Black Friday and Cyber Monday have come and gone, and you’ve made the move-or-lose decision on a new TV or laptop at a steeply reduced price. Right now, you’re probably thinking about your New Year’s resolutions. Re-evaluating work-life balance, finances and physical health could be at the top of your list.

One item that may not be: Ensure you have the best car insurance. We know you’re probably busy, and you may have even set up “auto-renewal” on your car insurance. You shopped years ago, found effective and cheap auto insurance, and called it a day. The auto-renewal feature gives you one less thing to do, right?

Sure, you could be missing out on the best car insurance for you for the next six months or the next year.

Earlier this year, a Redditor made a point of checking auto insurance and had to do a double take.

“We’ve been with Geico for 11 years and for some reason they raised our rates by 40% on our last renewal. the representative said, ‘Yes, sorry. Inflation,'” the Redditor wrote.

The person bought it and got a better deal with the USAA. In addition to inflation, here are some other reasons why you might want to check other auto insurance before your renewal date.

Trying to get a good deal on electric cars may be the big automotive trend right now. Buying the best car insurance every year might not save you time, but it could save you money. Other factors, such as a clean driving record, could affect your plan. Drive safely and comply with the laws to get the best odds on the lowest cost insurance plans. Make sure you read the fine print of your plan. While some low-deductible plans seem like great deals at first glance, you’ll likely have to pay more out of pocket if you have an accident. You can easily compare prices by getting quotes online or by talking to an insurance broker who can provide you with more information.

Editors’ Recommendations

Contents

What types of insurance should you avoid?

15 Insurance Policies You Don’t Need On the same subject : Cheap car insurance for high risk drivers.

- Private Mortgage Insurance. 🇧🇷

- Extended Warranties. 🇧🇷

- Auto Collision Insurance. 🇧🇷

- Rental car insurance. 🇧🇷

- Car Rental Damage Insurance. 🇧🇷

- Flight Insurance. 🇧🇷

- Waterline coverage. 🇧🇷

- Life Insurance for Children.

What kind of insurance should you never go without? Auto Insurance. Owner/Renter Insurance. Health plan. Long term disability insurance.

What are the 4 types of insurance that everyone should have?

There are, however, four types of insurance that most financial experts recommend that we all have: life, health, auto, and long-term disability. See the article : Oklahoma drivers are feeling the financial impact of auto insurance inflation.

Can you still use EHIC card in Spain?

An EHIC or GHIC covers state health care, not private treatment. With an EHIC or GHIC, you can obtain necessary medical treatment in Spain under the same conditions as a Spanish citizen. This means that you will receive healthcare services for free or at a reduced cost.

Is EHIC card still valid in UK?

If you have a UK European Health Insurance Card (EHIC), it will be valid until the expiry date of the card. Once it expires, you will need to order a GHIC to replace it.

What are 3 important tips on filing an auto insurance?

Record all details of the accident. Take pictures or make notes of any cars involved, not just your own. Read also : 2023 outlook for car insurance buyers: Here’s the bill. Get information about the other driver – name, phone number, license plate, vehicle make and model, insurance company and policy number.

What are the 3 parts of an auto insurance policy? Responsibility. Most automobile insurance policies contain three main parts: bodily injury liability insurance, property damage liability insurance, and coverage for uninsured/underinsured motorists.

What is the most important part of auto insurance?

The most important coverage should be your state’s minimum liability and property damage coverage. More than anything else, you need to maintain car insurance to stay legal to drive. You risk losing your driver’s license and fines driving without it.

What is the most important part of a personal auto policy?

Part A: Liability Coverage This is the only part of auto insurance that is mandatory. This coverage protects other people from suffering a financial loss if the policyholder causes them material or bodily harm.

What type of coverage is best for car insurance?

You should have the highest amount of liability coverage you can afford, with 100/300/100 being the best level of coverage for most drivers. You may need additional coverage to protect your vehicle, including comprehensive, collision and gap coverage.

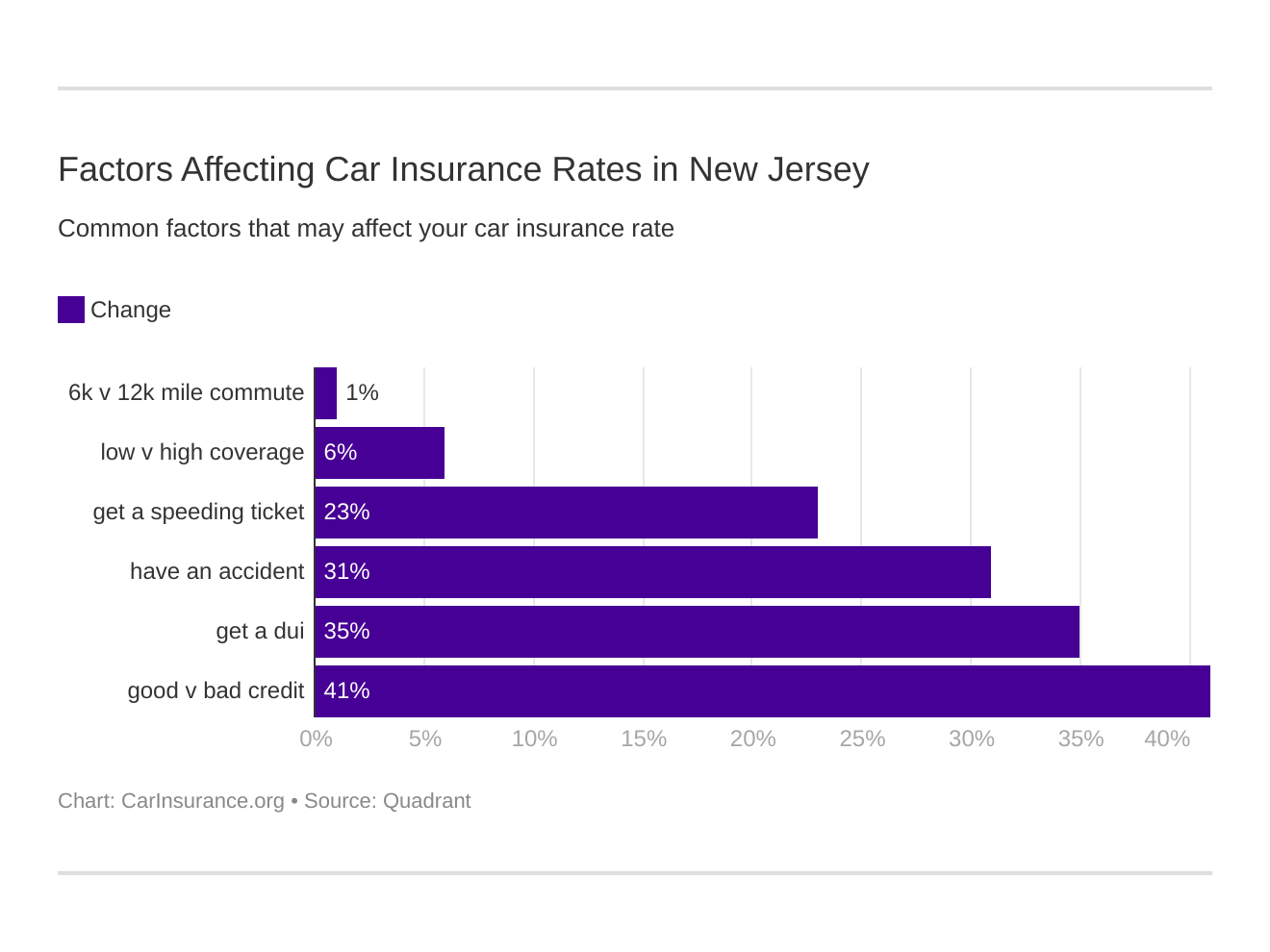

What are three factors that affect your auto insurance?

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographic factors, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and your driving history.

Can two people insure the same car?

You and your partner can take out separate policies for the same car. Car insurance policies are for both the vehicle and the driver, so it is perfectly normal, legal and common for two people to be insured on the same vehicle under separate policies. There are a few reasons why you might consider doing this.

Can two single people have the same car insurance? Unmarried couples who live together can purchase joint car insurance and may be required to list each other on their insurance if they opt for separate policies.

Can two people have insurance on the same car?

Most insurers allow you to add a significant other, such as a boyfriend, girlfriend, fiancé, or domestic partner, to your car insurance policy if you live together. Depending on the insurer, a significant other may also add your vehicle to a joint policy if both cars are held at the same permanent residence.

What documents do I need for a carte grise?

You must certify on honor that the applicant for the brown license has a vehicle insurance certificate and a driving license corresponding to the category of the registered vehicle. You do not need to attach a digital copy (photo or scan) of your driver’s license.

How long does it take to register a car in France?

You can temporarily drive with the carte grise crossed out. After registering the change of ownership in your name, you will receive a provisional vehicle registration certificate (CPI) valid for 30 days. You will receive your final brown letter by certified mail within a week of your application being approved.

How do you change ownership of a car in France?

How to change ownership of a car in France? The seller must complete a « certificate of transfer » (Cerfa 15776) with the buyer. The seller must then declare the change of ownership of the car (“registration of transfer”, we can handle this request). The buyer must apply for the transfer of ownership of the vehicle online, for example with us.

Is it better to have two people on car insurance?

When you have more than one driver in the household, getting multi-driver car insurance is the best way to ensure that all drivers are covered and can save you some money on your car insurance premiums.

Is it cheaper to get car insurance as a couple?

Is car insurance cheaper if you are married or single? Car insurance is often cheaper for married drivers. On average, they pay 5% less for full coverage insurance than single drivers, saving about $8 a month.

Is it better to have joint car insurance?

Adding your spouse to your policy ensures that you are both covered in the event of an accident. If you and your spouse both have good driving records, a joint car insurance policy can save you money with lower premiums and a multi-car discount (if your insurance company offers one).

Does adding someone to your car insurance lower it?

Adding a driver to your car insurance policy will have an impact on your rates. However, it’s not the case that adding another driver will always increase them – depending on who the primary and secondary drivers are, adding another driver can actually significantly reduce car insurance costs.

Can you have a glass of wine and drive in France?

France has very strict laws about drunk driving. The French limit for drunk driving is 50 mg of alcohol in 100 ml of blood. Sanctions and Penalties: Drivers found to have between 50mg and 80mg of alcohol in their blood can be fined €135 (£112).

How many units can you drink and drive in France? The blood alcohol limit for driving in France is 0.5 grams/litre (down from the UK limit of 0.8 g) and means you can break the law with a glass or two of wine. You are liable for prosecution if you are above or equal to this limit.

Is one glass of wine over the driving limit?

But as a general rule, 2 liters of regular beer or 2 small glasses of wine can put you over the limit. This equals about 4.5 units of alcohol. For more information, check out our alcohol unit calculator. But this is not a firm rule for everyone.

How many glasses of wine before you can’t drive?

Typically, men can consume more alcohol than women before their BAC exceeds the legal driving limit. In general, a 137-pound woman would need to consume three glasses of wine in an hour to stay above the . 08, while a 170-pound man can drink up to four glasses of wine in an hour and be at or above the 0.08 level. 08 level.

What is your BAC after 1 glass of wine?

Behonick said that if a 150-pound man had a standard drink, that would give him a BAC of about 0.025 percent. A standard drink is defined as 12 ounces of beer, 4 ounces of wine, or a shot of 80 alcohol.

Can I drive after 1 drink?

This leaves many drivers wondering, “is it safe to drive home alone if I’ve only had a beer or two?” The answer is no. While a drink or two will usually keep you below the legal limit, any amount of alcohol CAN affect your ability to drive safely in ways you may not even realize.

Is the French drink drive limit same as UK?

France has very strict laws about drunk driving. A maximum of 0.5 mg/ml of alcohol per liter of blood is allowed, compared to 0.8 mg/ml in the UK.

Can you use a UK driving licence in France?

Your license is recognized in France as long as it is valid. Paper licenses are generally valid until age 70. For plastic photo card licenses, the expiration date is on the front. If your UK license has expired or has less than 6 months remaining, you must exchange it for a French license.

What is the minimum ban for drink driving UK?

6 months in prison. an unlimited fine. a driving ban for at least 1 year (3 years if convicted twice in 10 years)

What is the drink drive limit in France?

Drunk driving limit France has very strict drunk driving laws. The French limit for drunk driving is 50 mg of alcohol in 100 ml of blood. Sanctions and penalties: Drivers found to have between 50mg and 80mg of alcohol in their blood can be fined €135.

Can I drink glass of wine and drive?

Even small amounts of alcohol can affect your ability to drive, and there’s no surefire way to drink and stay within your limit. The police’s advice is clear: avoid alcohol entirely if you intend to drive.

Can I drive after 1 drink?

This leaves many drivers wondering, “is it safe to drive home alone if I’ve only had a beer or two?” The answer is no. While a drink or two will usually keep you below the legal limit, any amount of alcohol CAN affect your ability to drive safely in ways you may not even realize.

How long does it take for wine to leave the body before driving?

It’s great that you are aware of safety and follow the rules of the road! While alcohol can take anywhere from 12 to 24 hours to completely leave your system, you don’t necessarily have to wait that long to drive safely. As a general rule of thumb, you should wait an hour for every drink consumed before driving.

How many units is a glass of wine?

A medium-strength glass of wine (175 ml) has about 2.3 units of alcohol.