Why is car insurance higher in some areas?

Contents

- 1 Why is car insurance higher in some areas?

- 2 Why is car insurance so expensive right now?

- 3 Did everyone’s car insurance go up?

- 4 Are relentlessly rising auto insurance rates squeezing car owners and stoking inflation?

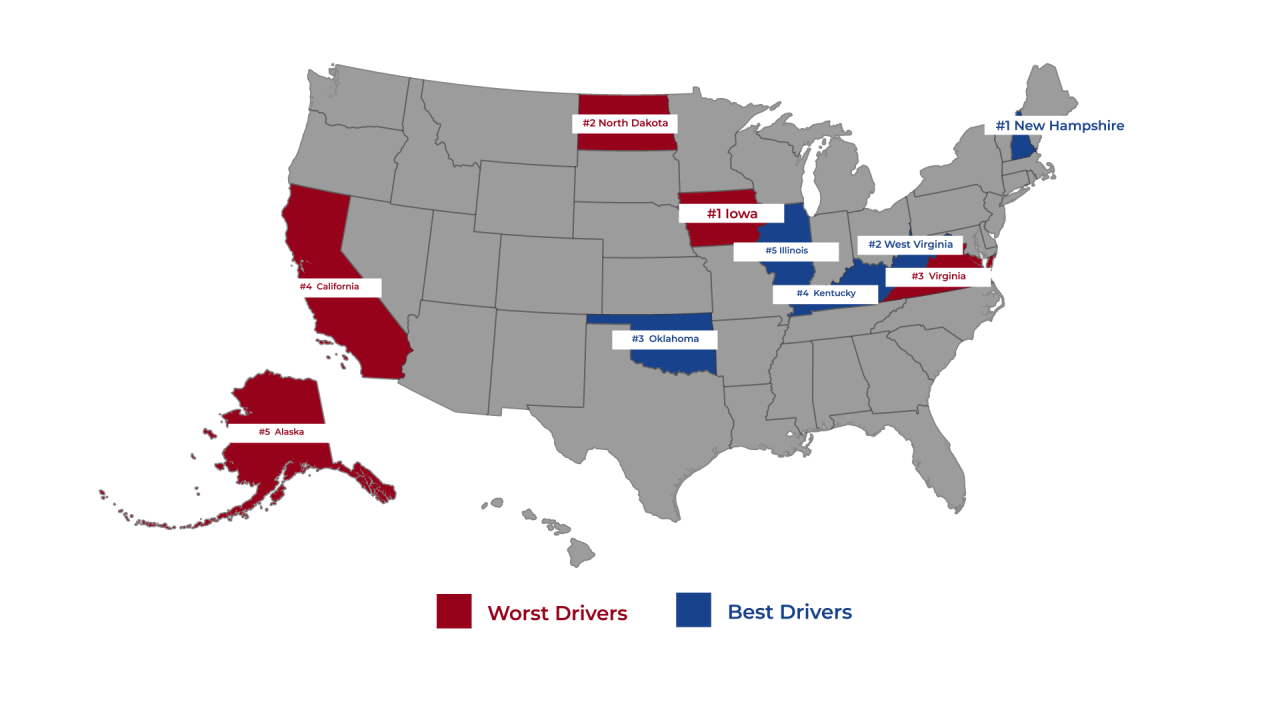

Your location Car insurance premiums vary from state to state, and even from ZIP code to ZIP code. Why? Big city drivers face a greater risk of accidents, car theft or vandalism, and therefore generally pay more for car insurance. Car repairs and medical treatment for injuries are more expensive in some areas than in others.

Why is car insurance so expensive right now?

The increase in insurance costs is in addition to the historically high prices for new and used vehicles from the coronavirus pandemic, as well as the increase in vehicle repair costs.

How much did car insurance increase in 2024? Car insurance costs have risen, leaving drivers looking for ways to save on car ownership costs. This may interest you : Possible car insurance fraud is being reported. In fact, according to a report from Bankrate, the average annual premium for full-coverage auto insurance rose to $2,543 in 2024 – up 26% from the previous year.

Why are car insurance rates increasing? Across the country, auto insurance costs have continued to rise over the past few years as natural disasters have become a greater threat to drivers and as vehicles cost more to repair and replace.

Why is car insurance so expensive all of a sudden?

Your particular driver profile, which includes factors such as where you live, your age and your driving record, will influence what you pay for car insurance. See the article : Car insurance prices are on the rise, and COVID-19 is to blame. But rising auto repair costs and an increase in disaster-related claims are significant reasons why car insurance rates are increasing for many drivers.

Why did my car insurance go up in 2024? It is normal for car insurance rates to increase every year even if you have not changed your policy or filed any claims. This can happen due to multiple factors, from inflation to increased claims in your area.

Why is my car insurance so high for no reason?

If your car insurance goes up for seemingly no reason when you renew your policy, it is likely due to an increase in risk that is out of your control. This may include reasons such as increased claims in your area (due to more extreme weather damage, more accidents, etc.) and higher car repair and replacement costs.

What is a factor that can cause your car insurance to go up? Some factors that can affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverage, limits and deductibles you choose. These factors can include things like your age, anti-theft features in your car and your driving record.

Why is my car insurance so high? Why Is My Car Insurance So High? Your car insurance can be expensive because of your driving history, location, vehicle or credit history. Recent insurance claims and violations can increase your rates for three to five years. On the other hand, it is possible to also have a car insurance company that costs more.

Did everyone’s car insurance go up?

Overall, the average annual car insurance premium increased by about 18% from 2023 to 2024 in California, according to a study by Bankrate.com. Still, car insurance rates can vary by city.

Why is car insurance so expensive all of a sudden? This may be because you have recent at-fault accidents, moving violations or convictions such as DUI on your insurance record. For car insurance companies, people who have such violations on their records are more likely to get violations in the future.

Why did my car insurance go up when nothing changed?

As unfair as it may seem, you may experience an automatic rate increase due to the insurance claims data in your ZIP code. To see also : Car insurance too high? Here are 5 ways to cut costs.. If your area has a high rate of theft, accidents, or weather-related claims, it becomes more risky for an insurance company to cover drivers there.

Why does my car insurance keep going up for no reason? If you’re wondering why your car insurance has gone up, you’re not alone. One of the most common reasons is simply because your insurer has increased their rates. Whether it’s accounting for inflation, recovering funds after a natural disaster or covering higher claims, many insurance companies have increased rates in 2022.

Why is my Geico insurance suddenly so much higher? Geico may have raised your rates because of changes in your policy or circumstances. Examples include adding a new type of cover, becoming eligible for an additional type of discount, being involved in an accident, or buying a new car.

Is it normal for car insurance to increase every year?

Annual increases are typical across the industry, but the way your risk factors are viewed by a particular company may vary. Understand your coverage and discounts to make sure you’re getting the best price for the insurance you need.

Will Progressive raise rates after 6 months? Your Progressive rates may increase after six months depending on a number of factors. Like other car insurance providers, Progressive typically raises your rates if you receive a speeding ticket or moving violation, cause an accident or make comprehensive insurance claims.

Does credit score affect car insurance? On average, drivers with poor credit pay 118 percent more for full coverage car insurance than those with excellent credit. California, Hawaii, Massachusetts and Michigan prohibit or limit the use of credit as a rating factor in determining auto insurance rates.

Did everyone’s car insurance go up?

Overall, the average annual car insurance premium increased by about 18% from 2023 to 2024 in California, according to a study by Bankrate.com. Still, car insurance rates can vary by city.

Why did my car insurance go up in 2024? Your particular driver profile, which includes factors such as where you live, your age and your driving record, will influence what you pay for car insurance. But rising auto repair costs and an increase in disaster-related claims are significant reasons why car insurance rates are increasing for many drivers.

Why is car insurance so expensive all of a sudden? This may be because you have recent at-fault accidents, moving violations or convictions such as DUI on your insurance record. For car insurance companies, people who have such violations on their records are more likely to get violations in the future.

Why did my car insurance go up when nothing changed?

The collective risk factor You are particularly affected by where you live and the people directly around you. If you live in an area where there are a lot of car thefts or a higher number of accidents, your insurance company may assume that there is a higher risk that you will also have similar claims.

Why is my Geico insurance suddenly so much higher? Geico may have raised your rates because of changes in your policy or circumstances. Examples include adding a new type of cover, becoming eligible for an additional type of discount, being involved in an accident, or buying a new car.

Is it normal for car insurance to increase every year?

Annual increases are typical across the industry, but the way your risk factors are viewed by a particular company may vary. Understand your coverage and discounts to make sure you’re getting the best price for the insurance you need.

Why does my car insurance keep going up every year? Car accidents and traffic violations are common explanations for an insurance rate increase, but other reasons why your car insurance rate may go up include changing address your, the addition of a new vehicle or driver, increases in claims in your ZIP code, and increases in auto repair. / replacement cost.

Does credit score affect car insurance? On average, drivers with poor credit pay 118 percent more for full coverage car insurance than those with excellent credit. California, Hawaii, Massachusetts and Michigan prohibit or limit the use of credit as a rating factor in determining auto insurance rates.

Why does my car insurance keep going up for no reason?

If you’re wondering why your car insurance has gone up, you’re not alone. One of the most common reasons is simply because your insurer has increased their rates. Whether it’s accounting for inflation, recovering funds after a natural disaster or covering higher claims, many insurance companies have increased rates in 2022.

How much is car insurance for a 20 year old in the UK?

Why is my car insurance so high with a clean record in the UK? When calculating your premium, insurers consider all your personal details and assess how likely you are to make a claim. If they think your personal circumstances mean you are more likely to ask, then they will consider you a higher risk and quote you a higher price.

Why did everyones car insurance go up?

Inflation, technology and bad drivers have increased everyone’s insurance rates, but there are a few things you can do to possibly lower yours. Have you noticed that the cost of your car insurance seems to be increasing? You are not alone.

Has car insurance increased in 2024 in Australia? A perfect storm of factors has seen the average car insurance premium increase by almost 20 percent in 2024. Find out how to save money. If you’ve received a renewal notice for your car insurance that’s nearly double the cost of last year, you’re not alone.

Why is my car insurance so high with a clean record in the UK?

When calculating your premium, insurers consider all your personal details and assess how likely you are to make a claim. If they think your personal circumstances mean you are more likely to ask, then they will consider you a higher risk and quote you a higher price.

Who has the cheapest car insurance in the UK?

How much is car insurance in France? In 2022, vehicle owners in France paid more than 500 euros for comprehensive vehicle insurance. Meanwhile, the average premium for third party liability insurance, which is mandatory for all drivers in France, only 153 euros.

Why is insurance so expensive in the UK?

A spokesman for Direct Line, one of the UK’s largest insurers, said: “Prices across the industry have been rising for some time and are mainly due to increased claims inflation and higher repair and labor costs. .

Why did my car insurance go up without an accident in Ontario?

Car premiums can increase due to claims, traffic violations or even inflation (darned inflation!).

Are relentlessly rising auto insurance rates squeezing car owners and stoking inflation?

NEW YORK (AP) â Rising auto insurance rates are squeezing car owners and fueling inflation. Auto insurance rates rose 2.6% in March and are up 22% from a year ago.