What Factors Reduce Your Car Insurance?

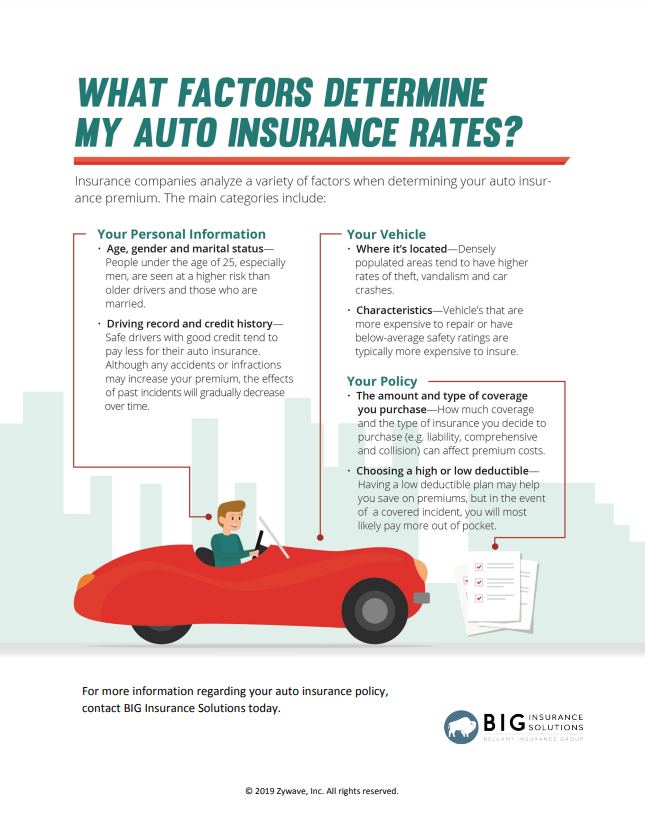

There are many factors that can affect your car insurance rates. Some of them are obvious, such as age and driving history. Others may be less known, such as the make and model of your car. In this article, we’ll go over some of the most common factors that can make bids go up or down. We’ll also give you tips on how to keep your bids as low as possible!

Compare rates from different car insurance companies

Contents

- 1 Compare rates from different car insurance companies

- 2 Ask your friends and family for recommendations

- 3 Bundle your car insurance with other policies, like homeowner’s or renter’s insurance

- 4 Pay your premium in full to get a discount

- 5 Increase your deductible to lower your monthly premiums

- 6 How do you calculate premium?

- 7 Does gender affect car insurance?

- 8 Did Geico rates go up 2022?

- 9 Is it cheaper to pay insurance every 6 months?

You’ve probably heard it a million times: “Shop around for the best rate on car insurance.” And that’s good advice! Premiums can vary greatly from company to company, so it pays to compare rates. To see also : Is it cheaper to buy car insurance online or over the phone?. The good news is that the internet makes it easier than ever to find cheap car insurance.

You can get quotes from different insurers with a few mouse clicks. And since most companies offer online discounts, you can save even more. So if you want to lower your car insurance costs, shop around and compare the rates of different companies. That could save you hundreds of dollars a year!

Ask your friends and family for recommendations

If you want to lower your car insurance rate, one of the best things you can do is ask your friends and family for recommendations. This may interest you : Responsibility Vs. Comparison of car insurance with full coverage. They may know about a company that offers discounts on things such as having multiple cars on the same policy or being a safe driver.

Additionally, they can give you an idea of what to expect in customer service and claims handling. Finally, they can provide first-hand insight into the relative strengths and weaknesses of various insurers.

Bundle your car insurance with other policies, like homeowner’s or renter’s insurance

Purchasing car insurance can be an overwhelming task. See the article : Who is the richest insurance in the world?. There are so many different companies and types of coverage to choose from that it can be difficult to know where to start.

However, one of the easiest ways to save on car insurance is to combine it with other policies. Many insurance companies offer discounts to customers who combine multiple policies. For example, you can save 10% or more on your car insurance by combining it with your homeowner’s or tenant’s insurance.

In addition, combining can make the management of different insurances

simpler rules. Instead of contacting multiple companies and payment terms, you can make a single payment that covers all of your policies.

Tying is a great way to save money on car insurance and to make your life easier and more organized. If you are purchasing car insurance, be sure to inquire about cross-selling options. You may be surprised how much you can save.

You may have heard that you can save money on your car insurance premium by paying the entire premium up front instead of making monthly payments. But how does it work? When you pay your premium in full, the insurance company doesn’t have to worry about charging you a monthly fee.

This saves time and money, which they will gladly give you in the form of a discount. In addition, the payment in full shows that you are financially responsible, which may result in a lower rate upon policy renewal. So if you can do this, paying the total car insurance premium is a great way to save money.

Everyone likes to feel like they’re getting a great deal, and when it comes to car insurance, lowering your monthly premium is a great way to save money. One way to do this is to increase your franchise.

Your excess is the amount you have to pay out of your own pocket before the insurance company covers the rest of the damage in the event of an accident. Increasing the franchise from $ 200 to $ 500 can often reduce monthly premiums by 10-20%.

Of course, this means that in the event of an accident, you will have to pay more out of your own pocket. Even so, if you are a safe driver, chances are you will never have to use that extra money anyway. So, raising your franchise can be a great way to lower your car insurance costs.

There are several ways to save money on car insurance. You can often get a great deal by shopping, bundling your policies, and paying the premium in full. Additionally, increasing your excess is a simple way to lower your monthly premiums. So if you want to save money on car insurance, keep these tips in mind.

Americans spend enormous amounts of money on healthcare every year and costs continue to rise. Part of this increase is due to government policies and the creation of national programs such as Medicare and Medicaid. There are also short-term factors, such as the 2020 financial crisis, which are driving up the cost of health insurance.

- The method of calculating the insurance premium

- Calculation of the formula. Insurance premium per month = monthly insurance amount x insurance premium rate. …

- Contribution to the country in the period from October 2008 to December 2011. …

From January 2012, the base for calculating the contribution was changed to daily.

Does gender affect car insurance?

How is the monthly premium calculated? For example, if the rate is $ 0.2 per $ 1,000 and the subscriber chooses $ 15,000 in coverage, the monthly premium would be $ 3. ($ 0.2 x 15 = $ 3).

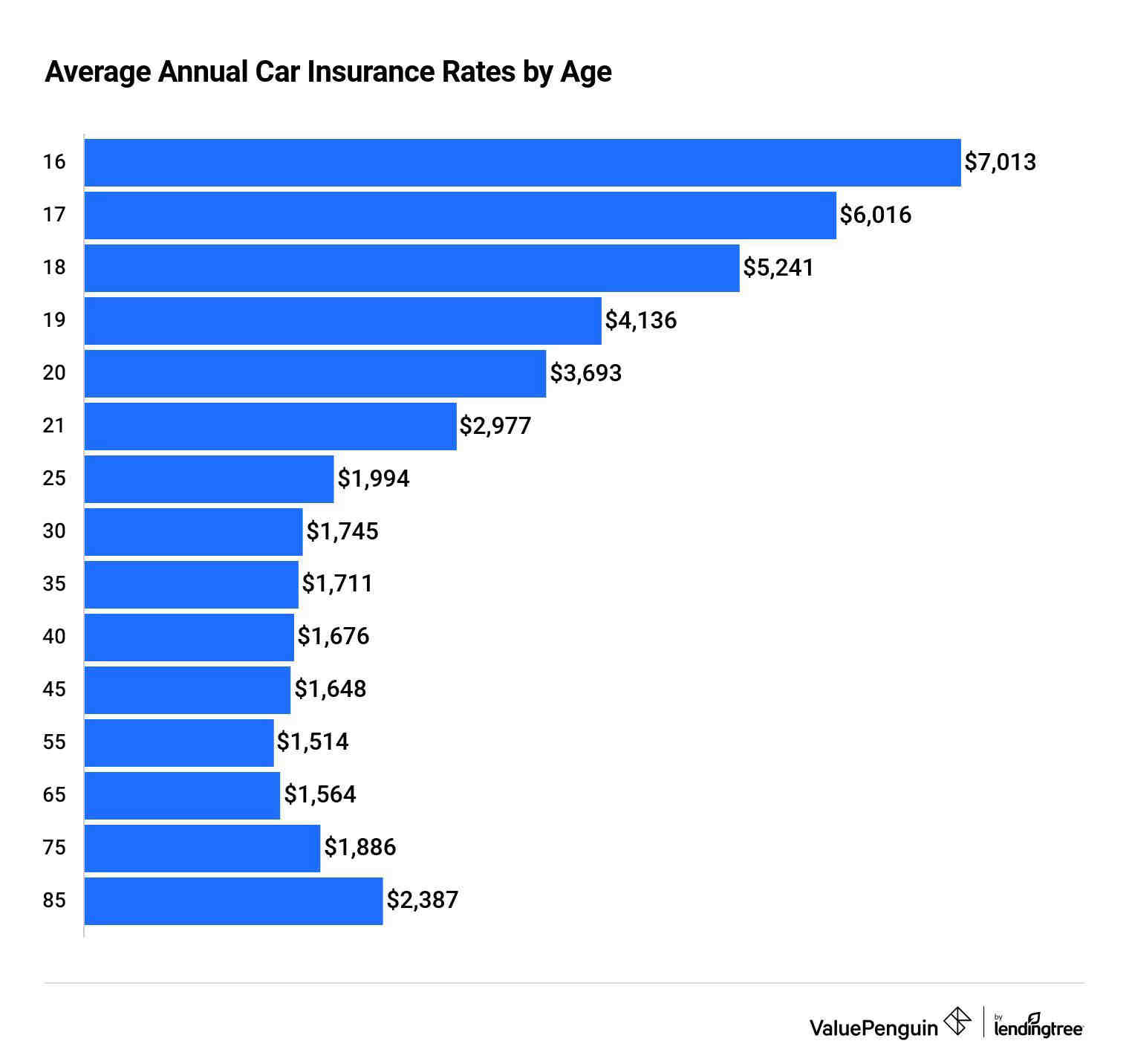

When it comes to buying car insurance, age and gender can affect your rates. Women typically pay less for car insurance than men. And it should come as no surprise that young drivers pay the most. Age correlates with driving experience and car accident risk.

Does gender play a role in insurance?

Can insurance companies discriminate on the basis of gender? Types of Unlawful Insurance Discrimination On the other hand, insurance companies cannot discriminate on the basis of socially unacceptable factors such as race, gender, and religion. Other examples of socially unacceptable factors are: National origin. Sexual orientation / preferences.

Does gender matter with insurance?

1 But insurance companies have traditionally associated gender with an applicant’s risk, so this is often a factor in determining premiums. However, insurers may not always take gender into account – it depends on the specific type of coverage and where you live.

Does gender affect life insurance?

Insurance companies are not allowed to price insurance by sex in the following states: California. Hawaii. Massachusetts.

Is car insurance cheaper for females?

Gender imbalances exist throughout society and can even emerge in the life insurance industry. According to the Haven Life survey, men on average have life insurance policies worth almost twice as much as their women.

Who has the best auto insurance rates for young drivers?

Women’s car insurance is generally cheaper than men’s because insurers have found a statistical correlation between the gender of the driver and the cost and frequency of car insurance claims. On average, men simply drive more than women.

What is the cheapest car insurance company for young drivers?

According to our car insurance rate study, USAA offers the best rates for young adults. On average, our research data for young adults insured by USAA has a test rate of $ 1,060 per year for vehicle insurance.

At what age does female car insurance go down?

Cheapest Car Insurance for 17-Year-Old Teens – Domestic At the state level, GEICO and Allstate are still the best choices for affordable insurance for a 17-year-old teenager. GEICO is the cheapest company in 20 states and Allstate is the cheapest in 17.

Does gender influence car insurance?

Car insurance rates begin to decline for young female drivers as young as 21, usually. When men or women turn 25, their statistical risk of an accident decreases. However, many insurance companies are starting to cut premiums for female drivers four years earlier.

Did Geico rates go up 2022?

Insurance companies are not allowed to price insurance by sex in the following states: California. Hawaii. Massachusetts.

Inflation Affects Auto Insurance Rates Several major auto insurers, including Allstate, Progressive, Geico and State Farm, had already raised rates in a number of states in early 2022, according to Bankrate.

Why did my car insurance go up 30 dollars?

Is GEICO losing money? GEICO LOSS Revenues increased 10% to $ 76.2 billion. Geico suffered an insurance loss of $ 487 million before taxes, the fourth consecutive quarterly loss. “All car insurers are faced with claims cost inflation,” said Seifert.

Claims Near You If your city has a high rate of theft, accidents and weather-related claims, driver insurance in your area becomes more risky. This risk can lead to an increase in the price of your car insurance policy, even if you have an excellent driving record.

Did GEICO raise their rates?

There are some things that are beyond your control but can still affect your premium, including: rising repair costs, an increase in the number of scattered drivers on the road, more drivers on the road, higher speed limits in your geographic area, and an increase in the number of uninsured drivers.

Is Liberty Mutual cheaper than Geico?

GEICO received two previous interest rate increases in California in 2017 and 2018 before the pandemic took drivers off the road and claims plummeted.

Why is Geico charging more?

Geico is the clear winner in terms of affordable car insurance rates. Geico car insurance offers are 8% to 44% cheaper than those from Liberty Mutual. In addition, Geico policies with both minimum and full coverage are cheaper than the national average.

Did auto insurance rates go up in 2022?

Geico’s rates increase when drivers extend coverage, are involved in an accident, receive a speeding ticket or file a claim. Certain life events, such as adding a teenage driver to your policy, can also increase your rates. Additionally, you can lose rebates which can increase your bonus.

Why is car insurance higher in 2022?

Like almost every purchase that consumers make right now, the average cost of car insurance is likely to increase for many drivers in 2022. Nationally, car insurance rates are rising 4.9 percent on average, according to data approved by S&P Global Market Intelligence.

Auto Insurance Study which states that auto insurance companies will have to raise their rates or close their doors. J.D. Power stated that car insurance is on the rise in 2022 due to three factors: rising repair costs, rising prices for used vehicles, and an increasing number of major collisions.

Is it cheaper to pay insurance every 6 months?

NEW DELHI: Health insurance premiums have increased by 10-25% recently, thanks to higher average claims and rising inflation in the healthcare sector. Sources from the health insurance sector say average claims have increased from 40,000-50,000 rupees to 80,000 rupees in the last two years.

In most cases, a six-month policy will be cheaper than a 12-month policy because you pay for the insurance for a shorter period of time. However, if you are comparing the price of car insurance on a monthly basis, it may not differ much between a six-month and a twelve-month policy.

Is it better to pay your car insurance monthly or annually?

Is it better to pay for 6 months car insurance in advance? Answer provided by. “Paying the full car insurance premium every six months will save you money. Depending on the insurer, this can significantly reduce your premium compared to your monthly payments.

Is paying car insurance monthly more expensive?

Annual premium payment is almost always the cheapest option. Many companies give a discount for paying the full amount as it is higher for an insurance company if the policyholder pays the premiums monthly as it requires manual processing every month to keep the policy active.

Should you pay insurance annually or monthly?

Monthly payments may seem like a cheaper option up front, but it’s almost always the most expensive way to pay for car insurance in the long run! Even if it’s more money up front, you’ll save money on your rates if you can pay for a year or half a year when purchasing car insurance.

Can you pay insurance every 6 months?

If you’re looking for the cheapest option with less commitment, it’s best to pay once a month. But if you want to minimize the number of payments and save money on interest over time, it makes sense to pay twice a year.

Is car insurance paid monthly or every 6 months?

Plus, if you pay the annual premium up front, you can qualify for a discount and eliminate the hassle of more frequent payment terms. Some insurance companies still offer annual policy terms along with the 6-month option, including Liberty Mutual, USAA, Erie, The Hartford, The General, Infinity, Safeco, and Unique.

Is Geico a 6 month policy?

Most insurance companies allow you to choose between paying your car insurance premium monthly, every six months, or annually. You can get a discount if you choose to pay the full amount for a six-month or one-year policy in advance.

Why is insurance every 6 months?

GEICO recently adopted a six-month insurance policy that allows customers to renew beyond that six-month period.

Why do insurance companies do 6 month policies?

Why do insurers offer six-month car insurance? Most insurers prefer a six-month car insurance policy to have flexibility in converting rates based on your driving history in the previous period.

What does a 6 month policy mean?

Why do insurers offer six-month car insurance? Most insurers prefer a six-month car insurance policy to have flexibility in converting rates based on your driving history in the previous period.

Can you cancel a 6 month insurance policy?

A six-month insurance policy simply means that you will be covered by the prescribed limits at the rate that the insurer has provided for you in your contract, for a full six months. After this six-month period, your provider will re-evaluate your rates.