Safe Pair of Hands: Do Drivers Get Cheaper Auto Insurance Quotes?

Contents

- 1 What are the four components of insurance premium?

- 2 What is the simplest way to lower your auto insurance premium?

- 3 What group pays the most for car insurance?

- 4 Can I ask my insurance to lower rates?

What are the main components of the premium and their value? There are three important features in a premium computer. On the same subject : What is collision insurance and what is covered?. They are (1) mortality, (2) maintenance cost, (3) expected return on investment.

Types of Insurance Premium See the article : Ohio car insurance rates are rising.

- Life. Life insurance premiums are determined by your personal information, including your age, health, and medical record. …

- Health. Some people may receive health insurance benefits from their employers, so they may not want to pay the premiums. …

- Auto. …

- Homeowners. …

- Renters.

Regular, limited, and single premium pay are different types of premiums in term insurance.

The difference between the price paid for a fixed-income security and the face value of the security in question is called a premium if that price is higher than par. The purchase price of the policy or the regular payment required by the policy to provide coverage for a specified period of time.

Types of Premium Payment Options in Term Insurance Term insurance offers the following premium payment models: Regular premium – term payment of premiums similar to the term of the policy. Limited premium â the term of paying premiums is less than the term of the life cover. Single payment â single payment.

What are the components of insurance?

Three components of any type of insurance are important: premium, policy limit, and deductible. Read also : How To Save A Car And Home Insurance Package | 2022.

Like many legal opinions, it took many cases and many decades—in some cases, centuries—to develop a stable view of the requirements of effective insurance. These factors are defined risk, exceptional event, unaffordable interest, variable risk, and risk sharing.

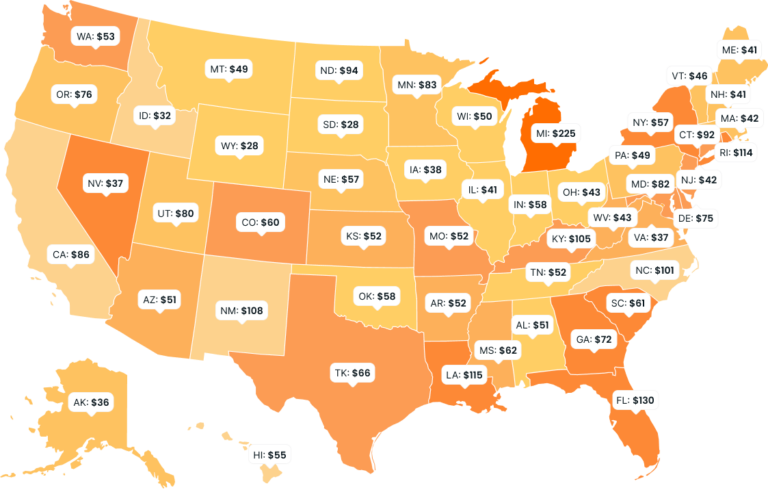

Several metrics factor into the cost of insurance premiums, including age, state and region of residence, and coverage amount.

Put higher deductibles on your auto insurance. Increasing your deductible – the amount you’ll pay out of pocket in the event of a claim – will lower your premium. Generally, deductibles range from $0 to $1,500.

Which of the following is a way to lower your insurance premiums? Increase your amount The more you withdraw, the less you will pay for your down payment. For example, from $250 to $500 can reduce the cost of your collision and comprehensive coverage by up to 30 percent. And if you go from $500 to $1,000, you can save an additional 31%.

Can you ask your insurance company for a lower rate?

Car insurance rates are non-negotiable, so you cannot ask your car insurance company to lower your rates. However, there are several ways to get more affordable premiums. Compare quotes from multiple insurers. Although states regulate the cost of car insurance, different companies offer different rates.

Can I get a lower rate on my car insurance?

Maintain a good driving record Not only does it prevent expensive speeding tickets or other traffic violations, you also help keep your insurance rates low by proving that you are not a dangerous driver. Additionally, if you have a credit-free or breach-free account, you may receive additional discounts.

Can you negotiate with your insurance company?

Negotiating with the car insurance company. If the initial offer of the adjuster is far below the estimate you have collected, you should communicate with the insurance company. You don’t have to file a lawsuit to get started. These discussions can take place in person or via email, but you will want to get the final decision in writing.

Ask for higher deductibles Deductibles are what you pay before your insurance starts. By asking for a higher fee, you can reduce your fees significantly. For example, increasing your deductible from $200 to $500 can reduce your collision and total coverage costs by 15 to 30 percent.

What insurance products are most profitable?

If you are wondering what types of insurance are most beneficial, life insurance is a good choice. Life insurance offers some of the highest commissions in the business. Health insurance products offer around 7 – 22% in commissions. Auto insurance yields agents about 10% to 15% in commissions.

The amount you pay for your health insurance each month. In addition to your premium, you often have to pay other costs for your health, including deductibles, copayments, and coinsurance.

What are some methods the insurance industry uses to avoid the adverse selection problem?

Insurance companies have three ways to protect themselves from bad choices, including carefully identifying risk factors, having a system for identifying information, and putting caps on coverage.

But you can take steps to lower your car insurance.

- Ask for a discount. If you want a better rate, ask for one! …

- Shop around. …

- Increase your deductible. …

- Drop coverage you don’t need. …

- Buy a car with insurance. …

- Change how you pay your premiums. …

- Be a better driver. …

- Include your rules.

Other factors that can affect your car insurance premiums include your driving style, population and coverage, limits and deductibles you choose. These factors may include things like your age, anti-theft devices in your car and your driving record.

What group pays the most for car insurance?

Men tend to pay more for car insurance overall, although the difference is small – about 1%. The difference is most pronounced for teenagers and young adults.

What groups of people pay the most for auto insurance? Generally, younger drivers can expect to pay higher rates than older drivers, and around 70, car insurance rates start to increase again. Due to accident events and data, men are riskier to insure than women and tend to pay higher rates.

What number is the cheapest insurance group?

Cars in insurance group 1 have the cheapest insurance premiums, making them a good bet if you’re on a budget. But how much you pay for your insurance depends on other factors as well, including your age, your claims history and how many miles you drive each year.

Is Geico really the cheapest?

Geico has the cheapest car insurance for most drivers in California. The company charges $31 per month on average for the lowest policy.

Which group insurance is cheapest?

What are the categories of car insurance? Each car belongs to one of 50 car insurance groups, which are used by insurers to help set the amount you pay. Cars in group 1 are the cheapest to insure, while those in group 50 are the most expensive – and the more powerful and luxurious your car, the higher the group they will enter.

Is insurance group 1 high or low?

Group one car is the cheapest class of car to insure. It is determined by factors such as engine size, value, safety and affordability.

Age is the main factor that insurance companies look at when looking at policy rates for one of its drivers. Regardless of gender, young drivers pay more for their car insurance than any other demographic, according to HuffPost.

Florida is the most expensive state for auto insurance with average auto premiums of $255,000 per year – which is about a 23% increase in prices from 2021, according to an Insure.com analysis. Surprisingly, not-at-fault drivers in states like Florida and Michigan pay more for auto insurance than drivers in other states.

What is the highest insurance category?

There are 50 categories of car insurance. Group 1 cars are the cheapest to insure, while Group 50 cars are the most expensive.

Car insurance premiums can vary up to 367% depending on age. Young drivers pay more for car insurance, as they are considered inexperienced and more likely to get into an accident. After age 25, motorist insurance rates begin to decrease.

Which age group pays most for car insurance?

Younger drivers pay more than older drivers, and regardless of where the driver lives, their rates drop steadily as they get older. Age versus Car Type: Age affects car insurance rates more than car type but the driver is young â between 15 and 25 years old.

Experienced drivers are less likely to get accident claims, which means they pay less for insurance. At Progressive, the average driver per driver decreases significantly from 19-34 and then stabilizes or decreases slightly from 34-75.

Which married or single group pays more for car insurance?

Insurance companies tend to charge married drivers lower insurance premiums because statistically, they are more risky and financially stable. This means they are involved in fewer car accidents and place lower claims than single drivers, making them less expensive to insure.

Can I ask my insurance to lower rates?

Car insurance rates are non-negotiable, so you cannot ask your car insurance company to lower your rates. However, there are several ways to get more affordable premiums. Compare quotes from multiple insurers. Although states regulate the cost of car insurance, different companies offer different rates.

How can one lower insurance costs? Maintain a good driving record Not only does it prevent expensive speeding tickets or other traffic violations, you also help keep your insurance rates low by proving that you are not a dangerous driver. Additionally, if you have a credit-free or breach-free account, you may receive additional discounts.

What are good questions to ask insurance companies?

Start the conversation: 8 questions to ask your insurance agent.

- What do I get rid of? …

- What is my premium? …

- What happens if I get into a car accident? …

- Does my homeowners insurance provide enough protection? …

- Is it time to consider life insurance? …

- Do I have enough money to pay? …

- Do I need an umbrella policy?

Is insurance negotiable?

Prices are not negotiable. In fact, every US state has a governing body, usually the department of insurance, that approves the rates set by providers, according to Janet Ruiz, property-casualty underwriter and director of communications at the Insurance Information Institute.

Car insurance rates are non-negotiable. Even if your payment is non-negotiable, a lower rate of car insurance can be found for you by using one or more cost saving strategies. Compare rates and save on car insurance today! Prices will continue to rise in 2022.

Can you negotiate with your insurance?

Negotiating with the car insurance company. If the initial offer of the adjuster is far below the estimate you have collected, you should communicate with the insurance company. You don’t have to file a lawsuit to get started. These discussions can take place in person or via email, but you will want to get the final decision in writing.

What is insurance negotiation?

Once the insurance company receives your claim package, the adjuster will try to negotiate. Most of the time, the adjuster will send a refund based on the needs of your package: usually the offer will try to meet the middle ground between the initial offer and your needs.