Ohio car insurance rates are rising

A Beacon Journal colleague recently lamented that his six-month auto insurance premium went up 17%, even though he had no claims, tickets or other changes in his family’s driving patterns.

His insurance agent said car insurance rates were going up across the country.

So I contacted both Dean Fadel, president of the Ohio Insurance Institute, the trade group for the state’s property and casualty insurers, and Robert Denhard, spokesman for the Ohio Department of Insurance, to find out what was going on.

Yes, according to the Ohio Department of Insurance. After two years of average auto insurance rate declines in 2019 and 2020, there was an average rate increase of 2.7% in 2021, Denhard said. This is according to data from the state’s 10 largest insurance groups, which make up 80% of the market, he said.

Denhard provided data for 10 years up to and including 2021 (2022 data not yet available). Average rates were up anywhere from a low of 0.5% (2018) to a high of 3.5% (2017) before falling to -1.7% in 2019, -3.7% in 2020 and then a increase of 2.7% in 2021. Various factors. can affect auto insurance rates, including driving behavior, driving violations, number of drives, vehicle type, claim activity, repair and material costs and medical costs, Denhard said.

Fadel said insurance prices are “driven by the economy. When you look at what it costs to replace a vehicle now (with supply chain issues and price increases) versus what it might have cost two years ago or even last year, it’s a lot more .

“Say your car breaks down and you need a rental car. Renting a car is going to last a lot longer because it will take longer to replace or repair the car. Parts are also more expensive. Cars are generally more expensive,” Fadel said. “If your car is totaled, it’s going to cost a little more than it did even a couple of years ago to get into a new car.”

There are pricing standards that must be approved by the Ohio Department of Insurance for each company, Fadel said.

Have they had demands or changes due to rising costs?

“We’re all putting money in a pot and the hope is that only a few people have to pull out of it,” Fadel said.

Fadel also pointed out that when the COVID-19 pandemic hit, most insurance companies issued some refunds or credits because there were fewer cars on the road.

“But what happened was that while there was less driving, it didn’t necessarily lead to lower claims costs because what happened was people still wrecked their cars,” he said. Someone was driving out of control, he said.

“On my commute when I got downtown, right after things closed, I felt like I-670 in Columbus was like I was driving the German Autobahn,” Fadel said. “Literally, cars were going 100 kilometers an hour just zooming past me, and what that translated to is increased severity of the accidents. So those costs went up a lot.”

Then the rising costs associated with supply chain issues were added, he said.

prices compared to what is happening nationally?

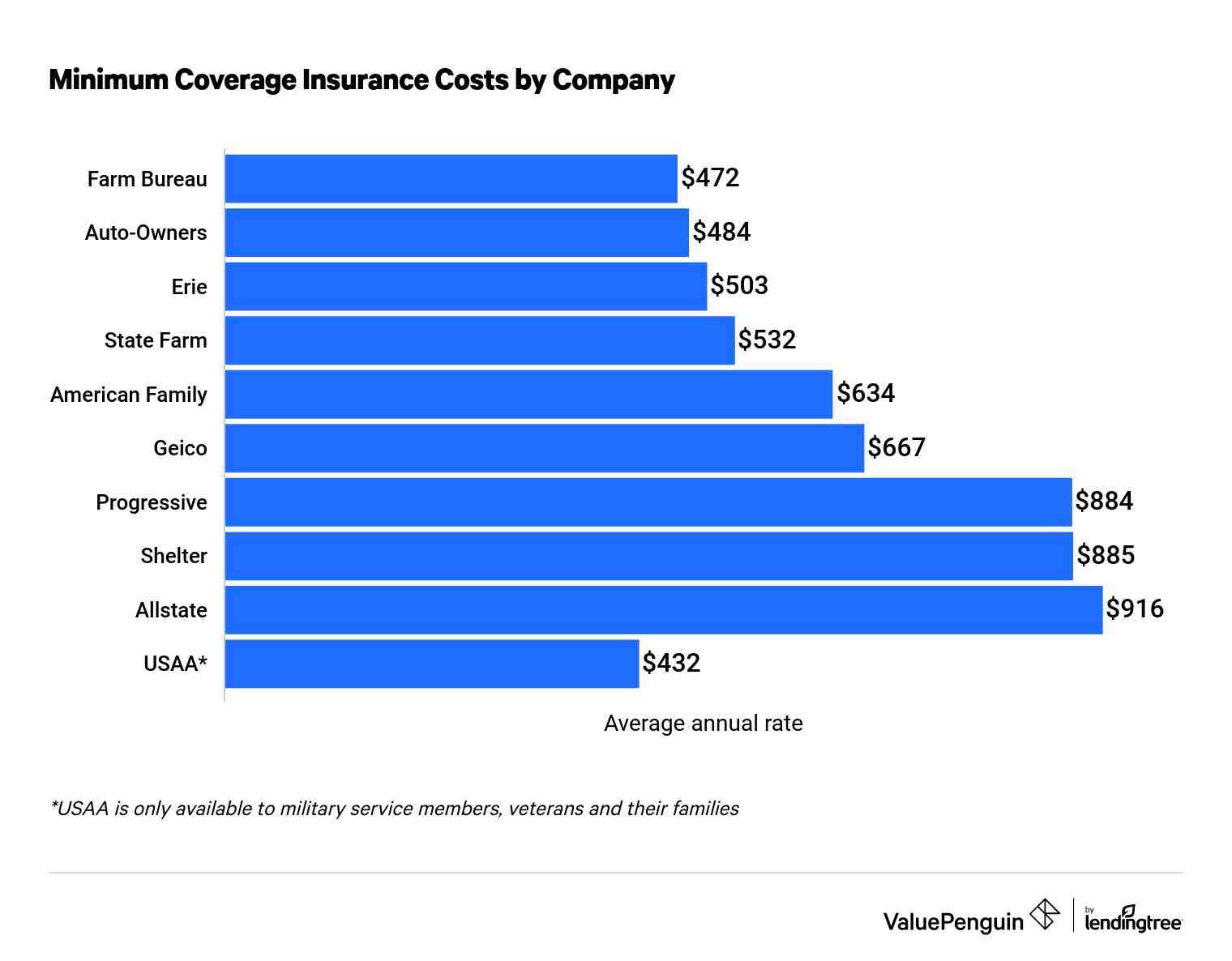

Historically, Ohio has one of the lowest average auto insurance premiums in the country, Denhard said. Ohioans paid an average of $802 — 11th lowest in the nation — for auto insurance in 2019, according to the most recent data available from the National Association of Insurance Commissioners. The national average was $1,070.

Should consumers, especially workers whose jobs have become more remote or hybrid since the pandemic, contact their insurer to reevaluate their coverage?

Yes, according to Fadel and Denhard.

“While driving activity has increased for many people, some may have changed their driving frequency,” Denhard said. “Most companies consider miles driven as a factor when calculating premiums. Some companies monitor when, where and how far a person drives to determine the cost of insurance. If a person’s driving frequency has changed significantly, they should talk to their insurance agent or company to see if there are options to reduce the premium amount.”

Fadel agreed that people should inform the agent about changes in driving, commuting and where they park their car.

“That’s where the agent plays a valuable role for the consumer,” he said.

Are there potentially similar increases for home insurance?

Yes, said Fadel. Lumber, labor and roofing supplies have gone up in price, which means the cost of replacing damage has also increased.

Fadel said he doesn’t have a crystal ball, so he doesn’t know what’s going to happen to the economy.

“But I can tell you that we are one of the most competitive markets and when companies are able to lower prices, they do it because they want to gain as much market share as they can,” he said.

Fadel warned consumers against being underinsured.

“Insurance to some extent is like anything else; you get what you pay for. So make sure you look at your coverage and understand the scope of coverage,” he said. “You can put yourself more at risk by saving a couple of hundred dollars.

“I would just caution people to be careful and make sure they work with an agent and that they have adequate coverage to meet their individual needs.”

Fadel suggested an annual check with your agent on your auto and homeowner’s insurance needs, especially if you’ve done any kind of upgrades or renovations to your house. Denhard said consumers with insurance concerns or questions can contact the Ohio Department of Insurance at 800-686-1526, [email protected] and via www.insurance.ohio.gov.

Beacon Journal staff reporter Betty Lin-Fisher can be reached at 330-996-3724 or [email protected]. Follow her @blinfisherABJ on Twitter or www.facebook.com/BettyLinFisherABJ To see her latest stories and columns, go to www.tinyurl.com/bettylinfisher

Does the age of the car affect the car insurance? Yes, a car’s value decreases as it ages, meaning your insurance company doesn’t have to pay out as much after an accident. Because of this, insurance rates can go down, helping many drivers with older vehicles save money.

Did car insurance go up with inflation?

Contents

- 1 Did car insurance go up with inflation?

- 2 Why did insurance rates go up 2022?

- 3 Can insurance companies increase premium renewal?

Drivers have seen a steady increase for motor insurance with prices in September 10. To see also : Do all auto insurance companies check credit?.3% higher than the same month last year, according to the Bureau of Labor Statistics’ latest Consumer Price Index reading.

Why did my car insurance go up suddenly? Car accidents and traffic violations are common explanations for insurance price increases, but there are other reasons for car insurance premiums to increase, including a change of address, new vehicle and claims in your zip code.

Insurance premiums remained stable in 2022, the study shows. To see also : 2022 Car Insurance Overview – Forbes Advisor.

How much have healthcare costs increased 2022?

PwC’s Health Research Institute (HRI) projects a medical cost trend of 6.5% in 2022, slightly lower than the 7% medical cost trend in 2021 and slightly higher than it was between 2016 and 2020.

The average annual premiums in 2022 are $7,911 for single coverage and $22,463 for family coverage. These amounts are equal to the 2021 premiums ($7,739 for single coverage and $22,221 for family coverage). The average family premium has increased by 20% since 2017 and 43% since 2012.

Why is car insurance higher in 2022?

Repair costs â Supply chain disruptions, higher auto parts prices and labor shortages lead to increased costs to repair your car and, in turn, higher insurance rates. Vehicle repair costs were 8.1% higher in July 2022 than in July 2021, according to the U.S. Bureau of Labor Statistics.

Did car insurance go up because of inflation?

Inflation causes higher prices in all industries, including auto insurance. This may interest you : What do the three insurance numbers mean?.

Are insurance rates going up because of inflation?

Insurance and Inflation If these costs increase, the price of insurance premiums is likely to increase as well. Unfortunately, these costs increase due to inflation. Building materials for housing are more expensive, there is a shortage of air which increases the prices of cars, and there is also a shortage of labour.

Does inflation affect insurance prices?

Insurance companies deal with increasing claim payouts, expenses and higher operating costs during periods of high inflation. In order for insurance companies to cover these rising costs, they often increase premiums, which directly affects the insured and harms consumers.

Does inflation affect insurance prices?

Insurance companies deal with increasing claim payouts, expenses and higher operating costs during periods of high inflation. In order for insurance companies to cover these rising costs, they often increase premiums, which directly affects the insured and harms consumers.

How is insurance affected by inflation?

Like many aspects of daily life, inflation also affects the insurance industry. An increase in premium costs leads to increased insurance purchases among policyholders, with more interest in telematics to reduce insurance costs. Damage costs also increase with the supply chain and inflationary pressure.

Is inflation good for insurance companies?

Claims costs will continue to rise due to disruptions in global commodity markets, but moderate general inflation may prevent insurers from increasing premiums for customers. The result could be a sharp decline in insurance capacity and a tough market with stricter insurance standards.

Why did insurance rates go up 2022?

Repair costs â Supply chain disruptions, higher auto parts prices and labor shortages lead to increased costs to repair your car and, in turn, higher insurance rates. Vehicle repair costs were 8.1% higher in July 2022 than in July 2021, according to the U.S. Bureau of Labor Statistics.

Will insurance premiums go up in 2022? Insurance premiums remained stable in 2022, the study shows.

Why did home insurance go up 2022?

Insurers are raising rates to cover billions of dollars in losses from worsening climate disasters, and rising inflation means homes require more home insurance to pay for rebuilding costs. The combination of these factors has resulted in some pretty drastic rate increases in 2022.

Why have homeowners insurance rates gone up so much?

Sky-high inflation is one of the main reasons behind the premium increase. Home insurance coverage is based on the cost of rebuilding your home, and that may have increased drastically as the price of many building materials has risen and supply chain issues have made the construction process more expensive.

Can insurance raise rates for no reason?

The insurance companies take factors beyond the car and personal driving habits when determining the price. For example, the following factors can cause your insurance bill to rise for seemingly no reason at all: Crime rate. Increased accidents – often from distracted drivers.

Why are insurance companies allowed to raise rates?

If an insurance company has taken on additional risk, or has seen an increase in claims from a previous year, they may raise rates to ensure adequate reserves.

Why did my car insurance go up when nothing changed?

It is also possible for the car insurance to go up without changes to the driving history or the policy. If it seems like your rates have gone up for no reason, it could be because the company had to pay out a lot of insurance claims at once (like after a hurricane) or because things are generally more expensive.

Why might insurance rates increase without any changes to a policy?

There are some things that are out of your control but can still affect your premium, including: rising repair costs, an increase in distracted drivers on the road, more drivers on the road, higher speed limits in your geographic area, and an increase in uninsured drivers.

Despite popular belief, health insurance premiums do not necessarily increase every year. This means that there is no official rule that your health insurance provider has the right to charge you an additional premium at each renewal.

Can a life insurance company increase your premium? The premium is guaranteed not to increase during the term. The longer the term, the higher the premium because the older, more expensive to insure years are factored into the premium. At the end of the term, your premium can increase dramatically.

Generally, when you make a claim against your policy over a specific amount due to an event that is primarily your fault, an insurance company will increase your premium by a certain percentage.

Let’s look at the reasons why your car insurance premium may increase over the years. These can include making a new claim or having a traffic violation added to your driving record, adding or changing a vehicle, adding or changing a driver and increasing your coverage.

What is the 80/20 rule in insurance?

The 80/20 rule generally requires insurers to spend at least 80% of the money they collect from premiums on healthcare costs and quality improvement activities. The other 20% can go towards administrative, overhead and marketing costs. The 80/20 rule is sometimes known as the Medical Loss Ratio, or MLR.

Is it normal for insurance to increase every year?

Annual increases are typical across the industry, but the way your risk factors are viewed by a particular company can vary. Understand your coverage and discounts to ensure you get the best price for the insurance you need.