What is a normal car insurance?

What is standard for car insurance?

Contents

- 1 What is standard for car insurance?

- 2 What is standard protection?

- 3 What is the best protection against uninsured drivers?

- 4 What does lower level car insurance cover?

Ordinary car insurance refers to basic car insurance given to drivers who fall into an accident situation. Normal protection will often be the cheapest type of car insurance available to a driver.

What is the difference between conventional and non-standard insurance? Regular car insurance is available for low-risk drivers. It is easy to find because all major insurers and local insurers usually provide it. This may interest you : What is raising the prices of car insurance?. Extraordinary insurance is designed for drivers who are considered to be at high risk by insurance carriers.

What is a good policy for car insurance?

The best liability for most drivers is 100/300/100, which is $ 100,000 per person, $ 300,000 per body injury risk and $ 100,000 per property damage risk. On the same subject : NJM Auto Insurance Review 2022 – Forbes Advisor. You want to have complete protection if you cause serious damage to the risk of error.

What insurance do you really need?

Most experts agree that health, health, long-term disability and car insurance are the four types of insurance you must have. Always consult your employer for available protection. If your employer does not provide the type of insurance you need, get quotes from several insurance providers.

What type of coverage is best for car insurance?

You should carry the highest level of protection you can, and 100/300/100 is the best level of protection for most drivers. You may need to take extra precautions to protect your vehicle, including full coverage, collision gaps.

What is a standard car insurance policy?

Common car insurance is a minimum or minimum level of protection available from an insurer. On the same subject : What does full coverage car insurance consist of?. The laws of many countries require the driver to have credit insurance and you will find out what the correct dollar value is.

What is the most basic car insurance?

In total, the six car insurance costs you will need are:

- Responsibility for Physical Risk Responsibility. …

- Property Damage Protection. …

- Medical Fees or Personal Injury Protection (PIP). …

- Full Disclosure. …

- Use of collision. …

- Uninsured / Uninsured Driver Protection.

What is a standard insurance policy?

Ordinary Form or General Policy â € ”an insurance policy form designed to be used by many different insurers and has exactly the same arrangements, regardless of which policy the insurance offers.

Which are 4 types of insurance coverages for cars?

The six most common car insurance options are: car loan protection, uninsured and uninsured drivers, complete protection, car protection, security medical bills and personal injury protection.

What does Standard mean in insurance?

A general policy is an insurance policy that covers common risks or provides protection that is mandated or recommended by the government. In other words, common policies are insurance policies that provide protection for general or general risks in a particular area of insurance.

What does Standard mean in insurance terms?

Ordinary Form or General Policy â € ”an insurance policy form designed to be used by many different insurers and has exactly the same arrangements, regardless of which policy the insurance offers.

What kind of insurance is the standard?

The Standard is an insurance company that sells group life and accident insurance and termination policy. Unlike other companies, it does not offer life insurance for individuals, so you can purchase insurance from The Standard as long as you work for a participating employer.

What does Standard life insurance mean?

Ordinary Health Insurance means health insurance that can be purchased from a health insurance company at regular rates without a fixed fee, based on personal health in general.

What is standard protection?

The Common Safety Rules refer to the NSPI’s strategic and coordinated work plan that is used to enhance personal safety and security of the Provisioning System and the additional equipment against damage.

Comment on ADR? In order to improve the perception of maturity riskeuses classes, the faucet commencer by vérifier le marquage et letietquetage des matières receptions of the chapter 14 of Fiches de Données de Sécurité uustièdes uusttiisees (FDS)

C’est quoi l’ADR de base ?

What is the base of the ADR of the base? ADR vient de l’acronyme Dangerous Goods Agreement, traduit en français par Accord européen relatif au transport international de marchandises riskeuses par route.

Comment obtenir l’ADR ?

In the shipping sector of the Maritandis riskeuses, the operators of the occupants do not pass a base formation and resuscitation of the fines of the stage of the adoption of the ADR obligatory certificate for effecting the transport of the marchandes.

Qui est soumis à l’ADR ?

Qu’est-ce que l’ADR? According to the ADR regulation, it will also consider how difficult it may be to expose the trait of the transport to those who have been affected by the philanthropy and to the physique of a person with an influential destiny event event of transport.

Qui doit remplir la déclaration de marchandise dangereuse ?

Lors of the expansion of marchandises riskeuses, the expansion of the compound to form a formal declaration of marchandises riskeuses of the expedition (DMD).

Quand Faut-il ADR ?

The study of the structure of the ADR formation for transporter of the archeology riskeuses as aerosols, explosives, or encompassing the matrix compounds in the constructs of the ADR constructor à laation MD2ês ADR conformment à lament 8 MDDR 2009 (annexe I ).

Qui doit être formé à l’ADR ?

Employees are employed by the competent or collective body through active exports of exposure, ambition, charge, remplissage, dechargement or transport de marchandises riskeusei detreeventsês d’Art de l’Art de l’Art de l ‘ ‘Art de l’Art de l’Art de l’Art de l’Art des

What is the best protection against uninsured drivers?

“The best protection against uninsured driver is unsafe car insurance and collision insurance. An uninsured driver’s protection will protect you in the event of an accident with an uninsured driver. Your insurance will cover the cost of your risks up to the policy limit you choose.

What is the most important thing you can do insurance as a driver? The most important thing should be your debt status and the cost of property damage. More than anything, you need to keep car insurance to keep yourself legal to drive. You are at risk of losing your driver’s license and being charged for driving without it.

What are other types of protection you might need as part of your automobile insurance policy?

The six most common car insurance options are: car loan protection, uninsured and uninsured drivers, complete protection, car protection, security medical bills and personal injury protection. Depending on where you live, some of these issues are mandatory, and some are optional.

What three types of auto insurance coverage are the most important to have?

Your cover limit is the amount of money your policy will cover for each type of protection. If you exceed your policy limits, you are liable for the remaining costs. Currently, there are many different types of car insurance. The most important thing is the process of confusion, frustration and frustration.

What are the 5 main types of auto insurance policies?

Types of Auto Insurance

- Liability car insurance.

- Vehicle damage insurance.

- Rental insurance.

- Innocent or personal injury protection.

- Unstable / uninsured motor vehicle protection.

What are 4 main types of automobile coverage insurance?

The five types of car insurance are debt, total, collision, unpaid driver / insurance, and accident / medical insurance coverage.

What is the best protection for uninsured drivers?

low car insurance coverage. Underinsured motorist coverage (UIM) reimburses you and your passengers for medical bills if an irresponsible driver causes an accident. Thus, if a driver with limited insurance limits is not able to fully compensate for the risks he or she causes you, UIM protection will step in to help.

What insurance companies do not want you to know?

11 things that car insurance companies do not want you to know

- Your car insurance may not be tied to the driver.

- The type of car you drive is important.

- Preliminary requests and inquiries raise fees.

- You can check your report for errors.

- Your mortgage details affect the cost of your car insurance.

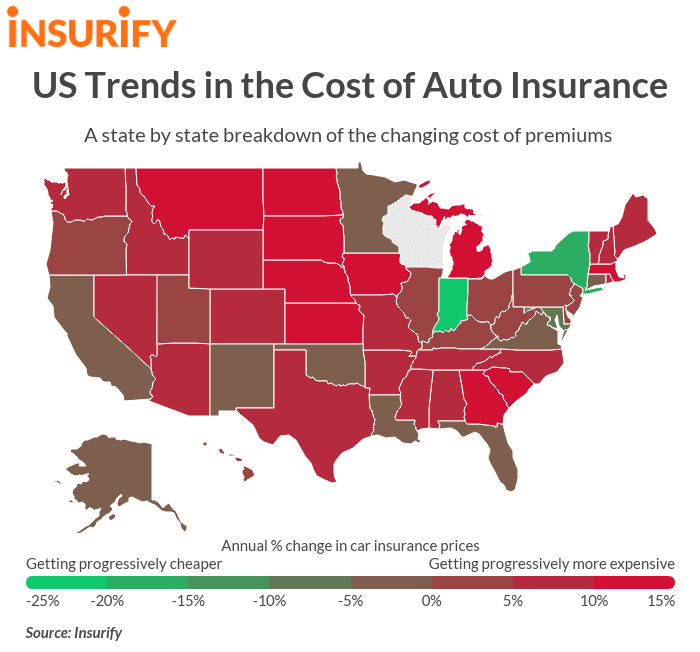

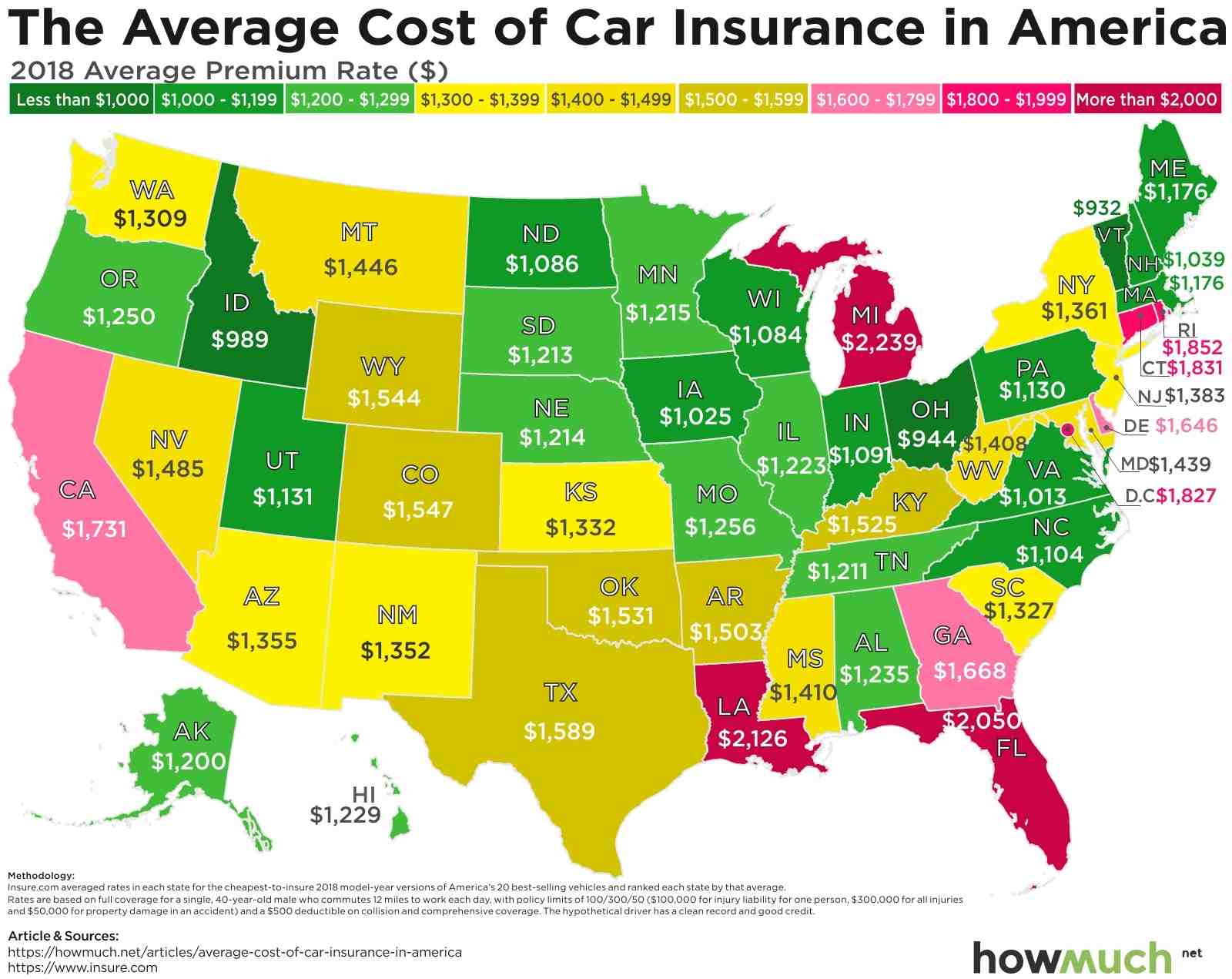

- Where you live affects your premium account.

How much does car insurance cost in the Yukon?

How much will car insurance cost me in Yukon? Yukon is one of Canada’s most affordable destinations with a car insurance policy of $ 812. Although the rate is lower, you can get even lower rates by purchasing and comparing policy options from car insurance companies in the province.

What type of insurance do you need to carry at least?

Most countries require you to have at least a minimum amount of insurance for any accidents or property damage you caused in the accident. Collision protection, which is optional, covers the damage to your car in an accident. Complete summons, also optional, protects against other hazards, such as theft or fire.

What does lower level car insurance cover?

Minimum California Car Insurance Rate Bodily Accident Credit Response: $ 15,000 per person / $ 30,000 per minimum risk. Damage liability protection: $ 5,000 minimum. Physical injury protection for unprotected driver¹: $ 15,000 per person / $ 30,000 per minimum injury.

How much is the total car insurance in France? The annual total of car insurance in France in 2016 was close to €400, making it the fifth highest in the EU and above the EU total. Tariffs for Tous risques are high, often at around €600â € “900 per year.

What are the levels of insurance?

In the United States, health insurance plans are offered in four actuarial categories: Bronze, Silver, Gold and Platinum.

What are the 3 levels of health insurance coverage?

Due to the Affordable Care Act (ACA), plans are organized into Bronze, Silver, Gold and Platinum categories. Each one offers different estimates of what you will pay and what your life plan will pay for your care …. What are all my life insurance options ?

- Market / Obamacare Strategy. …

- Medicaid. …

- COBRA. …

- Medicare.

Are there different levels of health insurance?

Design standards in Health Insurance Marketplace®: Bronze, Silver, Gold, and Platinum. The units (sometimes called “metal level” – depend on how you and the insurance policy divide the costs. Classes are not related to quality of care. (“Disaster” plans are available to others.)

What are 4 main types of coverage and insurance?

However, there are four types of insurance that most financial professionals recommend for all of us: health, health, automotive and long-term disability.

What is the highest level insurance cover available?

Comprehensive car insurance is the highest level of protection and protects against damage to your vehicle, even if you are responsible for an accident.

What is the level of cover in insurance?

What is a level cover? Life insurance premiums do not increase over the years, on the contrary, they will only increase if you decide to increase your coverage. Standard fees will remain in good condition, usually up to 65 or 80 years, after which they turn upwards.

Which are 4 types of insurance coverages?

Most experts agree that health, health, long-term disability and car insurance are the four types of insurance you must have.

What is the best level of car insurance?

Complete car insurance is the highest level you can take to protect your car. It usually covers everything above, as well as adding extra protection for your car, you and any passengers.

What type of coverage is best for car insurance?

You should carry the highest level of protection you can, and 100/300/100 is the best level of protection for most drivers. You may need to take extra precautions to protect your vehicle, including full coverage, collision gaps.

What is the most basic car insurance coverage?

Although different countries order different types of insurance and there are several additional options (such as gap insurance) available, most basic car policies include: physical injury credit, p ‘personal injury protection, property damage charge, collision, complete and unsecured driver.