Major auto insurance companies are getting out of California

On Your Side: California’s auto insurance crisis

Major auto insurers are pulling back in the California market because they say our drivers are too expensive to insure.

Californians are driving around as much as they did before the pandemic, but probably not as well.

Car accidents are on the rise and some insurance companies say they are paying out more than they are taking in. But, the insurance commissioner says the facts do not support their claims.

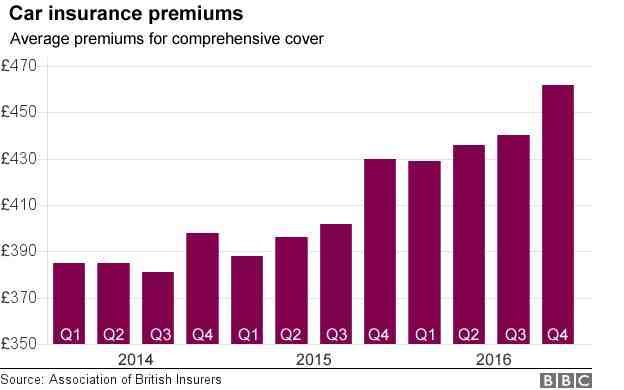

Between 2020 and 2021, auto insurance losses increased by 25% while premiums increased by only 4.5%, according to the Property Casualty Insurance Association of America. The rate and severity of car accidents is up as well as the costs to pay.

“The cost to rent a car has risen 33% and the cost for a new vehicle is up 11%,” said Denny Ritter, Property Casualty Insurance Association of America.

In California, some insurers have not seen a rate increase approved by the insurance commissioner in over 3 years.

“What we’ve seen is that you have insurers paying out more in claims than they take in with premiums. That’s not a sustainable business model,” Ritter said.

California is a very consumer friendly state and insurers must have any rate increase approved. State Farm, AllState and Farmer’s are asking the California Department of Insurance for a nearly 7% premium increase. Progressive is asking for more than 19%. A local agent says insurers are now making it harder for him to get new auto policies for drivers.

“They might ask you to pay in full instead of getting a payment plan. Right now, all the carriers I can even think of have restrictions. They literally say, don’t write please,” said Karl Susman of Susman Insurance.

Geico has closed all of its offices in California and Progressive has stopped advertising in the state.

“State Farm, you can’t get quotes by calling them anymore. You have to go to an agent’s office,” Susman said.

A spokesman for the Insurance Commissioner said “while insurance companies are focused on increasing rates, the insurance department is focused on protecting drivers and helping them get the most value from the premiums they pay.”

His office notes that the commissioner saved California $2.4 billion in reduced premiums during the height of the covid stay-at-home order — when the industry was still raking in $42 billion in excess premiums.

Insurers can’t refuse to insure California because we’re a “take-all market,” but agents say they have to go with smaller, lesser-known carriers if clients need insurance quickly.

The KCAL News Staff is a group of experienced journalists who bring you the content on KCALNews.com and CBSLA.com.

Create your free account or login for more features.

Enter an email address to continue

Please enter a valid email address to continue

What is the wealthiest insurance company?

Contents [hide]

- 1 What is the wealthiest insurance company?

- 2 What is the recommended car insurance coverage in California?

- 3 What are the top 5 insurance rating agencies?

- 4 What happened to GEICO in California?

What is the richest insurance company? On the same subject : How are car insurance rates determined? | Chase.

Who is the top five insurance company?

State Farm is the leading auto insurer in the United States, followed by Geico, Progressive, Allstate and USAA. State Farm has a 16% market share for car insurance, and the company sells policies online as well as through agents nationwide.

What are the top 5 insurance rating agencies? Read also : Comprehensive car insurance: What you need to know.

Five independent agencies with A.M. Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody’s and Standard & Poor’s rate the financial strength of insurance companies. Each has its own rating scale, its own rating standards, its own population of rated companies, and its own distribution of companies across its scale.

What is the #1 insurance company?

According to our 2022 data, USAA is the top car insurance company, but its insurance products are only available to members of the military community. If that doesn’t apply to you, the next best option is State Farm, which holds number 2 in our analysis.

What is the best car insurance right now?

The best car insurance companies:

- USA.

- Clear cover.

- Geico.

- State Farm.

- Passengers.

- Erie.

- Auto-Owners.

- Amica.

Who is the top 10 insurance company?

Top 10 Insurance Companies in India – Overview To see also : Texas home and auto insurance prices are rising fast.

- 4) Bajaj Allianz Life Insurance Company.

- 5) HDFC Life Insurance Company.

- 6) LIC Life Insurance Company.

- 7) Pramerica Life Insurance Company.

- 8) Exide Life Insurance Company.

- 9) Kotak Mahindra Life Insurance Company.

- 10) Reliance Nippon Life Insurance Company.

What is the #1 insurance company?

According to our 2022 data, USAA is the top car insurance company, but its insurance products are only available to members of the military community. If that doesn’t apply to you, the next best option is State Farm, which holds number 2 in our analysis.

Who is the leading insurance company in the US?

What are the biggest auto insurance companies? Progressive is the No. 1 auto insurance company in the country by market share, followed by State Farm, Geico and Allstate.

What is the recommended car insurance coverage in California?

Most financial experts recommend raising your liability to $50,000 per person and $100,000 per accident if you have few assets. With more assets – such as a house, an expensive car, or large amounts of savings – experts recommend increasing your coverage to at least $100,000 per person and $300,000 per accident.

Is $200 a lot for car insurance? Yes, $200 a month for car insurance is quite expensive, especially for minimum coverage. The average cost of car insurance ranges from about $60 per month for the state minimum to $166 per month for full coverage.

What is California’s average car insurance monthly rate?

The average cost of car insurance in California is $1,429 per year or $119 per month. It ranks 38th among states, with number 1 the cheapest. The factors that affect it the most are the age of the driver and the amount of coverage they buy. Car insurance rates in California can also vary depending on where you live.

Is it cheaper to pay car insurance every 6 months or monthly?

In most cases, a six month policy is going to be cheaper than a 12 month policy because you are paying for cover over a shorter period of time. However, if you compare your car insurance price on a monthly basis, it may not be much different between a six month policy and a 12 month policy.

How much is the minimum car insurance in California?

These are the minimum liability insurance requirements (per California Insurance Code §11580.1b): $15,000 for injury/death to one person. $30,000 for injury/death to more than one person. $5,000 for property damage.

How Much Is Most car insurance a month?

The cost of car insurance per month generally ranges between $110 and $130, depending on various factors including geographic location, car make and model, driving history, and more. However, car insurance costs also depend on factors such as gender, marital status and age.

What is considered full coverage car insurance in California?

Drivers who buy or lease a vehicle in California usually have to pay for full coverage under the terms of their leases or auto loans. Full coverage includes comprehensive, collision and liability insurance. You will be protected against car accidents as well as losses caused by vandalism, extreme weather, fire or theft.

Do you need full coverage on a financed car in California?

Yes, all vehicle financers must maintain fully insured car insurance for the life of their loan. The borrower still technically owns any vehicle that still has a balance left on the loan. Lenders require clients to maintain full coverage auto insurance to protect their investment.

What does full coverage car insurance consist of?

Full coverage car insurance is a term that describes having all the main parts of car insurance including Bodily Injury, Property Damage, Uninsured Motorist, PIP, Collision and Comprehensive. You are usually legally required to carry about half of those covers.

What is the difference between full coverage and liability car insurance?

Liability insurance covers injuries and damage to others when you are at fault. Full coverage often refers to liability and other coverages required by the state along with damage to your car (comprehensive and collision), but it is not actual insurance.

What auto insurance coverage should I have in California?

California liability insurance In California, you will need bodily injury coverage of at least $15,000 per person and $30,000 per accident. Property damage liability insurance: This insurance pays to repair the other party’s vehicle, up to $5,000 per accident, if you are at fault.

Do I need uninsured motorist coverage if I have collision and comprehensive in California?

Yes, you need uninsured motorist coverage even if you have collision and comprehensive coverage. Collision insurance will pay to repair your vehicle if you’re hit by an uninsured driver, but it won’t pay for any of your medical expenses, and comprehensive insurance won’t cover your expenses at all after a.

What are the 3 types of auto coverage?

Types of Car Insurance

- Coverage of liability. Protects you if you cause damage to others and/or their belongings. …

- Collision coverage. Covers your car if you hit another car, person or non-moving object (like the decorative rocks cousin Todd has at the end of his driveway). #…

- Comprehensive coverage.

How much uninsured motorist coverage do I need in California?

We recommend a minimum of $100,000 in SU coverage. Please note that you will be required to carry liability insurance equal to or higher than the uninsured/underinsured motorist insurance you receive.

What are the top 5 insurance rating agencies?

Five independent agencies with A.M. Best, Fitch, Kroll Bond Rating Agency (KBRA), Moody’s and Standard & Poor’s rate the financial strength of insurance companies. Each has its own rating scale, its own rating standards, its own population of rated companies, and its own distribution of companies across its scale.

What services insurance rating is AAA the highest? When evaluating the financial strength of a life insurance company, you will notice that the financial ratings of the different rating agencies vary….Standard and Poor’s has 21 rating categories, including:

- AAA, Extremely Strong.

- AA, Very Strong.

- A, Strong.

- BBB, Good.

- BB, marginal.

- B, Weak.

- CCC, Very Weak.

- CC, Extremely weak.

Which insurance company rating service is most accurate?

Insurance companies are subject to financial ratings which attempt to describe how financially stable they are. The most prominent financial rating agency for insurance companies is A.M. Best, although the big credit agencies all look at insurers, too.

Who is the top five insurance company?

State Farm is the leading auto insurer in the United States, followed by Geico, Progressive, Allstate and USAA. State Farm has a 16% market share for car insurance, and the company sells policies online as well as through agents nationwide.

What is the #1 insurance company?

According to our 2022 data, USAA is the top car insurance company, but its insurance products are only available to members of the military community. If that doesn’t apply to you, the next best option is State Farm, which holds number 2 in our analysis.

What are the four main insurance rating companies?

The four major insurance company rating agencies in the United States are A.M. Best, Moody’s, Standard & Poor’s, and Fitch.

What are the different ratings for insurance companies?

The Financial Strength Ratings (FSR) represent AMBest’s rating of an insurer’s ability to meet its obligations to policyholders. The rating scale consists of six ‘Safe’ grades: A, A (Advanced) A, Aâ (Excellent), and B and B (Very Good). The rating scale also includes six ‘vulnerable’ grades.

What insurance company has the best ratings?

US News Rating USAA is the best insurance company in our ratings. According to our 2023 survey, USAA customers report the highest level of customer satisfaction and are most likely to renew their policies and recommend USAA to other drivers.

What happened to GEICO in California?

GEICO has closed all 38 of its California offices that sell auto and homeowners policies and other lines.

Which insurance companies are leaving California? Major insurance companies are exiting/reducing underwriting in California due to California regulations and fire exposure. AIG and Chubb, two major insurance companies, are in the process of notifying homeowners that they will not renew some home coverage.

Why is GEICO laying off employees?

As reported by Ad Age, GEICO’s staff cuts come after a series of challenges – the insurer recently announced that it will raise rates in Illinois by 6% and close 38 of its offices in California, halting insurance sales in the state.

Is GEICO insurance company going out of business?

GEICO is Closing All Offices in California.

Why would a company decide to lay off employees?

The most common reasons why employees are laid off include cost cutting, downsizing, relocation, buyouts, and mergers. However, company owners can choose other options instead of terminating their employees’ contracts.

How many employees did GEICO layoff?

GEICO has closed its insurance offices in California. All 38 of them.

What is going on with GEICO in California?

The company has closed all 38 of its California offices. Geico is going all digital with its insurance policies in California.

Is GEICO insurance closing in California?

There is no impact on claims, and our claims team remains available to assist all customers, the company told RDN. “We continue to write policies in California, and we continue to be available through our direct channels for the more than 2.18 million California customers currently insured with us,” the carrier said.

Is GEICO good in California?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $31 per month for a minimum liability policy. That is 36% cheaper than the state average. The average cost of minimum coverage car insurance in California is $49 per month, or $587 per year.

Why is GEICO shutting down in California?

The Chronicle reports that insurance industry magazines are linking Geico’s decision to close California sales offices to its failure to raise insurance prices in line with Sacramento regulations and other market forces.

Is GEICO good in California?

Geico has the cheapest car insurance for most drivers in California. The company charges an average of $31 per month for a minimum liability policy. That is 36% cheaper than the state average. The average cost of minimum coverage car insurance in California is $49 per month, or $587 per year.

Is GEICO no longer in California?

GEICO is Closing All Offices in California.

Is GEICO a good car insurance for California?

GEICO offers the best cheap car insurance in California for an average of $521 per year. The company also ranks first for user satisfaction but third for claims.