– Commercial vehicle insurance covers more than just delivery vans and trucks and it is important to ensure that vehicles used for business purposes are properly insured. Small business owners, in particular, may try to save money by using their personal vehicle for business and not telling the insurance company, but the risk can quickly go away according to Rick Torres, State Agricultural Insurance Agent.

Although both auto and commercial vehicle insurance cover accidents, personal injury and property damage, there are major differences between them:

A Solvang car insurance agent reminds business owners that the nature of business driving, including carrying passengers, a wide variety of products, valuable equipment and supplies, and more increases the risk of loss. It is reasonable to expect that business insurance is a little more expensive than personal car insurance, but the price can be as expensive as expected.

Although commercial auto insurance sounds a lot like personal auto insurance, there are a number of differences. Commercial vehicles are often on the road more miles per year than a private vehicle, increasing the risk of a car accident. Commercial vehicles may carry paying passengers who may be injured in an accident. Commercial vehicles drive in and out of various parking lots, delivery areas, and often park in roadside inventory areas, increasing the chances of dents, scratches and other damage.

Commercial vehicle financing is an investment in a business and it is important to protect all business assets. Even a small fender-bender can have an effect. A damaged car needs to go out for maintenance, there may be a cost to hire another car for deliveries or important business appointments, or the car may need to be replaced.

Commercial vehicle coverage covers a variety of vehicles: cars, trucks, vans, farm vehicles and more. State Farm offers many different types of commercial vehicle insurance. One of the best business decisions is to make an appointment with Solvang’s auto insurance agent Rick Torres State Farm Insurance and discuss all of your business insurance needs, including auto insurance.

Rick Torres has served the insurance needs of businesses, individuals and families on the Central Coast of California since 2002. Born and raised on the Central Coast, Torres graduated from Cal Poly San Luis Obispo with a degree in Business Administration and worked in Solvang and Chambers. Buellton’s business, coached youth athletics, and supports a variety of community causes.

Torres and his team are always available to discuss all insurance needs and provide the best insurance solutions possible.

Insurance Agent Rick Torres

Is car insurance going up 2022?

Contents

- 1 Is car insurance going up 2022?

- 2 How big is the commercial auto insurance market?

- 3 Is credit score a factor in car insurance?

- 4 What is the purpose of commercial insurance?

540 Alisal Road, Suite 4 Read also : What is a decent credit score?.

Solvang, CA 93463

Why did my auto insurance go up in 2022?

(805) 688-5418

How much did car insurance go up in 2022? To see also : How do I buy insurance?.

As almost all consumers buy now, the average cost of car insurance is likely to rise for many drivers during 2022. Nationally, car insurance rates are increasing by an average of 4.9%, according to data from the approved rate filing. S&P Global Market Intelligence.

Why did my auto insurance go up for no reason?

Is it normal for your car insurance to increase every year? There are many factors that affect insurance rates. Lowering your credit rating, points against your driver’s record, or changing locations can cause your rates to increase. So, it’s normal for car insurance to go up every year.

Is progressive raising rates 2022?

Inflation. Perhaps the biggest driver of higher car insurance premiums in 2022 is the same thing that raises costs across the board” inflation. Between May 2021 and May 2022, the Consumer Price Index (CPI) has up 8.6%.

Why did my auto insurance go up for no reason?

According to S&P Global Business Intelligence data, the average rate of increase in filings is about 4. To see also : Is it better to stay with one insurance company?.9 percent. This means, while the average cost of car insurance is $1,771 a year for full coverage, consumers could soon be paying up to $1,858 a year for the same coverage.

Is Allstate available in Canada?

Claims in your area If your city has a high rate of theft, accident, and weather-related claims, it can be dangerous for an insurance company to cover drivers in your area. That risk can lead to increased car insurance rates, even if you have a perfect driving record.

Is Allstate a good brand?

Car repairs and replacements cost more Overall, these factors led to a 6.3% increase in car repair and maintenance costs between February 2021 and February 2022, as well as a 41.2% increase in used car prices.

Is Allstate hard to deal with?

Claims in your area If your city has a high rate of theft, accident, and weather-related claims, it can be dangerous for an insurance company to cover drivers in your area. That risk can lead to increased car insurance rates, even if you have a perfect driving record.

Will auto rates go up in 2022?

Learn more about Allstate Insurance Canada. It expanded into Canada in 1953 and is now headquartered in Markham, Ontario. It offers home and auto insurance in Alberta, Ontario, Quebec, New Brunswick and Nova Scotia.

Is now a good time to buy a car 2022?

Allstate tied for the No. 6 spot in our Best Auto Insurance Companies of 2022. It has average or below-average scores in all subcategories, including Best in Customer Service, Best in Claims Handling, and Most Most likely to be recommended.

How long will it take for car prices to drop?

Dealing with Allstate’s reputation is based on several factors. They make an impossible settlement for so many victims. It is a difficult company to deal with an injury claim.

Are 2022 car prices going up?

Rates are likely to increase in 2022 due to inflation and increased insurance claims.

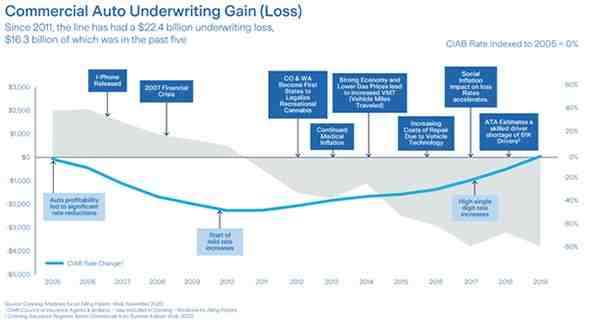

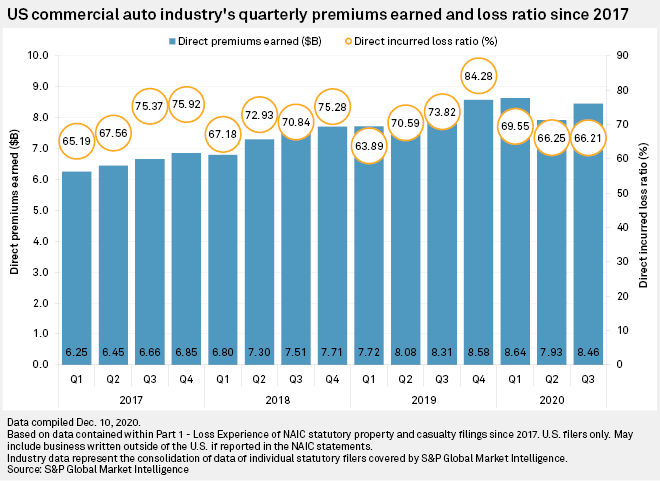

How big is the commercial auto insurance market?

| While rising used car prices are bad for those who can’t afford a new car, they could mean 2022 is a good time to buy a car for those who own a car and trade it in. help reduce the financial stake in buying a new car. | In fact, in November 2021, the average used car is 41% more expensive than it was before the disaster. Fortunately, car prices may return to normal sometime this year. In fact, currency expert Clark Howard says conditions will gradually improve during 2022. |

|---|---|

| Average new vehicle prices (ATPs) increased to $47,148 in May 2022, according to new data released by Kelley Blue Book, a Cox Automotive company. Prices rose 1% ($472) per month and are higher compared to a year ago, up 13.5% ($5,613) from May 2021. | $52.2bn |

| Commercial Vehicle Insurance US Market Size 2022 | 1.3% |

US Commercial Vehicle Insurance Market Size Growth to 2022

How big is the auto insurance industry?

4.4%

What is the future of car insurance?

Commercial Vehicle Insurance United States Annual Market Growth 2017–2022

How much money does the car insurance industry make?

What is the business insurance market? The Commercial Insurance Market means the providers of insurance or reinsurance for the risk associated with the first position of the first party on a regular basis and is not related to or not directly or indirectly controlled by the CUSTOMER or ARIANESPACE.

How big is the commercial insurance industry?

The global auto insurance market size was valued at $739.30 billion in 2019, and is projected to reach $1.06 trillion by 2027, growing at a CAGR of 8.5% from 2020 to 2027.

Is the auto insurance industry growing?

We conclude by 2040: Safety advances in autonomous vehicles could reduce total annual auto insurance premiums by up to 30 percent from current levels. Personal vehicle premiums could see a significant drop.

How big is US auto insurance industry?

How big is the car insurance industry? In 2020, the estimated revenue of the auto insurance industry is $288.4 billion.

Is insurance a growing industry?

The global commercial insurance market was valued at $692.33 billion in 2020, and is projected to reach $1,613.34 billion by 2030, growing at a CAGR of 9.7% from 2021 to 2030.

Are car insurance companies profitable?

The market size of the US Auto Insurance industry grew at a CAGR of 2.3% between 2017 and 2022.

How big is the commercial insurance market?

The auto insurance industry is worth $316 billion, as of 2022 according to IBISWorld data.

How big is the insurance industry globally?

According to Swyft’s annual Industry Report, after ranking 18th for growth in 2020, the insurance industry saw a 24.37% increase in applications year over year.

How big is the commercial insurance industry?

Like any industry, insurance companies make a profit while bad companies don’t. Insurance companies make money from premiums paid by consumers. They also generate income to invest this money. With varying risk and income, good insurance companies can remain profitable year after year.

Is credit score a factor in car insurance?

The global commercial insurance market was valued at $692.33 billion in 2020, and is projected to reach $1,613.34 billion by 2030, growing at a CAGR of 9.7% from 2021 to 2030. Commercial insurance is a type of insurance designed to protect business.

The total Global Health Insurance Market is estimated to reach USD 3.3 Trillion by 2028. The market stood at a revenue of USD 2.6 Trillion in 2021, and is expected to grow at a Compound Annual Growth Rate (CAGR) ) of 4.4%.

Is credit a factor in car insurance?

The global commercial insurance market was valued at $692.33 billion in 2020, and is projected to reach $1,613.34 billion by 2030, growing at a CAGR of 9.7% from 2021 to 2030.

Are insurance rates based on credit?

A high credit score lowers your car insurance rate, often significantly, with almost every company and most states. Getting a quote, however, does not affect your credit. Your credit score is an important part of determining how much you pay for car insurance.

What is the credit score for car insurance?

How does credit score affect insurance? Statistical analysis shows that those with low insurance scores are more likely to file a claim. Those with higher credit scores tend to get into fewer accidents and cost insurance companies less than their counterparts with lower scores.

How does bad credit affect insurance?

Your credit score is an important part of determining how much you pay for car insurance. A better score usually gets you a better rate, and worse credit makes your insurance more expensive. Bad credit can more than double the cost of insurance, according to a national analysis of premium insurers.

What is the credit score for car insurance?

How does credit affect car insurance rates? Nationwide uses a credit-based insurance score when determining premiums. Studies show that using these scores helps us better predict insurance losses. In fact, 92% of all insurers now consider credit when calculating auto insurance premiums.

What is an insurance credit score?

A good auto insurance score is usually above 700, and a higher score is always better. But it is important to remember that each car insurance provider and car insurance company has its own definition of “good†.

What’s the highest insurance credit score?

Insurance companies cite various studies that show that drivers with poor credit are more likely to file claims, which means these drivers pose a higher risk and potentially cost more to insure. The more risk and expense you incur, the higher the cost of your car insurance.

What is the purpose of commercial insurance?

A good auto insurance score is usually above 700, and a higher score is always better. But it is important to remember that each car insurance provider and car insurance company has its own definition of “good†.