Tips for lowering car insurance prices

written: Mar 18, 2022 / 15:54 EDT

Updated: 18/03/2022 03:54

WASHINGTON (WDVM) – Gas prices are rising, but this is not the only increase in driving costs – Inflation is also causing car insurance rates to rise.

Experts say the key to keeping your insurance rates low is to shop – just by comparing rates, you can save almost $ 900 a year. Other than just shopping around, increasing your deduction and claiming other benefits such as being a safe driver can work to your advantage. Maintaining a good credit score can also help reduce your insurance rates.

“Compare store, do not be afraid to do that,” said Rod Griffin, senior director of consumer education at Experian. “It enables you as a consumer. You want insurance companies to compete for your business, so use a tool like Experian to compare these rates and get the best terms you can.

What causes insurance rates to go up?

Contents

- 1 What causes insurance rates to go up?

- 2 How can I save more on my car insurance?

- 3 Can my son drive my car if he is not insured?

- 4 Why does my car insurance keep going up every month?

Car accidents and traffic injuries are common explanations for an increased insurance rate, but there are other reasons why car insurance premiums increase, including a change of address, new vehicle and claims in your zip code.

How can I save more on my car insurance?

IN THIS ARTICLE

- Shop around for your car insurance.

- Compare insurance costs before buying a car.

- Increase your sales.

- Reduce optional insurance on your older car.

- Bundle your insurance and / or stick with the same company.

- Get a good credit history.

- Benefit from low mileage discount.

- Ask about group insurance.

What is a way to reduce your car insurance premiums? Increase Your Deduction Another quick and easy way to reduce car insurance costs is by increasing your sales. If you can afford to pay a higher rate in case of a claim, you will see less car insurance costs for your premium.

Can you actually lower your car insurance?

There are two ways you can save on car insurance by reducing coverage. First, you can lower your policy limits. The other option is to drop unnecessary types of coverage. For example, if you own an old car that is not worth much, you may consider collision fall and a comprehensive coverage.

What raises and lowers your car insurance?

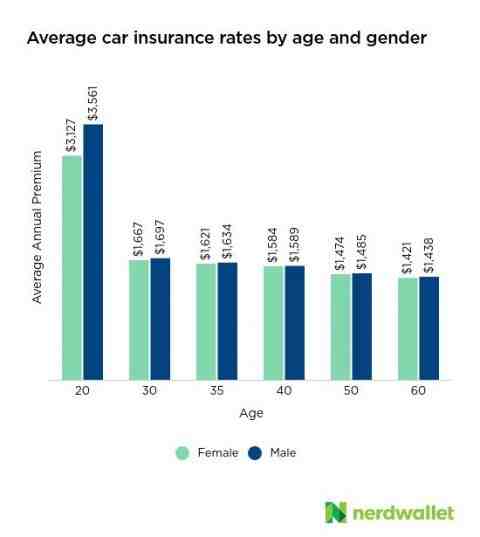

Some factors that can affect your car insurance premium are your car, your driving habits, demographic factors and the coverages, limits and rejections you have chosen. These factors can include things like your age, anti-theft features in your car and your driving record.

Is car insurance supposed to decrease every year?

When will car insurance premiums go down? From the age of 16 to 25, your car insurance rates are steadily declining for each year that you keep your driving record clean. Car insurance rates go down by age 25 by a large margin. Rates then slowly but surely drop to 65 years before rising again.

Will my car insurance go down on its own?

Car insurance premiums do not automatically go down when you pay for your car, but you can probably lower your premium by taking out coverage that is no longer required. … so you may have the flexibility to reduce your coverage and get a cheaper rate when your car is fully paid.

What raises and lowers your car insurance?

Some factors that can affect your car insurance premium are your car, your driving habits, demographic factors and the coverages, limits and rejections you have chosen. These factors can include things like your age, anti-theft features in your car and your driving record.

Common reasons for high car insurance costs include your driving record, age, coverage options where you live, the car you are driving, your credit history or not benefiting from discount. The average car insurance premium has also become more expensive as it has increased by more than 50% in the last 10 years.

What makes your car insurance go down?

Your age, driving history, credit score, address, occupation, and use of the car can all affect the cost of your car insurance. You can see that your car insurance decreases with age – especially between 18 and 25 years – when your insurance company offers age discounts.

Can my son drive my car if he is not insured?

Most insurers cover someone else who drives the insurer’s car with their permission once in a while. However, if you regularly start driving one of your parents’ cars, you will need to add or name them on their car insurance. Even without insurance, you are not allowed to drive your parents’ car legally.

Can someone who does not live with me drive my car? No, you can in most cases add someone who does not live with you and add your car insurance. Students who do not live at home but still use their parents’ home as a permanent address are the biggest exception to this rule.

Can I drive my parents car UK?

Yes, if you are properly insured and comply with other legal requirements for student drivers, such as being properly supervised by a more experienced driver, and showing L-plates.

Can I drive my mums car if Im fully comp?

No. There was a time when many full-comp policies would automatically give you third party insurance to drive any car, but those days are gone. So even if you are fully covered for your own car, do not assume that you are insured for other people to drive their car, otherwise you risk breaking the law.

Can I drive someone else’s car without insurance UK?

It is illegal to drive a vehicle on a road or in a public place without at least third party insurance. Even if the vehicle itself is insured, if you are not properly insured to drive it, you may be penalized.

Can I be the main driver on my parents car?

In the right circumstances, it is quite ok to be insured as a driver with the name on the parent policy; and you can save money in the short term, but there are several reasons why it is not always a good idea and in some cases even breaking the law!

Can my parents insure my car if I don’t live with them?

If you or your husband own a vehicle, you can decide to insure the vehicle on your own car insurance policy or on your parent’s policy. All drivers that share the same permanent residence should be listed on each policy. If you are married and do not live with your parents, you need your own policies.

Can I insure my daughters car if she owns it?

The Takeaway. There is no age limit to be on a parent’s car insurance policy. There is no need for your own policy if you do not own the car. Prices may be lower if you stick to your parenting policy.

Can I insurance a car that is not in my name?

Generally, you are covered by their car insurance policy, even if you are not listed as a regular driver on the vehicle. This is called “permissive use”: the vehicle owner and the car insurer allow you to drive the vehicle temporarily, so that the insurance cover extends to you when you use that vehicle.

Can I insure my car in my parents name?

You can not be on your parents’ car insurance if the car is in your name and you are listed as the sole owner. Your parents can not insure your car unless they are listed as owners. So if you are thinking of buying your own car, it is a good idea to ask for the first quotes from different insurance companies.

Can I drive my mums car?

There is no limit to how many people can drive the car, so any friends or family who have your permission are legally insured to drive it. This type of car insurance is much less common because most people have only one, or a few, named drivers added to their existing policies.

Who made IM in me mums car?

The original creator of the ring now identifies himself as Tristan Jay Simmonds after he was recently released as a transgender.

Why does my car insurance keep going up every month?

The increase in rate levels occurs when an insurance company finds that their overall rates are too low because expenses (losses) have arisen from recent claims that have been made, and on industry trends toward more expensive repair and medical costs. .

Why does my car insurance go up every month? Even drivers with a clean record can see an increase in their insurance renewal rate. As mentioned above, automatic rate increases are sometimes based on factors out of your control, such as claims and your zip code. Or, if you added a new driver or vehicle to your policy, your rate may also increase during the renewal period.

Why does my car insurance keep fluctuating?

Car insurance rates often fluctuate for a number of reasons. These reasons include your driving record, drivers on politics, vehicles on politics, state laws, and the accidents and crimes in your area. Driving Record – Your driving record is a major contributor to higher rates.

Is it normal for insurance to fluctuate?

Car insurers price their policies based on a number of factors. Sometimes these cost factors go up, and sometimes they go down. In most states, costs are currently rising. Your actions, as insurance, can also affect what you pay for.

Why did my car insurance go up when nothing changed?

Your new zip code may have higher crime rates, or be more densely populated, both factors that can affect your premiums. Sometimes, even if nothing has changed in your life, your insurance premiums can still go up due to factors that are completely beyond your control.

Why does my auto insurance go up every 6 months?

The increase in car insurance rates is usually associated with increases in the insurance risk of the insurance holder. But another reason that Progressives could increase rates after 6 months is that insurance costs worldwide have increased over time. … You have moved to a more densely populated region (considered a higher risk).

Is it cheaper to pay car insurance every 6 months?

In most cases, a six month policy is cheaper than a 12 month policy because you pay for coverage over a shorter period of time. However, if you compare your car insurance price on a monthly basis, there can not be much difference between a six month policy and a 12 month policy.

How much should insurance go up each year?

On average, car insurance premiums increased by 2% between 2018 and 2019 – the last year for which data were available.

Is it normal for car insurance to go up every year?

Annual increases are very typical across the industry, but the way your risk factors are viewed by a particular company can vary. To ensure that you do not overpay, you should know your coverage and discount to ensure you get the best price for the coverage you need.

How can I stop my car insurance going up?

The best way to avoid a car insurance increase is to keep your California driving record clean. You can even qualify for a “Good Driver Discount” if you do not have too many points on your record. Contact your insurance provider to see if you are eligible.

Qui est derrière Luko ?

Solid investors Bruno Rousset, Founder of April Assurance. Pierre-Yves Durand, former Marketing Director of Axa. Accel, a third-party investor in Spotify, ShiftTechnology and Deliveroo.

Comment fonctionne Luko ?

Op explique, op Filme les dégâts, Luko Assurance fait operating of fraud detection algorithms, and, if the sinister is simple, it is reimbursed in less than two hours. Sinon, a video expertise is realized remotely and a repairman intervenes for 48 hours.

Qui assure les trottinettes electriques ?

The French Federation of Insurance reminds that electric scooters must, as a motorized vehicle, have civil liability insurance. â † ’From 3,3€ / month, Luko’s electric scooter insurance and NVOI offer you compulsory civil liability.