Six Month Car Insurance: Cost Guide (2023)

Major insurance companies often offer six-month auto insurance policies, which allows drivers and providers to switch more easily than 12-month policies.

Most car insurance is valid for a period of six months. The Guides Auto team will show you what six month car insurance is, how it works and how much it can cost you. We will also recommend two of the best car insurance companies to help you find the lowest rates.

What Is Six-Month Car Insurance?

Contents

- 1 What Is Six-Month Car Insurance?

- 2 How Does a Six-Month Insurance Policy Work?

- 3 Six-Month Policy Costs

- 4 Should I Purchase a Six-Month Policy?

- 5 Six-Month Car Insurance: Conclusion

- 6 Frequently Asked Questions

- 7 Our Methodology

- 8 How many Canadians have no health insurance?

- 9 What province has the best healthcare in Canada?

- 10 Is Manulife better than Canada Life?

- 11 Who pays for healthcare in Canada?

Six-month car insurance refers to the term of the policy, or the length of time your policy is in effect. Most companies offer policies that last six months before renewal, although some insurers offer 12-month policies. See the article : Basic car insurance | Lifestyle | washtimesherald.com. If you have a six-month policy, your insurance company The insurer will reassess your risk and calculate your car insurance premium accordingly every six months.

What Is Temporary Insurance?

You may see six-month insurance referred to as “term” or “short-term” insurance, but that’s a bit misleading. None of the major car insurance companies offer short-term insurance, but you can keep the car insured for a short period of time by purchasing a six-month policy and canceling it when you’re done driving. On the same subject : How does insurance company make money?. Note that you may be subject to cancellation fees or other penalties for terminating your contract.

If you don’t drive often, consider mileage insurance. If you don’t own a car, non-owner car insurance may be an option.

How Does a Six-Month Insurance Policy Work?

Six-month and 12-month car insurance policies work the same way. If the company offers two types of policies, you will choose the one you prefer when you get a quote. To see also : What Are Car Insurance Premiums? – Forbes Advisor. Once you buy your insurance, the coverage will last for the period you choose.

You can have the option of paying the entire insurance premium upfront or in monthly installments. Some insurance companies offer a discount for paying your premium in full early. Depending on the types of car insurance discounts you qualify for, you may be able to lower your car insurance premiums even more.

Additionally, the six and 12 month plans work the same way. During the policy period, be it six months or a full year, your vehicle is protected under the coverage you purchased.

Six-Month Car Insurance Policy: Pros and Cons

Six-month insurance policies tend to be the most common choice, but there are some situations where it may make sense to buy annual insurance instead. In the sections below, we’ll look at the pros and cons of the six-month plan.

Pros of a Six-Month Insurance Policy

Here are some of the benefits of having a six-month car insurance policy:

Cons of a Six-Month Insurance Policy

Here are some of the disadvantages of having a six month car insurance policy:

Six-Month Policy Costs

The table below shows the average cost for a six-month car insurance policy from some of the largest providers in the country. We used data provided by Quadrant Information Services to determine the cost of low-debt and full coverage policies. These statistics are for a 35-year-old driver with good credit and a clean driving record.

Based on our rate estimates, USAA tends to have the cheapest six-month insurance policies. But it is important to note that USAA is only available for members of the military, veterans and their families. Six month car insurance from Farmers is usually the most expensive.

*To find these average rates, we divided the annual policy contents in half.

Factors That Affect Car Insurance Costs

When insurance agents read your quote, they consider several factors, including the following:

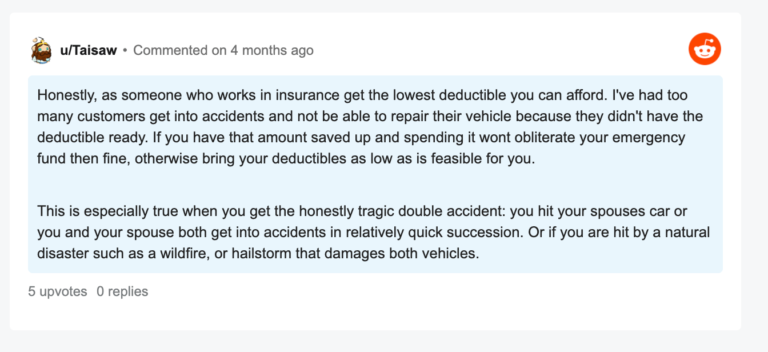

The deductible you choose will also affect the cost of your car.

Should I Purchase a Six-Month Policy?

Car insurance costs are different for everyone, so only you can have an accurate idea of whether a six-month or 12-month policy makes the most sense for you. . If you have basic insurance needs, you can choose to have a long term policy. If you know that a traffic violation will come off your record soon, buying a six-month policy will help you avoid locking in high insurance rates.

Six-Month Car Insurance: Conclusion

Six-month car insurance policies are usually offered by major car insurance companies. They help people who may qualify for lower premiums when they renew their policies.

Top Auto Insurance Recommendations

Our team has reviewed the top insurance companies in the market. We’ve compared auto insurance rates, and we recommend starting with Progressive and Geico.

Progressive: Low Rates for High-Risk Drivers

Progressive is known for offering lower rates for drivers with bad driving records. The company also has a well-reviewed telematics insurance program, SnapshotⓇ, that can help improve driving habits. Over time, Snapshot uses the data it collects to calculate the discount.

Continue reading: Advanced insurance review

Geico: Affordable for Most Drivers

Geico is the second largest auto insurance company in the country. It has a reputation for offering lower than average rates and an easy application process. An assessment of its financial strength from AM Best shows Geico should have no trouble covering claim payments.

Continue reading: Geico insurance review

Six-Month Car Insurance: FAQ

Below are the most frequently asked questions about six-month car insurance.

Frequently Asked Questions

Our Methodology

Because customers rely on us to provide accurate and correct information, we have created a comprehensive rating system to create our rankings of the best car insurance companies. We’ve gathered data from many car insurance providers to rank the companies on different levels. The result was an overall score for each provider, with insurers scoring higher on the list.

In this article, we have selected companies with high overall values and cost values. Cost estimates are based on auto insurance rate estimates provided by Quadrant Information Services and discount opportunities.

* Information correct at time of publication.

How many Canadians have no health insurance?

An estimated 250,000–500,000 people live without access to health insurance in Canada.

Is it true Canada has free health care? Canada has a universal health care system funded by taxes. This means that any Canadian citizen or permanent resident can apply for public health insurance. Each state and territory has a different health plan that covers different services and products.

What happens if I don’t have health insurance in Canada?

Canadian citizens who do not have a provincial or federal health insurance plan, who are considered uninsured Canadian citizens, and non-Canadian citizens are responsible for all Hospital charges. Hospital charges are in addition to doctor’s fees as charged by the doctor.

Is health insurance in Canada mandatory?

International students in Canada are required to obtain health insurance throughout their stay in Canada. Some states offer health coverage to some international students, either free of charge or for a fee. In these cases, international students usually have to apply to the province.

Can I stay in Canada without health insurance?

You may be denied entry if you do not have insurance. If your insurance is valid for less time than you expected to stay in Canada, you may be issued a work permit that expires at the same time as your insurance.

Can I go to a doctor in Canada without insurance?

Canada does not pay for hospital or medical services for visitors. You should get health insurance to cover any medical expenses before you come to Canada.

What percentage of people don’t have health insurance?

Fast Facts About Americans Without Health Insurance Nearly 30 million Americans of all ages did not have health insurance in 2021. That’s about 9.2% of the population. The number of people without health insurance varies between states. Massachusetts has the lowest unemployment rate at 3%.

How many people in the US have no health insurance 2022?

Forty-three percent of working-age adults were not adequately insured by 2022. These people were uninsured (9%), had a gap of coverage last year (11%), or they were insured all year but were not insured, which means that coverage does not give them access to affordable health services (23%).

How many people in the US have health insurance?

| Structure | Millions of people |

|---|---|

| – | – |

How many people in the US don’t have health insurance?

In 2021, as the coronavirus (COVID-19) pandemic continues, 27 million people – or 8.3 percent of the population – were uninsured, according to a report from the Census Bureau.

What percentage of the Canadian population has health insurance?

About 60% of Canadians are covered by health insurance, usually through work.

How many Canadians have no health insurance?

An estimated 250,000–500,000 people live without access to health insurance in Canada.

What percentage of Canadians have health insurance?

About two-thirds of Canadians have some form of health insurance that covers services such as vision, dental, outpatient medicine, rehabilitation physical and occupational, psychological and other counseling, and private hospital rooms.

How many people Cannot afford healthcare in Canada?

The report says an estimated 200,000 to 500,000 people in Canada live without health insurance. Updated September 27, 2022: Grace, who was diagnosed with stage three breast cancer, received her first chemotherapy treatment in late January 2020, according to Dr.

What province has the best healthcare in Canada?

British Columbia, the top-ranked province, ranks third behind Switzerland and Sweden, with an “A” of 4 out of 11. At 82.2 years, life expectancy in B.C. it is among the highest in the world.

Which Canadian province has the lowest cost of living? 1. New Brunswick: The Cheapest Province to Live in Canada.

Which city in Canada has the best health care?

| Status | City | In the province |

|---|---|---|

| 1 | Toronto | GO ON |

| 2 | Hawkesbury | GO ON |

| 3 | Cornwall | GO ON |

| 4 | Pembroke | GO ON |

Which province has the best health care in Canada?

British Columbia, the top-ranked province, ranks third behind Switzerland and Sweden, with âAâs at 4 out of 11. At 82.2 years, life expectancy in B.C. it is among the highest in the world.

Which Canadian province has the best quality of life?

Therefore, you can conclude that all Canadian provinces have high quality of life. However, Newfoundland, Labrador, Saskatchewan, and P.E.I. they are all top rated (rated âAâ) and have the best health in the country.

Which Canadian province has the best quality of life?

Therefore, you can conclude that all Canadian provinces have high quality of life. However, Newfoundland, Labrador, Saskatchewan, and P.E.I. they are all top rated (rated âAâ) and have the best health in the country.

What province has the highest quality of life?

Saskatchewan, Newfoundland and Labrador, P.E.I., and New Brunswick rank highest among all regions and receive âAâ grades.

Is Alberta or Ontario health care better?

Health care is comparable in Ontario. Taxes are actually lower than Ontario but the difference has narrowed since Alberta recently raised rates.

Is Manulife better than Canada Life?

| Summary of information | 4.0 | 3.7 |

|---|---|---|

| Administration | 3.5 | 3.3 |

| Culture | 3.7 | 3.4 |

Is Canadian Life the same as Manulife? Manulife Canada is a subsidiary of Manulife Financial Corporation, a Canadian multinational insurance company and financial services provider. Manulife has an extensive presence in Southeast Asia and also in the United States, where they operate through their insurance provider John Hancock.

What is the best type of life insurance in Canada?

Term life insurance is the best and most affordable option for many Canadians, which is why we show term prices below. Whole life insurance tends to cost five to 10 times more than term life policies.

What type of life insurance is the best?

For most people, term life insurance is sufficient, and it is the cheapest form of protection. It lasts for a fixed period of time and offers a guaranteed payout if you die during that time. If you are interested in lifelong protection, a permanent policy such as whole life insurance may be a good fit.

How much is $100000 in life insurance a month?

The average monthly cost of life insurance for a 10-year $100,000 policy is $11.02 or $12.59 for a 20-year policy.

What are the 3 main types of life insurance?

The three main types are whole life insurance, term life insurance and term life insurance.

Who is the number 1 insurance company in Canada?

1. Manulife. Manulife Financial Corporation provides financial advisory, insurance, and wealth and asset management solutions for individuals, groups and institutions through its offices in Canada, Asia and Europe, primarily as John Hancock in the US .

Who is the biggest auto insurance company in Canada?

Intact is Canada’s largest auto insurer and one of the largest providers of specialty insurance in North America. Among the benefits of choosing Intact are its top discounts and exclusive offers.

What are the big 3 insurance companies?

However, the insurance sector has a few bright spots. Three of the world’s 20 largest insurance companies â AXA Group, Chubb, and American International Group (AIG) â rose in the rankings, with AIG registering the biggest improvement, rising from 439 last year to claim the 90th place in 2022. .

Which is bigger Sun Life or Manulife?

The Manulife brand is ranked #- on the Global Top 1000 Brands list, as rated by Manulife’s customers. Their market cap is currently $32.68B. The Sun Life brand is ranked #306 in the Global Top 1000 Brands list, as rated by Sun Life customers. Their market cap is currently $29.79B.

Who is the best health insurance provider in Canada?

- Manulife. Manulife has everything to be proud of. …

- Ontario Blue Cross. Blue Cross was founded in 1939 and Manitoba was the first to establish the plan. …

- Sun Life Financial. Sun Life is ranked 235 in the Forbes Global 2000 list for 2022. …

- Life Assurance Company of Canada. …

- Group Medical Services (GMS)

Who is the number 1 insurance company in Canada?

Manulife is Canada’s largest insurance company, generating approximately $40 billion in annual revenue.

What is the highest rated health insurance company?

Kaiser Permanente is the top-ranked health insurance company in the U.S., according to available government data from the National Committee for Quality Assurance (NCQA). Good insurance companies include Blue Cross Blue Shield, UnitedHealthcare, Humana, Aetna and Cigna.

Who pays for healthcare in Canada?

Canada has a well-funded, publicly funded health care system called Canadian Medicare. Health care is funded and administered primarily by the 13 provinces and territories of the country. Each has its own insurance plan, and each receives financial assistance from the federal government on an individual basis.

How is health care funded in Canada? Publicly funded health care is funded by general revenue generated through federal, provincial, and local taxes, such as personal and business taxes, sales taxes, income taxes, and other revenues. .

Is health care actually free in Canada?

Public health care is considered free because patients are not required to pay any fees to receive medical care at a health care facility. However, public health care in Canada is funded by taxes paid by Canadian citizens and permanent residents.

How much do Canadians actually pay for healthcare?

According to a new study from the Fraser Institute, a family of two adults and two children with a household income of $156,086 will pay an estimated $15,847 for public health care in 2022.

How does Canada pay for free health care?

In Canada, the national government subsidizes health insurance. Most of the services that patients can receive in a hospital or general practitioner (GP) office are covered by government insurance.

Do you get free healthcare in Canada if you’re not a citizen?

How Health Care Works in Canada. Canada’s free public health care system offers a lot when it comes to its citizens and permanent residents. But when it comes to expats, it’s not completely free. Non-residents will be expected to cover additional costs themselves.

Can I move to Canada and get free healthcare?

Depending on your immigration status, the Canadian government offers free emergency medical services, even if you don’t have a government health card. If you have an emergency, it is recommended to visit the nearest hospital. The incoming clinic may charge you fees if you are not a resident of that province or territory.

How long do you have to live in Canada to get benefits?

Benefits from CanadaââCanada provides retirement, survivor and disability benefits through two separate programs. To receive OAS benefits, you must be 65 years of age or older and have been a Canadian citizen for at least 10 years after age 18 (or 20 years after age 18 to receive benefits paid outside of Canada).

Do you have to be a citizen of Canada to get free healthcare?

Universal health care—Canada’s free health care system strives to provide equal services for everyone as long as they are Canadian citizens or permanent residents. Pensioners also get health care in this country.

How much do Canadian citizens pay for healthcare?

According to a new study from the Fraser Institute, a family of two adults and two children with a household income of $156,086 will pay an estimated $15,847 for public health care in 2022.

Is healthcare free in Canada for citizens?

However, all citizens and permanent residents receive the necessary hospital and medical services free of charge where they are used. To pay for excluded services, including outpatient drugs and dental care, states and territories provide some coverage for targeted groups.

How much tax do Canadian citizens pay for healthcare?

Although taxes make up only 30 percent of the income of the average Canadian family, the amount that the Canadian government spends on health care is equal to about two-thirds of the total income of the people.

How much is healthcare per month in Canada?

In September 2021 the average payment for public health care insurance ranges from $3,842 to $15,039 for the six most common types of Canadian families, depending on the type of family.