Tips from experts on buying car insurance for the first time

Buying your first car is an exciting time for new drivers, but the upfront costs aren’t limited to the vehicle’s sticker price. In addition to state registration costs, taxes, and fees, many dealers will require proof of insurance for your new car before you can drive it off the lot.

For first-timers, shopping for auto insurance and getting the right amount of coverage at the right price can feel overwhelming. But the process is pretty straightforward – and once it’s all said and done, you’ll have the peace of mind you need to hit the road.

How to get car insurance for the first time

Contents

If you are a first-time buyer, here are the steps you should take to get car insurance for the first time:

Gather your important documents

When buying car insurance, you need to have some documents and personal information in hand to provide the insurance company you choose with everything it needs to give you your policy. On the same subject : When can northern Michigan drivers expect a $400 auto insurance refund?.

The agent will need your personally identifiable information (PII), such as your full name, date of birth, home address, and driver’s license number. It will also require basic information about the vehicle you are planning to insure. You’ll need the vehicle’s year, make, and model, as well as the vehicle identification number (VIN), which can be found on the driver’s side door or windshield. The agent will also ask a few questions to understand the car’s condition and usage, such as the current mileage, mileage, and date of purchase.

This information will not only tell the insurance company what coverage will meet your needs, but will also help determine the true value.

Determine what kind of coverage you’ll need and how much

Once you have gathered the necessary documents, shop around before you settle on one insurance company. Read also : What is the gender rule in insurance?. Many companies offer free estimates online to help put a number on how much you can expect to pay for coverage.

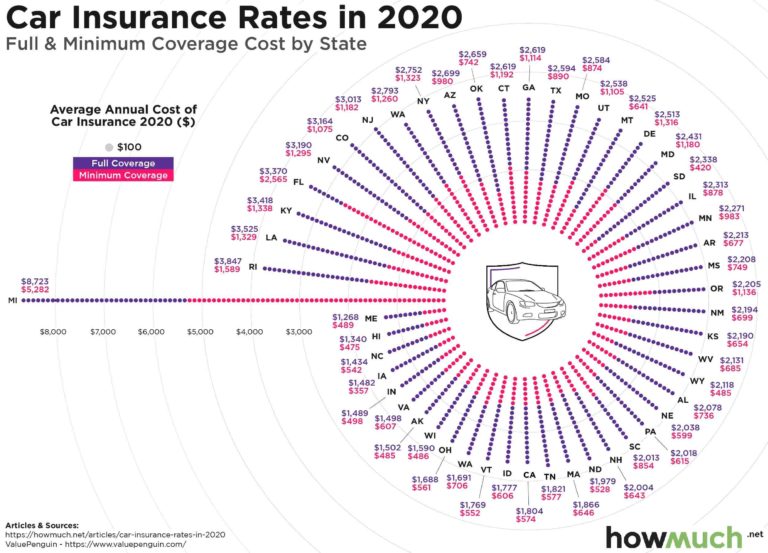

While your actual rate will vary based on your driving record, financial history, age, and more, you can expect to pay somewhere between $150 and $250 for your monthly rate. “With a good driving record and a long insurance history, it’s possible that the rate will decrease in the future,” said David Stuart, founder and president of Southwest Insurance Group.

There are different levels of coverage available, and no two policies are the same. But most car insurance policies will include the following:

Choose a policy that meets your needs

Once you’ve compared the rates and coverage limits from different insurers, you’ll want to choose the policy that—at the very least—meets your state’s minimum requirements. To see also : Is it better to stay with one insurance company?. Although Stuart says that if your budget allows, you may want to spend a little more on additional coverage.

While first-time drivers may face higher premiums because they are new to the road and pose a risk to insurers, you can still seek discounts to lower your costs by asking about low-mileage discounts or good student discounts. , or combine your insurance policy.

“Be willing to learn; we have insurance for a reason,” Stuart said. “Sure you can let the agent know you’re smart and want the best deal, but it’s important that the agent be able to recommend the best coverage for you. The last thing you want is to get the cheapest plan and then find out later you’re not covered when you need it. “

Follow Fortune tips on Facebook and Twitter.