Similar Posts

Car insurers secretly collect driver data using phone apps: report

Does Drivewise know if I’m speeding?Contents1 Does Drivewise know if I’m speeding?1.1 Does Drivewise penalize you for speeding?1.2 How does Drivewise know if I’m driving?2 Are car insurance trackers worth it?2.1 Do I need a vehicle tracking system?2.1.1 Should I get a tracking device for my car?2.1.2 Do all GPS trackers require a monthly fee?2.1.3…

Satisfied with Car Insurance Bills, Drivers Shift Gears

Does credit score affect car insurance?Contents1 Does credit score affect car insurance?1.1 Does Geico use credit scores?1.1.1 Does Geico look at credit scores?1.1.2 What is a good credit score for insurance?1.1.3 Why is my car insurance so high in Geico?1.2 How to improve auto insurance score?1.2.1 Why is my insurance score so low?1.2.2 How can…

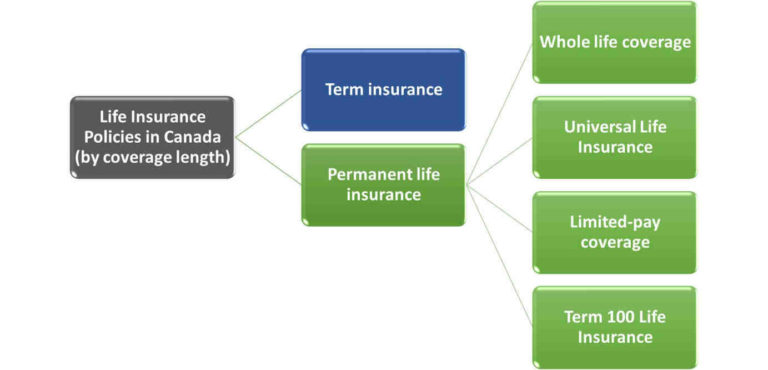

What are different types of insurance?

What are the 6 types of insurance?Contents1 What are the 6 types of insurance?1.1 What are the 4 basic types of insurance?1.1.1 What are basics of insurance?1.1.2 What are the 5 types of insurance?1.1.3 What is the type of insurance?2 How many insurance types are there?2.1 How many insurance companies are there in Egypt?2.1.1 How…

2022 Car Insurance Overview – Forbes Advisor

Editorial Note: We earn commissions from affiliate links on Forbes Advisor. Commissions do not affect the opinions or ratings of our editors. A general can be an option if you have trouble finding insurance because of your driver’s record or poor creditworthiness. By the way, with its high level of complaints and limited coverage of…

Class-action lawsuit claiming Geico overcharged for auto insurance to move forward

A federal judge has allowed a lawsuit against Geico Corp. proceed as a class action. Geico overcharged more than two million drivers in California for car insurance in the early months of the COVID-19 pandemic, it claims. At the beginning of the pandemic, some of the strictest quarantines were introduced. This led to forced changes…