9:00 p.m. CDT, Cooke County, Fannin County, Lamar County, Jack County, Wise County, Denton County, Collin County, Hunt County, Delta County, Hopkins County, Rains County, Palo Pinto County, Parker County, Tarrant County, Dallas County, Rockwall County, Kaufman County, Van Zandt County, Erath County, Hood County, Somervell County, Johnson County, Ellis County, Comanche County

You may want to double check your car insurance bill. Rates are rising and affecting a lot of people. Dan Roccato shares tips on keeping these insurance rates stable.

Latest Video

Contents

- 1 Latest Video

- 2 What are the five major types of insurance?

- 3 Is it cheaper to pay car insurance every 6 months?

- 4 Does credit affect car insurance rates?

- 5 What is the best bodily injury coverage?

When a rate hike is seen by an insurance company that the overall rates are too low, due to the costs (losses) and recent industry costs for more expensive repairs and medical costs due to recent claims. This may interest you : What are different types of insurance?.

What are the five major types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are all five types that everyone should have. On the same subject : Who is cheaper than Geico?.

What are the 6 main types of insurance? The six most common types of car insurance are self-liability coverage, uninsured and underinsured drivers coverage, comprehensive coverage, collision coverage, medical payments and personal injury protection.

What are the 5 types of insurers?

Types of insurers

- Different types of insurers. To see also : Which insurance share is best?. There are many types of property and accident insurance that operate in Texas. …

- Stock Insurance Companies. …

- Mutual societies. …

- Provincial Mutual Societies. …

- Farm Mutual Insurance Company. …

- Lloyds Plan companies. …

- Exchanges.

Who are insurers?

The insurer is a company that provides you with financial coverage in the event of specific and unfortunate events listed in your insurance policy. An insurer can be an insurance company as well as an insurance company.

What are the 3 types of insurance?

Next, we will look in more detail at the three most important types of insurance: property, liability, and life.

What is insurance what are its types?

Insurance policies can cover medical expenses, vehicle damage, business losses or travel accidents, etc. Life insurance and General Insurance are the two main types of insurance. General insurance can be classified into subcategories that fall into several types of policies.

What are 3 types of insurance?

Next, we will look in more detail at the three most important types of insurance: property, liability, and life.

Is it cheaper to pay car insurance every 6 months?

In most cases, a six-month policy will be cheaper than a 12-month policy because you pay for coverage in a shorter period of time. However, if you compare the price of your car insurance on a monthly basis, it may not be very different between a six-month policy and a 12-month policy.

Is it better to pay for car insurance every month or every year? Paying your insurance premiums every year is almost always the most expensive option. Many companies give you a discount for paying in full because it costs the insurance company more if an insurance company pays its premiums on a monthly basis, which requires monthly processing by hand to keep the policy active.

Does car insurance lower after 6 months?

If you keep your driving record clean and have a previous offense that expires in the next six months, your rates may go down. 6-month car insurance can also benefit drivers who will soon pay their car loan and those who improve their credit.

How often does car insurance decrease?

But assuming you’re a good driver, you’ll probably start to see a reduction in your car insurance even before you turn 25 every time you renew your policy. You may see an even bigger reduction when you turn 25, because the insurers see it then. a significant drop in the number of claims filed per age group.

How long does it take car insurance to decrease?

Generally, car insurance companies only consider the last three or five years of your driving history. So while accidents may not necessarily be removed from your record, they probably won’t be considered after that time.

Does my car insurance go down every 6 months?

While turning 25 does not guarantee a reduction in your premiums, 25 is the age at which many insurance companies reduce the amount young drivers pay. Even at age 25, your insurance premiums tend to go down as you get older, so checking in every six months can save you money.

Why do insurance companies do 6 month policies?

Why do insurers offer six-month auto insurance? Most insurers prefer six-month car insurance to have the flexibility to recalculate your rates during the previous term.

Why is insurance every 6 months?

Six-month policies are more common than annual insurance policies, as insurance companies allow you to easily calculate rates, taking into account regular pricing reviews and changes to your driving profile.

Is 6 months car insurance good?

Six-month policies can also be a good option if you want to be free to cancel your policy more often and avoid cancellation fees if your company charges you. In general, insurance agents recommend 12-month policies if you have the option to avoid the risk of raising your premium twice a year.

What does a 6 month policy mean?

Six-month car insurance is a type of insurance where the car owner makes a single payment to cover his car for six months, instead of the usual 12-month policy plan.

Is it better to pay 6 months upfront car insurance?

The answer is given. â € œPaying your car insurance premium in full every six months will save you money. According to your insurance carrier, this can significantly reduce your premium compared to your monthly payments.

Does insurance get cheaper after 6 months?

While 25 years does not guarantee that you will save money on your car insurance, many car insurance providers reduce rates for policyholders. As your premiums can also go down from the age of 25, shopping every six months can reduce your car insurance costs.

Is it better to pay monthly or upfront?

Suddenly it makes sense if you want to pay comfortably and save in the long run. On the other hand, you will have to pay installment payments if you do not have enough money in advance and are more comfortable with a consistent monthly payment.

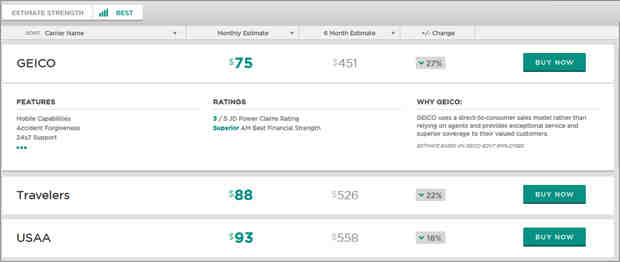

Is car insurance cheaper if you pay upfront?

The higher the risk for insurance, the more money it will require in advance. The lower the annual premium, the cheaper your car insurance will be. Two of the cheapest car insurance companies are USAA and GEICO. Read our guide to learn more about insurance payments.

Does credit affect car insurance rates?

Higher credit scores reduce your car insurance rate, often significantly, in almost every company and in most states. Getting a quote, however, does not affect your credit. Your credit score is a key part of determining the rate you pay for auto insurance.

What is the best bodily injury coverage?

The best liability coverage for most drivers is 100/300/100, which is $ 100,000 per person, $ 300,000 for personal injury liability per accident, and $ 100,000 for property damage liability per accident. You want to be fully protected if you cause serious damage in a guilty accident.

What should I choose for liability for bodily injury? Financial experts recommend bringing at least $ 100,000 in coverage for bodily injury liability for an injured person and $ 300,000 to cover the expenses of many victims. Most major auto insurance providers will allow you to increase your coverage to those levels, perhaps even higher.

What does is mean if the coverage limits are $250000 /$ 500000?

Let’s explain. $ 250,000 per person, $ 500,000 per accident, and $ 100,000 for property damage. In other words, most of what your insurance company will pay for a person’s injuries is $ 250,000 (per person), if several people are injured $ 500,000 (per accident) and property damage is $ 100,000.

What coverage limits do most insurance companies have?

Explained the limits of car insurance

- $ 50,000: The maximum coverage limit that your insurance will pay for bodily injury per person.

- $ 100,000: The limit your insurance will pay for bodily injuries for each accident.

- $ 30,000: The limit your insurer will pay for damage to property in another person’s vehicle or property.

What does the 25k 50k mean on insurance?

The first number 25 is worth $ 25,000. This is the maximum coverage for liability for bodily injury to a person injured in an accident or incident. The second number 50 is worth $ 50,000. This is the maximum liability coverage for all bodily injuries injured in an accident.

What does $100000 /$ 300000 /$ 100000 mean for liability coverage?

Industry experts suggest liability for at least $ 100,000 in personal injury liability per person / $ 300,000 for bodily injury per accident / $ 100,000 in property damage (100/300/100). This is how liability insurance works.

What are the three types of bodily injury coverage?

Car insurance

- Liability for bodily injury.

- Medical payments or personal injury protection (PIP)

- Liability for property damage.

- Crash.

- Integral.

- Uninsured and uninsured driver coverage.

What is third party bodily injury?

“Third Party Liability” refers to bodily injury caused to a person as a result of the actions or failures of a third party due to the negligence or negligence of third parties. Third party liability may arise when a natural person or entity that is separated from the employer is involved in a work-related accident.

What are the types of bodily injury?

Body injury refers to specific types of damage to the body after an event, such as bruises, burns, cuts, broken bones, and nerve damage. When someone takes out bodily injury insurance, it covers the expenses of the other person involved in the accident.

What are the 3 types of insurance?

Next, we will look in more detail at the three most important types of insurance: property, liability, and life.

What is the lowest bodily injury coverage?

The minimum amount required by law is $ 25,000 per person, $ 50,000 per accident.

What is the least amount of car insurance coverage?

According to ValuePenguin, they recommend at least a policy that includes: $ 100,000 in personal injury coverage per person. $ 300,000 for personal injury coverage per accident. $ 50,000 in property damage per accident.