August 1, 2022 by Leave a comment

Most seniors like to be independent. It may mean that you keep driving, even against the advice of your family. Fortunately, the insurance proves to be a good financial security in the event of accidents.

For minor accidents, such as a fender bent or a rear-end collision at low speed, car insurance may come in handy for seniors and their families.

One of the leading names in the auto insurance industry is Progressive. The provider is known for its cost-effective plans with something for everyone, including seniors. Make sure to check progressive car insurance reviews if your current coverage is expiring or if you want to change supplier.

Car Accidents Can Be Expensive

Contents

- 1 Car Accidents Can Be Expensive

- 2 Pick the Right Type of Insurance

- 3 Steps to Take After an Accident

- 4 The Bottom Line

- 5 Does insurance follow the car or the driver in California?

- 6 Do police investigate minor hit and runs in California?

- 7 What should you not say to your insurance company after an accident?

- 8 What happens if someone who isn’t on your insurance crashes your car?

This should come as no surprise, but every US state (except Virginia and New Hampshire) prescribes some form of car insurance to protect you and others involved in an accident from financial liability. Read also : Fighting over COVID auto insurance data could set the stage for massive combat control in Illinois.

However, you may be in trouble if you are driving without valid insurance. This would not only mean financial liability for covering the cost of the car and other damages, but also legal ramifications.

Pick the Right Type of Insurance

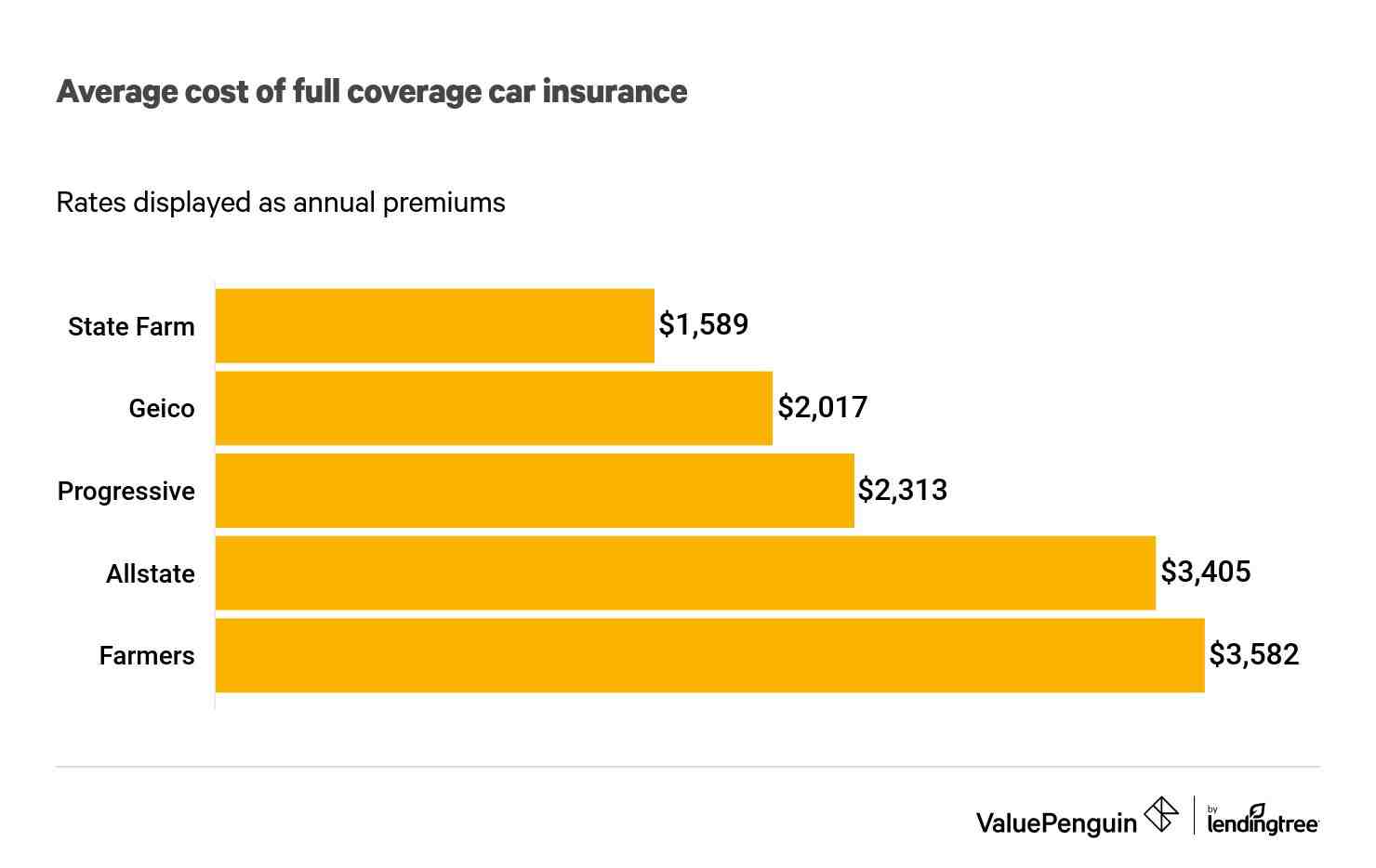

With many car insurers to choose from, choosing the right company can be quite a challenge. This may interest you : Report: Florida is ranked 2nd highest for car insurance costs. However, seniors can make the decision easier by asking their agent for the best insurance options or searching an online auto insurance comparison tool.

Many factors can affect your car insurance premiums, including your driving history, claim frequency, and so on. On the other hand, drivers who have a good driving history can get discounts on monthly insurance premiums.

Comprehensive insurance is the best protection for seniors as it covers most of the expenses. You may have to pay an excess with each claim, so make sure you have discussed all terms and conditions before selecting your preferred comprehensive car insurance plan.

Steps to Take After an Accident

The first thing you need to do after an accident is to make sure you and your passengers are safe and out of harm’s way. To see also : How does your address affect your car insurance?. After that, you can proceed to exchange contact numbers, insurance and policy details, along with the license plate, color and car model.

It is also recommended to make a note of the scene of the accident as this can help the insurance company process your claim faster.

Then you can apply for insurance with the supplier. The insurance appraiser will review the data provided by both parties and determine who is at fault. General vehicle inspection and property damage can also be performed.

The Bottom Line

It’s only natural to panic after a car accident, even if it’s a relatively minor incident. But if you remember the steps mentioned above, you can make sure that you are financially secure in the event of any damage.

It is not important to discuss blame, especially after an accident. Instead, take the situation calmly, regardless of the fault, and list all relevant information to assist with the claim process. Make sure you ask family or friends to take you to your preferred locations a few days after the accident and the car has been repaired.

You might also like…

Does insurance follow the car or the driver in California?

In California, insurance usually covers the car, but not all cases are the same. If you are planning to borrow the car to a family member or friend or borrow the car from someone else, remember that it is wise to look through both insurance policies first.

Can someone who is not covered drive drive in California? Permission to use Most car insurance policies cover the drivers listed on the policy or anyone you let them drive your car, says Nolo.com. This means that your insurance will likely cover the other driver in the event of an accident, as long as they had your license to drive your vehicle.

Does car insurance follow the car or the driver?

If you are not a “named driver” in car insurance, you will almost certainly not be insured. And both the driver and the car owner can get into trouble if they are caught without the necessary cover.

Will GEICO cover my car if someone else driving?

GEICO includes someone who drives your car, as long as they only occasionally drive it and you give them permission to do so. This is called fair use. As long as your roommate only drives 12 times a year or less, they are covered by your policy.

Is car insurance attached to the person or the car?

Contrary to popular belief, car insurance usually follows the car rather than the driver. If you let someone else drive your car and they have an accident, your insurance company will likely be responsible for paying your claim, depending on the coverage on your policy.

Does adding a driver to insurance cost more GEICO?

Typically, adding another vehicle will increase your rates more than adding a new driver to a vehicle already covered, especially if you both have similar risk profiles. The only way to know for sure what the bid increase will be is to get a quote from GEICO

Can you drive someone else’s car in California?

Driving Someone’s Vehicle Without Car Insurance Under California law, proof of financial liability or insurance is required to drive a vehicle. You cannot drive in California without insurance, and you or the person you borrow from must have insurance to legally drive.

What happens if someone else is driving my car and gets in an accident California?

If you let someone else take your car and they have an accident, your insurer is required to pay you compensation based on your policy coverage. The claim will be marked on your insurance records and this may affect your future insurance costs.

Can you drive someone’s car with their permission?

There is no limit to the number of people who can drive a car, so any friends or family who have your consent are legally insured to drive the car. This type of car insurance is much less common as most people only have one or a few named drivers added to their existing policy.

Can I drive a friend’s car with my insurance in California?

You are borrowing a vehicle from a family member or friend. When you drive a vehicle that belongs to a family member or friend, the losses resulting from the accident are usually covered under their insurance policy. However, it is the vehicle owner who chooses the insurance limits, not you.

What happens if someone else is driving my car and gets in an accident in California?

If you let someone else take your car and they have an accident, your insurer is required to pay you compensation based on your policy coverage. The claim will be marked on your insurance records and this may affect your future insurance costs.

What happens if someone else is driving my rental car and gets in an accident?

Specific to rental cars, who is the main tenant is responsible for the vehicle. If they allow an unauthorized driver to drive, they will have to pay for the vehicle if lost.

Is the registered owner of a car liable for an accident in California?

Who is responsible for the accident? Section 17150 of the California Vehicle Code states that the liability for an accident rests with the other owner. The owner pays for the insurance. The range therefore also covers the vehicle, not the person.

What happens if someone who isn’t on your insurance crashes your car?

The car owner may even be charged a fee to allow an uninsured driver to use his car. If you have damaged another vehicle or property, another driver may take legal action to recover the damage from you.

Do police investigate minor hit and runs in California?

California Police will work hard to identify the driver who hit him and escaped, both to compensate the victim and to punish the perpetrator. The police will work to investigate the accident, find evidence and track down the guilty driver.

How long will it take for the police to stop investigating and getting out of California? How long does a hit and run investigation take? People often ask “how long before the police stop investigating a hit and get away?” If there are no injuries and only property damage, a misconduct will be reported and must be filed within one year from the date of the incident.

How long do you have to report a hit and run in California?

Notify your agent and / or insurance company immediately. If someone is injured or the damage to the vehicle exceeds $ 750.00, you must report the accident to the Department of Motor Vehicles within 10 days. Failure to notify the DMV may result in the suspension of your driving license.

What is the statute of limitations for a hit and run in California?

What is the limitation period for an accident with set-off and runaway? Most California personal injury claims have a two-year statute of limitations (talk to your personal injury attorney about exceptions to this rule), including impact and escape accidents.

How long does it take to file a hit and run report in California?

For example, in California, drivers have 10 days to file an accident report with the Department of Motor Vehicles (DMV) if an accident: someone is injured or killed or. caused more than $ 1,000 in property damage to one casualty.

How long do you have to file a police report after a car accident in California?

Under the California Vehicle Code, you have 24 hours to report a car accident to a California Road Patrol or local police department if the accident happened in their jurisdiction. It is mandatory if someone was injured or killed in an accident.

What happens if you do a hit and run in California?

As a misdemeanor, strike and escape carries a sentence of up to six months in the County Jail, as well as a fine of up to $ 1,000.00 or both. Penalties can also include a 3-year suspension, property damage and 2 points in California Driving History.

How long do you have to report a hit and run California?

Under Assembly Bill 184, SOL lasts six years for a strike-and-escape charge in California. This means that the prosecutor must prosecute for hitting and running within six years of the driver’s commission of the offense. If he does not, no charges can be brought. AB 184 was signed in 2014.

How do I report a hit and run in California?

If you don’t stop, you could be convicted of “hit and run” and severely punished. Someone may be hurt and need help. Call 9-1-1 immediately to report a collision to the Police or California Highway Patrol (CHP).

Are most hit and runs solved?

Research has estimated that only about 10 percent of hit-and-run cases were resolved due to an overwhelming lack of evidence.

How many hit-and-runs happen in the US?

The current analysis shows that both the hit-and-run accident rate and the fatalities rate are increasing. An estimated 737,100 hit and run accidents occurred in 2015 (NHTSA, 2016). This translates into a hit and run crash that happens somewhere in the US every 43 seconds.

How many hit-and-run cases are solved in California?

Unresolved hits and escapees on the rise According to a LAPD memo, only 43% of hits and escapees have been investigated in the last five years. Only half of this small percentage is dissolved. Research shows that the average hit and run is around 26 minutes.

What state has the most hit-and-run accidents?

| Rank | 1 |

|---|---|

| Country | California |

| Fatal failures | 2948 |

| Fatalities | 3056 |

| Fatal accidents 10 billion miles | 8.8 |

What should you not say to your insurance company after an accident?

Even if you know the accident was your fault, don’t apologize or plead guilty at the scene as the insurer may have a clause on it. Exchange details with the other parties involved and contact your insurer to report the incident.

What happens if someone who isn’t on your insurance crashes your car?

The car owner may even be charged a fee to allow an uninsured driver to use his car. If you have damaged another vehicle or property, another driver may take legal action to recover the damage from you.

What happens when your friend crashes your car? Car insurance usually follows the vehicle, not the driver. Your friend’s insurance does not usually cover damages caused by an accident when he drives someone else’s vehicle. Your insurance usually covers your friend’s accident as long as your friend is a licensed driver and does not regularly borrow your car.

What happens if someone wrecks your car and they aren’t on your insurance progressive?

As long as you gave them permission to drive a car, they should be covered by insurance. Their policy covers your car and covers them in the same way as if they were driving their own car. Damage they cause to other cars, property or even personal injury is covered under the warranty. In the event of a collision, damage to your car is covered under the warranty.

Can I add my girlfriend to my car insurance progressive?

Add a significant other to your policy on the Progressive page. Log in to your policy or call 1-866-731-8075 to add your significant other. You will need their date of birth, driving history and driving license information, as well as a Vehicle Identification Number (VIN) if you plan to add their vehicle to a shared policy.

Can someone drive my car if they are not on my insurance progressive?

As long as you gave them permission to drive a car, they should be covered by insurance. Their policy covers your car and covers them in the same way as if they were driving their own car. Damage they cause to other cars, property or even personal injury is covered under the warranty.

What to do if someone hits your car and drives off progressive?

Do not leave the scene or move the car. Locate the person who hit your car and exchange the information (if possible) Take photos and contact the authorities to report to the police. Contact your insurer and file a claim if necessary.