What are different types of insurance?

What are the 6 types of insurance?

Contents

- 1 What are the 6 types of insurance?

- 2 How many insurance types are there?

- 3 How is an assurance vie taxed in France?

- 4 What is third party insurance?

Six common auto insurance coverage options include: auto liability coverage, uninsured and underinsured motorists coverage, comprehensive coverage, collision coverage, medical payment coverage, and personal injury protection. Read also : Which car insurance plan is best?.

What are the 8 types of car insurance? Top 8 types of car insurance to know:

- Liability only.

- Collision Coverage.

- Liability for Property Damage.

- Personal injury liability.

- Comprehensive coverage.

- Uninsured/underinsured coverage for motorists.

- Coverage for medical payments.

- Protection against personal injury.

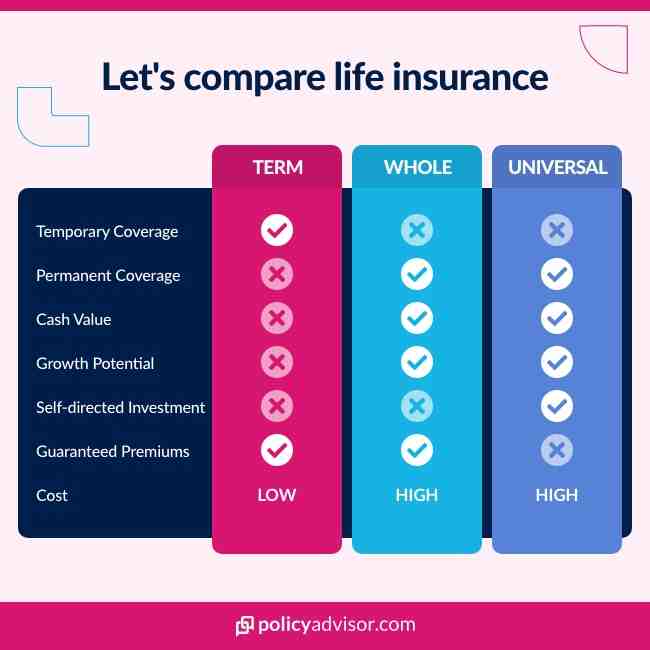

What are the 4 basic types of insurance?

However, there are four types of insurance that most financial experts recommend that we all have: life, health, auto, and long-term disability. This may interest you : NJM Auto Insurance Review 2022 – Forbes Advisor.

What are basics of insurance?

The basic principle of insurance is that an entity chooses to periodically issue small amounts against the possibility of a large unexpected loss. In principle, all policyholders bundle their risks. Any losses they incur are paid out of their premiums they pay.

What are the 5 types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance, and auto insurance are five types that everyone should have.

What is the type of insurance?

Most experts agree that life, health, long-term disability and auto insurance are the four types of insurance you should have. Always check with your employer first to see if there is coverage.

How many insurance types are there?

However, there are four types of insurance that most financial experts recommend that we all have: life, health, auto, and long-term disability. Read also : Is my insurance void if I go over mileage?.

What insurance do I need to travel to Egypt? Travel medical insurance is the only cover a traveler needs to enter Egypt, but most travel insurance policies are comprehensive and include a number of other benefits without increasing the cost of a policy. This includes coverage for travel delays and lost or delayed baggage.

How many insurance companies are there in Egypt?

The current market There are currently 32 insurance companies in Egypt, including 18 non-life insurers, 13 life insurers and one export credit insurer.

How many companies are there in insurance?

The insurance sector of India has 57 insurance companies – 24 in the life insurance sector while 34 are non-life insurers. Of the life insurers, Life Insurance Corporation (LIC) is the only company in the public sector. There are six public insurers in the non-life insurance segment.

What is the best health insurance company in Egypt?

| rank | businesses | Evolution 2019-2020* |

|---|---|---|

| 1 | Misr Life Insurance Company | 12.67% |

| 2 | Allianz Life Egypt | 35.14% |

| 3 | Metlife Egypt | 29.12% |

What are the big 3 insurance companies?

The five largest homeowners insurance companies in the US are State Farm, Allstate, USAA, Liberty Mutual, and Farmers.

Do you need insurance for Egypt?

Do I need travel insurance for Egypt? Yes, during the coronavirus pandemic, Egypt has made travel insurance mandatory for visitors. You must be able to show proof at the airport, so make sure you have your policy ready on arrival. Travel insurance can cover medical expenses, vacation cancellations, lost luggage and theft.

Is Egypt classed as worldwide for travel insurance?

While some companies treat Egypt as if it were part of Europe because it borders the Mediterranean Sea, other travel insurers classify it as a “global” destination.

Is Egypt covered by European travel insurance?

Does Egypt fall under Europe for travel insurance? Although Egypt straddles two different continents – Africa and Asia – neither is Europe, so you’ll find insurers usually consider it outside of Europe in their policies as well.

Does Egypt require Covid test?

Yes. All passengers traveling to Egypt (including Egyptians) must be in possession of a negative PCR test certificate for COVID-19 with Quick Response (QR) code, no later than 72 hours prior to flight departure.

How is an assurance vie taxed in France?

For profits arising from insurance through products whose premiums were paid after September 27, 2017, a flat rate of 30% tax is applied, consisting of 12.8% income tax and 17.2% social tax.

How is an SCI taxed in France? The SCI must file an annual tax return for every French income it has received, e.g. from the rental of the house. Because the company is fiscally transparent, the income is taxed on the shareholders, who can deduct any interest on a loan taken out to buy the property.

Can you cash in an Assurance Vie?

You can sell underlying investments and request a withdrawal at any time. This is known as rachat partiel and can be done automatically every month if you need a regular income. You can close the Assurance Vie at any time and withdraw all the funds.

Is life insurance taxable in France?

Life insurance policies (assurance vie) are not subject to inheritance tax unless the amount received by the beneficiary exceeds €152,500. Above this figure, a withholding tax is due at the rate of 20%. The level of the tax is increased to 25% for all benefits above €1,053,338.

How does assurance vie work in France?

Assurance Competition for Over 70s/Under 70s and Inheritance Tax In theory, an assurance competition is outside your estate and can therefore be left directly to the beneficiaries and not get caught up in the French legal process once you are gone. Since it is subject to its own rules, it also offers its own additional fees.

Is assurance vie a PFIC?

A PFIC is a passive financial investment company. It is a mutual fund or collective investment and is taxed in the US at an unfavorable rate. They are commonly found in Assurance Vie contracts and PEA.

How are offshore bonds taxed in France?

Social security tax. An offshore investment bond is considered a “contrat multisupports” as it is not invested in euros in France. The Social Security tax rate is 15.5% of the gain on your investment bond and this is calculated when you make a partial or full surrender.

Qui profite des paradis fiscaux ?

Do you want to use les paradis fiscaux? Les utilisateurs des paradis fiscaux (au sens large) sont très divers. There are large enterprises with an installation of financial institutions, financial institutions, banking, private wealthy, and an adjunct to investment companies.

Quelles sont les fraudes fiscales ?

Vous commettez une tax fraud si vous utilisez délibérément certain processes pour échapper ou tenter d’échapper à l’impôt. You can choose from several choices: Ne pas déclarer dans les délais. Cacher des biens or revenus soumis à l’impôt.

Quel est le problème des paradis fiscaux ?

The problem, the most certain foal jouer sur les deux tableaux : c’est le cas des privates qui veulente profiter des publics et du système social de la France without payer leurs impôts ; ou des entreprises comme Apple or Google qui veulent développer leurs activités in France sans se soumettre à la …

Are life insurance proceeds taxable in France?

Life insurance policies (assurance vie) are not subject to inheritance tax unless the amount received by the beneficiary exceeds €152,500. Above this figure, a withholding tax is due at the rate of 20%. The level of the tax is increased to 25% for all benefits above €1,053,338.

Is overseas life insurance taxable?

If you have interests in a foreign company, trust or life insurance policy, state the income you receive from it on your tax return. This income can be attributed to you, even if it has not yet been paid out and is known as imputed foreign income.

How does life insurance work in France?

Life insurance in France is called assurance vie. This is a savings policy in which your money is invested for your pension, but in the event of death it is paid out before the term has expired. You must take out life insurance with a French mortgage lender or bank loan.

Do I have to pay income tax on life insurance proceeds?

Answer: In general, the life insurance proceeds that you receive as a beneficiary due to the death of the insured person are not included in the gross income and you do not have to report them. However, any interest you receive is taxable and you must report it as interest received.

What is third party insurance?

The third-party insurance is the basic insurance that only reimburses third-party damage. The claim recipient is not the policyholder, but another person or vehicle affected by the first party’s insured vehicle.

What is the difference between full and third-party insurance? In general, comprehensive auto insurance covers you for a wide range of damage, injuries and loss to your passengers, your vehicle and other property. Third party auto insurance is more limited and covers damage to other vehicles and their passengers, but usually not much else.

What is difference between first party and third party insurance?

First party refers to the insured person, second party is the insurer and third party is the person to whom damages are owed by the first party in an accident.

What is the difference between first party and third party?

The first party is the insured. The second party is the insurance company. The third party is another person. A third-party liability insurance claim is therefore made by someone who is not the policyholder or the insurance company.

What is a first party insurer?

First-party insurance is a type of coverage where you, the first-party, make a claim against your policy. This means you pay for your coverage, and when an accident occurs, you ask your insurer to pay you based on the terms of your insurance policy.

Is third party insurance better than first party insurance?

In the event of a car accident, the first party will get personal accident cover of up to Rs 15 lakh from the second party. In the event of a car accident, the third party will receive compensation from the second party up to an amount determined by the Motor Accident Claims Tribunal based on the extent of the damage caused.