jersey drivers when inflation is at a record high, even if buying a car is more expensive? Repairing a car is more expensive. Supply chain problems add to the cost,” he said. Whelan. “This is the absolutely wrong time to raise premiums on New Jersey drivers.”

Sen. Jon Bramnick (R-Union), a committee member, said crash victims too often receive inadequate compensation for the injuries or property damage they suffer. Bramnick is a personal injury lawyer.

“During this process, we did not really focus our attention on the injured party and the consequences of low rates,” Bramnick said. “I understand the impact of insurance rates. I understand the costs. But we also talk about two issues – one, the victim and what the victim should be entitled to, and prices. And as long as we balance the two, we can have a discussion. But if that victim is no longer part of the discussion, then we do not have a discussion.

Senate President Nicholas Scutari, who sponsored eight of the nine bills, said New Jersey’s minimum coverage limits are the lowest in the country – and have not been raised in 50 years.

“We are long in favor of reforms,” Scutari said in a statement. “We need stronger consumer protection so that insurance holders are not denied the rights and compensation they deserve.”

Lawyers told the Senate panel that drivers who have low incomes and come from color communities are already paying more than they should for car insurance.

Instead of basing car insurance rates on a motorist’s driving history and safety record, many insurers use education, occupation, and consumer credit to determine rates. This means they often charge higher premiums for those who are least likely to afford them: poor and non-white drivers.

Some legislators have introduced bills in the last two legislative sessions to solve this problem, but they have not happened. It was reintroduced to the Assembly in January, but remains discontinued.

Maura Collinsgru, director of politics and advocacy at New Jersey Citizen Action, urged committee members to act on the bill instead.

Most of the five members of the committee voted to advance all nine bills. His Robert Singer (R-Ocean) opposed any measure, citing affordability concerns.

Advancing from a bill lawmakers would increase the minimum liability coverage for commercial vehicles to $ 1.5 million, Singer said: “This will destroy small business owners. I think we are not taking care of small businesses.

GET THE MORNING IN THE MORNING AND DELIVERED IN YOUR INBOX

GET THE MORNING IN THE MORNING AND DELIVERED IN YOUR INBOX

Our stories can be published online or in print under Creative Commons license CC BY-NC-ND 4.0. We only ask you to change or shorten style, provide the right attribution and link to our website. Kuckt w.e.g. our Republican guidelines for the use of photos and graphics.