What is bodily injury liability insurance? – Forbes Advisor

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not interfere with the opinions or evaluations of our editors.

If you are in a car accident and found to be at fault, bodily injury liability insurance covers medical expenses for others. It also covers other costs, such as the loss of the other driver’s income and your legal fees if you are sued for the accident.

In most states, some level of bodily injury liability insurance is required.

What Is Bodily Injury Liability Insurance?

Contents [hide]

- 1 What Is Bodily Injury Liability Insurance?

- 2 Do I Need Bodily Injury Liability Insurance?

- 3 What Does Bodily Injury Liability Insurance Cover?

- 4 What Does Bodily Injury Liability Insurance Not Cover?

- 5 How Much Bodily Injury Insurance Do I Need?

- 6 How Much Does Bodily Injury Liability Insurance Cost?

- 7 Best Car Insurance Companies 2022

- 8 What’s the difference between PIP and bodily injury?

- 9 What do the numbers in 25 50 25 auto insurance mean?

- 10 How do I find out my deductible?

- 11 Why do I have to pay a $500 deductible?

Physical liability insurance is part of your car liability insurance. It helps with the costs of injury incurred by others as a result of an accident for which you are responsible. To see also : Bill increasing minimum car insurance coverage clears legislature. In other words, its purpose is not to reimburse the driver (such as you) who caused the accident but to compensate people in other vehicles who have been injured.

Bodily injury liability insurance usually has two separate cover limits: a per capita limit and an accident limit. These limits are often expressed as a series of numbers, such as 15/30/15. The first two numbers represent the limits of bodily liability and the third number is the limit of your property damage liabilities. For example, here’s what 15/35/15 means.

If you have an accident and one other person is injured, your limit of liability per person will apply. But if multiple people are injured, your accident limit will apply to all the combined costs of the accident.

Do I Need Bodily Injury Liability Insurance?

All states except New Hampshire and Virginia require liability car insurance, including bodily injury coverage. If your state requires it, you may need to show proof of insurance when registering a vehicle.

Even if your state does not require bodily injury liability, it is still smart to maintain basic coverage. This may interest you : Is comprehensive insurance full coverage?.

What Does Bodily Injury Liability Insurance Cover?

Physical injury liability insurance covers a range of costs related to car accident injuries that you (or someone who was driving your car) cause to others. This may interest you : What is raising the prices of car insurance?.

Medical costs

Many types of medical expenses for others involved in an accident you cause are covered, such as emergency care, continuing medical care and hospital fees.

Legal fees

If you are sued by an accident injured person, this liability insurance will cover your legal protection fees, court costs, judgments and settlements, up to the limits of your policy.

Loss of income

In cases where a person is injured in an accident caused by a job loss, bodily injury liability insurance may cover the income they lose as a direct result of the accident.

Funeral expenses

If another driver or one of his passengers dies as a result of the accident, liability insurance may cover the costs of the funeral.

What Does Bodily Injury Liability Insurance Not Cover?

There are three main costs that bodily injury liability insurance does not cover.

Your medical costs

Physical injury liability insurance covers the medical expenses incurred by others as a result of the accident, but does not cover your own medical expenses.

If you want coverage for your medical expenses, you may be able to purchase personal injury protection or medical payment coverage (MedPay), depending on your state.

Property damage

If you have an accident, the other driver’s vehicle will probably be damaged. Or you could damage someone else’s property, such as a fence or even a house or store. This is covered by the property damage part of the liability car insurance.

Damage to your own vehicle

Bodily injury liability insurance will not cover damage to your own vehicle. If you want to cover your car repair bills for your vehicle, you will need to purchase collision insurance.

How Much Bodily Injury Insurance Do I Need?

The minimum liability insurance you must set by state laws. But the minimum is usually not enough and creating an accident that can lead to significant costs for others could lead to financial vulnerability.

For example, Florida car insurance requires at least $ 10,000 of human bodily injury. But that’s not far off if you have a car accident and the other driver’s a serious injury. You remain responsible for any amount that exceeds the limits of your liability policy.

A good rule of thumb is to have enough liability coverage to cover what you could get in a legal case.

One way to get a better level of liability insurance is to buy personal umbrella insurance in addition to your car insurance. This cover will start if the costs of an accident exceed the limits of liability insurance.

Full coverage car insurance is worth considering if you need liability insurance and coverage for your own vehicle. While there is no specific policy known as “full coverage,” it usually refers to a policy that includes liability insurance, collision insurance and comprehensive insurance.

Related: How Much Car Insurance Do You Need?

How Much Does Bodily Injury Liability Insurance Cost?

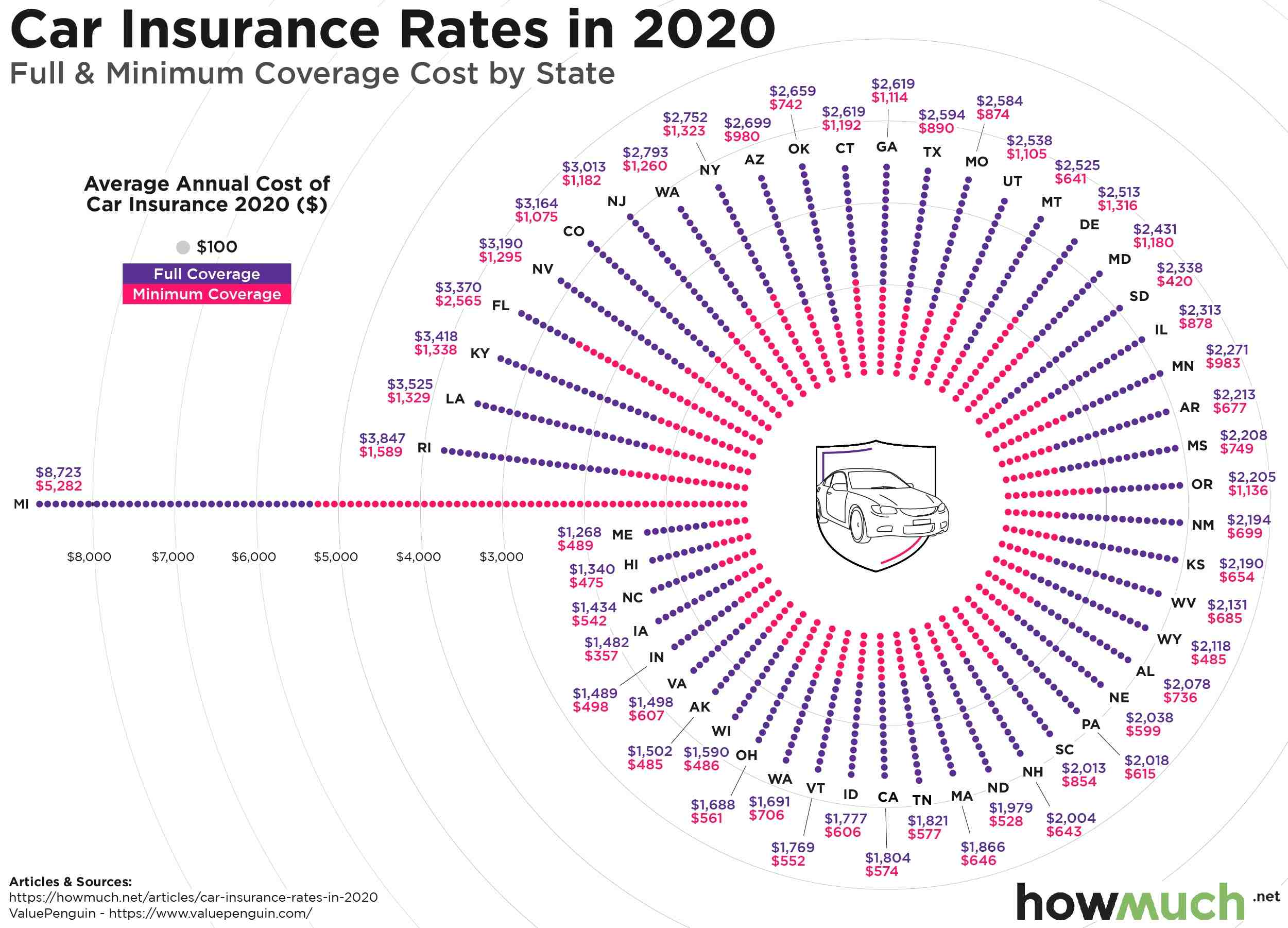

The national average cost of liability insurance is $ 650.35 per year, according to the National Association of Insurance Commissions. This medium includes coverage for bodily injury and property damage.

Your bodily injury liability insurance costs will depend on factors such as:

Related: Liability Insurance: Cost and Cover

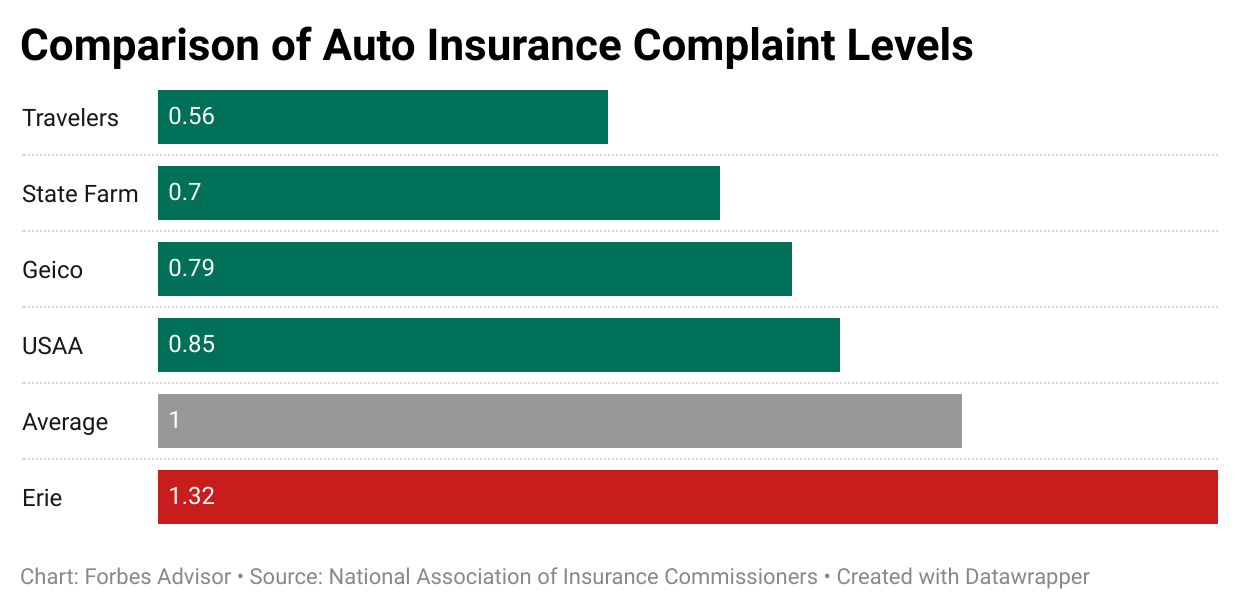

Best Car Insurance Companies 2022

With so many options for car insurance companies, it can be difficult to know where to start to find the right car insurance. We’ve evaluated insurers to find the best car insurance companies, so you don’t have to do that.

What’s the difference between PIP and bodily injury?

Physical injury occurs if you are at fault in an accident and pays the bills to others involved in the accident. Personal injury protection is available in no-fault insurance state and covers your expenses no matter who is at fault in the accident.

Is PIP the same as no fault? Personal injury protection, also known as PIP coverage or no-fault insurance, covers medical expenses regardless of who is at fault. It often also includes lost wages. Depending on the state you live in, PIP may be an available insurance cover or an essential policy supplement.

What is considered a bodily injury?

Physical injury refers to specific types of damage done to the body after an incident, such as bruises, burns, cuts, broken bones, and nerve damage. When a person is carrying bodily injury insurance, it covers the costs of the other person involved in the accident.

What should bodily injury be?

What is Physical Injury Liability? If you are responsible for a car accident, physical injury liability coverage pays for the medical expenses of the injured (excluding yourself). This coverage also helps cover payment for legal protection where you are sued for damages.

What are the three types of bodily injury coverage?

Car Insurance

- Liability for bodily injury.

- Medical payments or personal injury protection (PIP)

- Liability for property damage.

- Collision.

- Comprehensive.

- Uninsured and uninsured motorist cover.

What is considered an accidental bodily injury?

Accidental Physical Injury means an Injury that occurs as a result of an Accident and independent of all other causes due to an external traumatic event or due to exposure to the elements.

Is PIP the same as bodily injury?

Differences in Coverage Types Personal injury protection insurance (PIP) coverage includes payment for medical and rehabilitation costs related to injury, loss of income, and funeral and burial expenses. Physical injury liability coverage includes payment for any physical injuries that occur in an accident caused by you.

Is PIP the same as liability?

PIP insurance is not the same as bodily injury liability insurance. PIP covers you and any other passengers in your vehicle, and occupational injury liability insurance covers the occupants of other vehicles in the event of a collision fault.

What is PIP considered?

Personal injury protection (PIP), also known as no-fault insurance, helps cover expenses such as medical bills, lost wages or funeral expenses following a car accident, regardless of who is at fault. The requirements for this coverage vary from state to state.

What does PIP mean in a car accident?

Personal injury protection (PIP), also known as no-fault insurance, helps cover expenses such as medical bills, lost wages or funeral expenses following a car accident, regardless of who is at fault. The requirements for this coverage vary from state to state. Let’s look at the definition of personal injury protection.

What do the numbers in 25 50 25 auto insurance mean?

If you bought a 25/50/25 car insurance policy, that means you have $ 25,000 in coverage for your bodily injury liability per person, $ 50,000 for your bodily injury liability per accident, and $ 25,000 for property damage liability. In 17 states, 25/50/25 insurance is the minimum car insurance required.

What does 50 100 25 on a car insurance policy mean? Numbers like 50/100/25 are the dollar (thousands) limits for car liability insurance coverage: The first number is the amount of Physical Injury liability coverage you have for injuring or killing someone in an accident.

What do the numbers 50 100 50 mean in regards to insurance coverage?

Liability insurance limit amounts are given as three numbers separated by slash marks, for example, 50/100/50. In this case, the first 50 means $ 50,000 and refers to the amount of bodily injury coverage per person covered by the policy. The $ 100 means 100,000 body injury coverage per accident.

How do I get my LLQP license in Ontario?

If you are interested in obtaining a license as a life or accident and illness insurance agent in Ontario, you must: Complete a Superintendent – authorized LLQP training course. Write and pass the LLQP exam offered by the official exam administrator.

WHO issues LLQP license in Ontario?

It is administered by Durham College. To take the exam you must present the LLQP course completion certificate. (Note: These certificates will only be valid for one year after you have passed the exam.

What is the hardest insurance licensing exam?

Each insurance licensing exam presents its own challenge. Between Life and Health, students say the Health insurance exam is the hardest. Health insurance policies are more complex than life insurance policies. The property insurance exam is easier than the Casualty insurance exam.

What does 25 50 15 Mean on an auto insurance policy?

A 25/50/15 policyholder has covered up to $ 15,000 for property damaged in an accident at fault. In most cases the property is the car (s) of the other driver (s) or house if your vehicle jumps the curb in some way.

What is a 25 50 policy?

So, for example, stating a 25/50 limit for bodily injury means that the insurance policy will cover up to $ 25,000 per person injured in an accident and a total of $ 50,000 in accident claims alone.

What does the auto policy term 25/50 25 mean?

25/50/25 Limits of Liability The most common minimum liability limit across state lines is 25/50/25. When broken down, there would be $ 25,000 worth of bodily injury coverage per person, $ 50,000 worth of bodily injury coverage per accident and $ 25,000 worth of property damage cover per accident.

What does the 50 stand for on an insurance policy if it says 50 100 25 on your policy?

What does 50/100/25 mean? Numbers like 50/100/25 are the dollar (thousands) limits for car liability insurance coverage: The first number is the amount of Physical Injury liability coverage you have for injuring or killing someone in an accident.

What is a 25 50 policy?

So, for example, stating a 25/50 limit for bodily injury means that the insurance policy will cover up to $ 25,000 per person injured in an accident and a total of $ 50,000 in accident claims alone.

What does 15 30 5 mean in the auto insurance?

15/30/5 minimum liability limits mean the insurance company will provide bodily injury liability coverage of up to $ 15,000 per person injured in one accident, $ 30,000 for each person injured in one accident, and up to $ 5,000 for property damages in one accident. timpiste.

How do I find out my deductible?

“Your deduction is usually listed on your insurance proof card or confirmation page. If your card is missing or you would prefer to look elsewhere, try checking your official policy documents. Deductible items represent the amount of money that drivers agree to pay before insurance begins to cover costs.

How can I make my medicine deductible? Call your insurance company or read your credit paperwork to verify your deduction. Your deduction will also be listed on your Benefit Explanation (EOB). You will want to meet your deductible early in the year, if possible.

What is my insurance deductible?

How much you pay for covered health care services before your insurance plan starts paying. With $ 2,000 deductible, for example, you pay for the first $ 2,000 of covered services yourself. A fixed amount ($ 20, for example) you pay for a covered healthcare service after you have paid your deductible.

How do I find out my deductible?

â € œYour deduction is usually listed on your insurance proof card or on the declaration page. If your card is missing or you would prefer to look elsewhere, try checking your official policy documents. Deductible items represent the amount of money that drivers agree to pay before insurance begins to cover costs.

What does it mean to have $1000 deductible?

A deductible is what you pay out of pocket when you make a claim. Deductions are usually a specific dollar sum, but can also be a percentage of the total insurance amount on the policy. For example, if you have a $ 1,000 deductible and have a car accident that costs $ 4,000 to repair your car.

Is it better to have a $500 deductible or $1000?

$ 1,000 deductible is better than $ 500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you pay lower premiums. Choosing deductible insurance depends on the size of your emergency fund and how much you can pay for monthly premiums.

Is it better to have a $500 deductible or $1000?

$ 1,000 deductible is better than $ 500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you pay lower premiums. Choosing deductible insurance depends on the size of your emergency fund and how much you can pay for monthly premiums.

What does it mean when you have a $1000 deductible?

A deductible is what you pay out of pocket when you make a claim. Deductions are usually a specific dollar sum, but can also be a percentage of the total insurance amount on the policy. For example, if you have a $ 1,000 deductible and have a car accident that costs $ 4,000 to repair your car.

How do I know if I reached my deductible?

How will I know if I have complied with my deduction? Your health insurance company’s website will probably allow you to log in and view your deductible status. Check the back of your insurance card for a customer service number and call to confirm your deductible status.

How long does it take to reach your deductible?

It may take you several months or one visit to achieve that deductible. You will pay your deductible payment directly to the medical professional, clinic or hospital.

Do you pay for everything until you meet your deductible?

A deductible is a fixed amount that you may have to pay out of pocket before your plan starts paying for cover costs. Not all health plans have a deductible, and this amount may vary by plan. Each year, it starts around, and you will need to deduct the deduction for that year before your plan benefits begin.

What happens if I reach my deductible?

After you meet your deductible, your health insurance plan will pay your share of the cost of covered medical care and you will pay your share, or share of expenses.

Why do I have to pay a $500 deductible?

Deductible car insurance is the amount you have to pay out of pocket to cover accidental damages before the insurance company covers anything. For example, if you have a $ 500 deductible, you will need to pay that $ 500 out of pocket before your insurer will pay a dime towards damages.

How does a deduction work? A deductible is what you pay for healthcare services before your health insurance starts paying. How it works: If your plan is $ 1,500 deductible, you will pay 100 percent of eligible health care costs until the total bill is $ 1,500. Next, you share the cost with your plan by paying coinsurance.

What does it mean to have $1000 deductible?

A deductible is what you pay out of pocket when you make a claim. Deductions are usually a specific dollar sum, but can also be a percentage of the total insurance amount on the policy. For example, if you have a $ 1,000 deductible and have a car accident that costs $ 4,000 to repair your car.

Is a 1000 deductible Good for health insurance?

The $ 1,000 deductible is good for people who earn a healthy income and have enough savings to handle unexpected events, such as car accidents, home damages, and theft of valuables. Choosing $ 1,000 deductible will greatly reduce your policy costs.

Is a $1000 deductible good?

$ 1,000 deductible is better than $ 500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you pay lower premiums. Choosing deductible insurance depends on the size of your emergency fund and how much you can pay for monthly premiums.

How does a $1000 deductible work?

$ 1,000 deductible means you have to pay at least that amount out of pocket before your insurance company pays the rest. In most cases, your insurance company will pay the amount of the claim, less the $ 1,000 deductible, directly to you or a third party to whom services are due.

What is a good deductible?

Choosing a deductible $ 500 is a good idea for passers-by who have at least some cash in the bank – sitting in an emergency fund or saving for something else. The advantage of choosing a higher deductible is that your insurance policy costs less.

Is it better to have a $500 deductible or $1000?

$ 1,000 deductible is better than $ 500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you pay lower premiums. Choosing deductible insurance depends on the size of your emergency fund and how much you can pay for monthly premiums.

Is a high or low deductible better?

In most cases, the higher the deductible plan, the lower the premium. When you are willing to pay more in advance when you need care, you save on what you pay each month. The lower the deductible plan, the higher the premium.

What’s considered a good deductible?

A high deduction plan is any plan that has $ 1,400 or more deductible Opens in new window for individual coverage and $ 2,700 or more for family coverage.

Why is it important to pay a deductible?

Deductible mitigates that risk because the policyholder is responsible for some of the costs. Essentially, deductible items operate to align the interests of the insurer and the insured so that both parties seek to mitigate the risk of catastrophic loss.

Is it worth paying a deductible?

When you increase the deduction on your insurance, you can save money, but if you need to file an insurance claim, you will pay more out of pocket. If you have the money to pay for small issues yourself without filing an insurance claim, it may make sense for you to raise your deductible.

When would you have to pay a deductible?

The answer to when you pay is relatively simple. You have to pay a deductible whenever you claim your car insurance. The deductible is an agreed amount that you must pay out of pocket whenever you make an insurance claim before the insurer covers the cost of the damages.

Is it better to have a $500 deductible or $1000?

$ 1,000 deductible is better than $ 500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you pay lower premiums. Choosing deductible insurance depends on the size of your emergency fund and how much you can pay for monthly premiums.