Top Tips to Lower Your Car Insurance Premiums

Merging multiple insurance policies under a single provider can lead to some pretty hefty savings, a fact that many savvy consumers have discovered. Picture this: you bundle your auto insurance with other types—like homeowners or renters coverage—and voilà! Insurance companies often reward this strategy with lower premiums. It’s not just about saving cash; it also tidies up the chaos of managing different policies and cultivates a more integrated relationship with your insurer, which could mean better customer service down the line.

But wait, there’s more! Beyond those sweet financial perks, bundling offers a delightful boost in coverage cohesion. Each type of insurance isn’t just sitting on its own island; they’re designed to work together harmoniously. By consolidating these policies into one neat package, policyholders might uncover broader coverage options and minimize pesky gaps that can leave them exposed. Plus, navigating claims becomes less of a headache when everything is streamlined under one umbrella. All these benefits come together to foster an overall sense of security—a reassuring feeling that every facet of your financial safety net is being addressed as one cohesive whole.

Benefits of Multi-Policy Discounts

Contents [hide]

One of the smartest moves you can make to slash those car insurance premiums is to bundle up—like a cozy winter scarf—with multiple policies from the same insurer. Picture this: many companies dangle enticing discounts when you merge your home, auto, and other coverage types into one neat package. Not only does this tidy up your insurance management like a well-organized drawer, but it also paves the way for some serious savings since insurers often shower loyal clients with rewards in the form of multi-policy discounts.

But wait! There’s more than just saving a pretty penny. Bundling isn’t merely about frugality; it can elevate your entire coverage experience. Imagine having all your policies under one roof—it simplifies communication and streamlines claims processes as if everything were on autopilot. See the article : Michigan has dropped to the fourth most expensive state for auto insurance, a new report shows. Plus, when you’ve got all your eggs in one basket (the good kind!), customer service tends to improve because agents who know your complete portfolio can whip out personalized advice and recommendations tailored just for you. This seamless integration cultivates a sturdy bond with your insurance provider, ultimately reaping benefits during those crucial moments when you need them most!

Review Your Credit Score

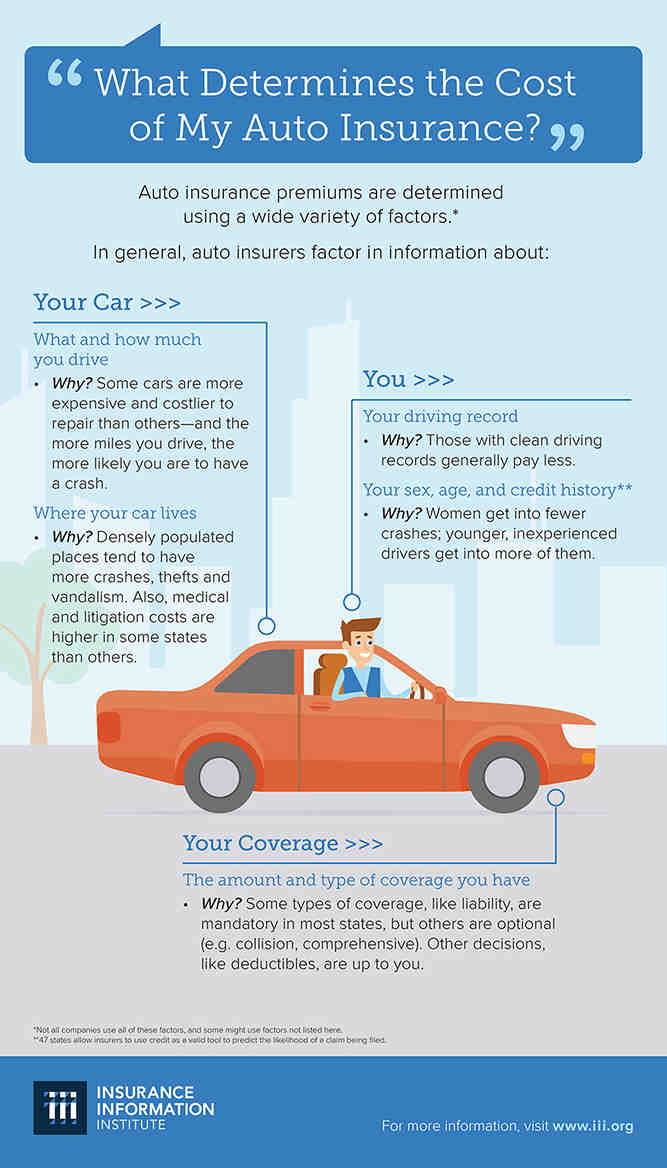

A credit score, that elusive numerical representation of your fiscal responsibility, wields considerable power when it comes to car insurance premiums. Insurers often interpret a higher credit score as a hallmark of a conscientious individual—yes, the kind who pays their bills on time and manages their finances with care—which can lead to pleasantly reduced rates. Read also : Cheapest car insurance with no down payment. On the flip side, enter the lower score: like an ominous cloud looming overhead, it signals potential risk in the eyes of these companies, coaxing them into adjusting their rates upwards. So you see, nurturing a robust credit score does more than just bolster your financial wellbeing; it directly shapes how much you’re shelling out for insurance coverage.

But wait—there’s more! Regularly scrutinizing your credit report is not merely advisable; it’s essential! Errors and discrepancies lurk in the shadows like sneaky little gremlins that could wreak havoc on that all-important number. If left unchecked, they might drag down your score faster than you can say “premium hike.” By keeping tabs on your credit status frequently—think of yourself as a vigilant guardian—you arm yourself with the power to dispute inaccuracies and take meaningful strides toward enhancing your credit standing. This proactive approach isn’t just about feeling good; oh no! It can translate into significantly lowered premium rates and delightful savings when it comes to insuring your vehicle.

How Credit Affects Insurance Rates

Insurance companies frequently hinge their premium calculations on credit scores, a pivotal element in the intricate web of risk assessment. A robust credit history—like a seasoned sailor navigating through turbulent waters—signals responsible financial behavior to insurers, who often interpret this as a signifier of lower risk among policyholders. To see also : Washington auto insurance rates are expected to increase by about 20% this year. The outcome? More favorable rates that feel like golden tickets in an otherwise daunting landscape.

On the flip side, those grappling with poor credit scores may find themselves cast into the murky depths of high-risk classification, resulting in premiums that can loom larger than life itself. It’s a curious dance between numbers and perceptions—a relationship steeped in contention and debate.

The connection between credit scores and insurance rates remains contentious territory! Many consumers are blissfully unaware that their financial past can dramatically sway their premiums—an unexpected twist in an already complex narrative. However, there lies hope: regularly monitoring and actively working to elevate one’s credit score could unlock significant savings on car insurance over time! Simple yet effective actions—timely bill payments and reducing debt—can bolster one’s creditworthiness like lifting weights at the gym, ultimately leading to lowered costs for insurance coverage.

Consider Usage-Based Insurance

In a world where car insurance often feels like a one-size-fits-all ordeal, the rise of usage-based insurance programs brings an intriguing twist. Imagine this: your driving habits become the key to unlocking personalized premium rates! This dynamic approach relies on monitoring tools—be it sleek telematics devices or handy mobile apps—that diligently record everything from your speed and braking patterns to those late-night drives under starlit skies.

This isn’t just about numbers; it’s about rewarding drivers who tread lightly on the asphalt with enticing discounts. For those conscientious souls behind the wheel, this method transforms their safe driving into tangible financial savings.

Now consider a pay-as-you-drive plan—it could slash insurance costs for those who hit the road sparingly or pride themselves on cautious maneuvers. By pivoting away from outdated assessment strategies and diving into real-time data collection, consumers can peel back layers of mystery surrounding how their choices shape their premium bills. It’s not merely innovation; it’s a paradigm shift that nudges us toward safer driving habits while potentially padding our pockets over time.

Pay-As-You-Drive Programs

Imagine a world where your insurance premium dances to the rhythm of your actual driving habits! Enter these groundbreaking programs that allow drivers to pay based on their real-life behaviors behind the wheel. With the magic of telematics technology at play, insurers meticulously monitor factors like mileage, speed, and even those subtle braking patterns you might not think twice about. This treasure trove of data transforms into a tailor-made insurance premium—one that truly mirrors your unique risk profile. Picture this: safe drivers could potentially pocket substantial savings when compared to conventional insurance models.

But wait, there’s more than just dollars and cents at stake here! These programs do more than lighten your financial load; they spark a shift towards safer driving practices too. The mere awareness of being under the watchful eye of monitoring can nudge individuals toward adopting a more cautious approach on the road. Over time, this ripple effect doesn’t just bless prudent drivers with lower rates; it weaves itself into the broader tapestry of overall road safety. By delving into the nitty-gritty details of each program, consumers empower themselves to make savvy choices regarding their insurance options—it’s all about informed decisions in an ever-evolving landscape!

Choose Your Vehicle Wisely

When it comes to picking a ride, the interplay of make, model, and safety features can’t be overlooked—they can dramatically sway your insurance premiums. Picture this: safer vehicles usually pull in lower rates because they’re linked to fewer accident claims. It’s all about that safety dance! And don’t forget—the cars that dodge theft or boast low repair bills often open the door to even more savings on your policy. So, gravitating toward those with stellar safety ratings and top-notch security systems isn’t just smart; it’s downright savvy.

On the flip side of the coin, high-octane machines or beasts with roaring engines typically drive insurance costs skyward. Insurers eye these speed demons as riskier propositions—think speed traps and fender benders galore! For those eager to keep their wallets happy while cruising around town, diving into research on various models’ insurance rates before sealing the deal is key. This proactive strategy ensures that your new wheels not only fit your driving style but also harmonize beautifully with your financial aspirations.

The choice of vehicle you opt for wields considerable influence over your insurance premiums, a fact that often goes unnoticed until the bill arrives. Insurers delve into an array of factors—think make, model, age, and those all-important safety features—when they crunch the numbers to set your rates. High-performance cars? They’re like a double-edged sword: thrilling on the road but inherently riskier, thanks to their penchant for speed and the unfortunate correlation with accidents. This perilous reputation translates into heftier premiums.

On the flip side, you’ve got vehicles celebrated for their reliability and stellar safety ratings; these tend to bring down costs since they represent less risk in insurers’ eyes. But wait! There’s more nuance at play here. Types of vehicles—like SUVs or trucks—can also have wildly different premium rates depending on how they’re used and what kind of safety accolades they’ve gathered along the way.

Then there are other sneaky influencers lurking in the shadows: theft rates could send your costs soaring if you’re driving something coveted by car thieves, while repair expenses can add another layer of complexity to how much you end up shelling out each month. However! If your ride is decked out with cutting-edge safety technology—think anti-lock brakes or collision avoidance systems—you might just score some sweet discounts.

Navigating this labyrinthine landscape isn’t just about picking a car; it’s about understanding these intricate dynamics so that consumers can make savvy decisions that harmonize with both their budgets and unique insurance needs.

- Vehicle make and model significantly impact insurance premiums.

- High-performance vehicles generally incur higher premiums due to increased risk.

- Cars with excellent safety ratings can lead to lower insurance costs.

- SUV and truck types vary in premium rates based on their usage and safety features.

- Cars with high theft rates can result in increased insurance costs.

- Repair costs for specific vehicles can influence overall insurance expenses.

- Advanced safety technologies can qualify drivers for premium discounts.

Regularly Review and Update Your Policy

Regularly diving into the depths of your car insurance policy is not just a good idea—it’s absolutely essential! Why, you ask? Because it’s all about spotting those hidden savings and ensuring you’re cruising along with the best coverage possible. Life tosses us curveballs: moving to a new neighborhood, bringing home that shiny new ride, or even tweaking how we hit the road can all shake up your insurance needs in ways you might not expect. By keeping your policy fresh and relevant, you’re not just syncing it with your current life; you’re also opening the door to discounts and better rates that could be lurking just around the corner.

And let’s not forget about those ever-shifting pricing models that insurance companies love to play with! They’re constantly recalibrating based on industry trends and individual circumstances. Have you cleaned up your driving record or embraced safer habits behind the wheel? If so, congratulations—you might find yourself eligible for some sweet premium reductions! A yearly review of your policy isn’t merely a formality; it’s an expedition into discovering enhanced coverage options, uncovering additional discounts, or even embarking on a journey toward finding a more competitive provider. Optimizing what you spend has never felt so invigorating!

Keeping Your Information Current for Best Rates

Staying attuned to the ebb and flow of your personal circumstances can dramatically sway your insurance premiums—it’s a dance of dollars and decisions! Have you relocated to a new abode, snagged a shiny new ride, or undergone some life-altering shift? If so, it’s crucial—no, essential—to give your insurance provider the heads-up. A medley of factors plays into the pricing puzzle that is coverage. Keeping your info fresh ensures that your policy mirrors reality; this alignment might just unlock better rates and tailored options that cater to your unique needs.

But wait—there’s more! Regularly diving into the depths of your policy isn’t just smart; it’s downright savvy for cost management. Insurance companies frequently tinker with their pricing algorithms and roll out enticing discounts, yet these perks don’t always trickle down automatically to every policyholder. By reconnecting with your insurer periodically, you could unearth hidden savings waiting in the wings. This routine check-in not only empowers you to snag those sweet deals but also keeps you in the loop about any shifts in policy terms that might influence how well you’re covered.

Conclusion

Slashing those pesky car insurance premiums demands a proactive mindset, folks! Think about it: by harnessing clever strategies like bundling your policies or keeping a keen eye on your credit score, you can really lighten that financial load. And let’s not overlook the potential of usage-based insurance programs—if your driving habits are safe and sound, they could unlock some serious savings!

Now, here’s where it gets interesting: the kind of vehicle you roll around in plays a crucial part in determining those premiums. So making savvy choices is absolutely essential! Don’t forget to keep your policy updated; this way, you can snag any benefits from shifts in coverage rates or changes in your personal situation.

Staying clued-in on what influences your car insurance isn’t just smart—it’s key to better managing your finances overall. With the right moves under your belt, securing comprehensive coverage while trimming costs becomes an achievable goal!