7 Types of Insurance are; Life Insurance or Personal Insurance, Property Insurance, Marine Insurance, Fire Insurance, Liability Insurance, Warranty Insurance.

What is RSA car insurance?

Contents

Roadside Assistance (RSA) coverage offers the much-needed emergency assistance to a car owner if his / her vehicle breaks down or has a mechanical failure on the road or at home. It can be very frustrating to be stuck in an unknown location without access to a mechanic. This may interest you : What are the 3 types of car insurance?. This is where RSA coverage comes in handy.

Has RSA insurance been sold? RSA Insurance Group Plc was acquired by Tryg A / S and Intact Financial Corporation on June 1, 2021. RSA consisted of three divisions; Canada, Scandinavia, and UK & International (the UK, Luxembourg, Ireland and Southwest Asian companies).

What does RSA stand for in insurance?

What is Roadside Assistance Coverage in Car Insurance? Roadside Assistance (RSA) coverage offers the much-needed emergency assistance to a car owner if his / her vehicle breaks down or has a mechanical failure on the road or at home. This may interest you : What is IDV insurance?.

What does the RSA stand for?

As most people in the cybersecurity and technology communities know, RSA is a public key encryption technology developed by RSA Data Security, Inc., which was founded in 1982 to collaborate. commercialize the technology. The acronym? It means Rivest, Shamir, and Adelman, the inventors of the technique.

What is RSA life insurance?

RSA Insurance Group Limited (formerly RSA Insurance Group plc and Royal and Sun Alliance) is a British multinational general insurance company headquartered in London, England. RSA has major operations in the United Kingdom, Ireland, Scandinavia & Canada.

What does RSA stand for in business?

| Acronym | Definition |

|---|---|

| RSA | Selling Association |

| RSA | Renaissance Society of America |

| RSA | Alabama Retirement Systems |

| RSA | Royal & Solar Alliance |

Who is part of the RSA Insurance Group?

| Type | Private limited company |

|---|---|

| Website | www.rsagroup.com |

Who owns Intact Financial Group?

This was soon followed by our Initial Public Offering, and we began trading on the Toronto Stock Exchange with ING Group retaining 70% ownership. To see also : How many types of car insurance are there?. 2009: ING Canada becomes Intact Financial Corporation, with 100% of its common stock exchanged on the TSX following ING Group’s divestiture of its assets.

What is the RSA in UK?

The Royal Society for the Encouragement of Arts, Manufactures and Commerce (RSA), also known as the Royal Society of Arts, is a London-based organization committed to finding practical solutions to social challenges.

What happened to RSA?

On September 1, 2020, Symphony Technology Group (STG) completed its acquisition of RSA from Dell Technologies. RSA has become an independent company, one of the largest cybersecurity and risk management organizations in the world.

Does RSA own unifund?

This agreement is a change of ownership for RSA and therefore a new roofing company. To see also : What are the 5 types of auto insurance?. Our operations and brands operate as usual and our contact points, products and assertion processes remain the same.

Who owns Western Assurance company?

Western Assurance (WA) is part of RSA Insurance, offering home and auto insurance through trusted independent insurance brokers in Ontario.

Who owns Intact Financial Group?

This was soon followed by our Initial Public Offering, and we began trading on the Toronto Stock Exchange with ING Group retaining 70% ownership. 2009: ING Canada becomes Intact Financial Corporation, with 100% of its common stock exchanged on the TSX following ING Group’s divestiture of its assets.

Who own the Johnson insurance?

Today, we are pleased to announce that Johnson Inc. (“Johnson”) was acquired by Intact Financial Corporation, the largest provider of property and casualty insurance in Canada and a leading provider of special insurance in North America.

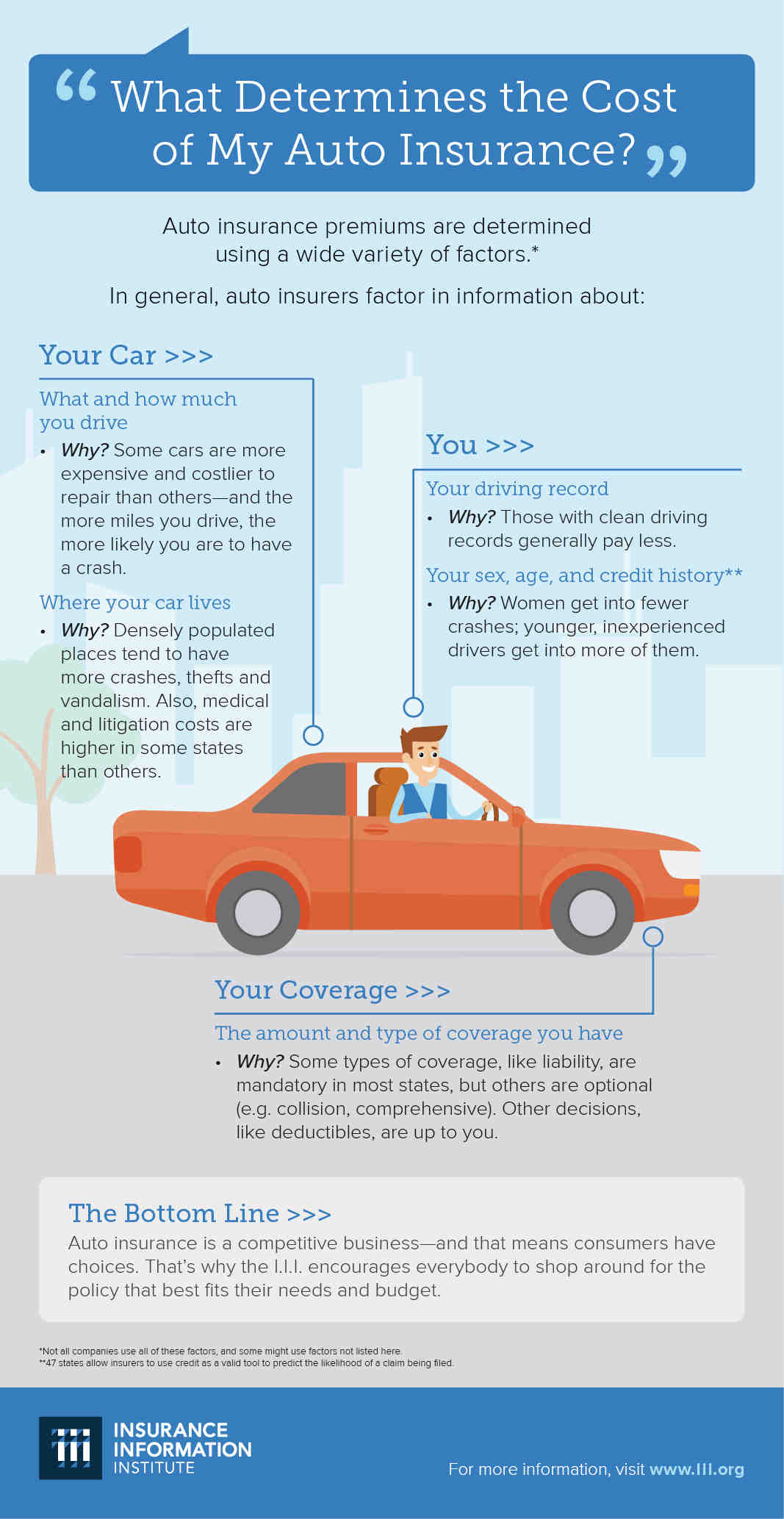

Why is liability insurance the most important type of insurance to have?

Liability protection is one of the most important types of insurance coverage. It is designed to protect you from the cost of litigation and legal liability if your negligence causes harm to another person. On the same subject : What is basic car insurance called?. In some cases, it is even required.

Why is liability the most important coverage? If you are caught driving without liability insurance, you will have to pay fines and may lose your driver’s license. Worse still, if you are involved in an accident and you are under no liability, you are liable for any damage you have caused, including any medical expenses as well as any property damage.

What is the most important insurance to have?

Health insurance is the most important type of insurance you will ever buy. That’s because if you don’t have health insurance and something goes wrong, it’s not just your money that’s at risk – it’s your life. Health insurance is intended to cover the costs of medical care.

What insurance do you really need?

Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have. Always check with your employer first for available coverage. If your employer does not offer the type of insurance you want, get quotes from several insurers.

What is the most important type of insurance?

Health insurance is probably the most important type of insurance. A 2016 Kaiser Family Foundation / New York Times survey found that one in five people with medical bills filed for bankruptcy. With such statistics, investing in health insurance can help you avoid a major financial hardship.

What are 5 important insurances you should have?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

Which insurance is most important and why?

Health insurance is probably the most important type of insurance. A 2016 Kaiser Family Foundation / New York Times survey found that one in five people with medical bills filed for bankruptcy. With such statistics, investing in health insurance can help you avoid a major financial hardship.

What type of insurance is most popular?

These are the seven most common types of insurance that every individual needs – or at least should consider.

- Health insurance. …

- Life insurance. …

- Disability Insurance. …

- Long Term Care Insurance. …

- Homeowners and Tenants Insurance. …

- Liability Insurance. …

- Car Insurance. …

- Protect Yourself.

What is insurance Why is it important?

Insurance is a financial safety net that helps you and your loved ones recover from something bad – like a fire, theft, lawsuit, or car accident. When you purchase insurance, you will receive insurance that is a legal contract between you and your insurance provider.

What are 5 important insurances you should have?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What is liability insurance and why it is important to have it?

Liability insurance provides protection against claims resulting from injuries and damage to people and / or property. Liability insurance covers legal costs and outlays for which the insured party would be held liable. Provisions not covered include Intentional damage, contractual liability and criminal prosecution.

Why is liability insurance so important?

Generally, it helps to pay to repair another person’s property or for their medical bills if the owner is found responsible for causing the damage or injury. If you are at fault for an accident that injures another person, coverage for bodily injury helps pay for their medical expenses.

What are the 5 main types of insurance?

Home or property insurance, life insurance, disability insurance, health insurance and car insurance are five types that everyone should have.

What are the 4 main types of coverage and insurance? The Bottom. Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have. Always check with your employer first for available coverage.

What are the 6 main types of insurance?

Six common auto insurance options are: auto liability, uninsured and underinsured motorist coverage, comprehensive coverage, collision coverage, medical payment coverage and personal injury protection. Depending on where you live, some of these covers are mandatory and some are optional.

What are the major types of insurance?

Fear not — we’ll break down everything you need to know about each of these types of insurance.

- Terminal Life Insurance. …

- Automatic Insurance. …

- Homeowners / Tenants Insurance. …

- Health insurance. …

- Long Term Disability Insurance. …

- Long Term Care Insurance. …

- Identity Theft Protection. …

- Umbrella Politics.

What are the major types of insurance?

Fear not — we’ll break down everything you need to know about each of these types of insurance.

- Terminal Life Insurance. …

- Automatic Insurance. …

- Homeowners / Tenants Insurance. …

- Health insurance. …

- Long Term Disability Insurance. …

- Long Term Care Insurance. …

- Identity Theft Protection. …

- Umbrella Politics.

What are the 3 types of insurance?

We then examine in more detail the three most important types of insurance: property, liability, and life.

What are the major types of life insurance?

There are two main types of life insurance – life and life insurance. Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, varied life, and varied universal life.

What are the 5 parts of an insurance policy?

Each insurance policy has five parts: statements, insurance agreements, definitions, exclusions and conditions. Many policies contain a sixth part: support. Use these sections as guidelines for reviewing policies. Examine each part to identify its main provisions and requirements.

What are the 6 elements of an insurance policy?

These elements are definable risk, random event, insurable interest, risk exchange and risk distribution. In addition, there is a very important legal difference between a reserve and an insurance company.

What are the 4 key elements of an insurance policy?

Most experts agree that life, health, long-term disability, and car insurance are the four types of insurance you should have.

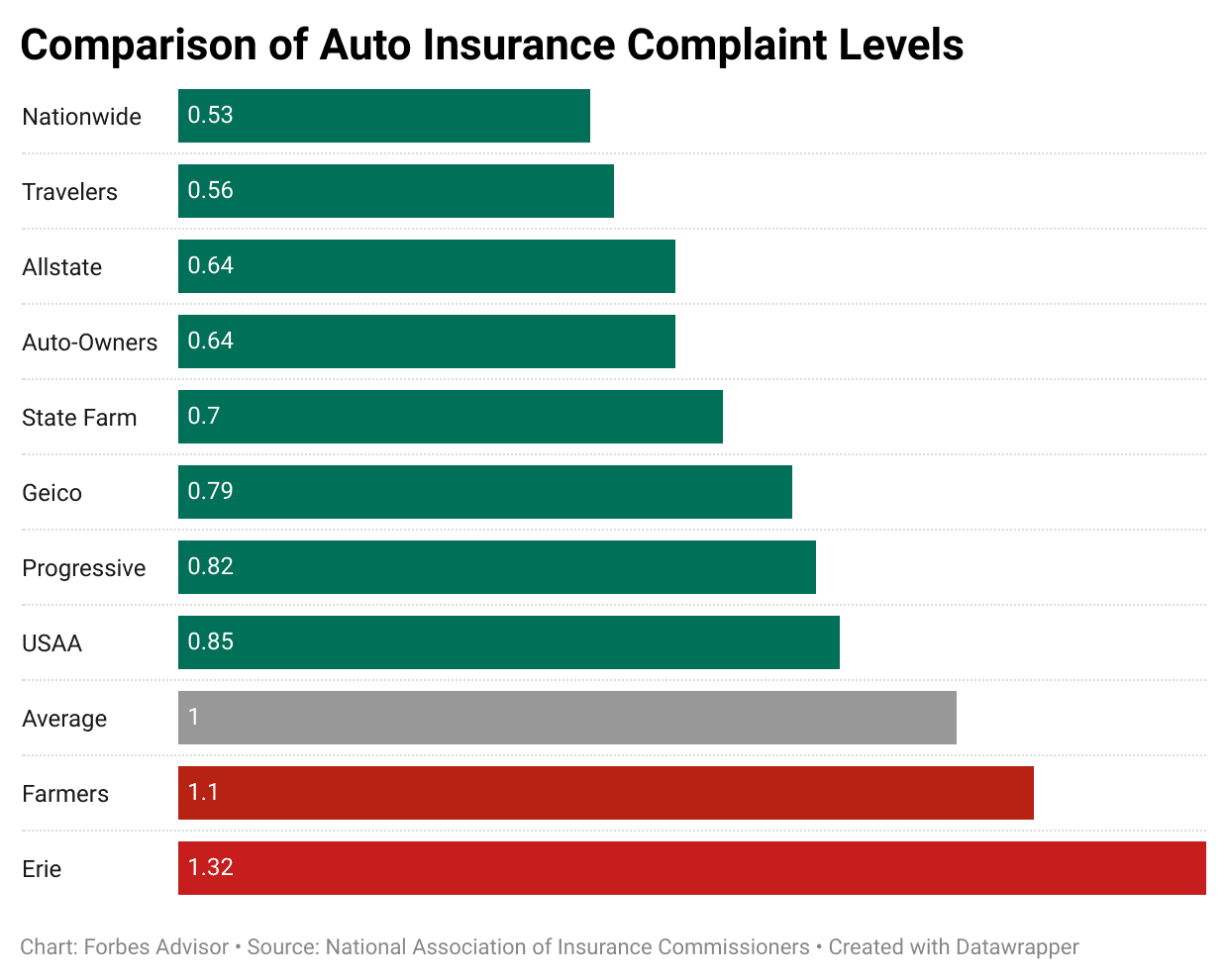

Is USAA a good company?

USAA is a good insurance company that is rated 3.3 / 5 by the editors of WalletHub, based on customer reviews, insurance quotes, and ratings from third-party organizations. USAA consumer reviews often praise the company’s low prices, but there are also reports of poor customer service and a slow claim process.

Is USAA really cheaper?

Is USAA reputable?

USAA insurance reviews on BBB and Trustpilot are mixed, but customers highly value the company through surveys by J.D. Power. In general, most politicians are happy with their experience with the company. USAA has a 1.23-star rating from customer reviews on the BBB and a 1.3-star rating from Trustpilot.

Is USAA a real insurance company?

USAA offers a wide range of insurance products and receives high marks in customer satisfaction surveys. Customers can also invest and bank through USAA, which is the country’s fifth largest auto insurer, according to the National Association of Insurance Commissioners.

Does USAA have a good reputation?

USAA has long been recognized for having a strong reputation. In addition to RI’s ranking, USAA was recently recognized as one of the World’s Most Ethical Companies® by the Ethisphere Institute for the third consecutive year and was named one of the World’s Most Admired Companies by FORTUNE® in the fifth. year.

Why is USAA in trouble?

Federal bank regulators fined USAA Federal Savings Bank $ 85 million on Wednesday for “engaging in unsafe or weak banking practices.” The Office of the Currency Supervisor found that USAA’s internal controls and information technology systems did not comply with any guidelines.

Is USAA a failure?

In December 2019, TPR reported that the Better Business Bureau had given the USAA an “F” rating for its efforts to resolve consumer complaints and for government action against the company. The bureau reported that 50 consumer complaints against the company remained unresolved.

What’s happening to USAA?

The sale of the Investment Management Company includes USAA investment funds, exchange-traded funds and 529 accounts. It closed in 2019 and Victory is expected to finish moving the accounts to their systems by 2020. The Investment Management Company includes USAA’s brokerage and managed portfolios.

Is USAA in trouble financially?

USAA Bank Saved $ 85 Million by Federal Regulators for “Violations of Law” USAA Federal Savings Bank must pay the U.S. government a $ 85 million fine after regulators found failures in the company’s risk management and information technology risk programs. The decision, announced Oct.

What is so great about USAA?

USAA has been an innovative bank for years. They offer many superior services as standard for all accounts. These include free checking and savings accounts with no minimum payment fees, free checks, free rewards debit card, free overcharge protection, free online billing and much more.

Does USAA have a good reputation?

USAA has long been recognized for having a strong reputation. In addition to RI’s ranking, USAA was recently recognized as one of the World’s Most Ethical Companies® by the Ethisphere Institute for the third consecutive year and was named one of the World’s Most Admired Companies by FORTUNE® in the fifth. year.

Is it worth joining USAA?

For qualified individuals and their families, however, USAA offers enough value that it is still worth using for personal banking and other financial needs. USAA Bank provides additional support for military members when they need it most – before, during and after deployment.