Sedan vs. Coupe: Which is the cheapest car to insure?

It’s easy to see why car insurance for a Ferrari would be more expensive than for a Toyota. But did you know that insuring a coupe over a sedan could cost you more?

Sedan vs. coupe: What’s the difference?

Contents

- 1 Sedan vs. coupe: What’s the difference?

- 2 How much is coupe car insurance?

- 3 Are sedans cheaper to insure than coupes?

- 4 How can you find the best price on car insurance?

- 5 How much should I insure my car for?

- 6 How do you trick car insurance?

- 7 What makes cars more expensive to insure?

- 8 Are coupes more expensive?

It’s easy to confuse the two body styles because of their similarities. What is the difference between a coupe and a sedan? A sedan has four doors. Other parts of the vehicle, such as the engine, trunk and passenger compartment, are separated from each other. On the same subject : Oklahoma drivers are feeling the financial impact of auto insurance inflation. This is known as the “three box design”. On the other hand, a coupe has two doors and a fixed roof, although it still has a three-box design. And a hatchback is considered a coupe if it has two doors.

The Society of Automotive Engineers (SAE) has a different take on the sedan versus coupe debate. It classifies coupes as fixed-roof cars with less than 33 cubic feet of interior space.

How much is coupe car insurance?

So how much does it cost to insure a coupe? “It depends on where you live and your driver profile, but coupe car insurance is usually relatively expensive,” explains the Jerry Insurance Agency. This may interest you : Another problem for American motorists: car insurance costs.

And because coupes are geared more towards childless singles and couples, they are slightly more expensive to insure. Coupé drivers are generally younger and have an increased risk of accidents. Less experienced motorists tend to file more insurance claims than experienced drivers. In addition, the make and model of the coupe play a significant role in insurance costs.

Are sedans cheaper to insure than coupes?

You may be wondering if insuring a sedan is cheaper than insuring a coupe. The answer is yes. Limousines are among the cheapest types of cars to insure. They are better suited to families, have more seating space and have good gas mileage. To see also : Is Progressive or Geico cheaper?. Because sedans are more family-friendly, auto insurance companies view their drivers as more responsible. They therefore have a lower risk of collision than drivers without family.

But that’s not always the case. When you buy a luxury sedan, your insurance premiums can be higher. It also depends on the vehicle size. For example, you can choose a compact, midsize or full size sedan and the insurance rates may differ.

Additionally, regardless of your car, your auto insurance premiums will be higher if you have a bad driving record.

How can you find the best price on car insurance?

The best way to find a reasonable price for car insurance is to shop around. For example, compare rates from national companies and small insurance providers.

Improving your credit score and driving habits can also help lower your auto insurance costs more than you might think.

Finally, check for discounts. Bundling your home or renters insurance with your car insurance can save you money.

RELATED: 4 Potential Downsides to a Cheap Car Insurance Plan

How much should I insure my car for?

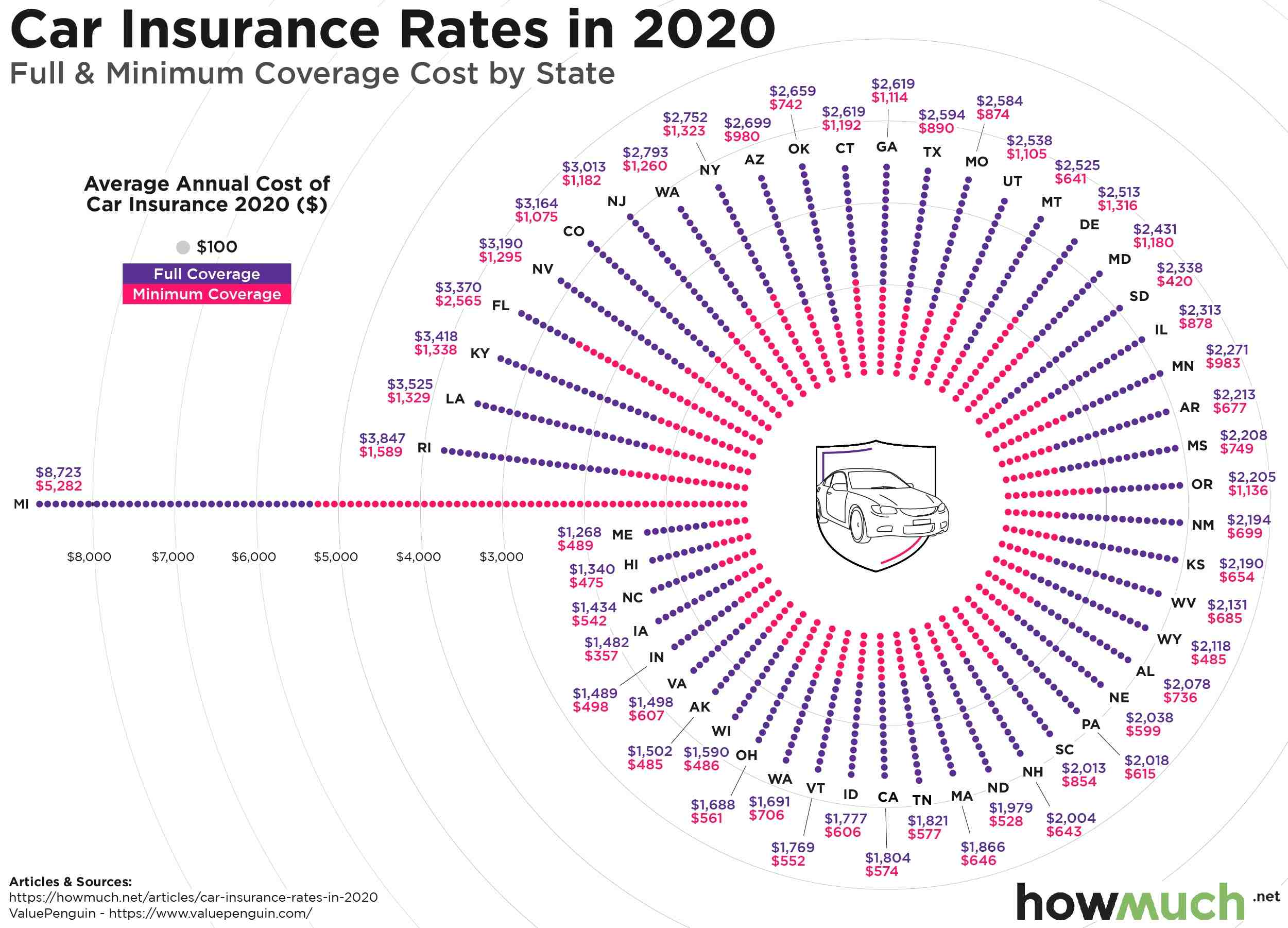

According to the data, residents in New South Wales pay significantly more for their annual car insurance premiums, averaging $120 a month ($1,440 a year), while drivers in Western Australia pay the cheapest at $88.60 a month average car insurance cost ($1,036.20 per year).

How much car insurance do I need based on net worth? Because property damage and personal liability insurance claims can vary widely depending on the driver and vehicle involved in the accident, we typically recommend carrying an amount equal to your net worth. To determine your net worth, add up your wealth and subtract that number from your total debt.

How much should I spend a month on car insurance?

The national median cost of auto insurance is $1,630 per year for 2022, according to NerdWallet’s rate analysis. That equates to an average car insurance rate of about $136 per month.

How much should you budget monthly to cover your insurance?

Set aside enough money monthly Whatever you plan to pay for insurance, break it down into a monthly budget amount. For example, if your home insurance is $900 every six months, save $150 every month. It’s a lot easier to plan on a $150 budget than to have $900 all at once.

Who costs the most on car insurance?

Those with a history of speeding, culpable accidents, traffic violations, or DUIs will be charged more for insurance. A breach will no longer affect your rates once it has disappeared from your file, which is typically three years. Less driving can mean lower rates.

What is the average amount spent on car insurance?

Drivers in the US pay an average of $1,771 a year for comprehensive auto insurance, or about $148 a month, according to Bankrate’s 2022 analysis of average premiums offered by Quadrant Information Services. Minimum coverage costs an average of $545 per year.

Is 100 a lot for car insurance?

Average National Cost Whatever the case, you’ll most likely find yourself paying upwards of $100 a month for auto insurance. In fact, if you’re a 40-year-old with plenty of experience, a solid driving history, and good credit, you can expect to pay around $135 a month.

Is 100 dollars a month good for insurance?

Is $100 a Month Good for Car Insurance? The average annual rate for 100/300/100 coverage with Collision Damage Waiver and a $500 deductible is $1,758. That’s about $146.50 per month. So if you can find a policy for less than that amount, e.g. B. under $100, this is considered an affordable tariff.

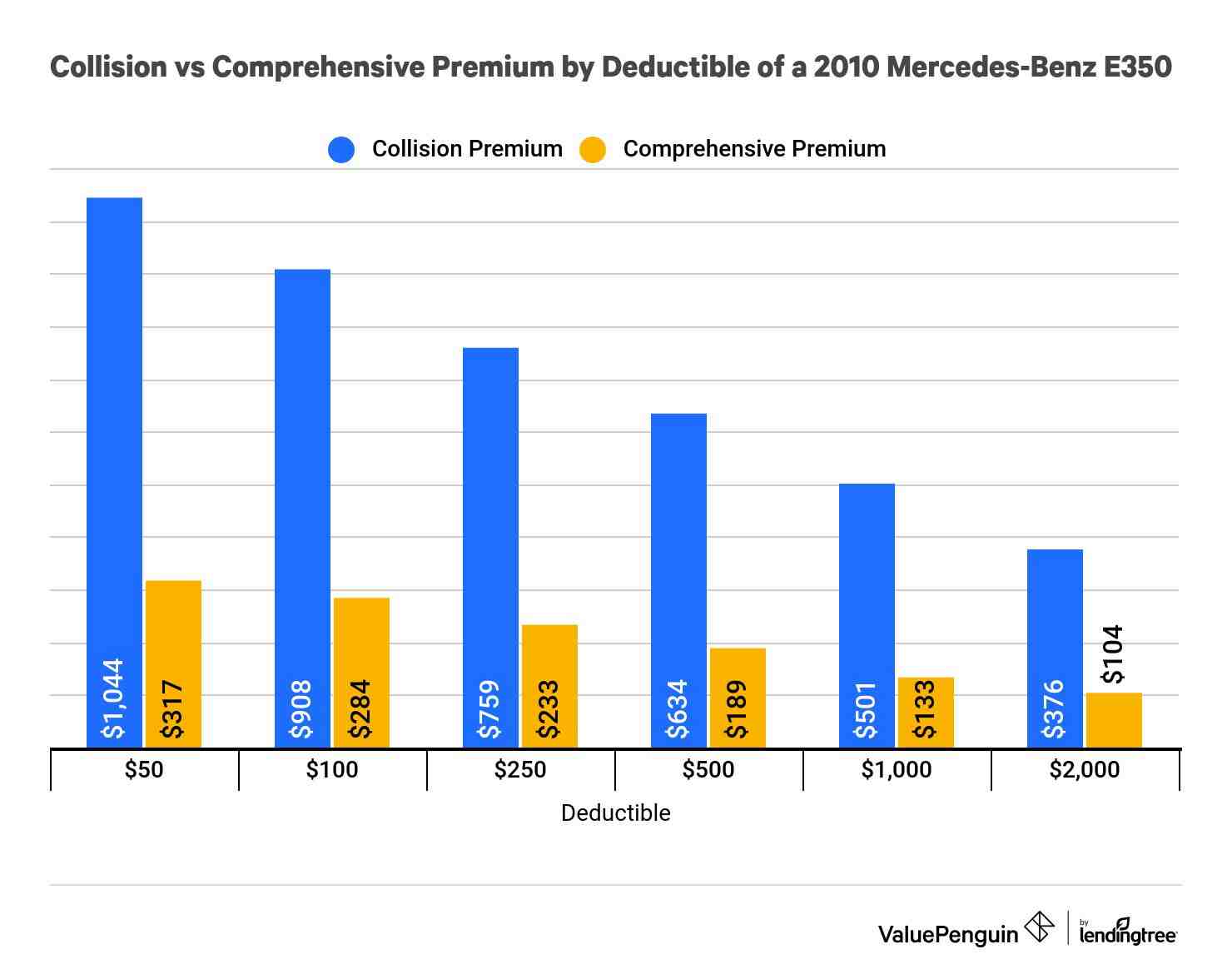

What is a 100 deductible car insurance?

If your deductible is $100 and you cause that $350 of damage by hitting a tree, you only have to pay your $100 deductible while your insurance company pays the other $250. However, you could spend more on your premium by having a lower deductible and end up never making a claim.

How much insurance coverage do you really need?

The central theses. You should carry the highest liability coverage you can afford, with 100/300/100 being the best coverage level for most drivers. You may need to carry additional coverages to protect your vehicle including Collision Damage Waiver, Collision and Gap coverage.

How do you trick car insurance?

- Look around to compare prices. The insurance space is very competitive and it’s worth looking around! …

- Bundle policies together for additional savings. …

- Park your car in a garage. …

- Show your good driving habits. …

- Increase your deductible. …

- Pay your premium annually. …

- Benefit from group rates. …

- Buy a car that is cheap to insure.

Can you cheat insurance companies? Answer provided by. “In the auto insurance industry, people sometimes try to withhold or change information at the time of making a claim or while purchasing a new policy in order to get better rates. Remember that these attempts are rarely successful, since it is practically impossible to “cheat” the system …

How can I scare my car insurance adjuster?

The most effective way to scare an insurance adjuster is to hire an experienced personal injury attorney.

Can you argue with an insurance claims adjuster?

After examining your argument, you can make a counter-argument. However, an appraiser may address a few things you should prepare for. When entering into negotiations with the insurance company and/or claims adjuster, you should have in mind a desired settlement and a minimum settlement that you will accept.

What should you not say to an auto insurance adjuster?

Never say you’re sorry or admit any mistake. Remember that a claims adjuster will look for reasons to reduce an insurance company’s liability, and any admission of negligence can seriously jeopardize a claim.

What makes cars more expensive to insure?

The Car You Drive – The cost of your car is a major factor in the cost of insurance. Other variables include the likelihood of theft, repair costs, engine size, and the car’s overall safety record. Cars with quality safety equipment may be eligible for premium discounts.

Why are certain cars more expensive to insure? The make, model, trim level, year, and body style of your car all play a role in how much auto insurance costs. An expensive car model with additional features and a large engine costs more in insurance than a standard car model with a high safety rating.

What type of cars make insurance higher?

Cars that increase insurance are usually sports cars, high-end vehicles, and cars with low safety ratings. Insurance companies use many factors to determine insurance premiums, including the potential cost of repairing the car and relevant historical trends for the make and model, such as: B. Claims and theft rates.

What type of cars cost more to insure?

Sports cars, luxury cars, and high-performance cars can be more expensive to insure because they also cost more to repair, are more likely to be stolen, and be involved in more accidents.

Is insurance higher for faster cars?

Statistics show that smaller, sportier cars are driven at higher speeds by younger, riskier drivers. Because they are involved in more accidents, they are more expensive to insure. For this reason, it stands to reason that larger vehicles such as SUVs would be less expensive to insure.

Does car insurance depend on car value?

In general, the more expensive your car, the higher your premium. Why? The insurance company is responsible for repairs – up to the actual cash value of the vehicle – if it has been damaged by an insured event and you have collision damage waiver and comprehensive insurance. The more your car is worth, the more you may have to pay.

Does the price of a car affect the cost of insurance?

Price of the car The price of your car plays a big part in determining your car insurance premiums. The more expensive the car, the more it costs to repair or replace. If it’s a sports car or a luxury vehicle, it costs even more. That’s why car insurance premiums are so much higher for expensive cars.

Does car insurance depends on the car?

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

How is car value determined for insurance?

It is determined by the replacement cost of your vehicle less depreciation, which takes into account factors such as age and wear and tear. Most insurance policies cover the actual cash value of your car in the event of a claim and use a third party to determine your vehicle’s ACV.

What factors affect how much car insurance costs?

Some factors that can affect your auto insurance premiums are your car, your driving habits, demographics, and the coverages, limits, and deductibles you choose. These factors can include things like your age, anti-theft features in your car, and how you drive.

Are coupes more expensive?

Coupes are almost always more expensive than their sedan equivalents, even if they use the same engines and have the same toys. Automakers charge more because they can; A coupe is more desirable and the public is willing to pay to look good.

Are coupes more expensive to ensure? And because coupes are geared more towards childless singles and couples, they are slightly more expensive to insure. Coupé drivers are generally younger and have an increased risk of accidents.

Are 2 doors more expensive than 4 doors?

In the world of 2-door vs. 4-door insurance, a coupe (2-door) is often more expensive to insure than a sedan (4-door) because while not all coupes are sports cars, many sports cars are coupes.

Is a two-door car cheaper than a four-door car?

Prices for two-door and four-door cars vary depending on the make and model. But most 2-door car models tend to be more expensive than 4-door models. Performance, body style and availability generally affect a car’s price.

Which is better 2-door or 4-door car?

Accessibility: A 2-door model is great if you’re more of a solo traveler around Springboro, but a 4-door model offers better cabin access. Passenger Compartment: A 2-door model generally has less room for rear passengers than a 4-door model, and some models only have room for two people.

Are two doors cheaper?

Because two-door cars are typically viewed as more stylish sports cars and are driven by riskier drivers, they generally have higher base rates.

How much does a coupe cost?

| Limousine – RRP | Coupé – RRP |

|---|---|

| Chevrolet Sonic – $16,720 | Honda Civic Coupe – $20,250 |

| Honda Civic – $21,250 | Chevrolet Camaro – $25,000 |

| Ford Fusion – $23,750 | Mazda MX-5 Miata – $26,850 |

| MazdaMazda6 – $24,475 | Ford Mustang – $27,155 |

Do coupes cost more to insure?

A coupe usually refers to a car with two doors and only the front seat. In fact, the word “coupe” means “cut out,” and the cut out part is the back seat. This type of car is best suited for a single person or a couple without children. That’s why a coupé usually costs more to insure.

Is a coupe only 2 door?

What is a coupe and its characteristics? A coupe is a two-door, closed-roof passenger car with a three-box body for the engine and passenger compartment. Most importantly, a coupe is a vehicle with less than 33 cubic feet of interior space.

Why are two door cars more expensive?

Why do 2-door cars usually have more expensive auto insurance than 4-door models? Two-door cars tend to be more expensive to insure because they’re typically sports cars, which insurance companies consider more likely to be involved in an accident or theft.

Why do people have 2-door cars?

In addition to the weight, two-door sports cars are more convenient. Due to the vehicle’s shorter wheelbase, drivers have a better turning radius, coupled with quicker and sharper handling – parking is also much less challenging. It’s a common misconception that two-door sports cars are more expensive to insure.

Do 2-door cars cost more?

Coupes are also usually more expensive to buy than four-door sedans. Keep in mind that sports cars have a higher rate of theft, which also contributes to their higher insurance premiums. Most coupe drivers are mostly single young men.

Is a 2-door car cheaper than a 4-door?

2-door vs. 4-door insurance: Are coupes more expensive than sedans? In general, the answer to this question is a big yes, and the difference is usually at least a few hundred dollars. However, the difference can quickly add up if you want to insure a high-end sports or luxury vehicle.